Press release

PVC Rigid Foam Market to Reach USD 1,354 Million by 2031 Top 10 Company Globally

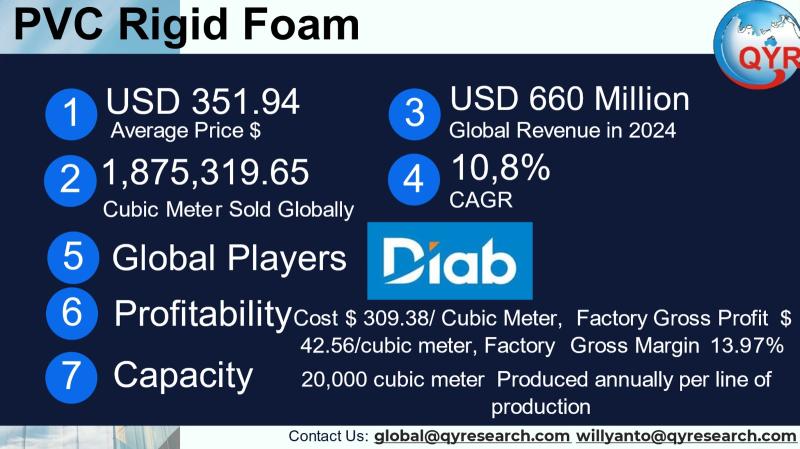

Rigid PVC foam is a closed-cell, cross-linked polyvinyl chloride material produced primarily by extrusion and foaming processes and used as a structural core and lightweight panel in construction, marine & composites, transportation, signage and furniture. Its appeal derives from a favourable strength-to-weight ratio, low water absorption, good dimensional stability, and compatibility with common resin systems for sandwich construction. Rigid PVC foam product forms include sheets/boards and cores in densities typically ranging from ~45 to 250 kg/m3; production uses PVC resin, stabilizers, lubricants, fillers and foaming agents processed on continuous extrusion/foaming lines. The material sits between commodity PVC (pipes, profiles) and higher-end composite cores in terms of price and performance, making it a preferred choice where structural stiffness and corrosion resistance are required at moderate cost.The PVC rigid foam market estimate USD 660 million in 2024. Reaching USD 1,354 million in 2031, with a growing CAGR at 10.8% to 2031. The average transactional price used for the study is USD 351.94 per cubic meter. The total global volume sold in 2024 is approximately 1,875,319.65 cubic meters. The estimated factory cost of goods sold (COGS) is USD 309.38 per cubic meter, producing a factory gross profit of about USD 42.56 per cubic meter and a factory gross margin around 13.97% on a per cubic meter. A representative breakdown of the COGS shows raw materials as the largest component, followed by energy, maintenance and other manufacturing overheads, labour, packaging & logistics and smaller line items for waste/consumables. Typical full-line production capacities vary by equipment specification: commonly available foam board extrusion lines range from roughly 20,000 cubic meter per machine. On a global basis rigid PVC foam is consumed across several distinct end-use clusters with different demand drivers and value density. Construction and building products typically form the largest aggregate share because of large volumes and frequent use of sheet/board formats. Structural composites and marine represent a high-value, technical application with lower volume but higher price per m3 and stronger technical specification and testing requirements. Transportation and industrial signage/printing boards are meaningful mid-volume markets. Furniture, shopfitting, and consumer fixtures make up a tail of diverse uses. Market reports and strategic industry summaries routinely show construction as the leading application, followed by transportation, marine/composites, signage and furniture regional mixes vary.

.

Latest Trends and Technological Developments

The industry in 2024 to 2025 is being shaped by two simultaneous themes: (1) raw-material and PVC resin capacity expansions that change feedstock availability and pricing, and (2) product- and process-level innovation emphasising lower resin uptake, improved closed-cell microstructures and better thermal/fire performance for demanding composite and marine applications. Notable market news: in May 2025 analysts reported material-capacity growth in PVC feedstocks with Asia slated to add significant PVC capacity through 2030, a development that will affect feedstock pricing and regional competitiveness (report published May 2025). Market commentaries through 2024 to 2025 also documented large PVC resin capacity additions by major producers that are altering supply dynamics (industry viewpoint published in 2025). Additionally, industry press and trade expos through 2024 to 2025 highlighted commercial activity from structural-core suppliers (Divinycell/DIAB, Gurit, AIREX/3A and regional suppliers) launching new product grades and multi-year supply contracts for subsea and wind-energy composites (examples reported in industry outlets in 2025). These items illustrate both supply-side shifts in PVC and demand-side moves toward higher-performance structural foam cores.

Asia (led by China, with growing contributions from India, South Korea, Japan and Taiwan) is the dominant region for PVC resin and downstream PVC foam production, benefiting from proximate upstream PVC resin capacity, integrated chemical complexes, and large construction and manufacturing end-markets. Producers based in China supply both local demand and exports to Southeast Asia and the Pacific; Chinese manufacturers also lead in production equipment availability and in lower-cost extrusion lines, which has enabled rapid build-out of capacity. The Asia region is therefore the natural centre of gravity for volume growth in rigid PVC foam, and price competition there tends to set the floor for export markets. Regional technical capability is improving too: manufacturers are introducing tighter density control, improved closed-cell structures (to reduce resin uptake in sandwich laminates) and product grades aimed at marine and wind-energy composites. Taken together, the Asia market is expected to be the primary growth engine for rigid PVC foam volumes and incremental capacity additions through the late-2020s.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5053224

PVC Rigid Foam by Type:

Medium Density Foam (100-300 kg/ m3)

High Density Foam ( >300 kg/ m3)

PVC Rigid Foam by Application:

Wind Power Generation

Aerospace

Shipbuilding

Rail Transportation

Others

Global Top 10 Key Companies in the PVC Rigid Foam Market

Diab

3A Composites GmbH

Maricell

CoreLite Composites

Gurit Services AG

Fibremax Ltd

Baoding Visight Advanced Material Technology Co., Ltd.

Luoyang Kebos New Material Technology Co., Ltd.(Longhua Technology Group (Luoyang) Co., Ltd.)

Changzhou Tiansheng New Materials

Jiangsu Changyou Environmental Protection Technology Co., Ltd.

Diab

Regional Insights

Within Southeast Asia, demand drivers are construction (interior cladding, façade panels, insulation), light-weight furniture/fixtures, signage and growing composite applications in marine and transport. Indonesia stands out among ASEAN markets because of its large and expanding construction sector, rising domestic manufacturing of modular building products, and improving import-substitution capacity for plastics and composite components. ASEAN markets are typically served by a mix of regional mills and imported boards/cores; Indonesia, Vietnam and Thailand show particular demand growth for medium-density structural foams used in window/door panels, partitions and furniture, while Singapore and Malaysia focus more on higher-spec composite core markets for marine and offshore applications. Price sensitivity remains higher in ASEAN than in developed markets, creating opportunity for lower-cost Asian producers to win share but also pressuring margins for local converters.

The industry faces cyclical feedstock price volatility because PVC resin is petrochemically derived and sensitive to ethylene/vinyl chloride monomer (VCM) costs and to capacity shifts. New PVC resin capacity can depress prices and squeeze margins, while feedstock tightness can raise costs quickly. Environmental and regulatory pressure (waste management, restricted additives, and end-of-life considerations) are increasing the compliance burden on producers and converters. Energy intensity of extrusion plants makes energy costs and uptime reliability a key risk to unit economics. Technical challenges include maintaining stable closed-cell microstructures at scale to minimise resin absorption during composite lay-up while keeping density and mechanical properties within tight tolerances demanded by high-value applications. Finally, trade flows and logistics (shipping costs, local duties) periodically re-route supply and change competitive positions among exporters and local mills.

Producers should prioritise feedstock integration or long-term resin contracts to stabilise margins, invest selectively in higher-throughput extrusion lines that support profitable economies of scale, and develop product grades that target high-value niches (marine, wind-energy core, fire-rated architectural panels). Converters can protect margins by offering value-added finishing (lamination, CNC machining, certified marine grades) and by securing regional distribution networks in Southeast Asia where demand is rising. Investors should evaluate producers on three vectors: proximity to low-cost PVC feedstock, product differentiation (engineered closed-cell cores or certified grades), and installed, modernized production lines (higher kg/h per line and automation to reduce labour intensity). Monitoring announced PVC resin expansions and their timing is critical because feedstock cycles materially affect pricing and margin outlook.

Product Models

PVC rigid foam is a lightweight, durable, and versatile material widely used in construction, transportation, marine, and industrial applications. It offers high strength-to-weight ratios, excellent chemical resistance, and ease of machining. Based on density.

Medium-Density Foam (100300 kg/m3) commonly used for general structural and insulation purposes. Notable products include:

Divinycell H60 Diab Group: Lightweight PVC foam core widely used in marine and wind energy structures.

Airex C70 3A Composites: Medium-density closed-cell PVC foam for sandwich structures in transport and building.

Klegecell R75 Gurit: Balanced density foam core with good mechanical properties for composites.

CoreLite PVC100 CoreLite Inc.: Versatile foam core used in boatbuilding, panels, and general lightweight structures.

Sekisui Foamlite M200 Sekisui Chemical: Medium-density PVC foam sheet for industrial and signage applications.

High-Density Foam (>300 kg/m3) which is ideal for demanding load-bearing and high-performance applications. Examples include:

Divinycell HP250 Diab Group: High-strength PVC foam core designed for demanding marine and aerospace structures.

CoreLite PVC300 CoreLite Inc.: Strong foam core for tooling, flooring, and high-performance panels.

Palight Project Palram Industries: Strong rigid foam board for demanding architectural and display uses.

Celtec Pro Vycom Plastics (Azek Company): Dense PVC foam designed for fabrication and structural performance.

Simona High-Density PVC Foam Simona AG: Heavy-duty foam sheet used in transportation and engineering projects.

Rigid PVC foam occupies a robust niche between commodity PVC and high-end composite cores: it offers cost-efficient structural performance and is well-positioned to grow where construction, marine composites and lightweight transport materials expand. Asia (and within that China) is the heart of production and will remain central to price formation and capacity additions; Southeast Asia and Indonesia particularly are important growth markets that will absorb both local production and exports. The industrys near-term outlook will depend on PVC feedstock dynamics, energy cost trends and the ability of suppliers to introduce differentiated, higher-value foam grades.

Investor Analysis

This report distils the most relevant operational and market signals investors need to evaluate opportunities in the rigid PVC foam value chain. What investors should care about: (a) volume growth (total cubic metres sold and CAGR trajectory), (b) per-unit economics (price per m3, COGS per m3, factory gross margin), (c) asset productivity (per-line production capacity ranges and the capex required to scale), and (d) demand mix (which downstream industries will absorb future volumes). How to use it: compare target company unit economics and installed capacity against the market averages and feedstock exposure identified here to stress-test margin scenarios under different resin-price outcomes. Why it matters: modest changes in feedstock price or utilization can swing factory margins materially; companies with secured feedstock, differentiated product grades, or access to higher-value downstream channels will show outsize returns relative to basic volume players. In short, the combination of per-unit margin data, capacity footprints and downstream demand make the difference between margin-stable investments and cyclically exposed ones.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5053224

5 Reasons to Buy This Report

It provides a 2024 baseline with per-unit pricing and factory economics to benchmark targets.

It quantifies global volume so investors and operators can map installed capacity to market demand.

It aggregates up-to-date regional intelligence for Asia and ASEAN where the largest growth and capacity shifts are occurring.

It compiles equipment capacity ranges per extrusion line to support capex and throughput modelling.

It highlights top global suppliers and recent industry news that affect near-term feedstock and price dynamics.

5 Key Questions Answered

What was the global rigid PVC foam market value in 2024 and how many cubic meter does that represent?

What is the average transactional price per cubic meter and the factory economics at that price?

What are typical production capacities per extrusion/foam line and how do density choices affect throughput?

Which downstream industries consume the most rigid PVC foam and what share do they represent?

Who are the leading global suppliers and what recent capacity or contract developments should investors note?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release PVC Rigid Foam Market to Reach USD 1,354 Million by 2031 Top 10 Company Globally here

News-ID: 4196803 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for PVC

PVC Coated Fabrics Market Accelerates at 5.3% CAGR as Transportation, Infrastruc …

The PVC coated fabrics market reached USD million in 2022 and is projected to witness lucrative growth by reaching up to USD million by 2031. The market is growing at a CAGR of 5.3% from 2024 to 2031.

Market growth is fueled by surging demand for durable, waterproof materials in transportation, marine, and construction sectors, alongside rising infrastructure projects and automotive upholstery needs. Key drivers include advancements in eco-friendly PVC formulations…

PVC Foam Profiles Market Outlook 2034: Global Valuation to Reach USD 4.8 Billion …

The global PVC foam profiles market was valued at US$ 2.9 Bn in 2023. As industries continue to adopt lightweight, moisture-resistant, and dimensionally stable materials, PVC foam profiles are witnessing growing integration into construction, automotive, marine, and furniture manufacturing applications. According to current projections, the market is set to expand at a CAGR of 4.2% from 2024 to 2034, ultimately reaching US$ 4.8 Bn by 2034. This sustained growth reflects…

The Growing PVC Window Market

New York, US, - [01-December- 2025] - The PVC window market is experiencing significant growth, driven by increasing demand for energy-efficient and sustainable building materials. As consumers and builders alike prioritize durability, cost-effectiveness, and environmental impact, PVC (polyvinyl chloride) windows have emerged as a preferred choice in residential and commercial construction. This press release provides an overview of the current state of the PVC window market, key trends, and future…

New PVC External Lubricant Improves Performance

Shandong HTX New Material Co., Ltd. is a newly established company that has already made a significant impact in the industry. Since its inception in March 2021, the company has been focused on producing high-quality PVC External Lubricant [https://www.htxchem.com/lubricant-manufacture-price-product/] and other related products. HTX is a comprehensive enterprise that not only specializes in PVC processing aids but also involves itself in research and development, production, and sales.

The product range offered…

PVC Pipes Market to See Major Growth by 2026 | Bow Plastics, Royal PVC, Tulsi Ex …

Latest released the research study on Global PVC Pipes Market, offers a detailed overview of the factors influencing the global business scope. PVC Pipes Market research report shows the latest market insights, current situation analysis with upcoming trends and breakdown of the products and services. The report provides key statistics on the market status, size, share, growth factors of the PVC Pipes

The study covers emerging player’s data, including: competitive…

Global Polyvinyl Chloride (PVC) Market 2017 -

Worldwide Polyvinyl Chloride (PVC) 2017 Research Report presents a professional and complete analysis of Global Polyvinyl Chloride (PVC) Market on the current situation.

In the first part, the report provides a general overview of the Polyvinyl Chloride (PVC) industry 2017 including definitions, classifications, Polyvinyl Chloride (PVC) market analysis, a wide range of applications and Polyvinyl Chloride (PVC) industry chain structure. The 2017's report on Polyvinyl Chloride (PVC) industry offers the global…