Press release

Australia Mobility as a Service Market Projected to Reach USD 1.14 Billion by 2033

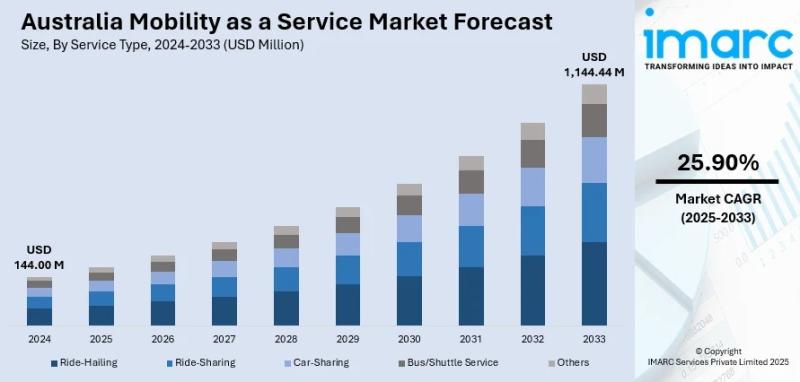

The latest report by IMARC Group, titled "Australia Mobility as a Service Market Report by Service Type (Ride-Hailing, Ride-Sharing, Car-Sharing, Bus/Shuttle Service, Others), Transportation Type (Private, Public), Application Platform (Android, iOS, Others), Propulsion Type (Electric Vehicle, Internal Combustion Engine, Others), and Region 2025-2033," offers a comprehensive analysis of the Australia mobility as a service market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia mobility as a service market size reached USD 144.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,144.44 Million by 2033, exhibiting a CAGR of 25.90% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 144.00 Million

Market Forecast in 2033: USD 1,144.44 Million

Market Growth Rate (2025-2033): 25.90%

Australia Mobility as a Service Market Overview

The Australia mobility as a service market is experiencing exceptional growth driven by implementation of government initiatives promoting sustainable transport, growing demand for integrated mobility solutions, continual advancements in digital platforms, and shift toward subscription-based transport models addressing increasing urban mobility needs. The market expansion is supported by rapid urbanization creating demand for efficient transportation solutions, environmental sustainability focus aligning with national climate targets, and rising costs of vehicle ownership steering consumers toward flexible mobility alternatives. Enhanced multi-modal integration, government support for smart mobility initiatives, and corporate mobility solution demands are positioning Australia's MaaS market for transformative growth and widespread adoption.

Australia's mobility as a service foundation demonstrates robust urbanization fundamentals with urban population reaching 86.62% of total population in 2023, creating substantial pressure on existing transport infrastructure. The country maintains ambitious climate targets including 43% emission reduction from 2005 levels by 2030 and Net Zero by 2050, driving demand for sustainable transport solutions. The proliferation of electric vehicle adoption with 85,319 units sold by September 2024, digital platform advancement, and multi-modal transport integration is creating favorable market conditions, requiring substantial investments in smart mobility infrastructure and integrated transport systems. Australia's strategic focus on sustainable urban development, combined with government policy support and corporate ESG requirements, makes it an increasingly attractive market for innovative MaaS platform development and deployment.

Request For Sample Report:

https://www.imarcgroup.com/australia-mobility-as-a-service-market/requestsample

Australia Mobility as a Service Market Trends

• Urbanization impact acceleration: Rapid urban growth in major cities including Sydney, Melbourne, Brisbane, and Perth creating escalating demand for efficient, scalable transportation solutions alleviating congestion and enhancing mobility.

• Sustainable transport integration: Environmental sustainability emphasis integrating eco-friendly options including electric buses, e-bikes, and shared electric vehicles aligning with national climate targets and low-emission mobility goals.

• Multi-modal platform development: Seamless connections among different transport modes including public transport, ride-hailing, car-sharing, and micro-mobility solutions through unified digital platforms eliminating multiple app requirements.

• Government smart mobility support: Active policy development promoting sustainable transportation networks, digital infrastructure investment, and regulatory frameworks encouraging innovation while maintaining safety and accessibility standards.

• Subscription-based model adoption: Rising adoption of subscription-based travel packages providing cost-effective alternatives to private car ownership with pay-per-use flexibility and integrated expense management capabilities.

• AI-driven personalization expansion: Growing use of artificial intelligence for personalized route optimization, carbon footprint calculation, and user preference-based recommendations enhancing overall mobility experience and sustainability awareness.

Market Drivers

• Urban population growth: Australia's urban population reaching 86.62% creating immense pressure on existing transport infrastructure and prompting adoption of integrated MaaS platforms for effective urban transit management.

• Climate target compliance: National commitment to 43% emission reduction by 2030 and Net Zero by 2050 driving integration of low-emission transport options and sustainable mobility solutions supporting environmental goals.

• Vehicle ownership cost escalation: Rising expenses for fuel, insurance, parking, and maintenance making private vehicle ownership less financially viable, particularly in urban environments, favoring flexible MaaS alternatives.

• Electric vehicle adoption: Accelerating EV sales with 85,319 units sold by September 2024 supporting National Electric Vehicle Strategy and infrastructure development creating opportunities for electric mobility integration.

• Digital platform advancement: Continual technological improvements in mobile applications, real-time tracking, unified payment systems, and intelligent ticketing enhancing user experience and platform accessibility.

• Corporate sustainability requirements: Growing demand for corporate mobility solutions helping companies meet ESG standards, reduce travel expenses, and support employee convenience through integrated transport packages.

Challenges and Opportunities

Challenges:

• Regulatory and policy barriers across different states and territories creating complex compliance requirements, divergent data sharing policies, and operational approval processes hindering cohesive nationwide MaaS deployment

• High infrastructure costs for digital foundations including real-time tracking systems, unified payment solutions, charging stations, and transport hubs requiring substantial capital investment and ongoing maintenance

• Integration complexity challenges coordinating various transport modes, operators, technologies, and business models within single user interfaces while ensuring real-time accuracy and reliability

• Revenue sharing disputes and competitive concerns among transport operators creating reluctance to share vital operational data and collaborate on unified platform development

• Consumer behavior adaptation requirements for transitioning from traditional transport methods to integrated digital mobility platforms requiring education and trust-building initiatives

Opportunities:

• Regional and suburban expansion addressing mobility gaps in smaller towns and rural areas through integrated solutions combining buses, ride-sharing, and micro-mobility alternatives improving accessibility

• Corporate mobility market growth providing tailored packages for business travel, commuting solutions, and integrated expense management appealing to companies seeking cost-effective employee transport options

• Public transport operator partnerships creating cohesive travel ecosystems through unified ticketing, real-time journey planning, and resource optimization reducing service redundancies and improving user experience

• Smart city integration opportunities aligning MaaS platforms with urban development plans, traffic management systems, and sustainability initiatives creating comprehensive mobility solutions

• Electric vehicle ecosystem expansion leveraging growing EV adoption and charging infrastructure development to provide sustainable, integrated mobility options supporting climate targets and environmental consciousness

Australia Mobility as a Service Market Segmentation

By Service Type:

• Ride-Hailing

• Ride-Sharing

• Car-Sharing

• Bus/Shuttle Service

• Others

By Transportation Type:

• Private

• Public

By Application Platform:

• Android

• iOS

• Others

By Propulsion Type:

• Electric Vehicle

• Internal Combustion Engine

• Others

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-mobility-as-a-service-market

Australia Mobility as a Service Market News (2024-2025)

• 2024: Australia's urban population reached 86.62% of total population creating substantial demand for efficient, integrated transportation solutions addressing congestion and mobility challenges in major cities.

• September 2024: Electric vehicle sales reached 85,319 units by end of September supporting National Electric Vehicle Strategy and creating opportunities for sustainable mobility integration within MaaS platforms.

• 2024: Government climate targets emphasized 43% emission reduction from 2005 levels by 2030 and Net Zero by 2050, driving integration of eco-friendly transport options within mobility service platforms.

• 2024: Corporate partnerships with MaaS providers expanded as companies aimed to meet Environmental, Social, and Governance standards through employee mobility programs and sustainable transport initiatives.

• 2024: Multi-modal integration advanced through seamless connections among public transport, ride-hailing services, car-sharing, and micro-mobility solutions eliminating need for multiple applications and tickets.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Service Type, Transportation Type, Application Platform, and Propulsion Type Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=33380&flag=F

Q&A Section

Q1: What drives growth in the Australia mobility as a service market?

A1: Market growth is driven by urban population growth reaching 86.62% creating transport infrastructure pressure, climate target compliance requiring 43% emission reduction by 2030, vehicle ownership cost escalation making private cars less viable, electric vehicle adoption with 85,319 units sold by September 2024, digital platform advancement enhancing user experience, and corporate sustainability requirements for ESG compliance and employee transport solutions.

Q2: What are the latest trends in this market?

A2: Key trends include urbanization impact acceleration in major cities requiring efficient transport solutions, sustainable transport integration with electric buses and shared vehicles, multi-modal platform development through unified digital systems, government smart mobility support through policy and infrastructure investment, subscription-based model adoption providing flexible alternatives, and AI-driven personalization for route optimization and user preferences.

Q3: What challenges do companies face?

A3: Major challenges include regulatory and policy barriers across states creating compliance complexity, high infrastructure costs for digital foundations and charging networks, integration complexity coordinating multiple transport modes and operators, revenue sharing disputes among transport providers, and consumer behavior adaptation requirements for transitioning to integrated digital mobility platforms.

Q4: What opportunities are emerging?

A4: Emerging opportunities include regional and suburban expansion addressing mobility gaps in underserved areas, corporate mobility market growth providing tailored business travel solutions, public transport operator partnerships creating unified travel ecosystems, smart city integration aligning with urban development initiatives, and electric vehicle ecosystem expansion leveraging growing EV adoption and charging infrastructure.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Mobility as a Service Market Projected to Reach USD 1.14 Billion by 2033 here

News-ID: 4195088 • Views: …

More Releases from IMARC Group

Indonesia Payments Infrastructure Market to Reach USD 3,585.7 Million by 2034 | …

Indonesia Payments Infrastructure Market Overview

According to IMARC Group's report titled "Indonesia Payments Infrastructure Market Size, Share, Trends and Forecast by Traditional Payment Infrastructure, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

The Indonesia payments infrastructure market size reached USD 627.2 Million in 2025. The market is expected to grow significantly, reaching USD 3,585.7 Million by 2034, exhibiting a robust…

Polylactic Acid Prices in January 2026: Trend Analysis & Forecast

The Polylactic Acid (PLA) Price Index indicates evolving global momentum driven by feedstock cost shifts, bioplastic demand, and regional supply balances. Recent Polylactic Acid (PLA) Prices have reflected moderate volatility across Asia, Europe, and North America due to changing corn-based feedstock economics and sustainable packaging adoption. This report provides a detailed review of the Polylactic Acid (PLA) price trend analysis 2026, Polylactic Acid (PLA) historical price data, and the Polylactic…

Soybean Oil Prices Rise in Q4 2025: Trend Analysis & Forecast

Soybean Oil Price Trend Analysis is essential for understanding how global supply conditions, trade flows, and policy decisions influence pricing movements across major regions. In 2025-2026, prices have remained sensitive to crop output, biodiesel blending requirements, freight costs, and changing procurement strategies. Seasonal harvest cycles and export competitiveness continue to shape short-term fluctuations. This report delivers a structured overview of recent developments, historical performance, and forward-looking price expectations to support…

India Gold Loan Market Forecast 2026-2034: Industry Size, Trends, Expansion and …

According to IMARC Group's report titled "India Gold Loan Market Size, Share, Trends and Forecast by Market Type, Type of Lenders, Application, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Gold Loan Market Report

The India gold loan market size reached USD 3.8 Billion in 2025. Looking ahead, the market is projected to grow and reach USD 5.2 Billion…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…