Press release

Philippines Foreign Exchange Market Expected to Reach USD 30,583.09 Million During 2025-2033

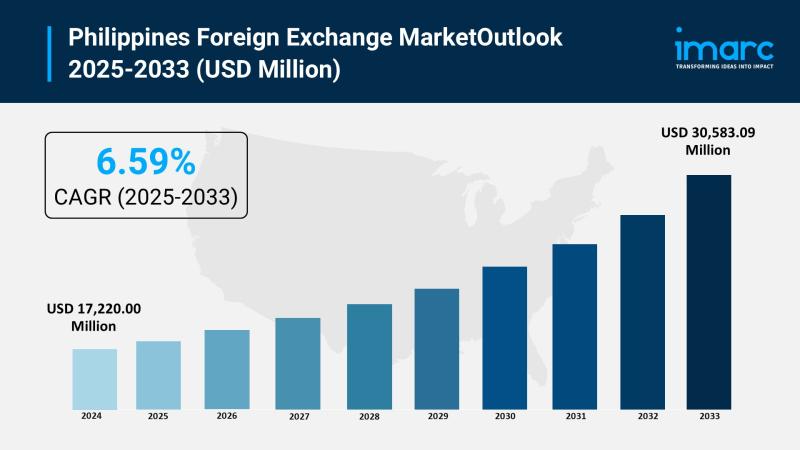

The latest report by IMARC Group, "Philippines Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2025-2033," provides an in-depth analysis of the Philippines foreign exchange market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines foreign exchange market size reached USD 17,220.00 million in 2024 and is projected to grow to USD 30,583.09 million by 2033, exhibiting a robust growth rate of 6.59% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 17,220.00 Million

Market Forecast in 2033: USD 30,583.09 Million

Growth Rate (2025-2033): 6.59%

Philippines Foreign Exchange Market Overview:

The Philippines foreign exchange market is experiencing robust growth driven by remittance inflows with USD 19.65 billion personal remittances H1 2025 growing 3% YoY from over 10 million OFWs, peso stabilizing at PHP 56.85-57 per USD mid-September 2025 reflecting recovery from earlier depreciation, and USD 3.42 billion net FDI inflows H1 2025. BSP projects peso weakening beyond PHP 56-58 range in 2025-2026 due to slower US Fed policy easing. Cross-border trade activity, exchange rate fluctuations, and digital banking expansion position foreign exchange as critical macroeconomic stability pillar.

Request For Sample Report: https://www.imarcgroup.com/philippines-foreign-exchange-market/requestsample

Philippines Foreign Exchange Market Trends:

Philippines foreign exchange market trends include peso stabilization at PHP 56.85-57 per USD mid-September 2025 reflecting recovery buoyed by increased FDI and remittance inflows. Personal remittances reached USD 19.65 billion H1 2025 growing 3% YoY with cash remittances at USD 17.67 billion up 2.9%. BSP projects peso weakening beyond DBCC assumptions PHP 56-58 in 2025 and PHP 55-58 in 2026 due to slower 75 basis point US Fed rate cuts anticipated 2025 and 25 bps 2026. October 2025 peso reached PHP 58.1470 per USD marking 1.63% monthly depreciation and 1.01% annual decline. Digital banking expansion enhances remittance transfer speed and volume. BSP interventions manage volatility through spot market operations and forward guidance maintaining macroeconomic stability amid external pressures.

Philippines Foreign Exchange Market Drivers:

Philippines foreign exchange market drivers include remittance structural inflows with USD 19.65 billion personal remittances H1 2025 growing 3% YoY from over 10 million OFWs providing stable foreign currency source cushioning peso and supporting reserves. Net FDI inflows totaling USD 3.42 billion H1 2025 despite 23.8% decline from USD 4.49 billion H1 2024 reflecting global sentiment shifts. Peso stabilization at PHP 56.85-57 mid-September 2025 demonstrating recovery from earlier depreciation. BSP monetary policy management through spot market interventions curbing excessive volatility protecting economic fundamentals. US Federal Reserve policy decisions influencing capital flows with 75 bps cuts anticipated 2025. Cross-border trade activity with substantial US linkages. Digital financial services expansion accelerating remittance processing. Foreign currency instruments investor participation adding liquidity. Exchange rate management addressing inflation targets and trade competitiveness maintaining confidence.

Market Challenges:

• US Fed Policy Impact affecting capital flows with slower 75 bps easing anticipated 2025

• Exchange Rate Volatility creating uncertainty for trade and investment planning

• Import Dependency particularly energy affecting trade balance and forex demand

• Global Economic Sensitivity exposing peso to US dollar movements and geopolitical tensions

• FDI Decline with H1 2025 inflows down 23.8% from H1 2024 levels

• Political Uncertainty adding pressure on peso stability and investor confidence

• External Shocks affecting balance of payments and reserve adequacy

Market Opportunities:

• Remittance Digitalization expanding mobile and blockchain-based transfer platforms

• Hedging Instruments offering currency swap and FX options for risk management

• Regional Trade Integration leveraging ASEAN economic partnerships

• OFW Financial Inclusion developing investment products for overseas workers

• Fintech Innovation providing competitive exchange rates and faster processing

• Export Diversification reducing USD dependency through multiple currency settlements

• Reserve Management optimizing foreign currency holdings for stability

Browse the full report with TOC and List of Figures: https://www.imarcgroup.com/philippines-foreign-exchange-market

Philippines Foreign Exchange Market Segmentation:

By Counterparty:

• Reporting Dealers

• Other Financial Institutions

• Non-Financial Customers

By Type:

• Currency Swap

• Outright Forward and FX Swaps

• FX Options

By Regional Distribution:

• Luzon

• Visayas

• Mindanao

Philippines Foreign Exchange Market News:

October 2025: Peso-dollar exchange rate reached PHP 58.1470 on October 17, 2025 up 0.15% from previous session with peso weakening 1.63% over past month and down 1.01% over last 12 months reflecting external pressures and slower US Fed easing expectations.

September 2025: Peso stabilized at PHP 56.85-57 per USD mid-September closing at PHP 56.86 on September 18, 2025 demonstrating recovery from earlier depreciation buoyed by increased FDI and remittance inflows supporting foreign exchange market liquidity.

H1 2025: Personal remittances reached USD 19.65 billion growing 3% YoY with cash remittances at USD 17.67 billion up 2.9% from over 10 million OFWs providing stable foreign currency source supporting peso and balance of payments.

H1 2025: Net FDI inflows totaled USD 3.42 billion marking 23.8% decline from USD 4.49 billion H1 2024 reflecting shifts in global investor sentiment amid geopolitical uncertainties affecting capital flows into Philippines.

January 2025: BSP Monetary Policy Report projected peso weakening beyond DBCC assumptions PHP 56-58 in 2025 and PHP 55-58 in 2026 due to slower US Federal Reserve monetary easing with 75 bps cuts anticipated 2025 and 25 bps 2026.

Key Highlights of the Report:

• Market analysis projecting growth from USD 17,220.00 million (2024) to USD 30,583.09 million (2033) with 6.59% CAGR

• Personal remittances reaching USD 19.65 billion H1 2025 growing 3% YoY from 10M+ OFWs

• Peso stabilizing at PHP 56.85-57 mid-September 2025 before reaching PHP 58.1470 October 2025

• Net FDI inflows USD 3.42 billion H1 2025 down 23.8% from H1 2024

• BSP projecting peso beyond PHP 56-58 range 2025-2026 due to slower US Fed easing

• Currency swaps dominating type segment with risk management applications

• Luzon leading regional distribution with highest financial institution concentration

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Philippines foreign exchange market growth to USD 30,583.09 million by 2033?

A1: The market is driven by remittance structural inflows with USD 19.65 billion personal remittances H1 2025 growing 3% YoY from over 10 million OFWs providing stable foreign currency cushioning peso, net FDI inflows USD 3.42 billion H1 2025 despite 23.8% decline reflecting global sentiment, and peso stabilization at PHP 56.85-57 mid-September 2025 demonstrating recovery. BSP monetary policy interventions managing volatility, US Fed policy decisions with 75 bps cuts anticipated 2025, and digital financial services expansion accelerating remittance processing contribute to the 6.59% growth rate.

Q2: How are BSP interventions and external factors transforming the Philippines foreign exchange landscape?

A2: BSP projects peso weakening beyond DBCC assumptions PHP 56-58 in 2025 and PHP 55-58 in 2026 due to slower US Federal Reserve 75 bps easing anticipated 2025. Peso reached PHP 58.1470 October 2025 marking 1.63% monthly depreciation reflecting external pressures. BSP implements spot market interventions curbing excessive volatility protecting economic fundamentals, inflation targets, and trade competitiveness. Remittances USD 19.65 billion H1 2025 and FDI USD 3.42 billion provide structural support. These developments position central bank management and external economic sensitivity as fundamental transformation drivers affecting capital flows and exchange rate dynamics.

Q3: What opportunities exist for foreign exchange stakeholders in emerging Philippines market segments?

A3: Stakeholders can capitalize on remittance digitalization expanding mobile and blockchain-based transfer platforms improving speed and reducing costs, hedging instruments offering currency swaps and FX options for corporate risk management, and OFW financial inclusion developing investment products for overseas workers optimizing remittance utilization. Fintech innovation providing competitive exchange rates and faster processing, export diversification reducing USD dependency through multiple currency settlements, and reserve management optimizing foreign currency holdings represent significant opportunities supporting macroeconomic stability, trade facilitation, and financial deepening objectives addressing external vulnerabilities and enhancing market resilience.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=41366&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Philippines Foreign Exchange Market Expected to Reach USD 30,583.09 Million During 2025-2033 here

News-ID: 4228529 • Views: …

More Releases from IMARC Group

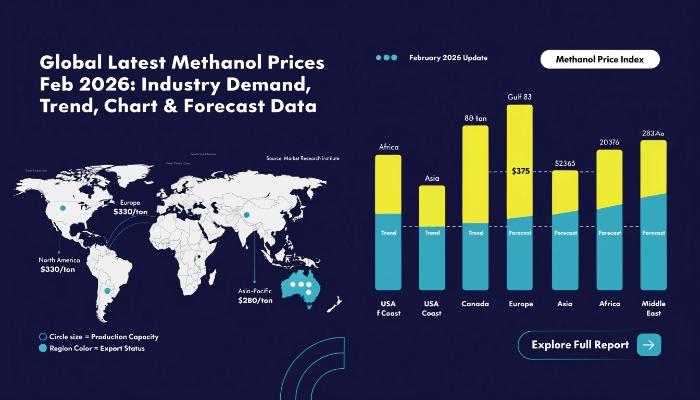

Global Latest Methanol Prices Feb 2026: Industry Demand, Trend, Chart & Forecast …

Africa Methanol Prices Movement Feb 2026

In February 2026, Methanol Prices in Africa reached USD 0.38/KG, marking a 5.6% increase. The upward movement was supported by firm demand from construction chemicals and fuel blending sectors. Improving industrial activity and steady imports contributed to positive pricing momentum across key regional markets.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/methanol-pricing-report/requestsample

Northeast Asia Methanol Prices Movement Feb 2026

Methanol prices in Northeast Asia remained unchanged at USD 0.35/KG in…

High-Pressure Laminate (HPL) Manufacturing Plant DPR 2026: Setup Details, Capita …

Setting up a high-pressure laminate (HPL) manufacturing plant involves meticulous planning, substantial capital investment, and a thorough understanding of composite panel production technologies. HPL is a versatile, durable decorative surface material widely used in interior design, furniture, flooring, and construction applications. Success requires careful site selection, efficient pressing and lamination processes, advanced production machinery, reliable sourcing of decorative paper and resins, and compliance with environmental and safety regulations to ensure…

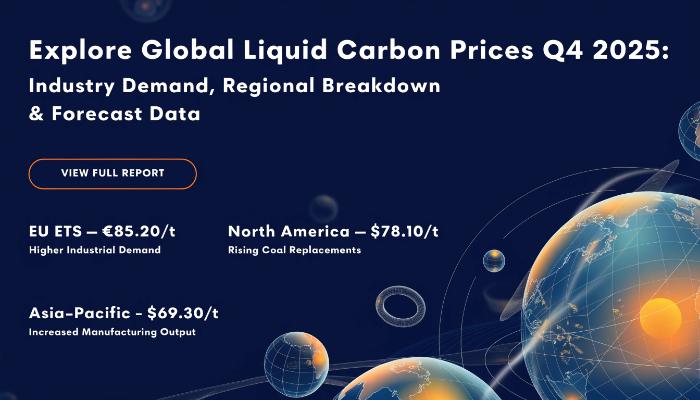

Global Liquid CO2 Prices Q4 2025: Industry Demand, Regional Breakdown & Forecast …

USA Liquid Carbon Dioxide Prices Movement Q4 2025:

During Q4 2025, liquid carbon dioxide prices in the USA reached USD 837/MT, reflecting tight supply conditions and strong demand from food processing, beverage carbonation, and industrial applications. Seasonal consumption, maintenance shutdowns at ammonia plants, and elevated logistics costs contributed to firm pricing across the domestic market.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/liquid-carbon-dioxide-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific…

Titanium Dioxide Production Cost Analysis Report 2026: Machinery and Technology …

Setting up a titanium dioxide manufacturing plant involves strategic planning, substantial capital investment, and comprehensive understanding of production technologies. This essential inorganic compound serves paint and coatings, plastics, and specialty chemical industries. Success requires careful site selection, efficient chloride or sulfate process operations, advanced reactor systems, reliable raw material sourcing, and compliance with environmental and safety regulations to ensure profitable and sustainable operations.

IMARC Group's report, "Titanium Dioxide Production Plant Project…

More Releases for USD

Bone Cement Market Outlook USD 1,871.10M-USD 3,512.31M

How Is the Bone Cement Market Supporting the Rise of Modern Orthopedic Surgery?

The Bone Cement Market plays a critical role in modern orthopedic and spinal procedures, acting as a foundational material for joint replacement, fracture fixation, and vertebral stabilization. Bone cement is widely used to anchor implants, restore bone structure, and improve patient mobility-making it an essential component of musculoskeletal care.

In 2025, the global bone cement market was valued at…

Autologous Cell Therapy Market Outlook USD 9.31B-USD 54.83B

How Is the Autologous Cell Therapy Market Redefining the Future of Precision Medicine?

The Autologous Cell Therapy Market is rapidly emerging as one of the most transformative areas in modern healthcare, offering highly personalized treatment options for complex and chronic diseases. By using a patient's own cells to repair, replace, or regenerate damaged tissues, autologous cell therapy minimizes immune rejection risks while maximizing therapeutic effectiveness.

In 2025, the global autologous cell therapy…

PACS Market USD 5.59B in 2025, USD 9.73B by 2035

Picture Archiving and Communication System (PACS) Market Expands as Digital Imaging Transforms Global Healthcare

Introduction: PACS at the Core of Modern Medical Imaging

The healthcare industry is undergoing a rapid digital transformation, with medical imaging playing a critical role in diagnosis, treatment planning, and patient monitoring. At the heart of this transformation lies the Picture Archiving and Communication System (PACS)-a technology that enables the storage, retrieval, management, and sharing of medical images…

Global HEOR Market USD 1.70B-USD 6.03B

Health Economics and Outcomes Research (HEOR) Market Accelerates as Value-Based Healthcare Redefines Global Decision-Making

Introduction: The Growing Importance of HEOR in Modern Healthcare

The global healthcare industry is undergoing a profound transformation, shifting from volume-driven care models to value-based healthcare systems that prioritize patient outcomes, cost efficiency, and real-world effectiveness. At the center of this transformation lies Health Economics and Outcomes Research (HEOR)-a discipline that evaluates the economic value, clinical outcomes, and…

Foam Tape Market Outlook 2035: Industry Growth from USD USD 4.89 Billion (2025) …

The Foam Tape Market plays a vital role in modern industrial and manufacturing ecosystems. Foam tapes are pressure-sensitive adhesive products manufactured using materials such as polyurethane, polyethylene, PVC, and acrylic foam. These tapes are widely used for bonding, sealing, insulation, cushioning, vibration damping, and noise reduction across multiple industries. Their ability to replace traditional mechanical fasteners like screws, bolts, and rivets has positioned foam tapes as a preferred solution in…

Chlorella Market Reach USD 465.85 Million USD by 2030

Market Growth Fueled by Increased Adoption of Plant-Based Proteins and Health Supplements

Global Chlorella Market size was valued at USD 303.75 Mn. in 2023 and the total Chlorella revenue is expected to grow by 6.3 % from 2024 to 2030, reaching nearly USD 465.85 Mn. . The growth of the market is majorly due to increase in the consumer awareness about health, the inclination towards plant-based food such as chlorella and…