Press release

Australia Luxury Goods Market: Outlook, Growth Projection & Opportunities 2025-2033

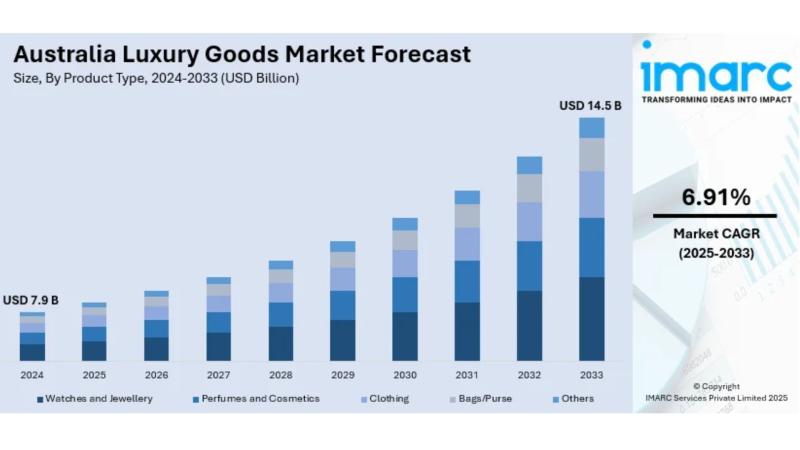

Australia Luxury Goods Market OverviewMarket Size in 2024: USD 7.9 Billion

Market Size in 2033: USD 14.5 Billion

Market Growth Rate 2025-2033: 6.91%

According to IMARC Group's latest research publication, "Australia Luxury Goods Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033", the Australia luxury goods market size reached USD 7.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6.91% from 2025-2033.

How Digital Innovation and Sustainability Are Transforming Australia's Luxury Goods Future

Digital Commerce Revolution: Digital transformation is driving unprecedented growth in online luxury retail across Australia. Affluent consumers are increasingly embracing e-commerce platforms, augmented reality virtual try-ons, and personalized digital shopping experiences that fundamentally reshape how premium brands engage with their customers. The integration of artificial intelligence and data analytics enables luxury brands to deliver hyper-personalized recommendations and seamless omnichannel experiences that meet the sophisticated expectations of Australian luxury consumers.

Sustainable Luxury Movement: Eco-conscious luxury consumption is defining new market trends as Australian consumers demand greater transparency and environmental responsibility from premium brands. Major retailers are responding with expanded sustainable collections, with brands like Pandora Australia introducing lab-grown diamonds and recycled silver jewelry in February 2024. This shift reflects growing consumer demand for environmentally responsible premium products that align with personal values without compromising on quality or prestige.

Jewelry Market Resilience: High-end jewelry has proven to be the most resilient luxury category globally, maintaining steady growth between zero to two percent to reach €31 billion in 2024. This resilience is driven by consistent high-low brand strategies that appeal to diverse customer segments, enhanced customer-centric approaches that prioritize personalized service, and exceptional craftsmanship in haute joaillerie segments that continue to captivate discerning collectors and fashion enthusiasts.

Premium Automotive Recovery: The luxury cars segment is demonstrating robust recovery potential with projected six percent value compound annual growth rate through the forecast period. This growth supports overall market expansion through high-value transactions and a growing affluent consumer base seeking premium automotive experiences that combine cutting-edge technology, exceptional performance, and sophisticated design elements.

Experiential Luxury Growth: Fine wines, champagne, premium spirits, and experiential luxury services are emerging as key growth drivers in the Australian market. This trend reflects a significant shift in consumer preferences, with affluent Australians increasingly favoring premium lifestyle experiences and consumable luxuries over traditional material luxury goods acquisitions, creating new opportunities for brands in the hospitality, travel, and premium beverage sectors.

Download a sample PDF of this report: https://www.imarcgroup.com/australia-luxury-goods-market/requestsample

Australia Luxury Goods Market Trends & Drivers

The Australian luxury goods market demonstrates remarkable resilience and strong growth potential, supported by the rising affluence of the consumer base, growing demand for premium products, and increasing interest in high-end lifestyle offerings. Australia's robust economy, characterized by high disposable income levels and sophisticated consumer preferences for quality and exclusivity, creates a fertile environment for luxury brand expansion and market penetration.

Cultural shifts toward luxury as status symbols, increased exposure to global fashion trends through digital media and international travel, and seamless technology integration in retail experiences are driving significant market expansion across all luxury categories. The rise of quiet luxury reflects evolving consumer preferences, with buyers increasingly favoring subtle, high-quality items over ostentatious displays of wealth. This trend particularly appeals to Australia's discerning luxury consumers who value understated elegance and exceptional craftsmanship.

Digital accessibility plays an increasingly crucial role in market growth, with growing internet penetration significantly boosting online luxury sales throughout 2024. The importance of omnichannel retail strategies has become paramount, with luxury brands investing heavily in creating seamless digital-physical shopping experiences that capture Australian consumers' evolving purchasing behaviors and expectations for convenience without compromising the premium brand experience.

The COVID-19 pandemic initially caused short-term luxury spending slumps through 2019-20, but government stimulus packages helped boost discretionary incomes, rapidly reversing negative trends. Industry revenue has grown at a compound annual growth rate of 3.8 percent over the past five years, reaching an estimated $7.7 billion in 2025. This demonstrates remarkable market resilience and strong recovery strength despite unprecedented global challenges.

Sustainability challenges and changing consumer consciousness are fundamentally reshaping luxury brand strategies, with increasing demand for eco-conscious products, transparent supply chains, and ethical manufacturing practices becoming non-negotiable for many affluent consumers. Australian luxury consumers are becoming more demanding, conscious, and less brand-loyal than previous generations, requiring luxury companies to innovate continuously in product development, customer service excellence, and authentic brand positioning that resonates with contemporary values.

Browse full report:

https://www.imarcgroup.com/australia-luxury-goods-market

Australia Luxury Goods Industry Segmentation

The report has segmented the market into the following categories:

Analysis by Product Type:

• Fashion and Apparel

• Jewelry and Watches

• Leather Goods and Accessories

• Cosmetics and Fragrances

• Premium Automobiles

• Fine Wines and Spirits

• Luxury Electronics

• Home and Living Products

Analysis by Distribution Channel:

• Specialty Luxury Stores

• Department Stores

• Online Retail Platforms

• Brand Flagship Stores

• Duty-Free Retail

• Multi-brand Boutiques

Analysis by End User:

• High Net Worth Individuals

• Ultra High Net Worth Individuals

• Affluent Millennials

• Generation Z Luxury Consumers

• International Tourists

• Corporate and Business Clients

Analysis by Price Segment:

• Ultra-Luxury (Above AUD 10,000)

• Premium Luxury (AUD 1,000-10,000)

• Accessible Luxury (AUD 200-1,000)

• Entry-Level Luxury (Below AUD 200)

Breakup by Region:

• New South Wales (Sydney)

• Victoria (Melbourne)

• Queensland (Brisbane, Gold Coast)

• Western Australia (Perth)

• South Australia (Adelaide)

• Australian Capital Territory (Canberra)

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players. Major international luxury conglomerates dominate the Australian market, including LVMH with prestigious brands such as Louis Vuitton, Fendi, and Loro Piana. The Kering Group maintains strong presence through Gucci, Balenciaga, and Saint Laurent, while American luxury houses Ralph Lauren, PVH Corporation (Calvin Klein, Tommy Hilfiger), and other established players compete vigorously for market share.

The market also features emerging Australian luxury brands that leverage local design sensibilities and craftsmanship heritage, alongside sustainable luxury innovators who are reshaping industry standards through ethical practices and environmental responsibility. These players compete through continuous innovation, exceptional customer experiences, strategic retail expansion, and authentic brand storytelling that resonates with increasingly sophisticated Australian luxury consumers.

Recent News and Developments in Australia Luxury Goods Market

September 2025: Major luxury brands are accelerating comprehensive digital transformation initiatives across Australian markets, implementing advanced augmented reality virtual try-on technologies and personalized artificial intelligence-driven customer service platforms. These innovations enhance omnichannel shopping experiences by seamlessly connecting online browsing with in-store visits, enabling customers to visualize products in their personal context before purchase, and providing unprecedented levels of personalized service that rival traditional boutique experiences.

August 2025: The Australian luxury fashion market demonstrates strong growth momentum as cultural shifts toward quiet luxury preferences reshape consumer behavior. Affluent buyers are increasingly favoring subtle, high-quality items over ostentatious displays of wealth, driving demand for premium craftsmanship, understated elegance, and timeless design. This trend particularly benefits heritage brands and artisanal luxury houses that emphasize quality materials, exceptional workmanship, and enduring style over seasonal trends.

July 2025: Sustainability has become a central focus for Australian luxury consumers, prompting major brands to expand eco-conscious product lines featuring recycled materials, ethical sourcing practices, and transparent supply chains. This shift meets growing environmental consciousness among affluent buyers who increasingly demand that luxury purchases align with personal values. Brands demonstrating genuine commitment to sustainability through verified practices and third-party certifications are gaining significant competitive advantages.

June 2025: Digital accessibility initiatives continue to boost online luxury sales significantly, with growing internet penetration and sophisticated mobile commerce platforms enabling seamless luxury shopping experiences across metropolitan and regional Australian markets. The integration of secure payment systems, augmented reality product visualization, and personalized recommendation engines has overcome traditional barriers to online luxury purchases, expanding market reach beyond major urban centers.

May 2025: Chanel introduced an exclusive high jewelry collection in Australia featuring rare gemstones and exceptional craftsmanship inspired by nature's beauty. Available only at selected boutiques in Sydney and Melbourne, this limited collection further solidifies Chanel's commitment to the Australian luxury market and demonstrates continued confidence in Australia's affluent consumer base despite global economic uncertainties.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Ask Analyst for customized report:

https://www.imarcgroup.com/request?type=report&id=24663&flag=E

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201-971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Luxury Goods Market: Outlook, Growth Projection & Opportunities 2025-2033 here

News-ID: 4201081 • Views: …

More Releases from IMARC Services Private Limited

Australia Cryptocurrency Exchange Market Size, Share, Trends 2025-2033

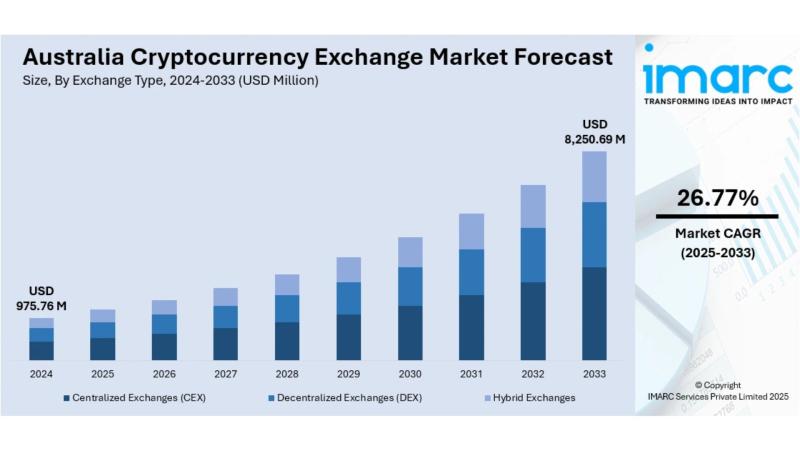

Australia Cryptocurrency Exchange Market Overview

Market Size in 2024: USD 975.76 Million

Market Size in 2033: USD 8,250.69 Million

Market Growth Rate 2025-2033: 26.77%

According to IMARC Group's latest research publication, "Australia Cryptocurrency Exchange Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia cryptocurrency exchange market size was valued at USD 975.76 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,250.69 Million by 2033, exhibiting a…

Australia Kidswear Market Size, Share, Trends and Forecast by 2025-2033

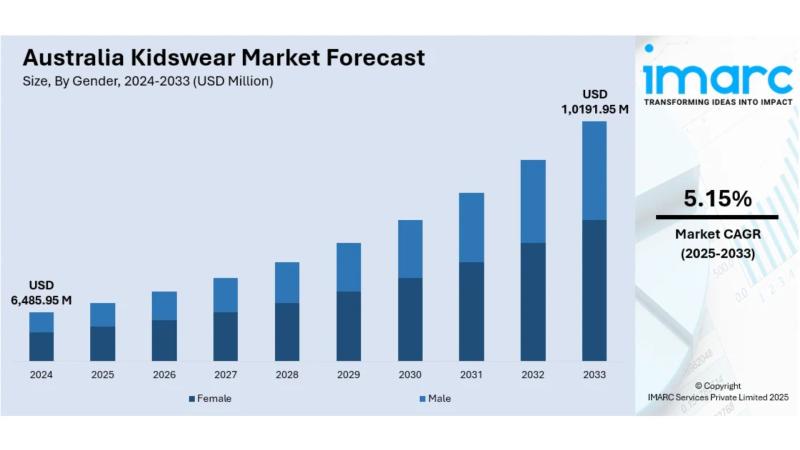

Australia Kidswear Market Overview

Market Size in 2024: USD 6,485.95 Million

Market Size in 2033: USD 10,191.95 Million

Market Growth Rate 2025-2033: 5.15%

According to IMARC Group's latest research publication, "Australia Kidswear Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia kidswear market size was valued at USD 6,485.95 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,191.95 Million by 2033, exhibiting a CAGR of 5.15%…

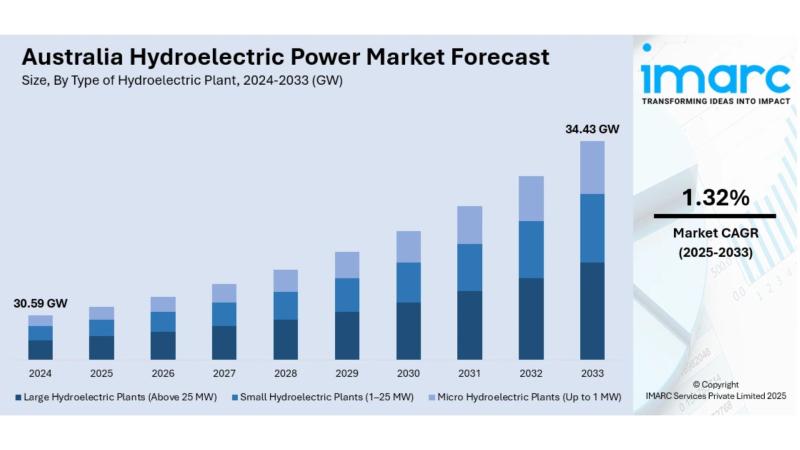

Australia Hydroelectric Power Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Hydroelectric Power Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia hydroelectric power market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia hydroelectric power market size reached 30.59 GW in 2024. Looking forward, IMARC Group expects the market to reach 34.43 GW…

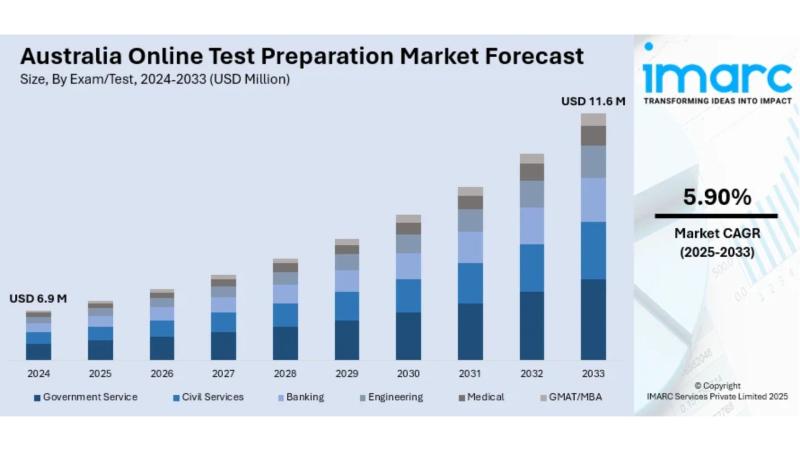

Australia Online Test Preparation Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Online Test Preparation Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia online test preparation market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia online test preparation market size reached USD 6.9 Million in 2024. Looking forward, IMARC Group expects the market…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…