Press release

Fuel Delivery Aggregator Business Model: Income, Expenses & Profitability

Fuel Delivery Aggregator Business Plan & Project Report OverviewIMARC Group's "Fuel Delivery Aggregator Business Plan and Project Report 2025" offers a comprehensive framework for establishing a successful on-demand fuel delivery platform business. The critical areas, including market trends, investment opportunities, revenue models, and financial forecasts, are discussed in this in-depth report and are therefore useful resources to entrepreneurs, consultants and investors. Whether evaluating the viability of a new venture or streamlining an existing one, the report gives an in-depth analysis of all the ingredients that make it successful, starting with business formation and profitability over time.

What is a Fuel Delivery Aggregator Business?

A Fuel Delivery Aggregator is a particular online ecosystem that is created to provide end-to-end on-demand fuel services to customers with licensed fuel services providers. These services focus on convenient access to fuel by use of modern mobile applications, GPS location position technology, secure payment system, fleet management software, real time delivery tracking services, and customer safety measures to meet the busy consumers, fleet operators, and businesses that are interested in efficient fuel procurement and delivery services.

Their services include doorstep fuel delivery, scheduled fuel refueling plans, emergency fueling services, fleet fuel provision, corporate fuel contracts, fuel quality guarantees, delivery tracking and notification, flexible payment, fuel consumption analytics, carbon footprint reporting, customer support program to individuals and organizations that believe in convenient and reliable access to fuel. Included in the category are on-demand fuel platforms, fleet fueling aggregators, corporate fuel service networks, and full fuel logistics management systems, which are focused on dependable delivery networks, fuel quality standards, customer convenience optimization, safety protocol compliance, delivery timing efficiency, payment security, environmental compliance, and overall fuel supply chain management.

To achieve these goals, Fuel Delivery Aggregators integrate state-of-the-art mobile application platforms, GPS tracking and routing systems, secure payment processing technology, fuel quality monitoring equipment, fleet management software, customer relationship management systems, delivery partner onboarding platforms, regulatory compliance tools, and fuel logistics analytics.

Depending on their positioning, these establishments may operate as consumer-focused on-demand fuel platforms, specialized fleet fueling services, corporate fuel supply aggregators, or comprehensive fuel logistics management centers, delivering complete fuel delivery solutions tailored to diverse customer segments, delivery requirements, fuel types, and regulatory compliance standards.

Request for a Sample Report: https://www.imarcgroup.com/fuel-delivery-aggregator-business-plan-feasibility-report/requestsample

Fuel Delivery Aggregator Business Market Trends and Growth Drivers

The trends and drivers of a Fuel Delivery Aggregator business are shaped by the increasing demand for convenience services and on-demand delivery solutions, growing urbanization leading to time constraints for fuel station visits, rising adoption of digital platforms for service procurement, and the expanding gig economy creating flexible delivery workforce opportunities. These factors, combined with corporate focus on operational efficiency, fleet management optimization, contactless service preferences accelerated by health concerns, and the growing emphasis on fuel cost management and consumption tracking, are fueling demand for digital fuel delivery solutions.

Contributing to this shift is the expanding smartphone penetration, increasing comfort with app-based services, growing awareness of fuel delivery safety standards, and the consumer preference for transparent pricing, flexible scheduling, real-time tracking, and integrated payment solutions within the evolving digital service economy.

To meet these demands, operators are investing in advanced mobile application development, GPS tracking and logistics optimization systems, secure payment processing platforms, delivery partner training programs, fuel quality assurance protocols, and compliance with transportation safety and fuel handling regulations. These investments not only enhance the customer experience but also strengthen business outcomes by aligning with broader trends in digital transformation and on-demand service delivery.

Revenue diversification is another critical factor in building financial resilience. In addition to direct delivery service fees and fuel markup revenues, income streams may include delivery partner commission fees, premium service subscriptions, corporate contract revenues, fuel analytics and reporting services, advertising partnerships with fuel brands, loyalty program partnerships, insurance partnerships, and value-added services like vehicle maintenance scheduling.

Market coverage and delivery network density play a vital role in success. Platforms positioned in urban and suburban markets with high vehicle ownership, commercial fleet concentrations, busy professional demographics, and established fuel supply networks benefit from steady service demand and operational efficiency. At the same time, reliable delivery partner networks, compliance with fuel transportation and safety protocols, and adherence to environmental and regulatory standards ensure operational excellence and consumer trust.

However, the business also faces risk factors, such as regulatory challenges related to fuel transportation and storage requirements, intense competition from traditional fuel stations and emerging delivery platforms, dependence on fuel price volatility and supply chain disruptions, seasonal variations in demand, insurance and liability concerns related to fuel handling, and the need for significant initial investment in technology infrastructure and regulatory compliance.

A successful Fuel Delivery Aggregator business model requires careful financial planning-including capital investment in technology platform development and delivery infrastructure, procurement of fuel inventory and delivery equipment, and adoption of fleet management and customer service tools. It also demands skilled technology staff and operations personnel, supported by effective marketing strategies to build brand awareness, foster customer loyalty, and establish long-term partnerships with delivery providers, fuel suppliers, and corporate clients. By delivering reliable fuel delivery services, innovative digital experiences, and exceptional customer support, these businesses can strengthen urban logistics infrastructure while encouraging customers to adopt convenient and efficient fuel procurement solutions.

Report Coverage

The Fuel Delivery Aggregator Business Plan and Project Report includes the following areas of focus:

• Business Model & Operations Plan

• Technical Feasibility

• Financial Feasibility

• Market Analysis

• Marketing & Sales Strategy

• Risk Assessment & Mitigation

• Licensing & Certification Requirements

The comprehensive nature of this report ensures that all aspects of the business are covered, from market trends and risk mitigation to regulatory requirements and customer acquisition strategies.

Key Elements of Fuel Delivery Aggregator Business Setup

Business Model & Operations Plan

A solid business model is crucial to a successful venture. The report covers:

• Service Overview: A breakdown of on-demand fuel delivery, scheduled refueling programs, fleet fueling services, emergency fuel delivery, corporate fuel contracts, delivery tracking systems, payment processing, and customer support services offered

• Service Workflow: How each fuel order, delivery scheduling, partner assignment, route optimization, fuel quality verification, delivery completion, and customer feedback process is managed

• Revenue Model: An exploration of the mechanisms driving revenue across multiple service categories and customer segments

• SOPs & Service Standards: Guidelines for consistent delivery quality, safety protocols, fuel handling standards, and customer satisfaction assurance

This section ensures that all operational and customer service aspects are clearly defined, making it easier to scale and maintain service quality.

Buy Report Now: https://www.imarcgroup.com/checkout?id=38819&method=1911

Technical Feasibility

Setting up a successful business requires proper technology and logistics infrastructure planning. The report includes:

• Market Selection Criteria: Key factors to consider when choosing target markets and service coverage areas

• Technology & Infrastructure Costs: Estimations for required mobile app development, backend systems, logistics infrastructure, and associated costs

• Equipment & Systems: Identifying essential fuel delivery equipment, mobile applications, GPS tracking systems, and payment processing technology

• Platform & Operations Setup: Guidelines for creating efficient digital platforms and delivery management systems

• Regulatory Requirements & Costs: Understanding the licensing and compliance requirements necessary to run fuel delivery operations

• Human Resources & Wages: Estimating staffing needs, roles, and compensation for technology staff, operations managers, customer service representatives, and delivery partners

This section provides practical, actionable insights into the technology and logistics infrastructure needed for setting up your business, ensuring operational excellence and regulatory compliance.

Financial Feasibility

The Fuel Delivery Aggregator Business Plan and Project Report provides a detailed analysis of the financial landscape, including:

• Capital Investments & Operating Costs: Breakdown of initial and ongoing investments

• Revenue & Expenditure Projections: Projected income and cost estimates for the first five years

• Profit & Loss Analysis: A clear picture of expected financial outcomes

• Taxation & Depreciation: Understanding tax obligations and technology depreciation

• ROI, NPV & Sensitivity Analysis: Comprehensive financial evaluations to assess profitability

This in-depth financial analysis supports effective decision-making and helps secure funding, making it an essential tool for evaluating the business's potential.

Market Insights & Strategy

Market Analysis

A deep dive into the fuel delivery aggregator market, including:

• Industry Trends & Segmentation: Identifying emerging trends and key market segments across consumer fuel delivery platforms, fleet fueling services, corporate fuel aggregators, and comprehensive fuel logistics providers

• Regional Demand & Cost Structure: Regional variations in on-demand service adoption and cost factors affecting delivery operations

• Competitive Landscape: An analysis of the competitive environment including established fuel delivery platforms, traditional fuel stations with delivery services, logistics companies, and emerging on-demand service providers

Profiles of Key Players

The report provides detailed profiles of leading players in the industry, offering a valuable benchmark for new businesses. It highlights their strategies, platform features, market coverage, and business models, helping you identify strategic opportunities and areas for differentiation.

Capital & Operational Expenditure Breakdown

The report includes a comprehensive breakdown of both capital and operational costs, helping you plan for financial success. The detailed estimates for technology development, infrastructure, and operating costs ensure you're well-prepared for both initial investments and ongoing expenses.

• Capital Expenditure (CapEx): Focused on mobile app and platform development, technology infrastructure setup, delivery equipment procurement, warehouse and storage facilities, customer service centers, and regulatory compliance systems

• Operational Expenditure (OpEx): Covers ongoing costs like staff salaries, fuel inventory costs, delivery partner payments, technology maintenance, marketing expenses, insurance and compliance costs, and customer acquisition expenses

Financial projections ensure you're prepared for cost fluctuations, including adjustments for fuel price volatility, delivery demand variations, technology upgrade costs, and competitive market pressures over time.

Profitability Projections

The report outlines a detailed profitability analysis over the first five years of operations, including projections for:

• Total revenue from delivery fees, fuel markups, subscription services, and corporate contracts, expenditure breakdown, gross profit, and net profit

• Profit margins for each revenue stream and year of operation

• Revenue per customer projections and market penetration growth estimates

These projections offer a clear picture of the expected financial performance and profitability of the business, allowing for better planning and informed decision-making.

Request For Customization: https://www.imarcgroup.com/request?type=report&id=38819&flag=E

• Market Entry and Expansion Strategy

• Feasibility Studies and Business Planning

• Company Incorporation and Platform Development Support

• Regulatory and Licensing Navigation

• Competitive Analysis and Benchmarking

• Industry Partnership Development

• Branding, Marketing, and Customer Strategy

About Us

IMARC Group is a leading global market research and management consulting firm. We specialize in helping organizations identify opportunities, mitigate risks, and create impactful business strategies.

Our expertise includes:

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fuel Delivery Aggregator Business Model: Income, Expenses & Profitability here

News-ID: 4198227 • Views: …

More Releases from IMARC Group

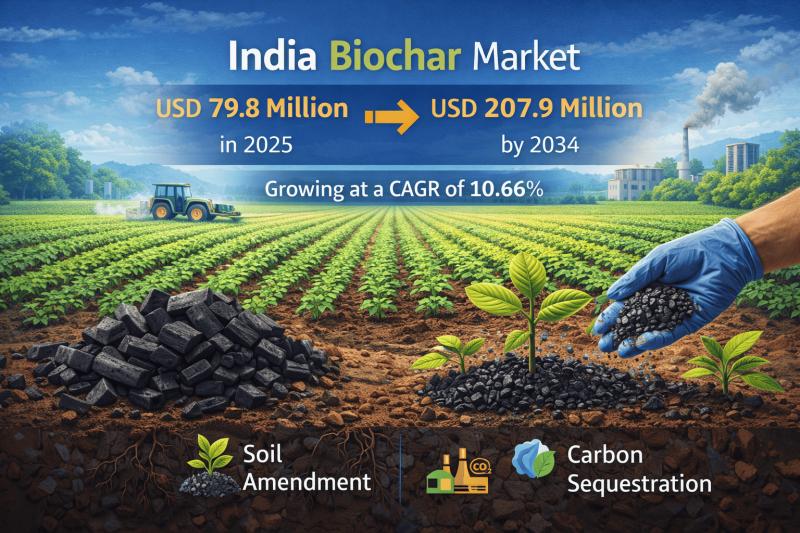

India Biochar Market Expected to Reach USD 207.9 Million by 2034, Industry Growi …

IMARC Group's latest research publication "India Biochar Market Size, Share, Trends and Forecast by Feedstock Type, Technology Type, Product Form, Application, and Region, 2026-2034" the India biochar market size reached USD 79.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 207.9 Million by 2034, exhibiting a growth rate (CAGR) of 10.66% during 2026-2034.

Request a Sample Report: https://www.imarcgroup.com/india-biochar-market/requestsample

What is Biochar?

Biochar is a carbon-rich material produced through…

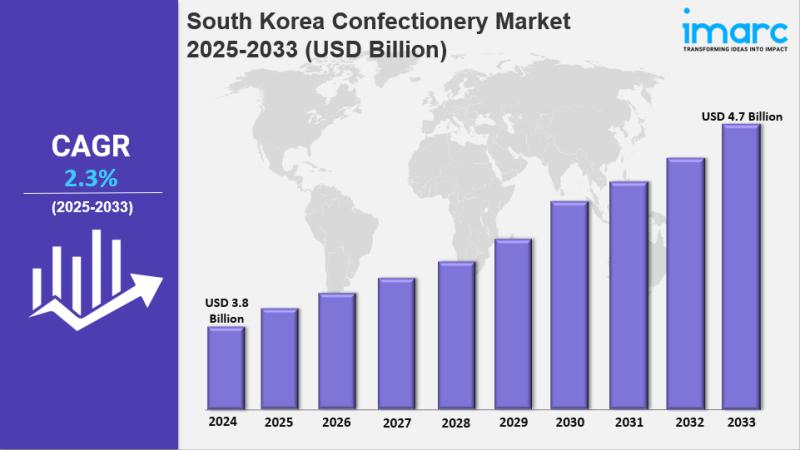

South Korea Confectionery Market Size, Growth, Latest Trends and Forecast To 203 …

IMARC Group has recently released a new research study titled "South Korea Confectionery Market Report by Product Type (Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, and Others), Age Group (Children, Adult, Geriatric), Price Point (Economy, Mid-Range, Luxury), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, and Others), and Region 2025-2033", offers a detailed analysis of the market…

India Facility Management Market Expected to Reach USD 7.13 Billion by 2034, Ind …

IMARC Group's latest research publication "India Facility Management Market Size, Share, Trends and Forecast by Solution, Service, Deployment Type, Organization Size, Vertical, and Region, 2026-2034" The India facility management market size was valued at USD 2.86 Billion in 2025 and is projected to reach USD 7.13 Billion by 2034, growing at a compound annual growth rate of 10.66% from 2026-2034.

Request a Sample Report: https://www.imarcgroup.com/india-facility-management-market/requestsample

What is Facility Management?

Facility management refers to…

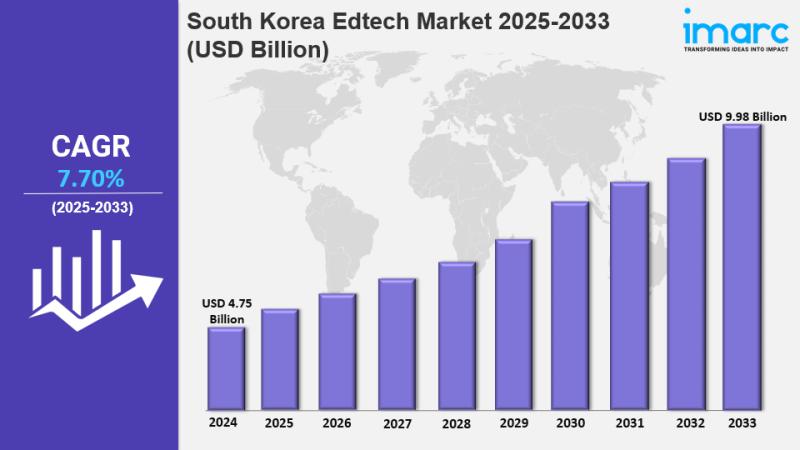

South Korea Edtech Market Share, Size, In-Depth Insights, Trends and Forecast To …

IMARC Group has recently released a new research study titled "South Korea Edtech Market Report by Sector (Preschool, K-12, Higher Education, and Others), Type (Hardware, Software, Content), Deployment Mode (Cloud-based, On-premises), End User (Individual Learners, Institutes, Enterprises), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview:

South Korea edtech market size reached USD…

More Releases for Fuel

Fuel Cell Market to Expand Significantly by 2024 | Horizon Fuel Cell Technologie …

The "Fuel Cell Market" intelligence report, just published by USD Analytics, covers insurers' micro-level study of important market niches, product offers, and sales channels. In order to determine market size, potential, growth trends, and competitive environment, the Fuel Cell Market provides dynamic views. Both primary and secondary sources of data were used to generate the research, which has both qualitative and quantitative depth. Several of the major figures the study…

Electronic Fuel Management System Market Share and Future Forecast 2022 to 2028 …

The global Electronic Fuel Management System market revenue is expected to register a CAGR of 8.8% during the forecast period.

Latest Study on Industrial Growth of Electronic Fuel Management System Market 2022-2028. A detailed study accumulated to offer current insights about important features of the Electronic Fuel Management System market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, value chain optimization, price, and other substantial factors. While emphasizing…

Marine Gensets Market: Information by Vessel Type (Commercial Vessel, Defense Ve …

A marine genset is a power unit generator that supplies electricity to ships. It offers reliable and fuel-efficient electric power generation for onboard power, emergency gensets, and diesel-electric propulsion. It can be fueled by gas, diesel, hybrid fuel, and others. It has application in offshore commercial vessels, defense vessels, and offshore vessels, among others. Nowadays, most of the marine gensets are fueled by diesel. However, the introduction of alternative fuels…

Fuel Card Market to 2027 - Global Analysis and Forecasts By Type (Branded Fuel C …

The global fuel card market is estimated to account US$ 6.29 Bn in 2018 and is expected to grow at a CAGR of 5.8% during the forecast period 2019 – 2027, to account to US$ 10.39 Bn by 2027.

Request Sample Pages of “Fuel Card Market” Research Report @ www.theinsightpartners.com/sample/TIPRE00003099/?utm_source=openpr&utm_medium=10387

Fuel Card Market: Key Insights

Fuel Card Market Size 2021, by manufacturer, region, types, and application, forecast till 2028 is analyzed and researched on…

Clean Fuel Technology Market – Development Assessment 2025 | Clean Fuel Develo …

Global Clean Fuel Technology Market: Overview

Clean technology in general implies the use of any service, product, or system that has as little of a negative impact on the environment as possible. Aspects of clean technology include the conservation of energy, sustainable resources, and clean sources of fuels. Clean fuels can refer to the use of renewable fuels such as biogas, or also blended fuels such as fossil fuels with renewable…

Fuel Cell Interconnectors Market By Product Type Ceramic based, Metal based; By …

Global Fuel Cell Interconnectors Market Introduction

A fuel cell is a battery that generates electricity through an electrochemical reaction where the fuel cell interconnector is a layer made up of either ceramic or metallic material, which combines the electricity generated by each individual cell. Fuel cell interconnectors are placed between each individual cell to connect the cells in the series. Ceramic fuel cell interconnectors are more suitable for high-temperature working conditions…