Press release

Australia Toys Market Projected to Reach USD 3.03 Billion by 2033

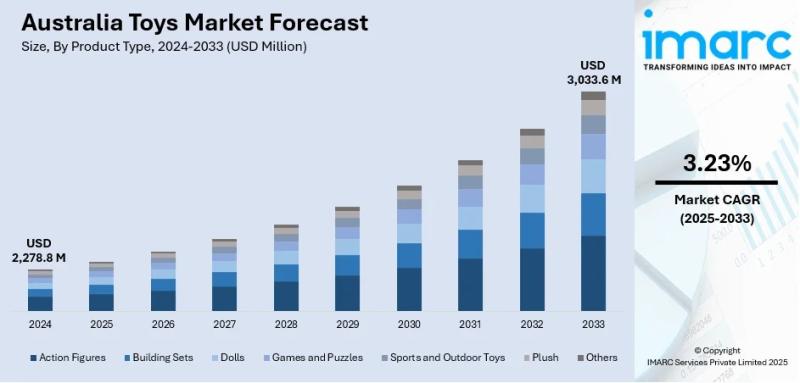

The latest report by IMARC Group, titled "Australia Toys Market Report by Product Type (Action Figures, Building Sets, Dolls, Games and Puzzles, Sports and Outdoor Toys, Plush, Others), Age Group (Up to 5 Years, 5 to 10 Years, Above 10 Years), Sales Channel (Supermarkets and Hypermarkets, Specialty Stores, Department Stores, Online Stores, Others), and Region 2025-2033," offers a comprehensive analysis of the Australia toys market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia toys market size reached USD 2,278.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,033.6 Million by 2033, exhibiting a CAGR of 3.23% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 2,278.8 Million

Market Forecast in 2033: USD 3,033.6 Million

Market Growth Rate (2025-2033): 3.23%

Australia Toys Market Overview

The Australia toys market is experiencing steady growth because digital interfaces and interactive features that adapt to modern learning methods are incorporated by key players, eco-friendly toy production is promoted by a cultural transition that rises toward sustainability, Australian content and licensing that is culturally relevant is preferred by consumers, and physical and digital interactions are blended by hybrid play experiences. The market expansion is supported through nostalgic and licensed toy popularity because it creates multigenerational appeal, because innovation focuses on STEM education and digital integration, and because growing collectibles culture involves adult consumers. Educational toys see improved demand so people give gifts seasonally plus solid e-commerce platforms develop positioning Australia's toys market so it keeps developing while maintaining cultural resonance.

The basis of Australia's toys market shows a strong cultural identity. Since local brands such as Bluey, Play School, and The Wiggles succeed, they make product design distinct plus licensing opportunities resonant. The country notably maintains advanced consumer awareness among millennial as well as Gen Z parents. These parents prioritize sustainability alongside educational value and cultural relevance when they purchase toys. The proliferation of hybrid digital-physical play experiences plus STEM-focused educational toys plus omnichannel retail strategies creates favorable market conditions, and those conditions do require substantial investments in technology integration in addition to sustainable material sourcing along with culturally authentic content development. Australia uniquely combines environmental consciousness also prioritizes education in addition to including strong local cultural content so increasingly attracts revolutionary toy developers plus authentic brand positioners.

Request For Sample Report:

https://www.imarcgroup.com/australia-toys-market/requestsample

Australia Toys Market Trends

• Sustainability and ethical sourcing: Rising cultural transition toward eco-friendly toys using recyclable, biodegradable, and sustainably sourced materials with brands like Happy Planet Toys producing locally-made recycled-plastic toys resonating with consumer values.

• Local cultural relevance: Strong consumer preference for Australian-themed toys and licensing agreements with popular franchises including Bluey, The Wiggles, and Play School creating culturally resonant products and educational experiences.

• Hybrid digital-physical integration: Progressive blurring between physical toys and digital experiences driving demand for AR-enabled toys, coding components, and app-based learning combining tactile and screen-based interactions.

• Nostalgia-driven licensing: Return of beloved franchises like Teenage Mutant Ninja Turtles and My Little Pony creating multigenerational appeal with parents introducing timeless characters to their children.

• STEM education focus: Growing emphasis on science, technology, engineering, and mathematics toys with coding kits, robot toys, and interactive learning tools preparing children for technology-oriented futures.

• Adult collectibles participation: Expanding collectible culture with surprise elements, blind boxes, and limited releases appealing to Gen Z and Millennials extending toy market beyond traditional age demographics.

Market Drivers

• Educational toy demand: Parents and schools prioritizing STEM-focused toys including coding kits, robot toys, and interactive learning tools supporting child development and future technology skills preparation.

• Cultural brand resonance: Success of Australian franchises like Bluey becoming cultural icons both locally and internationally creating strong licensing opportunities and brand loyalty among consumers.

• Sustainability consciousness: Millennial and Gen Z parents increasingly aware of environmental impact driving demand for eco-friendly toys made from FSC-certified wood, organic cotton, and recyclable materials.

• Digital integration adaptation: Children's changing play patterns with ubiquitous technology access creating demand for hybrid toys blending augmented reality, app-based learning, and tactile interaction experiences.

• Multigenerational appeal: Nostalgic toy returns and collectibles culture engaging both children and adults expanding market demographics and creating sustained demand across age groups.

• Innovation and technology: Continuous development of interactive features, smart toys, and app-enabled products adapting to modern learning methods and evolving consumer expectations for educational value.

Challenges and Opportunities

Challenges:

• Import dependency vulnerabilities with high reliance on overseas suppliers, particularly China, creating exposure to supply chain disruptions, currency fluctuations, and increasing freight costs affecting pricing strategies

• Digital disruption impact through screen-based entertainment and mobile gaming causing age compression where children rapidly transition to sophisticated digital play, challenging traditional physical toy categories

• Regulatory compliance complexity with ACCC safety standards requiring extensive testing and documentation increasing costs and market entry barriers particularly for smaller retailers and niche players

• Counterfeit product risks undermining consumer confidence and brand integrity while creating safety hazards through non-compliant materials and production processes requiring legal protection investments

• E-commerce competition pressure from international platforms like Temu and Shein offering cheap imports requiring local retailers to excel in unique offerings and customer service differentiation

Opportunities:

• Indigenous content expansion through government and community support for Aboriginal-owned businesses creating authentic cultural representation in children's games and educational activities

• Technology partnership development collaborating with local educational institutions and tech companies to create innovative STEM toys aligned with Australian curriculum and learning objectives

• Omnichannel retail evolution combining physical stores with digital marketing through QR codes, virtual experiences, and influencer campaigns enhancing customer engagement and market reach

• Sustainable innovation leadership developing comprehensive eco-friendly product lines and circular economy initiatives appealing to environmentally conscious consumers and creating competitive differentiation

• Adult market expansion through sophisticated collectibles, premium nostalgia products, and cross-platform content creating additional revenue streams and extending product lifecycle beyond traditional demographics

Australia Toys Market Segmentation

By Product Type:

• Action Figures

• Building Sets

• Dolls

• Games and Puzzles

• Sports and Outdoor Toys

• Plush

• Others

By Age Group:

• Up to 5 Years

• 5 to 10 Years

• Above 10 Years

By Sales Channel:

• Supermarkets and Hypermarkets

• Specialty Stores

• Department Stores

• Online Stores

• Others

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-toys-market

Australia Toys Market News (2024-2025)

• 2024: Bluey continued international success as Australian cultural icon creating strong licensing opportunities and driving local toy sales while establishing Australia as content creator for global children's entertainment market.

• 2024: Happy Planet Toys expanded production of locally-made recycled-plastic toys addressing growing consumer demand for sustainable and environmentally responsible toy options among eco-conscious parents.

• 2024: Melbourne toy libraries received additional local grants funding expanding access to high-quality toys particularly for families with children with disabilities, promoting inclusive play and community resource sharing.

• 2024: Moose Toys reported increased counterfeit product challenges requiring enhanced product authentication and legal protection measures to safeguard brand integrity and consumer safety standards.

• 2024: Australian retailers expanded hybrid play experiences integrating augmented reality and app-based learning responding to children's changing play patterns and technology integration demands.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Product Type, Age Group, and Sales Channel Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=21946&flag=F

Q&A Section

Q1: What drives growth in the Australia toys market?

A1: Market growth is driven by educational toy demand for STEM-focused learning tools, cultural brand resonance through successful Australian franchises like Bluey, sustainability consciousness among millennial and Gen Z parents, digital integration adaptation combining AR and app-based learning, multigenerational appeal through nostalgic returns and collectibles, and continuous innovation incorporating interactive features adapting to modern learning methods.

Q2: What are the latest trends in this market?

A2: Key trends include sustainability and ethical sourcing using recyclable and biodegradable materials, local cultural relevance through Australian-themed licensing with Bluey and The Wiggles, hybrid digital-physical integration blending AR and tactile experiences, nostalgia-driven licensing creating multigenerational appeal, STEM education focus preparing children for technology futures, and adult collectibles participation expanding market demographics beyond traditional age groups.

Q3: What challenges do companies face?

A3: Major challenges include import dependency vulnerabilities creating supply chain and currency risks, digital disruption impact through screen-based entertainment causing age compression, regulatory compliance complexity with ACCC safety standards increasing costs, counterfeit product risks undermining consumer confidence and safety, and e-commerce competition pressure from international platforms requiring differentiation through unique offerings and superior customer service.

Q4: What opportunities are emerging?

A4: Emerging opportunities include indigenous content expansion through Aboriginal-owned business support creating authentic cultural representation, technology partnership development with educational institutions for innovative STEM toys, omnichannel retail evolution combining physical and digital experiences, sustainable innovation leadership through eco-friendly product development, and adult market expansion through sophisticated collectibles and premium nostalgia products extending traditional demographics.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Toys Market Projected to Reach USD 3.03 Billion by 2033 here

News-ID: 4198957 • Views: …

More Releases from IMARC Group

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…