Press release

Australia Foreign Exchange Market to Surge to USD 323.32 Billion From 2025 to 2033

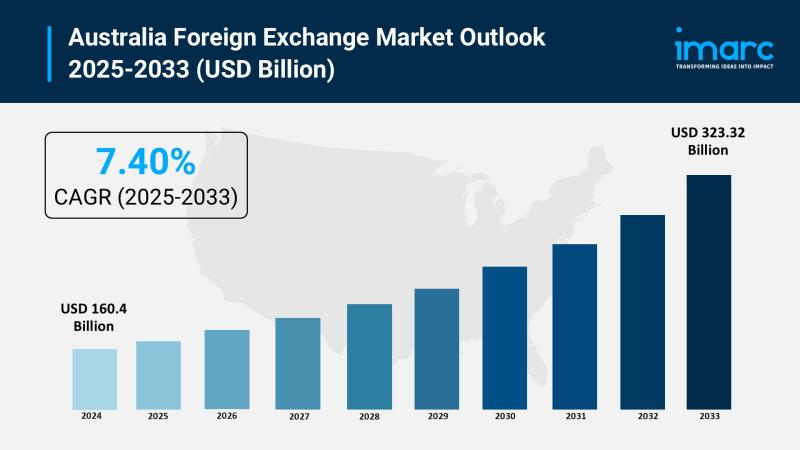

The latest report by IMARC Group, "Australia Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2025-2033," provides an in-depth analysis of the Australia foreign exchange market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia foreign exchange market size reached USD 160.4 billion in 2024 and is projected to grow to USD 323.32 billion by 2033, exhibiting a robust growth rate of 7.40% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 160.4 Billion

Market Forecast in 2033: USD 323.32 Billion

Growth Rate (2025-2033): 7.40%

Australia Foreign Exchange Market Overview:

The Australia foreign exchange market is experiencing robust growth driven by strong economic ties to the Asia-Pacific region, particularly with China, increasing demand for hedging and speculative trading, and significant technological advancements transforming trading capabilities. The market demonstrates strong momentum characterized by robust liquidity, driven by institutional players, retail brokers, and the country's strategic position as a gateway between Western and Asian markets. Strategic expansion is fueled by Australia's resource-driven export economy, favorable regulatory environment established by the Australian Securities and Investments Commission (ASIC), and the Reserve Bank of Australia's monetary policy framework promoting market stability. The sector benefits from advancing algorithmic and high-frequency trading technologies, growing integration of ESG-conscious currency strategies, and cryptocurrency adoption with improved financial performance as 65.9% of providers demonstrate profitability while forex trading volumes continue their upward trajectory.

Request For Sample Report: https://www.imarcgroup.com/australia-foreign-exchange-market/requestsample

Australia Foreign Exchange Market Trends:

• Algorithmic Trading Expansion transforming market dynamics through sophisticated mathematical models and high-frequency trading techniques executing trades in milliseconds, improving liquidity and narrowing spreads across all currency pairs

• Sustainable Finance Integration advancing through ESG-conscious currency strategies as investors increasingly align forex portfolios with environmental, social, and governance principles, particularly in renewable energy and sustainable development sectors

• Cryptocurrency Integration expanding rapidly as Bitcoin, Ethereum, and stablecoins gain acceptance for cross-border transactions and alternative investments, with forex brokers increasingly offering cryptocurrency pairs alongside traditional currency pairs

• Digital Trading Innovation accelerating through fintech solutions, real-time payment systems like the New Payments Platform (NPP), and blockchain-powered platforms enhancing currency conversion efficiency and security

• Asia-Pacific Gateway Positioning strengthening Australia's role as a financial bridge between Western economies and Asian markets, leveraging strategic time zone advantages for early price discovery and global liquidity provision

• Commodity-Driven Dynamics influencing currency movements as Australia's position as a prime commodity exporter creates direct correlations between global demand for iron ore, coal, and natural gas with Australian dollar valuation

• Regulatory Excellence maintaining transparent and well-regulated market environment through ASIC oversight, promoting investor protection, market integrity, and attracting both domestic and international participants

Australia Foreign Exchange Market Drivers:

• Asia-Pacific Trade Relationships creating substantial demand as Australia's strong economic ties with China, Japan, and India drive consistent need for currency conversions and hedging activities across international trade transactions

• Technological Advancement supporting market expansion through algorithmic trading platforms, AI-powered analytics, and blockchain solutions enabling faster execution, improved efficiency, and enhanced security for market participants

• Regulatory Stability motivating market participation as ASIC's transparent oversight and the Reserve Bank of Australia's clear monetary policy framework provide low-risk environment for domestic and international forex trading

• Commodity Export Economy driving currency demand as Australia's position as major exporter of iron ore, coal, and natural gas creates ongoing forex activity linked to international trade settlements and investment flows

• Foreign Investment Growth enabling market diversification as multinational companies and institutional investors require currency conversion services for direct investment, profit repatriation, and portfolio management activities

• Time Zone Advantage supporting liquidity provision as Sydney's strategic position between North American market close and Asian market open enables early price discovery and continuous global trading opportunities

• Retail Trading Democratization facilitating sector growth as online platforms and competitive spreads enable individual investors to access forex markets previously dominated by institutional participants

Market Challenges:

• Market Volatility affecting trading stability as global economic uncertainties, geopolitical tensions, and commodity price fluctuations create unpredictable currency movements impacting both institutional and retail participants

• Regulatory Compliance Complexity increasing operational costs through extensive licensing requirements, reporting obligations, and adherence to international standards for both domestic and foreign-based forex service providers

• Technological Infrastructure Requirements constraining competitive positioning as continuous investment in advanced trading systems, cybersecurity measures, and real-time settlement capabilities demands significant capital allocation

• Counterparty Risk Management challenging market participants as credit exposure, settlement failures, and operational risks require sophisticated risk management frameworks and adequate capital buffers

• Competition Intensity pressuring profit margins as proliferation of forex brokers, fintech platforms, and institutional market makers creates pricing pressures and demands constant innovation

• Cybersecurity Threats requiring ongoing vigilance as digital trading platforms face increasing risks from sophisticated cyber attacks, data breaches, and fraudulent activities targeting financial transactions

• Global Economic Sensitivity creating uncertainty as Australia's forex market remains highly responsive to international economic developments, central bank policies, and shifting trade dynamics beyond domestic control

Market Opportunities:

• Fintech Innovation creating opportunities through development of AI-powered trading algorithms, machine learning-based market analysis tools, and blockchain solutions improving transaction efficiency and transparency

• ESG-Aligned Products developing green FX indices, sustainability-linked hedging instruments, and ESG-screened currency portfolios addressing growing investor demand for socially responsible financial products

• Cryptocurrency Services expanding offerings through integration of digital currencies, stablecoin trading pairs, and blockchain-based settlement systems attracting tech-savvy traders and institutional adopters

• Regional Market Expansion leveraging Asia-Pacific growth through enhanced connectivity with Singapore, Hong Kong, and Tokyo markets, offering specialized currency pairs and cross-border transaction services

• Retail Market Development targeting individual investors through user-friendly mobile applications, educational resources, and competitive pricing structures democratizing access to forex trading opportunities

• Corporate Hedging Solutions providing sophisticated risk management products for businesses exposed to currency fluctuations, including customized forward contracts, options, and automated hedging platforms

• Public-Private Partnerships collaborating with government agencies on infrastructure development, regulatory innovation, and international market integration initiatives promoting Australia's position as global forex hub

Browse the full report with TOC and List of Figures: https://www.imarcgroup.com/australia-foreign-exchange-market

Australia Foreign Exchange Market Segmentation:

By Counterparty:

• Reporting Dealers

• Non-financial Customers

• Other Financial Institutions

By Type:

• Currency Swap

• Outright Forward and FX Swaps

• FX Options

By Regional Distribution:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Australia Foreign Exchange Market News:

September 2025: The Reserve Bank of Australia announced that preliminary results for the 2025 Triennial Central Bank Survey of Foreign Exchange and OTC Derivatives Markets will be released, providing comprehensive insights into market structure and trading volumes.

August 2025: Australia's foreign exchange reserves increased to 103,876 AUD million in August from 102,815 AUD million in July 2025, demonstrating continued strength in the country's external financial position and forex market stability.

April 2025: The Australian dollar experienced significant volatility, fluctuating within a range of US4 cents with its largest daily decline of 4.5% against the US dollar outside of the global financial crisis, reflecting heightened market sensitivity to economic developments and global trade dynamics.

Key Highlights of the Report:

• Comprehensive market analysis projecting robust growth from USD 160.4 billion in 2024 to USD 323.32 billion by 2033 with 7.40% CAGR

• Detailed examination of Australia's strategic position as Asia-Pacific gateway for currency trading, leveraging time zone advantages and regional economic ties

• Strategic assessment of technological transformation through algorithmic trading, high-frequency trading, and fintech innovations reshaping market dynamics

• In-depth analysis of regulatory framework excellence with ASIC oversight and Reserve Bank of Australia's monetary policy supporting stable trading environment

• Regional market evaluation covering all Australian territories with diverse economic drivers, from Sydney's financial hub to Western Australia's resource-driven forex demand

• Sustainability integration insights highlighting ESG-conscious currency strategies and green finance product development opportunities

• Cryptocurrency adoption assessment revealing growing integration of digital currencies and blockchain technologies into traditional forex trading platforms

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Australia's foreign exchange market growth to USD 323.32 billion by 2033?

A1: The market is driven by Australia's strong economic ties with Asia-Pacific nations, particularly China, creating consistent demand for currency conversions linked to commodity exports and international trade. Technological advancements in algorithmic trading, the country's strategic time zone positioning between Western and Asian markets, and a stable regulatory environment established by ASIC contribute to the robust 7.40% growth rate during the forecast period.

Q2: How is technology transforming the Australian foreign exchange market?

A2: Technology is fundamentally reshaping the market through algorithmic and high-frequency trading systems that execute trades in milliseconds, AI-powered analytics for market prediction, and blockchain-based platforms improving transaction security and efficiency. The introduction of real-time payment systems like the New Payments Platform (NPP) and growing integration of cryptocurrencies are creating new trading opportunities while enhancing market liquidity and transparency for both institutional and retail participants.

Q3: What role does Australia's regulatory framework play in market development?

A3: Australia's regulatory environment, overseen by ASIC and supported by the Reserve Bank of Australia's monetary policy framework, provides a transparent, stable, and low-risk trading environment that attracts both domestic and international participants. The comprehensive licensing requirements, investor protection measures, and alignment with international standards have established Australia as one of the world's most reliable forex markets, fostering confidence and encouraging sustained market growth and innovation.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=21958&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Foreign Exchange Market to Surge to USD 323.32 Billion From 2025 to 2033 here

News-ID: 4201477 • Views: …

More Releases from IMARC Group

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…