Press release

Mobile Automatic Charging Robots Market to Reach CAGR 16,9% by 2031 Top 20 Company Globally

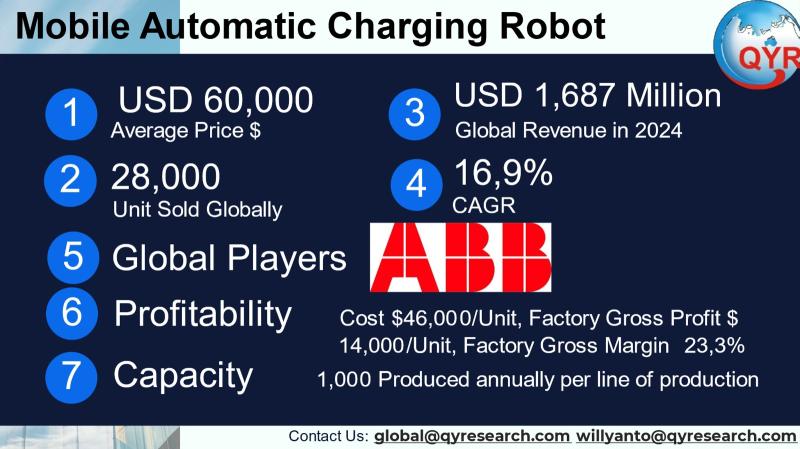

Mobile Automatic Charging Robots (MACRs) are autonomous platforms that travel to electric vehicles, robots, or other battery-powered assets and deliver charging services without fixed infrastructure at every parking bay. They combine autonomous navigation, power-transfer hardware (contact or wireless), fleet energy management software, and safety/communications systems to service fleets, parking facilities, airports, logistics hubs and public charging networks. MACRs address intermittent grid constraints, reduce the need for dense fixed chargers, and enable flexible on-demand replenishment of power for EVs and industrial robots alike. This report treats MACRs as the intersection of robotics, power electronics, and charging services and frames market sizing, unit economics, regional deployment patterns, technology trends, capacity metrics and investor implications accordingly.The global mobile automatic charging robot market is USD 1,687 million in 2024 and an assumed compound annual growth rate of 16.9% to 2031, market size reaching USD 5,033 million in 2031. Average MACRs units are priced at USD 60,000 per unit, with estimated global unit shipments totaling about 28,000 in 2024. The cost of goods sold per unit is set at USD 46,000. Factory-level gross profit per unit in the profile used for this report is USD 14,000, reflecting a factory gross margin of 23.3%. The breakdown of COGS by category (percent of COGS) is: chassis and mechanical structure 28%; battery & powertrain 30%; sensors and electronics 15%; software & controls 8%; assembly & labor 12%; packaging & logistics 7%. A standard single production line for a full machine can produce roughly 1,000 unit per line per year. Demand composition downstream, the split by application is estimated as: logistics & warehousing 45%, EV charging services (public/private fleets) 20%, airports & transport hubs 10%, retail & parking operators 10%, and other municipal/event uses 15%.

Latest Trends and Technological Developments

The technology frontier for MACRs is advancing along three converging axes: higher-power contactless charging, integrated fleet energy management, and expanded real-world pilots in transport hubs. In April 2024 WiBotic announced a 1 kW wireless charging platform targeted at a broader class of mobile robots, signaling increased interest in contactless high-power solutions that reduce mechanical wear and alignment complexity (April 2024). In late 2024 several autonomous EV-charging robot pilots and product launches attracted attention: Forbes covered an autonomous EV robot (FlashBot) bringing power to remote sites (Dec 2024), and regional players began introducing robotized DC chargers into Southeast Asia in 2024 (AugustSeptember 2024 product launches and deployments). Hyundai Motor Group and partners have also publicly moved from internal trials toward real-world deployments and demonstrations for transport hubs and airport pilots, highlighting commercialization momentum (announcements and deployments reported in 2024 May 2025). In parallel, several market reports and industry analysts observed rapid market growth in the robot charging station segment in 2024 and reiterated the humanitarian and operational drivers for mobile charging namely flexibility, lower fixed-infrastructure cost and easier retrofits of existing parking and logistics sites.

Asia is a leading region for MACR adoption for three reasons: concentrated EV growth, strong OEM and energy-player participation, and high density of large facilities (airports, logistics hubs, multi-storey parking) that benefit from mobile solutions. China and Northeast Asia have produced a robust vendor ecosystem of mobile-charging suppliers and integrators; research trackers and market reports identify more than twenty active players and strong domestic product development activity during 2023 to 2024. Japan, South Korea and China are notable for early industrial deployments and integration with factory-floor automation and airport pilot schemes. South Koreas collaboration between OEMs and airports and Hyundais publicized trials are illustrative of demand emerging from integrated mobility ecosystems. The Asia Pacific market benefits from government-driven EV infrastructure programs plus private launches of mobile DC-charger robots; the regions mix of mature charging networks (urban China, South Korea, Japan) and rapidly maturing markets (Southeast Asia, India) creates parallel opportunities for both fleet and consumer-facing MACR business models.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5054699

Mobile Automatic Charging Robots by Type:

Rail-Guided Type

Laser-Guided Type

Vision-Guided Type

Hybrid Navigation Type

Others

Mobile Automatic Charging Robots by Application:

Industrial Manufacturing

Warehouse & Logistics

Autonomous Vehicle Charging

Hospitals and Commercial Facilities

Others

Global Top 20 Key Companies in the Mobile Automatic Charging Robots Market

ABB

Siemens

Bosch Rexroth

KUKA

FANUC

Omron Corporation

Yaskawa Electric

Staubli

Panasonic Industry

Evatronix

Mobile Industrial Robots

Fetch Robotics

Clearpath Robotics

Autoguide Mobile Robots

Geek+

Quicktron

GreyOrange

Vecna Robotics

AutoX

Locus Robotics

Regional Insights

Southeast Asia is shifting from proof-of-concept to early commercial rollouts. In AugustSeptember 2024 several entrants targeted Malaysia and Singapore with robot EV charger launches (publicized product launches and pilots), signaling appetite among private operators and car-park owners for pilot deployments. Indonesia shows a two-track dynamic: rapidly expanding fixed-charger infrastructure and eagerness from government and large regional OEMs to build the ecosystem. Indonesia reported strong growth in charging points in 2023 and national policy changes (including moves to allow greater private investment in charging infrastructure) are accelerating year-on-year deployment which positions Indonesia as a promising market for both fixed and mobile charging solutions as EV volumes scale. Notably, headline investments and plans by regional OEMs (e.g., VinFasts 2025 charging network plans) underscore expected demand for charging technologies across the archipelago. Across ASEAN, developers are targeting malls, multi-storey carparks, logistics hubs and fleet depots; local players and newcomers are proposing robotized DC chargers to complement or reduce dependence on fixed-grid upgrades, particularly where right-of-way or grid capacity is constrained.

MACR commercialization faces technical, regulatory and business-model hurdles. On the technical side, higher-power wireless delivery remains constrained by efficiency and thermal limits versus plug/contact approaches; alignment, safety and interoperability with different vehicle inlet standards require engineering work and standards alignment. On the regulatory and site-integration side, permitting for autonomous mobile units in public garages and curbside zones can be slow and varies by jurisdiction; insurance and liability frameworks for mobile external devices are still maturing. Supply-chain constraints (particularly battery cells and high-power electronics) and variability in production scale make unit costs sensitive to component pricing and low-volume manufacturing. Lastly, customer procurement cycles especially for large airports and parking operators can be conservative and slow, delaying large fleet rollouts despite clear technical benefits. Several market trackers also call out replacement/maintenance cost and standardization as adoption barriers for broad municipal deployments.

Vendors should prioritize modularity (support both contact and wireless interfaces), robust fleet energy-management software with predictive charging scheduling, and partnerships with local EV network operators to solve Permitting + Payment integration. Pilots at high-visibility sites (airports, logistics parks, large retailers) accelerate proof-of-value; co-funding or revenue-share models with parking operators reduce the up-front capex burden on end customers. Buyers fleet operators and parking owners should model TCO against fixed chargers, include maintenance and replacement cycles in procurement decisions, and insist on standards-based communication interfaces to avoid vendor lock-in. Strategic alliances with local energy providers can mitigate constraints on grid upgrades and provide bundled renewable-energy charging propositions an increasingly attractive commercial pitch in Asia and ASEAN markets.

Product Models

Mobile Automatic Charging Robots are advanced robotic systems designed to recharge electric vehicles (EVs), autonomous mobile robots (AMRs), and industrial equipment without human intervention. These robots improve operational efficiency in smart factories, logistics hubs, and EV infrastructure.

Rail-Guided which follow fixed tracks. Notable products include:

Siemens Rail-Guided Charging Robot Siemens AG: Fixed-path charging robot for industrial AGVs and logistics systems.

KUKA RAIL-CHARGE KUKA Robotics: Rail-mounted charging unit designed for automated production lines.

Murata Rail Charging System Murata Machinery: Supports rail-guided AMRs with efficient auto-charging.

Elettric80 Rail-Guided Robot Charger Elettric80: Automated guided vehicle (AGV) charging robot on fixed rails.

JBT Rail-Guided AutoCharge JBT Corporation: Provides automated charging for guided material handling vehicles.

Laser-Guided which navigate with LiDAR-based mapping. Examples include:

ABB LaserCharge Robot ABB Robotics: Uses LiDAR to locate EV charging ports with high accuracy.

BlueBotics ANT Laser T-CHARGE BlueBotics SA: Laser-guided auto-charging system for industrial AMRs.

Continental Laser-Based EV Charger Continental AG: Precision charging robot with 3D LiDAR positioning.

Omron LD LaserCharge Omron Corporation: Laser-guided charging robot for factory mobile robots.

MiR Laser Docking Charger Mobile Industrial Robots (MiR): Automates AMR charging using laser mapping.

Vision-Guided which use cameras and AI for dynamic positioning. Notable products include:

NIO PowerVision Charger NIO Inc.: Vision-guided charging system for EV infrastructure.

XPeng Robot Charger XPeng Motors: Uses AI vision to dock charging cable to EV port.

BYD Vision-Guided Charger BYD Auto: Automated charging robot for EVs using computer vision.

Robotic Vision Charger Rocsys BV: AI vision-guided robotic arm charger for EVs.

Easelink Matrix Charging Robot Easelink GmbH: Vision-guided ground-based auto-connector for EVs.

Hybrid Navigation which combines multiple navigation methods for high flexibility. Examples include:

Siemens Hybrid Docking Robot Siemens AG: Dual-guided charging robot for EVs and AGVs.

Omron Hybrid AMR Charger Omron Corporation: Hybrid-guided charging robot for factory AMRs.

Rocsys Hybrid Docking System Rocsys BV: Robotic charging arm using both cameras and laser sensors.

KUKA Hybrid Guided Charger KUKA Robotics: Industrial hybrid charging solution for AGVs and AMRs.

NaaS Automatic Charging Robot NaaS Technology Inc.: This robot uses multiple navigation technologies all autonomously

Mobile Automatic Charging Robots are moving beyond niche trials into targeted commercial deployments as markets grapple with faster EV adoption and constrained fixed-charging capacity. The space combines robotics, power electronics and fleet software creating multiple entry points for technology innovators, OEMs, energy companies and parking operators. While unit economics at current prices imply modest factory gross margins (below 30% in the representative profile used here), scale, standardization and local partnerships can materially improve outcomes. Asia and Southeast Asia are priority regions due to their high EV adoption trajectories, infrastructure programs and active pilot activity by both incumbents and agile startups.

Investor Analysis

This report aggregates market size, growth trajectory, unit economics, production capacity per line and sector demand mix. Investors can use these metrics to model entry valuations, break-even thresholds, capital requirements for scaling production lines, and sensitivity to component-cost volatility. The combination of accelerating demand in Asia/ASEAN, visible pilot-to-commercial pathways (airports, mall carparks, logistics depots) and modular business models (capex lease, managed charging services, revenue share) makes MACRs an attractive adjacent play to EV charging and warehouse automation; the relatively high unit price with mid-teens market CAGR implies sizable upside for incumbents or scale-focused startups that can compress COGS and expand line capacity. The investor takeaways are: focus on partners that can secure local permits, vertically integrate battery/powertrain sourcing or contract favorable long-term supply, and pursue recurring-revenue service contracts to smooth margins.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5054699

5 Reasons to Buy This Report

Comprehensive Asia & ASEAN-focused market context and unit-economics modeling that reflect current price points and production profiles.

Curated, dated technology and pilot news items that show where commercialization is occurring now.

Practical manufacturing metrics for financial modeling and due diligence.

Downstream demand segmentation and strategic guidance for partnerships and go-to-market in Southeast Asia.

A short list of leading vendors and recommended investor actions to accelerate time-to-value.

5 Key Questions Answered

What is the market size and growth rate for MACRs?

What are realistic unit economics for a MACR OEM?

Which Asian and ASEAN markets are moving fastest toward deployment and why?

What are the main technological trends and recent real-world pilots or product launches?

How should investors and vendors structure partnerships, production scale and business models to capture value?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Automatic Charging Robots Market to Reach CAGR 16,9% by 2031 Top 20 Company Globally here

News-ID: 4200445 • Views: …

More Releases from QY Research

Top 30 Indonesian Palm Oil Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Astra Agro Lestari Tbk (AALI) Plantation & CPO producer; reported Q3 2025 net profit of ~USD 64.3 million.

PT Andira Agro Tbk (ANDI) Palm oil plantation & processing.

PT Eagle High Plantations Tbk (BWPT) Plantation & CPO operations.

PT Cisadane Sawit Raya Tbk (CSRA) Plantation & crude palm oil.

PT Dharma Satya Nusantara Tbk (DSNG) Plantation & palm…

Smart Thrusters Power the Future of Marine Automation: Market Outlook & Strategy …

Underwater thrusters are compact marine propulsion systems used to maneuver ROVs (Remotely Operated Vehicles), AUVs (Autonomous Underwater Vehicles), USVs, inspection drones, subsea robots, small submersibles, and dynamic positioning modules.

Core function: provide vector thrust, station keeping, precise navigation, and stability control in harsh underwater environments.

Typical construction: brushless DC motors, corrosion-resistant housings (aluminum/SS316/titanium), magnetic coupling seals, pressure compensation, and modular ESC integration.

Used heavily across offshore energy, subsea inspection, aquaculture, defense, marine research,…

Paper Replaces Plastic: The USD 1.4B Honeycomb Kraft Packaging Boom

Honeycomb kraft packaging is a paper-based cushioning and void-fill material manufactured by die-cutting and expanding kraft paper into a hexagonal honeycomb structure that provides shock absorption, compression strength, and lightweight protection.

Used as a plastic-free substitute for bubble wrap, EPS foam, and plastic fillers.

Global Market Overview

2025 market size: USD 1,420 million

2031 market size: USD 2,449 million

Forecast CAGR (2025 to 2032): 8.1%

Average selling price (ASP): USD 1,150/ton

Total unit volume sold (2025): 1,234K…

How High-Flex and EV Demand Are Transforming the Ribbon Cable Business

Flat ribbon cables are multi-conductor cables with parallel insulated wires bonded together in a flat strip format, enabling compact routing, high pin-count interconnection, and cost-efficient mass termination.

Widely used across electronics, computing, telecom, automotive electronics, industrial automation, and consumer devices where space savings, airflow, and organized harnessing are critical.

Increasing integration of compact electronics, IoT hardware, and high-density connectors is accelerating demand for flexible, lightweight interconnect solutions.

Industry Overview & Global Market Snapshot

Standard…

More Releases for Robot

RoboPaw Robot Puppy Review: Is This Robot Dog Worth Buying?

RoboPaw Robot Puppy Review: Is This Robot Dog Worth Buying?

The rise of smart robotic pets has transformed how families introduce companionship, creativity, and safe entertainment into their daily routines. Among the newest innovations gaining massive attention is the RoboPaw Robot Puppy, a highly interactive, expressive, and surprisingly intelligent robotic companion designed for kids, adults, and even seniors who want play, comfort, and engagement without the responsibility of a real pet.

The…

Wuffy Robot Dog Reviews: All Truth about Wuffy Robot Dog (wuffy the robot dog)

Parents around the world are asking the same question right now: can a robot puppy really replace some of the comfort and fun of a real dog? In a time when many families live in apartments, juggle allergies, or simply cannot handle the responsibility of a pet, wuffy robot dog reviews are starting to stand out online for one simple reason. This is not another plastic gadget that flashes once…

Major Market Shift in Robot Kitchen Industry: Robot-Operated Or AI-Powered Resta …

What Is the Forecasted Market Size and Growth Rate for the Robot Kitchen Market?

The robot kitchen market has grown strongly in recent years. It is projected to grow from $3.35 billion in 2024 to $3.66 billion in 2025, at a CAGR of 9.3%. The growth is driven by automation and efficiency, rising labor costs, consumer demand for convenience, innovation and competition, and the emphasis on food safety and hygiene.

The robot…

AI Robot Toy Market Likely to Enjoy Massive Growth (2024-2029)ROYBI AI Robot , D …

According to HTF Market Intelligence, the Global AI Robot Toy market to witness a CAGR of 17.8% during the forecast period (2024-2029). The Latest Released AI Robot Toy Market Research assesses the future growth potential of the AI Robot Toy market and provides information and useful statistics on market structure and size.

This report aims to provide market intelligence and strategic insights to help decision-makers make sound investment decisions and identify…

TPA Robot launches a new industrial linear robot

The single axis robot KK Series, developed by TPA ROBOT, uses partially hardened U-shaped steel base track to significantly increase the robot's strength and load capacity. Due to the different environments, we have three type of linear robot series, KSR, KNR and KFR, depending on the type of cover used.

For the return system between the track and the slider, the contact surface between the ball and the ball groove adopts…

Robot Battery Market 2023- 2028 Global Insights by Industry Volume, Opportunitie …

The Robot Battery Market research report gives consistent conveyance of the substance. Information gathered in the notification is from verified and reliable sources. Besides, the report additionally breaks down the forthcoming patterns and openings likely to propel the Robot Battery Market. Moreover, the Robot Battery Market provides creative strategies and plans that help market players to stay ahead of the competition. Besides, the Robot Battery Market research report likewise evaluates…