Press release

Medical Packaging HDPE Cards Market to Reach USD 1,975 Million by 2031 Top 10 Company Globally

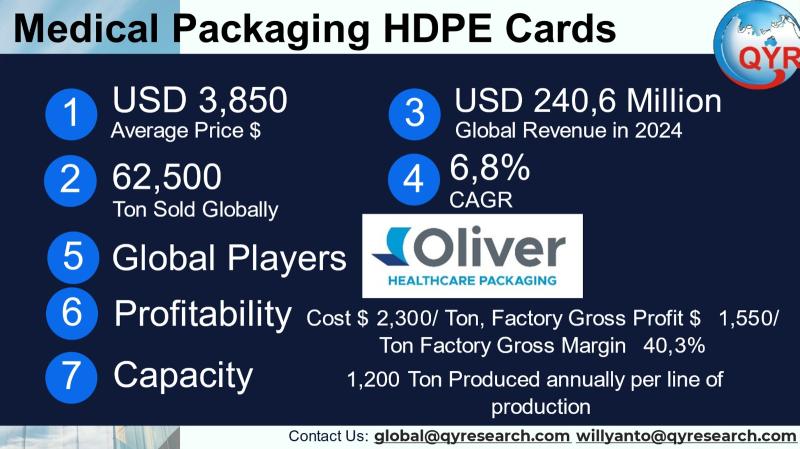

Medical packaging HDPE cards (also called mounting cards, backer cards, pouch cards or die-cut inserts) are thin, die-cut sheets of high-density polyethylene used to position, protect and retain medical devices inside sterile barrier systems such as pouches and trays. They are engineered to provide secure device retention with minimal volume and weight, and are widely used as a lower-cost, recyclable alternative to thermoformed trays for single-use surgical instruments, catheters, guidewires and small components. The product is manufactured in controlled cleanroom environments and sold into device OEMs, contract packagers and sterile packaging converters. Recent industry commentary highlights HDPE cards as a sustainability-oriented substitute that reduces package footprint and shipping emissions while meeting sterility and handling requirements.The specific Medical Packaging HDPE Cards market size for 2024 is USD 240,6 million, with a compound annual growth rate of 6.8% projected through 2031, reaching USD 450 Million in 2031. The average selling price is USD 3,850 per ton and global volume sold in 2024 stood at 62,500 tons. Cost of goods sold is USD 2,300 per ton. Factory gross profit per ton is USD 1,550, which corresponds to a factory gross margin of 40.3% per ton. A typical full machine production line for HDPE is around 1,200 - 1,500 tons per year. Downstream demand by end market is concentrated in medical devices, followed by pharmaceutical secondary packaging, diagnostics, dental and other healthcare consumables; medical devices account for the single largest percentage of demand due to high unitization and sterility requirements.

Latest Trends and Technological Developments

Sustainability and footprint reduction have been the most visible trends: industry publications and supplier blogs report HDPE mounting cards promoted as an eco-friendly, lower-footprint alternative to rigid trays (Packaging Digest, July 2024). Innovative materials and certified cleanroom production remain priority developments; for example, suppliers are marketing virgin-HDPE clean-cut cards produced in ISO 7/ISO 8 cleanrooms and highlighting recyclability and lower total-package emissions (Oliver Healthcare Packaging product and PackTalk content, multiple posts including May 2025). Industry suppliers have also announced material-specific innovations such as MediSheet formulations to strengthen device retention within sterile packages (Spartech announcement, Aug 2023). These items illustrate active supplier-driven innovation to meet sterility, regulatory and sustainability needs.

Asia-Pacific is a strategically important region for HDPE packaging generally and medical packaging specifically. The regional HDPE packaging market recorded a leading share in 2024 driven by strong pharmaceutical, medical device manufacturing and personal care demand across China, India, Japan and Southeast Asian manufacturing hubs. Contract packaging and nearshoring of device assembly to Asia have supported local demand for HDPE card solutions, and suppliers with local cleanroom converting capability have a commercial advantage. Regional cost dynamics (lower labor and proximity to resin supply) improve margin potential for converters operating in Asia, while regional regulatory and sterilization standards together with rising attention to sustainability are leading OEMs to prioritize locally validated, recyclable HDPE card suppliers.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5053681

Medical Packaging HDPE Cards by Type:

Standard Type

Customized Type

Medical Packaging HDPE Cards by Application:

Medical Devices

Pharmaceuticals

Electronics and Semiconductors

Others

Global Top 10 Key Companies in the Medical Packaging HDPE Cards Market

Oliver

Nelipak

Placon

PLITEK

CleanCut Healthcare Packaging

UFP Technologies

Steven Label

PDCI Medical

Dongguan Yinso Medical Packaging

Dongguan SafeSecure Medical Packing

Regional Insights

Within Southeast Asia (ASEAN), demand is concentrated in countries expanding medical manufacturing capacity and public healthcare procurement. Indonesia is an important growth market: healthcare infrastructure investment, growing domestic pharmaceutical and device assembly, and government procurement rules that favor local content are shaping packaging demand. Indonesias broader rigid and flexible plastic packaging markets show multi-billiondollar size and steady CAGR, and reports specific to medical device packaging in Southeast Asia project growth as hospitals and clinics modernize sterile supply chains. These dynamics point to rising local demand for HDPE cards, especially where local converters can meet regulatory validation and local content requirements.

Key challenges for the HDPE card segment include raw material price volatility (HDPE resin cost swings affect margins at fixed selling prices), the need for validated cleanroom production and sterilization compatibility testing (ISO 11607 compliance obligations), competition from alternate materials and formats (paper/cardstock inserts, PET-G, thermoformed trays), and the sustainability paradox while HDPE cards reduce transport footprint they remain plastic and require robust end-of-life recycling streams to achieve full circularity. Regulatory and buyer validation cycles in medical device packaging are lengthy and can be a barrier to new entrants and converters lacking cleanroom or biocompatibility data.

Suppliers with vertically integrated converting, in-house cleanroom capacity, and demonstrated sterilization compatibility benefit from faster qualification with device OEMs. Cost competitiveness can be preserved by optimizing resin procurement and improving line efficiency (higher yields in die-cutting and reduced scrap). For OEMs and contract packagers, switching from trays to HDPE cards can materially reduce logistics and packaging costs; however, qualification timelines and validation data must be budgeted. Sustainability claims should be supported with life-cycle assessments (LCAs) and local recycling partnerships to avoid greenwashing risks. Strategic M&A or partnerships that add regional converting footprints in Asia/ASEAN accelerate time-to-market for device manufacturers seeking local supply.

Product Models

Medical Packaging HDPE Cards are durable, lightweight, and hygienic packaging materials widely used in healthcare for labeling, sealing, and product information storage. They are resistant to moisture, chemicals, and sterilization processes, making them suitable for medical devices, pharmaceuticals, and hospital supplies.

Standard Type offering ready-made designs for general use. Notable products include:

MedCard Standard HDPE Gerresheimer AG: Durable card for medical device packaging with sterilization compatibility.

Bormioli Pharma Standard Card Bormioli Pharma: Lightweight card ensuring compliance in sterile packaging.

Schreiner MediPharm HDPE Label Card Schreiner Group: Designed for pharmaceutical packaging traceability.

SteriPack Standard Card SteriPack Group: Reliable medical packaging card suited for sterile barrier systems.

Oliver Healthcare Packaging Card Oliver Healthcare: Moisture-resistant HDPE card for device and pharma packs.

Customized Type tailored to meet specific branding, regulatory, or functional needs. Examples include:

Bemis Custom HDPE Medical Card Bemis Healthcare Packaging: Tailored design for medical companies needing unique identifiers.

Pakster Custom ID HDPE Card Pakster Medical Packaging: Custom printed card for tracking and patient safety.

FlexMed Custom HDPE Card Flexcon Company Inc.: Specialized HDPE card with variable data printing.

Wipak Custom Medical HDPE Card Wipak Group: Tailored solution for sterile packaging with branding elements.

Nelipak CustomCard HDPE Nelipak Healthcare Packaging: Personalized packaging card meeting global healthcare regulations.

Medical Packaging HDPE cards occupy a well-defined niche between rigid trays and simple pouching delivering secure retainment, lower cost and reduced transport footprint while requiring cleanroom converting and regulatory validation. With a 2024 market value of USD 240,6 million, 62,493 tons sold, a USD 3,850/ton price point and an expected CAGR of 6.8% to 2031, the segment offers steady, mid-single-digit growth driven by medical device unitization, sustainability priorities and the expansion of device manufacturing in Asia and ASEAN markets. Margin profiles at the factory level are attractive when lines run efficiently, but suppliers must manage resin volatility, validation timelines and recycling claims carefully.

Investor Analysis

This research report highlights several investor-relevant signals. What to watch: the addressable market size, unit economics, and regional end-market growth in Asia/ASEAN. How investors can use it: valuation models for converters should reflect line-level capacity, achievable utilization rates, and resin-price pass-through mechanics; M&A diligence should prioritize cleanroom certification, existing OEM qualifications, and regional footprint (especially in Asia/ASEAN). Why it matters: HDPE cards combine predictable recurring demand (sterile device packaging) with operational leverage high fixed cost of cleanroom lines but attractive gross margins at scale making well-managed converters potential targets for consolidation or growth investment. Investors should also weigh sustainability risk/messaging and the time required for OEM qualification into purchase decisions.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5053681

5 Reasons to Buy This Report

To obtain a focused economic snapshot of the HDPE medical card segment including 2024 market size, unit volumes and per-ton unit economics.

To evaluate regional demand dynamics in Asia and ASEAN for go-to-market or expansion planning.

To benchmark supplier margins, COGS composition, and line-level production capacity assumptions for valuation and operational improvement work.

To access a concise review of recent technological and sustainability trends that affect qualification and procurement decisions.

To identify strategic acquisition or partnership targets among active converters and suppliers in the HDPE medical card space.

5 Key Questions Answered

What was the Medical Packaging HDPE Cards market size in 2024 and what is the forecasted CAGR to 2031?

What are the unit economics for HDPE card production?

Which regions show the strongest near-term demand drivers and why?

What are the main technological and sustainability trends impacting HDPE mounting cards and supplier capability requirements?

Who are the principal suppliers and converters active in this space and what capabilities make them strategically important?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Medical Packaging HDPE Cards Market to Reach USD 1,975 Million by 2031 Top 10 Company Globally here

News-ID: 4198811 • Views: …

More Releases from QY Research

Top 30 Indonesian Beverages Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Multi Bintang Indonesia Tbk (MLBI) Beer & alcoholic beverages

PT Delta Djakarta Tbk (DLTA) Beer brands like Anker & Carlsberg

PT Sariguna Primatirta Tbk (CLEO) Non-alcoholic beverages

PT Akasha Wira International Tbk (ADES) Beverage producer including water & drinks

PT Ultrajaya Milk Industry & Trading Company Tbk (ULTJ) Milk products, juices & drinks

PT Mayora Indah Tbk (MYOR) Coffee,…

Behind the Paint: Cost Structures, Technology Trends, and Strategic Growth in An …

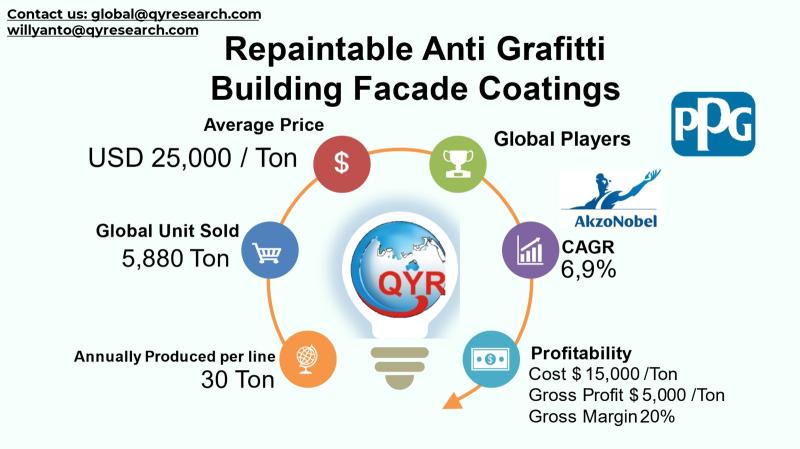

The global repaintable anti-graffiti building facade coatings industry is a specialized segment of the broader protective coatings market concentrating on products that protect exterior architectural surfaces from vandalism and urban environmental wear. Repaintable anti-graffiti coatings are engineered to allow repeated graffiti removal and overpainting without degrading the underlying surface, making them critical for durable facade protection in urban environments that demand aesthetic preservation and reduced lifecycle maintenance costs. Against a…

Ensuring Compliance and Growth: Asia Pacifics Role in the Future of Food Contact …

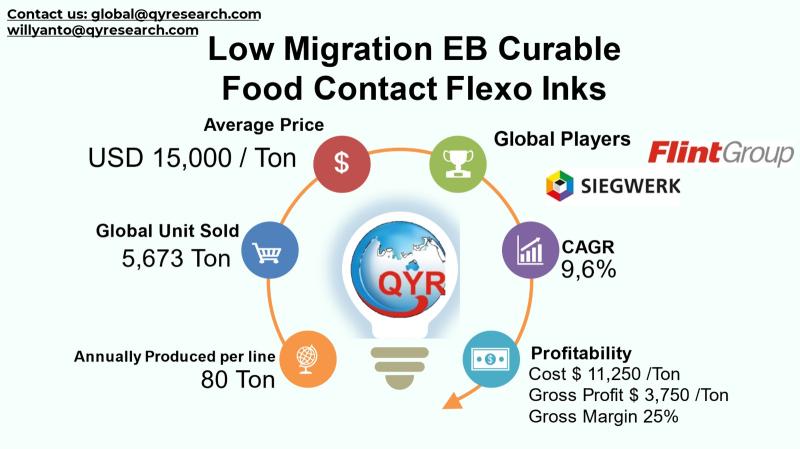

The global Low-Migration Electron Beam (EB) Curable Food Contact Flexo Inks industry encompasses specialized flexographic ink formulations that are designed to minimize chemical migration into food packaging, satisfying stringent regulatory safety standards. These inks cured via electron beam technology eliminate the need for photoinitiators and solvents that could potentially transfer into food or sensitive products, thereby addressing both regulatory and consumer safety concerns. The industry supports a broad range of…

From Flavor to Fortune: Market Dynamics in Global Fruit Syrups Explained

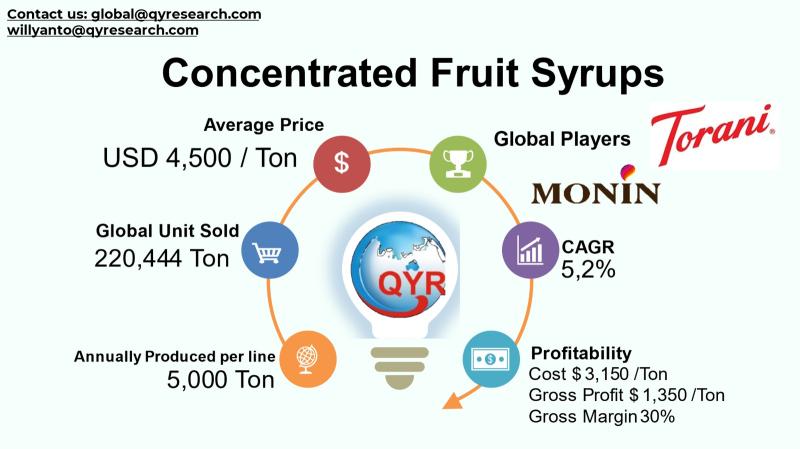

The global concentrated fruit syrups market represents a crucial niche within the broader non-alcoholic concentrated syrup and flavorings industry. These syrups, made by reducing fruit juice to a dense, highly flavorful liquid, serve as key ingredients across beverages, confectionery, bakery, dairy, and sauces, enhancing sweetness, flavor, and product versatility. The industry is influenced by rising consumer demand for natural, clean-label ingredients and the rapid expansion of the global food and…

More Releases for HDPE

Beyond Numbers: Understanding PCR HDPE Market Size

In this comprehensive report, analysts conduct an in-depth study of the global PCR HDPE market, delving into key factors such as drivers, challenges, recent trends, opportunities, advancements, and the competitive landscape. Utilizing research techniques like PESTLE and Porter's Five Forces analysis, the researchers provide a clear understanding of both the current and future scenarios within the global PCR HDPE industry. Accurate data on PCR HDPE production, capacity, price, cost, margin,…

Latest Trends In Global Recycled HDPE Market

Recycled HDPE, or High-Density Polyethylene, is a versatile and environmentally friendly material derived from the recycling of plastic products made from HDPE.

HDPE is a type of plastic commonly used for items like milk jugs, detergent bottles, and plastic bags. The recycling process for HDPE involves collecting, cleaning, and melting down these used plastic items to create new products.

Request for Sample@

https://mobilityforesights.com/contact-us/?report=20042

Recycled HDPE is valued for its durability, resistance…

Geomembrane manufacturer, HDPE geomembrane factory, geosynthetics supplier

MTTVS® Geosynthetics company specializes in research ,development,production,promotion and application of geosynthetics.And is the world's leading supplier of geosynthetics. Founded in 2014,located in Shandong China.With ISO9001,ISO14001,ISO45001 international authoritative management system certification of powerful large manufucture.We have more than 10 international advanced equipment production lines and a huge professional engineering and technical team.and has successfully consolideated and developed core markets to maximize value for customers.Through the processing of synthetic raw materials.we develop,manufacture…

hdpe geomembrane liner fabric manufacturer,geotextile manufacturer Company,HDPE …

GD Geosynthetics Company is a comprehensive processing enterprise of composite geosynthetics, geotextiles, geomembranes, geogrids, geounits, three-dimensional composite drainage nets, ecological bags, drainage boards. High-level management, high-level scientific research team, conform to the trend of domestic and international chemical fiber market, constantly innovate and update, cater to the market and meet the needs of consumers. Gained the trust of consumers.

Geosynthetics are widely used in anti-seepage treatment of roads, bridges, reservoirs, tunnels,…

Research Focuses on Global HDPE Geomembrane

HDPE Geomembrane Report by Material, Application, and Geography – Global Forecast to 2021 is a professional and in-depth research report on the world's major regional market conditions, focusing on the main regions (North America, Europe and Asia-Pacific) and the main countries (United States, Germany, united Kingdom, Japan, South Korea and China).

The report firstly introduced the HDPE Geomembrane basics: definitions, classifications, applications and market overview; product specifications; manufacturing processes; cost structures,…

Global HDPE Decking Market Research Report 2017

HDPE Decking Revenue, means the sales value of HDPE Decking This report studies HDPE Decking in Global market, especially in North America, Europe, China, Japan, Southeast Asia and India, focuses on top manufacturers in global market, with capacity, production, price, revenue and market share for each manufacturer, covering UPM Kymmene Universal Forest Products Advanced Environmental Recycling Technologies Fiberon Azek Building Products Cardinal Building Products Certainteed Corporation Duralife Decking and Railing…