Press release

Self Repairing Polymers Market to Reach CAGR 26,2% by 2031 Top 20 Company Globally

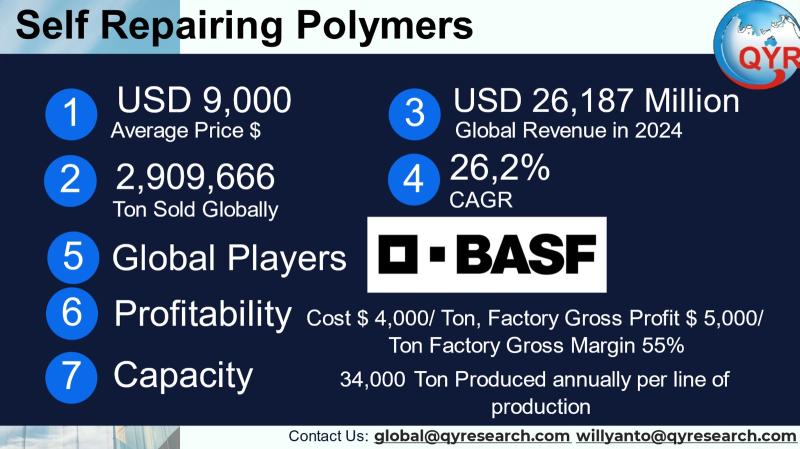

Self-repairing polymers (also called self-healing or self-repairing plastics) are engineered polymer systems that autonomously restore structural integrity after damage through physical, chemical or encapsulated healing mechanisms. These materials range from microcapsule-based coatings that release healing agents on scratch to intrinsically dynamic polymers that reform bonds at the molecular level. Across applications the value proposition is longer service life, lower maintenance cost, improved safety and a smaller lifecycle environmental footprint compared with conventionally repaired parts. Commercial formulations today include microcapsule/vascular systems, reversible covalent and supramolecular networks, and composite hybrids that combine intrinsic and extrinsic healing. Research and pilot production are driving improvements in speed of repair, mechanical recovery, temperature range for healing, and scalability for industrial uses.The global market for self-repairing polymers in 2024 is presented here as USD 26,187 million, reaching USD 133,730 million in 2031 with a growing CAGR of 26,2%. Using a representative average selling price of USD 9,000 per ton, the industry sold approximately 2,909,666 tons globally in 2024. Typical factory economics shown in this report use a cost of goods sold of USD 4,000 per ton, factory gross profit USD 5,000 per ton, and Factory gross margin is 55%. A full machine production capacity reach 34,000 Ton/year. The COGS breakdown by component is presented as raw materials 55%, energy & utilities 20%, direct labor 10%, factory overhead 10% and packaging & logistics 5%. On that basis, factory gross profit is USD 3,600 per ton and the factory gross margin is 40.0% per ton. A standard specialty polymer production line for these advanced formulations is assumed here to have a full machine production capacity of roughly 10,000 tonnes per line per year (capacity will vary widely by technology and configuration). Downstream demand by end-use is concentrated in automotive (28%), coatings / surface protection (22%), electronics & flexible devices (18%), construction & infrastructure (12%), medical & healthcare devices (10%) and other industrial uses (10%). (Where sourceable data exists it is referenced in the following sections; some unit economics in this report are modelled industry averages to produce a consistent apples-to-apples view for investors and strategists.).

.

Latest Trends and Technological Developments

Material science research and commercialization have both accelerated, with three themes standing out: (1) intrinsic self-healing mechanisms that operate at ambient or near-ambient temperatures enabling repeated healing cycles, (2) hybrid materials that combine intrinsic and extrinsic approaches to deliver strength plus repeatability, and (3) integration of self-healing functionality into high-value sectors such as aerospace, EV battery enclosures, and flexible electronics. A notable academic advance was reported by Texas A&M University on April 2025, where researchers described a dynamic polymer able to self-heal after puncture by reversibly transitioning between solid and liquid states to reseal damage. A high-impact fundamental paper published in 2025 in Nature Communications described methods to induce mechanical self-healing in glassy polymer systems through controlled oscillatory deformation, opening new paths for structural polymer applications. In addition, university and industry groups (Carnegie Mellon, and others) reported in mid-2025 on hybrid polymer architectures that combine different healing mechanisms to improve toughness and repeatability (August 2025). On the commercial side, several industry reports and market analyses through 20242025 show rapidly rising interest and multi-billion-dollar forecasts for self-healing materials and coatings, driven by automotive, electronics and infrastructure demand.

Asia is the largest regional market by volume for polymers generally and is rapidly scaling adoption of self-repairing formulations because of strong downstream demand in electronics manufacturing, automotive production, and coatings for infrastructure. China remains the dominant volume market and development center for polymer manufacturing scale-up, where local chemical majors and specialty firms are investing in pilot production for microcapsule and dynamic polymer systems. Japan and South Korea are innovation hubs for electronics and flexible device applications, where intrinsic self-healing films and coatings are being trialled in consumer electronics and wearable devices. India is an emerging research and pilot-scale manufacturing region with active academic breakthroughs and an increasing number of start-ups translating lab discoveries toward industrial demonstrations. Across Asia, regulatory priorities (safety, toxicity of healing agents, recyclability) and growing sustainability mandates are directing R&D toward non-toxic chemistries and designs compatible with circularity. Several global suppliers are expanding APAC production footprints to shorten supply chains and serve major OEMs located in the region.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5053740

Self Repairing Polymers by Type:

Microcapsule Based Self Healing Polymers

Chemically Cross Linked Self Healing Polymers

Shape Memory Polymers

Intrinsic Self Healing Polymers

Others

Self Repairing Polymers by Application:

Construction

Automotive

Consumer Electronics

Aerospace

Others

Global Top 20 Key Companies in the Self Repairing Polymers Market

BASF SE

CompPair Technologies Ltd

Covestro AG

Evonik Industries Corp

High Impact Technology LLC

Huntsman International

NEI Corporation

Sika AG

The Dow Chemical Company

Arkema

Michelin Group

AkzoNobel N.V.

Autonomic Materials Inc

Nature Works LLC

TotalEnergies Corbion

Acciona S.A.

PPG Industries Inc

Feynlab Inc

Wanhua Chemical Group Co., Ltd

Shanghai Huayi Group

Regional Insights

Southeast Asia (ASEAN) shows a two-track pattern: downstream manufacturers in electronics, footwear, coatings and automotive components in countries such as Vietnam, Thailand, and Malaysia are beginning to specify higher-performance surface and polymer materials, creating pockets of demand for self-repairing chemistries; meanwhile Indonesia driven by a large domestic construction market, growing automotive assembly and a rising plastics chemicals sector is positioning itself as both a consumption market and a production hub for commodity to mid-specialty polymer lines. Indonesia's market is particularly interesting for investors because local manufacturing of polymer intermediates and improving port/logistics capabilities reduce landed cost for ASEAN fabricators. Adoption in ASEAN will likely start in higher-value niches (coatings for maritime infrastructure, protective films for electronics assembly, and specialty components in two- and four-wheel vehicles) and expand as costs decline and qualification cycles are completed. Several regional chemical producers and contract manufacturers are evaluating license and tolling arrangements with technology owners to bring pilot capacity to Southeast Asia.

Key obstacles to broad commercial adoption include cost and scale: specialty self-repairing polymers still command substantial price premiums over commodity resins, which constrains penetration into price-sensitive applications. Technical challenges remain in delivering repeatable, fast healing under ambient conditions while maintaining long-term mechanical performance, weathering resistance and compatibility with existing production methods. Regulatory and safety issues particularly for healing chemistries that use reactive monomers, isocyanate derivatives or encapsulated solvents create approval hurdles in medical and close-contact consumer applications. Supply chain complexity for specialized additives, tight IP landscapes and fragmented standards for performance testing further slow procurement and OEM qualification. Finally, recyclability and end-of-life pathways for some self-healing systems are not yet mature, which raises ESG concerns for large customers seeking circular solutions.

Companies aiming to win should prioritize partnerships with OEMs in automotive and electronics to co-develop formulations that meet qualification cycles and integrate healing functionality into existing form factors, because OEM specification is the fastest route to scale. Licensing and toll-manufacturing are effective near-term scaling models to limit capital intensity while proving market acceptance. For manufacturers, cost-engineering to reduce COGS (raw material substitution, energy optimization, and process intensification) will be a critical competitive lever to bring price closer to commodity thresholds while preserving margin. Investors and strategists should watch IP ownership in proprietary healing chemistries, the formation of standard test protocols (which will accelerate procurement), and regulations around chemicals of concernthese three elements will shape winners and losers. There is also strategic value in vertical integration into downstream coatings and component assembly because it reduces qualification friction for OEMs.

Product Models

Self-repairing polymers are advanced smart materials engineered to automatically restore structural integrity after damage. These materials reduce maintenance costs, extend product lifespans, and improve safety in industries.

Microcapsule-Based Self-Healing Polymers Contain tiny capsules filled with healing agents that break open when faults form, releasing the agent to seal the damage. Notable products include:

Autonomic Healing Polymer University of Illinois / Autonomic Materials Inc.: Pioneering polymer with embedded microcapsules releasing dicyclopentadiene for fault repair.

Evonik Self-Healing Epoxy Evonik Industries: Microcapsule-based epoxy resin used in coatings and adhesives.

BASF Self-Healing Paint Prototype BASF SE: Automotive clear coat that repairs minor scratches using encapsulated polymers.

NEI Smart Coatings NEI Corporation: Nano- and microcapsule hybrid coatings for corrosion protection.

Nippon Paint Self-Healing Coating Nippon Paint Holdings: Microcapsule paint system that restores surface protection after damage.

Chemically Cross-Linked Self-Healing Polymers Use reversible chemical bonds that can break and reform, allowing the material to repair itself multiple times. Examples include:

Reversibly Cross-Linked PU Covestro AG: Polyurethane with dynamic covalent bonds enabling repeatable healing.

Arkema Vitrimers Arkema Group: Self-healing thermosets using dynamic covalent chemistry.

LG Chem Reversible Bond Polymer LG Chem: Chemically cross-linked elastomers for electronics applications.

Henkel Loctite Self-Healing Adhesive Henkel AG: Adhesive formulation with covalent cross-links for durability.

Mitsubishi Chemical Cross-Linking Polymer Mitsubishi Chemical: High-performance cross-linked systems for coatings.

Shape Memory Polymers Return to their original shape when exposed to heat, light, or another trigger, closing faults or deformations. Notable products include:

SMP Technologies Asmp Shape Memory Polymer SMP Technologies Inc.: Commercial SMP widely used in medical stents and actuators.

Dow Chemical Shape Memory Polyurethane Dow Inc.: SMP system applied in adhesives and sealants.

Boston Scientific SMP Stent Boston Scientific: Medical stents using shape memory polymer expansion.

PolyOne Shape Memory Composites Avient Corporation (PolyOne): Composite SMPs for aerospace and automotive lightweight structures.

MedShape Morphix SMP MedShape Inc.: Orthopedic implants using shape memory polymer systems.

Intrinsic Self-Healing Polymers Have built-in molecular networks (like hydrogen bonding or supramolecular interactions) that allow them to self-repair without added capsules or triggers. Examples include:

Arkema Supramolecular Polymers Arkema Group: Intrinsic healing using hydrogen bonding networks.

LG Chem Intrinsic Elastomers LG Chem: Elastomeric materials with reversible bonding.

BASF Supramolecular Coating BASF SE: Coatings that self-heal through polymer chain mobility.

DSM Self-Healing Urethanes DSM: Urethane elastomers with hydrogen-bond driven healing.

Evonik Intrinsic Polymer Films Evonik Industries: Films that self-repair without external agents.

Self-repairing polymers represent a fast-growing segment within advanced materials driven by demonstrable lifecycle cost savings, improved product uptime, and attractive fit for high-value sectors such as automotive, electronics and aerospace. While near-term adoption is concentrated in coatings and protective films, rapid academic and pilot-scale advances are expanding the addressable market into structural and device-level applications. Economic scale, standardization of performance testing, and sustainable end-of-life solutions are the three factors that will determine pace of mainstream market penetration. Given the high stated market value for 2024 and the projected high-teens to mid-20s CAGR associated with self-healing materials, investors and strategic buyers should treat the space as a technology-enabled growth category with multiple entry points from specialty coatings to integrated polymer parts.

Investor Analysis

This research report highlights several concrete, investable signals. What to invest in: companies with proven, scalable healing chemistries, strong OEM partnerships (especially in EV/automotive and consumer electronics), and defensible IP or exclusive licensing deals. How to deploy capital: favor staged investments that pair technology validation (pilot production, third-party qualification) with capacity expansion (tolling agreements or small modular lines) rather than large greenfield plants; consider M&A of specialist startups by strategic acquirers as a near-term exit pathway. Why it matters: the sectors margin profile (model factory gross margin ~40% per ton in our baseline) and the large implied addressable volume (multi-million tonne equivalent at current pricing) mean that successful scale can create high returns; moreover, early positioning in regulatory-compliant, recyclable chemistries can create long-term competitive advantage as OEMs push ESG requirements. This reports unit economics, capacity assumptions and downstream demand mix give investors the numbers needed to model IRR on specific manufacturing investments or to stress-test acquisition valuations.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5053740

5 Reasons to Buy This Report

It consolidates a full year market sizing with unit-level economics for investment modeling.

It provides regional insights for Asia and ASEAN pinpointing near-term adoption sectors and manufacturing opportunities.

It summarizes the latest high-impact research and commercial news to capture innovation trajectories.

It offers actionable strategic recommendations for go-to-market, capacity planning and partnership models.

It lists leading players and compares commercial incumbents with specialist innovators for M&A and partnership scouting.

5 Key Questions Answered

What was the 2024 market size and implied global volume at the selected price?

What are the representative factory economics?

Which downstream industries will drive the greatest near-term demand and what are their relative shares?

Where in Asia and ASEAN should investors prioritize capacity or partnerships?

Who are the top technology and manufacturing players to watch for partnership, acquisition or competition?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Self Repairing Polymers Market to Reach CAGR 26,2% by 2031 Top 20 Company Globally here

News-ID: 4198813 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for Polymer

MDR Certificate For Single Polymer Clip Applier And Multiple Polymer Clip Applie …

EU Quality Management System Certificate

Regulation (EU)2017/745, Annex Ix Chapter I and III

MDR 804963 R000

Manufacturer: Hangzhou Sunstone Technology Co., Ltd

Address:

2nd Floor of Building 1,

#460 Fucheng Rd, Qiantang Area

Hangzhou

Zhejiang

310018

China

Single Registration Number: CN-MF-000040501

EU Authorised Representative: MedPath GmbH

Address:

Mies-van-der-Rohe-Strasse 8

80807

Munich

Germany

Scope: See attached Device Schedule

On the basis of our examination of the quality system in accordance with Regulation (EU) 2017/745, Annex IX

Chapter I and lll, the quality system meets the requirements of the Regulation. For the…

Acrylic Polymer Market

𝐓𝐡𝐞 𝐠𝐥𝐨𝐛𝐚𝐥 𝐚𝐜𝐫𝐲𝐥𝐢𝐜 𝐩𝐨𝐥𝐲𝐦𝐞𝐫 𝐦𝐚𝐫𝐤𝐞𝐭 𝐰𝐚𝐬 𝐯𝐚𝐥𝐮𝐞𝐝 𝐚𝐭 𝐚𝐩𝐩𝐫𝐨𝐱𝐢𝐦𝐚𝐭𝐞𝐥𝐲 𝐔𝐒𝐃 𝟐𝟎 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐢𝐧 𝟐𝟎𝟐𝟐 𝐚𝐧𝐝 𝐢𝐬 𝐩𝐫𝐨𝐣𝐞𝐜𝐭𝐞𝐝 𝐭𝐨 𝐫𝐞𝐚𝐜𝐡 𝐔𝐒𝐃 𝟑𝟔.𝟗 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐛𝐲 𝟐𝟎𝟑𝟐, 𝐠𝐫𝐨𝐰𝐢𝐧𝐠 𝐚𝐭 𝐚 𝐜𝐨𝐦𝐩𝐨𝐮𝐧𝐝 𝐚𝐧𝐧𝐮𝐚𝐥 𝐠𝐫𝐨𝐰𝐭𝐡 𝐫𝐚𝐭𝐞 (𝐂𝐀𝐆𝐑) 𝐨𝐟 𝟔.𝟒% 𝐟𝐫𝐨𝐦 𝟐𝟎𝟐𝟑 𝐭𝐨 𝟐𝟎𝟑𝟐.

𝐀𝐜𝐫𝐲𝐥𝐢𝐜 𝐏𝐨𝐥𝐲𝐦𝐞𝐫 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰

The acrylic polymer market has experienced significant growth due to its versatile applications across various industries, including paints and coatings, adhesives, textiles, and construction. Acrylic polymers are favored for…

Polymer Processing Aids: Enhancing Efficiency and Quality in Polymer Manufacturi …

Introduction

Polymer Processing Aids (PPAs) are indispensable additives used to improve the efficiency, quality, and cost-effectiveness of polymer manufacturing. These aids, often added in small quantities, significantly enhance polymer production by reducing surface defects, improving flow properties, and reducing wear on manufacturing equipment. Their role is critical in enabling smooth, uninterrupted processing, leading to higher-quality end products and improved manufacturing productivity. With the ever-growing demand for polymers across industries like automotive,…

What Are Lithium Polymer? Information About Lithium Polymer Batteries Guide

Did people know that Lithium Polymer power over 80% of the drones used in recreational and commercial applications today? Lithium Polymer (LiPo) batteries have become a staple in modern electronics. From powering smartphones and laptops to energizing drones and electric vehicles, these batteries offer a blend of high energy density and flexibility that makes them ideal for a wide range of applications. In this article, we'll dive deep into what…

Custom Polymer Synthesis Market 2023 Will Record Massive Growth, Trend Analysis …

The Custom Polymer Synthesis Market Trends Overview 2023-2030:

A new Report by Stratagem Market Insights, titled "Custom Polymer Synthesis Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2030," offers a comprehensive analysis of the industry, which comprises insights on the Custom Polymer Synthesis market analysis. The report also includes competitor and regional analysis, and contemporary advancements in the market.

This report has a complete table of contents, figures, tables, and charts,…

Silyl Modified Polymer (MS Polymer) Market Forecast Research Reports Offers Key …

Silyl Modified Polymer (MS Polymer) Market: Introduction

MS polymers, also known as silyl modified polymers or silyl terminated polymers, are polymers with a silane group. A silyl modified polymer (MS polymer) usually refers to a hybrid polymer backbone, usually polyurethane or polyether and a silane end group. Formulators can change the backbone polymer in sealants and adhesives utilizing MS polymers to match the specified application, achieving silicone-like performance while avoiding the…