Press release

Australia Freight and Logistics Market Size, Share & Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Freight and Logistics Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia freight transportation market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia freight and logistics market size reached USD 93.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 137.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.32% during 2025-2033.Report Attributes:

• Base Year: 2024

• Forecast Years: 2025-2033

• Historical Years: 2019-2024

• Market Size in 2024: USD 93.8 Billion

• Market Forecast in 2033: USD 137.3 Billion

• Market Growth Rate 2025-2033: 4.32%

For an in-depth analysis, you can refer to a sample copy of the report: https://www.imarcgroup.com/australia-freight-logistics-market/requestsample

How Is AI Transforming the Freight Transportation Industry in Australia?

Artificial intelligence is revolutionizing Australia's freight and logistics sector, enhancing operational efficiency, predictive capabilities, and supply chain optimization:

• Predictive Analytics for Route Optimization: AI algorithms are analyzing traffic patterns, weather conditions, and historical data to optimize delivery routes in real-time, reducing fuel consumption and improving delivery times across Australia's vast distances

• Automated Warehouse Management: Machine learning systems are managing inventory levels, predicting demand patterns, and optimizing warehouse operations through robotic automation, reducing labor costs and improving accuracy

• Fleet Management Intelligence: AI-powered systems are monitoring vehicle health, driver behavior, and maintenance needs to prevent breakdowns, ensure compliance with safety regulations, and optimize fleet utilization

• Supply Chain Visibility Platforms: Advanced AI systems are providing end-to-end supply chain transparency, enabling companies to track shipments, predict delays, and proactively manage disruptions across multiple transportation modes

Australia Freight Transportation Market Overview

The Australian freight and logistics sector is experiencing steady growth driven by e-commerce expansion, infrastructure development, and sustainability initiatives:

• E-Commerce Growth Impact: Rising demand for products from international online retailers is driving cross-border logistics solutions, including customs clearance, international shipping, and last-mile delivery services

• Sustainability Transformation: Companies are adopting electric vehicles, energy-efficient warehouses, and renewable energy sources, with Team Global Express integrating over 300 electric trucks through a $190 million financing agreement

• Digital Innovation Integration: Advanced technologies including GPS tracking, fleet management systems, and automated systems are improving operational precision and speed across logistics operations

• Infrastructure Investment: Continuous improvements in transport infrastructure including ports, rail networks, and road systems are supporting increased trade volumes and operational efficiency

• Regulatory Compliance Focus: Enhanced safety and compliance standards are driving investments in modern fleets, safety training, and environmental monitoring systems

Key Features and Trends of Australia Freight Transportation Market

Current market dynamics reflect significant shifts toward digitalization, sustainability, and operational excellence:

• Cross-Border E-Commerce Expansion: CIRRO E-Commerce's launch of international shipping services to New Zealand, North America, and Europe demonstrates growing demand for efficient cross-border logistics solutions

• Carbon Analytics Integration: Sydney startup Ofload's $31 million funding for its Carbon Analytics Platform highlights the industry's focus on emissions monitoring and compliance with federal regulations

• Multi-Modal Transportation Growth: Integration of trucks, ships, trains, and planes is optimizing cargo movement based on distance, cost, and delivery requirements across Australia's diverse geography

• Green Logistics Prioritization: Companies are implementing route planning optimization, shipment consolidation, and alternative fuels including hydrogen and biofuels for sustainable transportation

• Technology-Enhanced Safety: Fleet management systems are monitoring driver behavior, ensuring vehicle maintenance, and meeting environmental standards while improving supply chain reliability

Growth Drivers of Australia Freight Transportation Market

• International Trade Volume Expansion: Growing import and export activities driven by global connectivity and trade agreements are creating sustained demand for freight transportation services

• E-Commerce Boom: Rapid growth in online retail and cross-border shopping is driving demand for last-mile delivery services, warehousing solutions, and international logistics capabilities

• Mining and Resource Exports: Australia's position as a major commodity exporter requires specialized freight services for bulk materials, creating consistent demand for heavy transportation and port logistics

• Infrastructure Development Projects: Government investments in ports, rail networks, and transportation infrastructure are creating new capacity and improving operational efficiency

• Supply Chain Digitization: Investment in technology platforms, automation, and data analytics is improving operational efficiency while creating competitive advantages for early adopters

Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/australia-freight-logistics-market

Innovation & Market Demand of Australia Freight Transportation Market

Technological advancement and evolving market requirements are creating new opportunities for logistics service providers:

• Autonomous Vehicle Integration: The development of autonomous trucks and drones for cargo delivery is creating chances to reduce costs and operate 24/7, especially in remote areas.

• Blockchain Supply Chain Transparency: The use of blockchain technology is improving cargo tracking, customs paperwork, and the security of transactions in international trade routes.

• Internet of Things (IoT) Integration: Smart sensors and connected devices are offering real-time monitoring of cargo, temperature control, and condition tracking for sensitive goods.

• Cloud-Based Logistics Platforms: Centralized management systems are allowing real-time coordination between shippers, carriers, and customers while simplifying operations.

• Green Technology Adoption: Investing in electric vehicle fleets, solar-powered warehouses, and carbon-neutral transportation options is creating a competitive edge.

Australia Freight Transportation Market Opportunities

Emerging opportunities are creating pathways for growth across various logistics segments and service offerings:

• Regional Connectivity Enhancement: Underserved regional and remote areas offer chances for specialized logistics services, especially in mining, agriculture, and tourism.

• Cold Chain Logistics Expansion: The rising need for fresh produce, pharmaceuticals, and goods that need specific temperatures opens up opportunities for refrigerated transportation and storage.

• Same-Day Delivery Services: Urban areas offer chances for fast delivery services that support e-commerce, medical supplies, and urgent business needs.

• Sustainable Logistics Solutions: Increased corporate commitments to sustainability boost demand for carbon-neutral shipping, eco-friendly packaging, and responsible transportation options.

• Cross-Border Trade Facilitation: Growing trade relationships with Asian markets create opportunities for specialized international logistics services and customs knowledge.

Australia Freight Transportation Market Challenges

Several obstacles continue impacting market growth and operational efficiency across the freight transportation sector:

• Driver Shortage Crisis: The ongoing shortage of qualified truck drivers limits capacity expansion and raises labor costs, especially for long-haul transportation services.

• Infrastructure Bottlenecks: Port congestion, rail capacity issues, and road maintenance problems cause delays and increase costs, particularly during busy shipping seasons.

• Fuel Price Volatility: Changing fuel prices affect operational expenses and profit margins, making it necessary to use effective pricing strategies and fuel hedging methods.

• Regulatory Compliance Complexity: Stricter emissions rules, safety standards, and cross-border documentation requirements lead to compliance costs and operational challenges.

• Technology Integration Cs: The high initial costs for fleet modernization, digital platforms, and automation systems present challenges for smaller logistics providers.

Australia Freight Transportation Market Analysis

Current market conditions reflect both resilience and transformation amid global supply chain challenges:

• Investment Acceleration: Major funding rounds including Team Global Express's $190 million clean energy financing and Ofload's $31 million carbon analytics investment demonstrate strong investor confidence

• Technology Adoption Leadership: Australian logistics companies are leading adoption of electric vehicles, carbon monitoring systems, and international shipping platforms

• Market Consolidation Trends: Larger logistics providers are acquiring technology startups and specialized services to expand capabilities and market reach

• Government Support Integration: Clean Energy Finance Corporation backing and federal emissions regulations are driving sustainable transportation investments

• International Expansion Success: CIRRO E-Commerce's successful launch of international services demonstrates growing capability in cross-border logistics management

Australia Freight Transportation Market Segmentation:

1. By Logistics Function:

o Courier, Express and Parcel:

Domestic

International

o Freight Forwarding:

Air

Sea and Inland Waterways

Others

o Freight Transport:

Air

Pipelines

Rail

Road

Sea and Inland Waterways

o Warehousing and Storage:

Non-Temperature Controlled

Temperature Controlled

o Others

2. By End Use Industry:

o Agriculture, Fishing and Forestry

o Construction

o Manufacturing

o Oil and Gas

o Mining and Quarrying

o Wholesale and Retail Trade

o Others

3. By Region:

o Australia Capital Territory & New South Wales

o Victoria & Tasmania

o Queensland

o Northern Territory & Southern Australia

o Western Australia

Australia Freight Transportation Market News & Recent Developments:

2024: Team Global Express announced plans to integrate over 300 electric trucks, vans, and mobile chargers into their fleet, supported by a $190 million financing agreement led by the Clean Energy Finance Corporation, advancing their environmentally friendly transportation goals.

2024: Sydney logistics startup Ofload secured $31 million in funding to introduce its Carbon Analytics Platform (CAP), designed to help Australian businesses monitor carbon emissions across supply chains as new federal emissions reporting regulations approach.

2024: CIRRO E-Commerce launched international shipping services from Australia to New Zealand, North America, and Europe, offering efficient customs clearance, comprehensive management, and thorough shipment tracking for Australian businesses.

Australia Freight Transportation Market Key Players:

• Australia Post

• Toll Holdings

• Linfox

• StarTrack

• TNT Australia

• DHL Australia

• FedEx Australia

• Team Global Express

• Mainfreight Australia

• CTI Logistics

Key Highlights of the Report:

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter's Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=21998&flag=E

FAQs: Australia Freight Transportation Market

Q1: What was the Australia freight and logistics market size in 2024?

A: The market reached USD 93.8 Billion in 2024.

Q2: What is the expected market value by 2033?

A: The market is projected to reach USD 137.3 Billion by 2033.

Q3: How is AI transforming the freight transportation industry in Australia?

A: AI is enabling predictive analytics for route optimization, automated warehouse management, intelligent fleet management systems, and comprehensive supply chain visibility platforms that improve efficiency and reduce costs.

Q4: What are the main growth drivers for this market?

A: International trade volume expansion, e-commerce boom, mining and resource exports, infrastructure development projects, and supply chain digitization are the primary drivers.

Q5: Which freight transportation segments show the strongest growth potential?

A: Cross-border e-commerce logistics, sustainable transportation services, cold chain logistics, and technology-enhanced warehousing demonstrate the highest growth potential across the market.

Conclusion of Report:

Australia's freight transportation market is experiencing strategic transformation while adapting to sustainability demands and technological advancement:

• Investment Leadership: Major funding commitments including Team Global Express's $190 million clean energy investment and Ofload's $31 million carbon analytics platform demonstrate strong investor confidence in sustainable logistics solutions

• Technology Integration Success: Successful launches of carbon monitoring platforms and international shipping services showcase Australia's capability in developing innovative logistics technologies

• Sustainability Transformation: Industry-wide adoption of electric vehicle fleets, energy-efficient warehouses, and carbon analytics platforms positions Australia as a leader in green logistics practices

• Cross-Border Capabilities: CIRRO E-Commerce's international expansion demonstrates growing expertise in cross-border logistics management and customs facilitation

• Infrastructure Foundation: Continued investment in transport infrastructure and digital platforms creates robust foundations for sustained market growth and operational efficiency

• Market Resilience: Despite global challenges, the market maintains healthy growth rates through continuous adaptation to changing consumer demands and regulatory requirements

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Freight and Logistics Market Size, Share & Trends | 2025-2033 here

News-ID: 4198828 • Views: …

More Releases from IMARC Services Private Limited

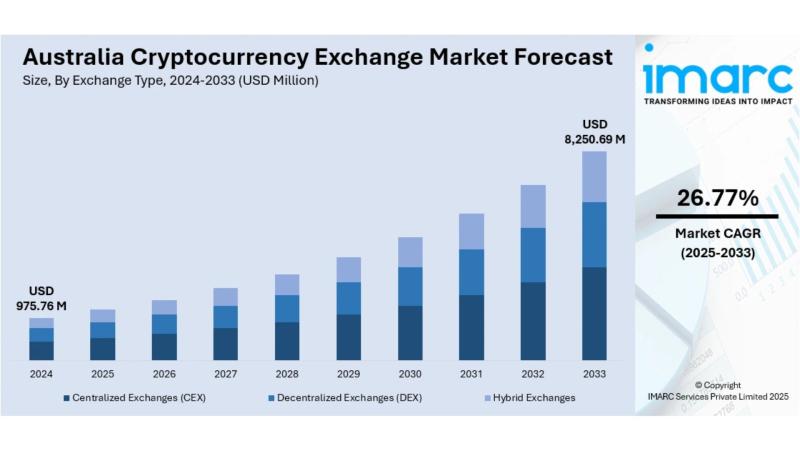

Australia Cryptocurrency Exchange Market Size, Share, Trends 2025-2033

Australia Cryptocurrency Exchange Market Overview

Market Size in 2024: USD 975.76 Million

Market Size in 2033: USD 8,250.69 Million

Market Growth Rate 2025-2033: 26.77%

According to IMARC Group's latest research publication, "Australia Cryptocurrency Exchange Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia cryptocurrency exchange market size was valued at USD 975.76 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,250.69 Million by 2033, exhibiting a…

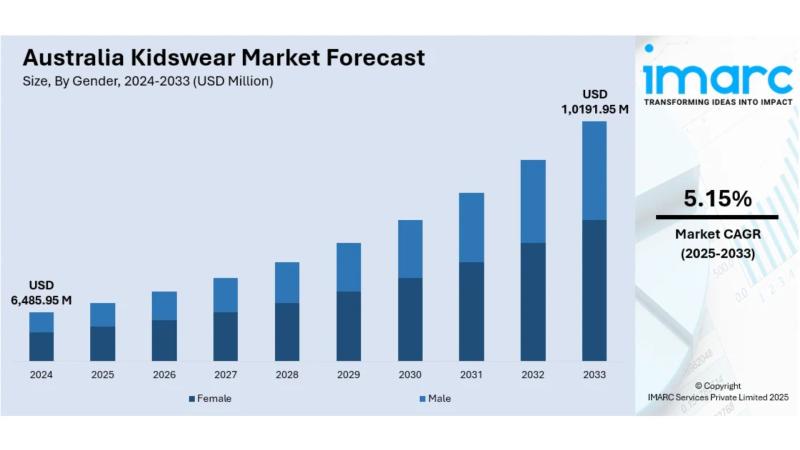

Australia Kidswear Market Size, Share, Trends and Forecast by 2025-2033

Australia Kidswear Market Overview

Market Size in 2024: USD 6,485.95 Million

Market Size in 2033: USD 10,191.95 Million

Market Growth Rate 2025-2033: 5.15%

According to IMARC Group's latest research publication, "Australia Kidswear Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia kidswear market size was valued at USD 6,485.95 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,191.95 Million by 2033, exhibiting a CAGR of 5.15%…

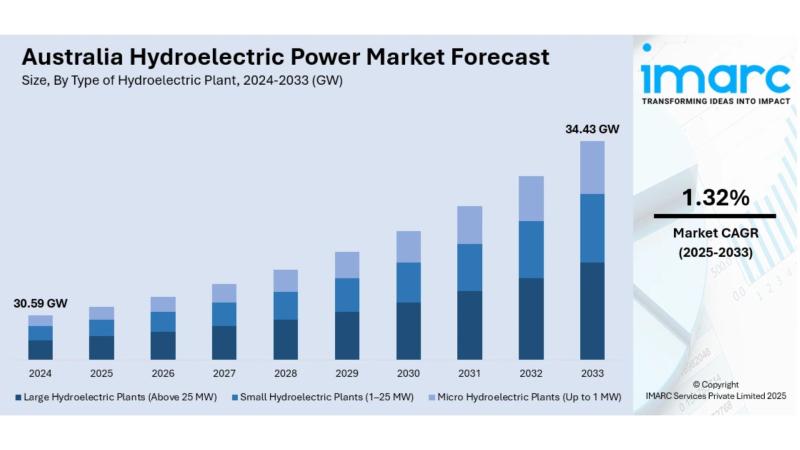

Australia Hydroelectric Power Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Hydroelectric Power Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia hydroelectric power market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia hydroelectric power market size reached 30.59 GW in 2024. Looking forward, IMARC Group expects the market to reach 34.43 GW…

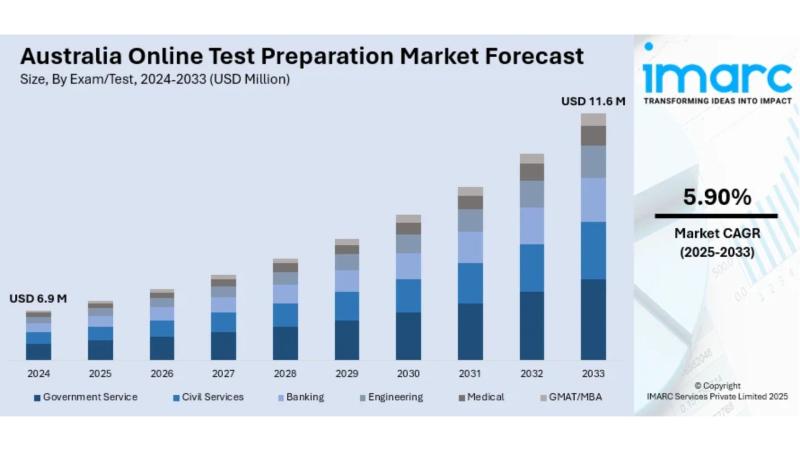

Australia Online Test Preparation Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Online Test Preparation Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia online test preparation market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia online test preparation market size reached USD 6.9 Million in 2024. Looking forward, IMARC Group expects the market…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…