Press release

Australia Banking Market 2025 | Worth USD 1,390.7 Million by 2033 | Exhibit a CAGR of 7.79%

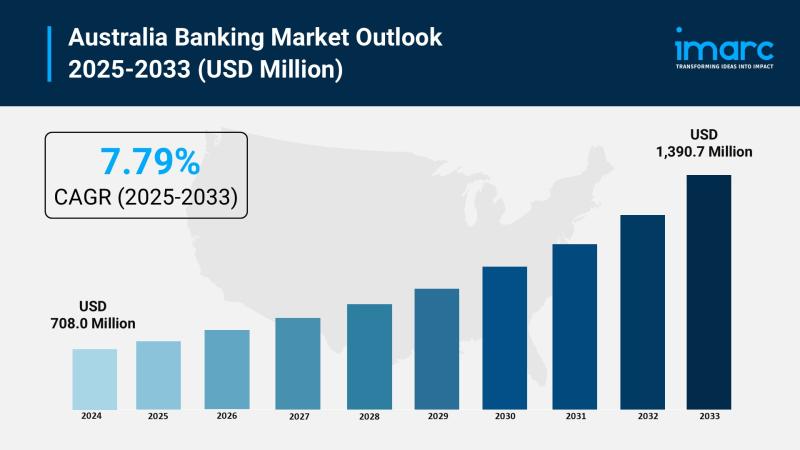

The latest report by IMARC Group, "Australia Banking Market Size, Share, Trends and Forecast by Banking Services, End User, and Region, 2025-2033," provides an in-depth analysis of the Australia banking market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia banking market size reached USD 708.0 million in 2024 and is projected to grow to USD 1,390.7 million by 2033, exhibiting a steady growth rate of 7.79% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 708.0 Million

Market Forecast in 2033: USD 1,390.7 Million

Growth Rate (2025-2033): 7.79%

Australia Banking Market Overview:

The Australia banking market is experiencing steady growth driven by growing focus on improving client experience, rising use of digital wallets, contactless payments, and instant payment solutions, and increasing investment in cybersecurity to address data breaches and identity theft. The market demonstrates strong momentum with National Australia Bank (NAB) introducing its "customer brain" in 2024 powered by Pega's customer decision hub, which increased client engagement by 40% through personalized services across digital and human channels. Strategic expansion is fueled by the rise of digital payment systems, with NAB and PayPal launching an in-app feature in 2024 enabling clients to connect debit and credit cards to PayPal wallet seamlessly. The sector benefits from Australia's mandatory superannuation system directing billions of dollars annually into investment channels overseen by banks, while key market drivers include population growth in urban areas like Sydney, Melbourne, and Brisbane driving housing finance demand, rising mortgage lending supporting residential property aspirations, and prudential oversight by APRA ensuring banking sector resilience through stringent capital adequacy requirements and risk-based supervision.

Request For Sample Report: https://www.imarcgroup.com/australia-banking-market/requestsample

Australia Banking Market Trends:

• Client Experience Enhancement advancing through AI-powered support systems, chatbots, and virtual assistants providing personalized help, with NAB's customer brain increasing client engagement by 40% through real-time data analytics

• Digital Payment Integration revolutionizing transactions through digital wallets, contactless payments, and instant payment solutions, with NAB-PayPal partnership enabling seamless card connection via mobile app

• Cybersecurity Investment Acceleration strengthening security infrastructure through biometric verification, encryption technology, and AI-powered fraud detection, with Waave introducing biometric verification and Westpac launching SaferPay fraud detection

• Open Banking Implementation enabling secure customer data sharing through Consumer Data Right (CDR) regulations allowing personalized financial products and enhanced customer experiences

• Fintech Collaboration Growth expanding through partnerships between traditional banks and technology firms leveraging innovation in payments, lending, and wealth management services

• Digital Banking Dominance shifting customer preferences toward mobile and online banking platforms reducing reliance on physical branches while enhancing service accessibility

• Wealth Management Expansion growing through personalized retirement planning, investment guidance, and superannuation solutions addressing aging demographic needs

Australia Banking Market Drivers:

• Population Growth and Urbanization creating substantial demand for housing finance, savings accounts, and credit offerings as Sydney, Melbourne, and Brisbane experience consistent urban expansion and migrant influx

• Rising Mortgage Lending sustaining residential property ownership aspirations through competitive loan offerings, refinancing alternatives, and first-home buyer incentives in high-growth urban areas

• Superannuation System directing billions of dollars annually into investment channels managed by banks generating revenue through asset management fees, fund administration, and financial planning services

• Digital Transformation Acceleration driving adoption of cashless transactions, mobile banking, and online services as technology-savvy consumers demand convenient financial solutions

• Regulatory Framework Stability supporting market confidence through APRA's prudential oversight ensuring capital adequacy, risk management, and financial system resilience

• Consumer Protection Standards building trust through ASIC's enforcement of equitable practices, transparent disclosures, and ethical standards in financial services delivery

• Reserve Bank Support providing emergency funding through lender of last resort function maintaining credit flows and payment system continuity during economic uncertainties

Market Challenges:

• Regulatory Compliance Complexity requiring substantial resources for monitoring, reporting, and maintaining financial practices to meet APRA and ASIC standards while adapting to frequently changing regulations

• Fintech Competition Intensity pressuring traditional banks as digital-first neobanks and fintech firms offer quicker, more personalized, and cost-efficient financial solutions using AI and blockchain technologies

• Cybersecurity Threat Escalation demanding continuous investment in advanced security solutions including encryption, multi-factor authentication, and real-time fraud detection protecting sensitive customer data and financial information

• Operational Cost Pressures managing expenses associated with regulatory compliance, technology upgrades, and physical branch networks while maintaining competitive pricing and profit margins

• Customer Retention Challenges addressing competition from innovative fintech alternatives offering seamless digital experiences and specialized financial products attracting traditional banking customers

• Economic Volatility Impact navigating interest rate fluctuations, property market variations, and economic downturns affecting loan demand, credit quality, and overall banking profitability

• Technology Infrastructure Investment requiring significant capital allocation for digital platform development, data analytics capabilities, and legacy system modernization maintaining competitive positioning

Market Opportunities:

• Regional Market Expansion developing presence in underserved rural and regional areas offering specialized agricultural financing, land loans, and community banking services tailored to local industries

• Open Banking Innovation leveraging Consumer Data Right framework to create personalized financial products through secure data sharing, adaptive credit scoring, and tailored savings plans building customer loyalty

• Wealth Management Services Growth capitalizing on aging demographic through comprehensive retirement planning, investment advisory, superannuation solutions, and portfolio diversification services

• Digital-First Product Development creating innovative mobile banking features, AI-powered financial planning tools, and automated investment platforms appealing to technology-savvy consumers

• Sustainable Finance Leadership developing green lending products, ESG investment portfolios, and climate-risk assessment services meeting growing demand for environmentally conscious banking

• Small Business Banking expanding specialized services for SMEs including tailored lending solutions, cash flow management tools, and business advisory services supporting entrepreneurship

• Strategic Fintech Partnerships collaborating with technology firms to integrate innovative solutions, accelerate digital transformation, and expand service capabilities beyond traditional banking

Browse the Full Report with TOC & List of Figures:https://www.imarcgroup.com/australia-banking-market

Australia Banking Market Segmentation:

By Banking Services:

• Retail Banking

• Commercial Banking

• Investment Banking

• Corporate Banking

• Others

By End User:

• Individual Consumers

• Small and Medium Enterprises (SMEs)

• Large Corporations

• Government and Public Sector Entities

By Regional Distribution:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Australia Banking Market News:

September 2025: Australia banking market reached USD 708.0 million in 2024 with steady growth projected at 7.79% CAGR through 2033, while major banks continued enhancing digital capabilities and customer experience through AI-powered platforms and personalized services.

July 2025: Digital payment adoption accelerated across Australian banking sector with contactless transactions and mobile wallet usage reaching new heights, while open banking regulations enabled innovative data-sharing solutions for personalized financial products.

May 2025: Cybersecurity investments intensified as banks implemented advanced biometric verification, AI-powered fraud detection, and real-time prevention systems addressing escalating cyber threats and protecting customer data.

March 2025: Wealth management services expanded significantly as banks developed comprehensive retirement planning solutions, superannuation integration, and investment advisory services targeting Australia's aging demographic and growing financial complexity needs.

Key Highlights of the Report:

• Comprehensive market analysis projecting steady growth from USD 708.0 million in 2024 to USD 1,390.7 million by 2033 with 7.79% CAGR

• Detailed examination of client experience enhancement through NAB's customer brain platform increasing engagement by 40% using AI-powered personalization and real-time analytics

• Strategic assessment of digital payment integration with NAB-PayPal partnership enabling seamless card connection through mobile app improving digital shopping experiences

• In-depth analysis of cybersecurity investment acceleration through biometric verification, encryption technology, and AI-powered fraud detection systems protecting customer data

• Regional market evaluation covering all Australian territories with focus on urban growth areas driving housing finance and retail banking demand

• Regulatory framework insights highlighting APRA prudential oversight, ASIC consumer protection, and RBA lender of last resort functions supporting market stability

• Market opportunity assessment revealing regional expansion, open banking innovation, and wealth management growth potential creating new revenue streams

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Australia's banking market growth to USD 1,390.7 million by 2033?

A1: The market is driven by growing focus on improving client experience through AI-powered platforms like NAB's customer brain increasing engagement by 40%, rising use of digital wallets and contactless payments, and increasing cybersecurity investments addressing data breaches. Population growth in urban areas driving housing finance demand, rising mortgage lending supporting property ownership, and Australia's superannuation system directing billions annually into investment channels contribute to the steady 7.79% growth rate.

Q2: How are digital innovations transforming the Australian banking market?

A2: Digital innovations are revolutionizing banking through AI-powered support systems providing personalized assistance, seamless digital payment integration like NAB-PayPal partnership enabling instant card connections, and open banking regulations allowing secure data sharing for customized financial products. Banks are investing heavily in mobile platforms, chatbots, virtual assistants, and real-time analytics improving customer experiences while reducing operational costs.

Q3: What role does cybersecurity play in market development?

A3: Cybersecurity is critical as digital banking expansion increases cyber threat risks including data breaches and identity theft. Banks are implementing advanced security measures including biometric verification like Waave's fingerprint and Face ID authentication, AI-powered fraud detection like Westpac's SaferPay prevention, and encryption technologies building customer trust. These investments are essential for regulatory compliance, protecting sensitive data, and maintaining competitive positioning in the digital banking landscape.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=24701&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Banking Market 2025 | Worth USD 1,390.7 Million by 2033 | Exhibit a CAGR of 7.79% here

News-ID: 4201428 • Views: …

More Releases from IMARC Group

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…