Press release

Global Smart Silent Printing Machines Market to Reach USD 4528 Million by 2031 with 14.7% CAGR Driven by Heidelberg and HP Inc

A new industry briefing consolidates the latest data points and 2025 breakthroughs in Smart Silent Printing Machines-high-efficiency from QYResearch presses that integrate intelligent controls with low-noise operation for packaging, labeling, publishing, and customized print environments. The market is scaling rapidly on the back of automation, AI-driven workflows, and demand for quieter, cleaner production floors.Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) https://www.qyresearch.com/sample/4936807

Latest Data

• 2024 market size: US$1,734 million

• 2031 forecast: US$4,528 million

• CAGR (2025-2031): 14.7%

• 2024 output: ~17,300 units (global)

• Average global selling price (2024): ~US$100,000 per unit

• Use case: Low-noise, intelligent presses deployed across packaging, labeling, publishing, customized/short-run jobs; optimized for automated, noise-controlled production environments.

Company List

Heidelberg

Koenig & Bauer

Komori Corporation

Canon Inc.

Ricoh Company

Xerox Corporation

HP Inc.

Bobst Group

Manroland Goss

Mark Andy

Windmöller & Hölscher

Gallus Ferd. Rüesch AG

Durst Group

EFI Electronics for Imaging

Fujifilm Corporation

Konica Minolta

Agfa-Gevaert Group

Müller Martini

Domino Printing Sciences

SCREEN Holdings

Uteco Converting S.p.A.

Nilpeter A/S

Omet S.r.l.

Riso Kagaku Corporation

Product profiles for five leading companies:

Heidelberg - Speedmaster XL 106 (sheetfed offset)

• Max sheet size: 750 × 1,060 mm

• Max print format: 740 × 1,050 mm (straight); 730 × 1,050 mm (perfecting)

• Speed: Standard 18,000 sph; up to 18,000 sph in perfecting; select versions up to 21,000 sph

• Substrate thickness: up to 1.00 mm (without perfector), up to 0.80 mm (with perfector)

• Automation: Push to Stop, Intellistart 3, Intelliline, Industry 4.0 connectivity

• Use cases: High-end commercial and packaging jobs

Koenig & Bauer - Rapida 106 X (sheetfed offset)

• Speed: Up to 20,000 sph, including perfecting

• Automation: ErgoTronic AutoRun for autonomous list printing, automated plate logistics

• Positioning: High-productivity medium-format platform with strong digital integration

• Applications: Commercial and packaging printing

Komori - Lithrone GX40 advance (40-inch sheetfed offset)

• Max sheet size: 750 × 1,050 mm

• Speed: Up to 18,000 sph (GX40 advance); G40 advance versions around 17,200 sph

• Automation/AI: KHS-AI (self-learning presets), A-APC (Asynchronous Automatic Plate Changer), KP-Connect integration

• Target work: Packaging and commercial print with large sheet capability and short makereadies

HP Inc. - HP Indigo 100K (B2 digital press)

• Sheet size: Max 750 × 530 mm; min 510 × 330 mm

• Throughput: 6,000 sph (EPM 3/0); 4,500 sph (4/0); 2,250 sph (4/4)

• Image size: Up to 740 × 510 mm

• Resolution: 812 dpi at 8-bit; virtual 2438 × 2438 dpi

• Substrates: 70-400 gsm uncoated; 90-400 gsm coated (~75-450 μm)

• Workflow: Non-stop feeding, predictive services, PrintOS connectivity

Bobst Group - MASTER DM5 (inline hybrid label press)

• Process: UV inkjet + DigiFlexo all-in-one (print, embellish, convert in one pass)

• Resolution: 1,200 × 1,200 dpi, 3 drop sizes

• Digital print speed: Up to 100 m/min

• Web widths: 370 mm and 430 mm options

• Ink laydown: Up to ~16 g/m2 (application-dependent)

• Automation: On-the-fly job and cylinder changes, Ink-on-Demand, modular architecture

Application List

Packaging Printing

Label Printing

Commercial Publishing

Industrial Product Printing

Others

Classification List

Flexographic Printing Machines

Offset Printing Machines

Digital Printing Machines

Screen Printing Machines

Others

Cost, Gross Profit & Gross Margin - Snapshot

• The report's average selling price is ~US$100,000 per unit (2024).

• Manufacturer financials give real-world gross margin anchors for industrial presses:

• Komori (FY2024): Gross margin ~33.2%. Using the US$100k ASP, an analogous machine would imply COGS ≈ US$66.8k and gross profit ≈ US$33.2k per unit.

• Koenig & Bauer (2024): Gross margin 23.1%. At a US$100k ASP this implies COGS ≈ US$76.9k and gross profit ≈ US$23.1k per unit.

• HP Inc. Printing (Q3 FY2025): Operating margin 17.3%, offering a benchmark on profitability dynamics in this segment.

2025 Trend Watch: Key News, Achievements & What They Signal

AI-driven automation becomes the default. In 2025, leading vendors converged on "lights-out-ready" workflows: from AI-assisted job setup to predictive maintenance and automated quality monitoring. HP Indigo used CHINA PRINT 2025 to show an AI-underpinned portfolio and debut the Indigo 120K HD and 18K HD in Asia, positioning the line as a bridge from analog to digital with higher uptime and operator-lite changeovers. For plants targeting quieter operations, smarter motion control and closed-loop QA also reduce mechanical stress and vibration-two drivers of acoustic output over long shifts.

Throughput records raise the bar-without sacrificing stability. Kodak turned heads at Hunkeler Innovationdays 2025 with its PROSPER 7000 Turbo-a web-fed full-color inkjet press demonstrated at up to 410 m/min. Beyond raw speed, Kodak showcased stable output at frame rates high enough to play back moving sequences on the press monitors-evidence of tightly synchronized transport, drying, and inspection subsystems. In "silent" production environments, higher stability typically correlates with less rattle, better damping, and smoother drive profiles, which can meaningfully lower perceived noise despite higher web speeds.

Component-level advances unlock broader materials-and quieter duty cycles. Epson's S3200-U1-2, S3200-U3-2, and D3000-U1R printheads improve UV-ink compatibility, reliability and continuous-use stability at up to 1,200 dpi with near-nozzle recirculation. For OEMs, easier drop-in upgrades allow tuning pumps and fans more conservatively for specific substrates-often reducing acoustic peaks. Expanded UV compatibility also shifts work from solvent-heavy lines to cleaner, digitally cured workflows favored in modern "quiet" factories.

"Connected Automation" matures from slogan to factory reality. Komori's 2025 program emphasized Connected Automation and unveiled a 29-inch sheetfed UV inkjet press for China, while also showcasing a Virtual Smart Factory environment at its Tsukuba technology center. The direction of travel is unmistakable: press islands integrated into MES/ERP, autonomous makeready, and sensors feeding predictive models. These smart-factory principles are allies of "silent" operation-precise motion planning and edge analytics can trim unnecessary accelerations, tame fans during dwell periods, and surface early signs of noisy wear before failures.

Packaging and labels remain the noise-sensitive growth engine. The report highlights packaging and label printing as dominant downstream drivers. In practice, these jobs increasingly run inside mixed-use facilities (often near converting, inspection, and fulfillment), where noise limits and operator well-being are mandated by policy or customer ESG requirements. That's pushing buyers toward digitally-native, servo-rich architectures with better isolation, passive/active damping, and refined airflow-hardware traits that sit under the "silent" umbrella even when not marketed explicitly as such.

Profit pools shift toward uptime, service, and software. 2025 manufacturer results reinforce that margins depend on steady utilization and service monetization-not just hardware list price. Koenig & Bauer's 2024 results show a 23.1% gross margin amid revenue softness; management is steering toward 5-6% operating EBIT margin by 2026 by leaning into service, packaging, and efficiency levers. Heidelberg exited FY2024/25 with a steady 7.1% adjusted EBITDA margin and now guides toward up to ~8% in FY2025/26, citing cost discipline and order intake post-drupa. For buyers, that translates to stronger software roadmaps and more embedded automation features in 2025 refreshes-many of which tend to be quieter by design.

Low-noise by design: a competitive differentiator-especially in retrofits. Although vendors seldom brand large production presses as "silent," engineering attention to acoustics is rising. At the component level, quieter linear drives and stepper/servo drivers, tuned motion profiles, better frame damping, and more efficient curing/cooling are filtering from high-end SKUs into mid-range models. With Epson's 2025 printhead family broadening the UV window, OEMs can redesign duty cycles (less purge, smoother re-circulation) to keep fan peaks down and avoid resonance at common line speeds. In short, the "silent" in smart silent printing is increasingly achieved via system-level orchestration rather than a single noise-reduction feature.

Regional momentum: Asia's showcase year. CHINA PRINT 2025 emerged as the year's most influential venue for smart, automated presses. HP Indigo's 120K HD and 18K HD Asian debuts crystallized the market's pivot toward high-speed digital with lower operator load. Komori likewise used the Beijing stage to position new packaging and digital solutions. For procurement teams in APAC, the message is clear: fully integrated automation stacks are now widely available and shipping regionally, not just as Europe- or U.S.-centric flagships.

What's new in 2025-headline achievements:

• Kodak PROSPER 7000 Turbo: live 410 m/min inkjet demonstrations in Europe-pushing the speed frontier while highlighting stability, process control, and on-press quality visualization.

• HP Indigo 120K HD & 18K HD: Asian debuts with AI-driven automation for faster changeovers and broader application coverage-converters can consolidate more work onto fewer, smarter lines.

• Epson S3200/U-series & D3000-U1R: new printheads with enhanced UV compatibility, higher reliability, and 1,200 dpi capability-accelerating OEM upgrades and enabling quieter, more efficient duty cycles.

• Komori "Connected Automation" & Smart Factory: from exhibit themes to a fully operational Virtual Smart Factory at Tsukuba, signaling that Industry 4.0 for print is now concrete.

Downstream companies:

• All Color Printers

• E.B. Box Company

• Edelmann Group

• Grupo Gráfico Romo

• J.S. McCarthy Packaging + Print

• Moquin Press

• Peczuh Printing & Paperbox

• Spectrum Packaging Corporation

• Caribbean Label Crafts

• I.B.E.

• SPC (Spectrum Packaging Corporation again)

• McLean Packaging

Request for Pre-Order Enquiry On This Report https://www.qyresearch.com/customize/4936807

Strategy implications for 2025-2027 buys. Given the market's 14.7% CAGR trajectory to 2031, buyers should:

1. prioritize architectures with native AI/automation hooks (pathway to quieter, more stable production);

2. require printhead-upgrade roadmaps (like Epson's) to extend machine life and reduce retrofit noise/energy penalties;

3. model gross profit not just from throughput but from noise-compliant shift patterns (night operations, urban plants) that smart/silent machines uniquely unlock; and

4. benchmark service and software SLAs-as suppliers chase higher operating margins, buyers can negotiate bundled analytics/QA features that improve both uptime and acoustic performance.

Contact Information:

Tel: +1 626 2952 442 ; +351 914374211(Tel & Whatsapp); +86-1082945717

Email: qinyue@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About us:

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

Related Report:

Smart Silent Printing Machines - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/4936809/smart-silent-printing-machines

Global Smart Silent Printing Machines Market Outlook, In‐Depth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/4936807/smart-silent-printing-machines

2025-2031中国智能静音印刷机械市场现状研究分析与发展前景预测报告

https://www.qyresearch.com.cn/reports/5746987/smart-silent-printing-machines

2025-2031全球与中国智能静音印刷机械市场现状及未来发展趋势

https://www.qyresearch.com.cn/reports/5746986/smart-silent-printing-machines

Chapter Outline:

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Smart Silent Printing Machines Market to Reach USD 4528 Million by 2031 with 14.7% CAGR Driven by Heidelberg and HP Inc here

News-ID: 4196773 • Views: …

More Releases from QYResearch Europe

Global Aerospace Grade Smart Assembly Lines Market 2024 USD 4251 Million to 2031 …

According to recent report from QYResearch, the global market for aerospace-grade smart assembly lines stood at US$4,251 million in 2024 and is projected to reach US$8,712 million by 2031 at a 10.2% CAGR (2025-2031). In 2024, approximately 670 lines were produced globally at an average selling price (ASP) of about US$6.343 million per line. These highly automated systems integrate AI, industrial robotics, advanced sensing, and digital control to deliver repeatable,…

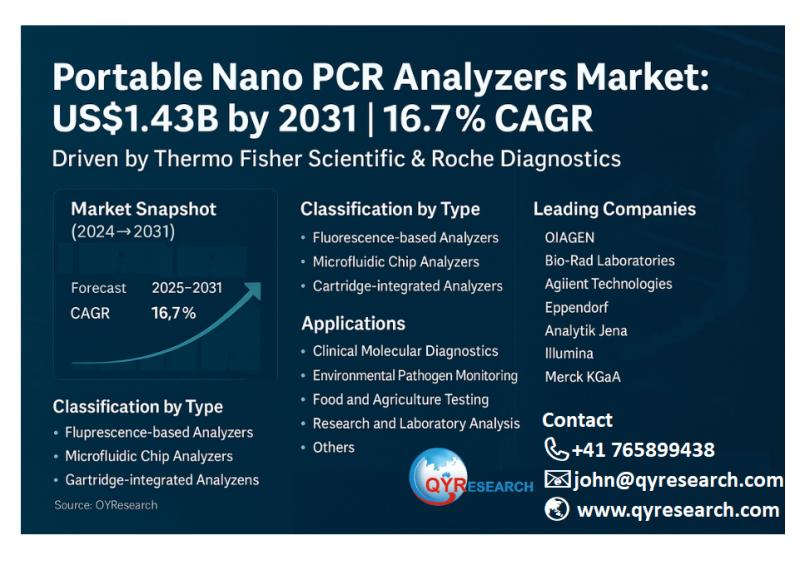

Portable Nano PCR Analyzers Market Growth to US$1.43 Billion by 2031 with 16.7% …

According to the latest QYResearch Report, the global market for Portable Nano PCR Analyzers was valued at US$484 million in 2024 and is expected to reach US$1,427 million by 2031, growing at a CAGR of 16.7% during the forecast period of 2025-2031. Global production in 2024 reached around 96,800 units, with an average price of about US$5,000 per unit. These portable devices utilize nanotechnology-enhanced PCR processes for rapid on-site genetic…

Global Multiphase Flow Conveying Equipment Market to Reach USD 10.88 Billion by …

The global market for Multiphase Flow Conveying Equipment is transitioning from a specialized engineering niche to a core enabler of industrial efficiency across upstream energy, chemicals, mining, and wastewater sectors. According to QYResearch 2025 edition of Multiphase Flow Conveying Equipment - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031, the market was valued at US$7,380 million in 2024 and is projected to reach US$10,879 million by 2031,…

Global Smart Eye-Tracking Medical Devices Market Size Reaches US$3.0 Billion by …

The global Smart Eye-Tracking Medical Devices market has entered a stage of accelerated clinical adoption and product diversification. According to QYResearch 2025 Global Smart Eye-Tracking Medical Devices Market Research Report, the market was valued at US$973 million in 2024 and is projected to reach US$3,009 million by 2031, growing at a CAGR of 17.5% from 2025 to 2031. Global output in 2024 reached approximately 64,900 units, with an average price…

More Releases for Print

Global Print Media Market, Global Print Media Industry, Covid-19 Impact Global P …

The print media market entails of sales of newspapers, magazines, several other periodicals, books, directories and mailing lists, and many other works, such as calendars, greeting cards, and maps and concerned services such as advertising space by countless entities (organizations, sole traders or partnerships) that publish print media.

According to the report analysis, ‘Print Media Global Market Report 2020-30: Covid 19 Impact and Recovery’ states that News Corp; Pearson PLC; Bertelsmann;…

Aussie Print Icon SNAP Set to Take on Offshore Print Giants with the Release of …

Snap Print & Design is taking on the major offshore players in the online print industry through the launch of Snap Print-Online, providing SNAP customers with access to a world leading DIY graphic design technology powered by Canva, all supported by local Snap Centre expertise, convenience, and speed of service.

Renowned as the market leader in the 'bricks and mortar' delivery of print services for well over the past century, SNAP…

Wet Glued Labels Market, Size, Share, Company Profiles By | Offset Print Flexogr …

The Global Wet Glued Labels Market report studies the latest market trends to find the challenges existing in the market that might disrupt the industry following business ventures or product launches. It has been structured explicitly to help readers understand all key elements of the industry. The Wet Glued Labels market report is comprised of a combination of accurate market insights, practical solutions, emerging talent, and the latest technological advancements.…

Print Server Market Report 2018: Segmentation by Type (Internal print server, Ex …

Global Print Server market research report provides company profile for Canon, Edimax, Xerox, IOGEAR, NETGear, TRENDnet, D-Link, HP, Brother International, Startech, Dymo, Linksys and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report…

Print Audit® Releases Print Audit 6.6

With numerous reporting enhancements and fixes, the Print Audit 6 upgrade is available for free to current users.

Calgary, Alberta – December 8, 2011 – This week, Print Audit®, the print management company, released the latest version of its flagship software, Print Audit 6. This release offers users many improvements to the program’s core tracking and reporting functions, including enhancements to the software’s integration and tracking with Adobe products.

Print Audit 6…

Print Audit Rules with Print Audit 6

Newest version of Print Audit’s flagship print management product boasts hundreds of cost-saving and environmentally friendly improvements based on customer feedback

CALGARY, ALBERTA (April 2009) – In 2008, Print Audit 5 helped companies around the world save 190,000 trees, recover $150 million, and redirect half a billion pages to more efficient print devices. Now print management company Print Audit is releasing the next version of its popular flagship product, Print Audit…