Press release

Saudi Arabia Trade Finance Market: Size, Share, Emerging Trends, Current Growth Drivers & Forecast 2033

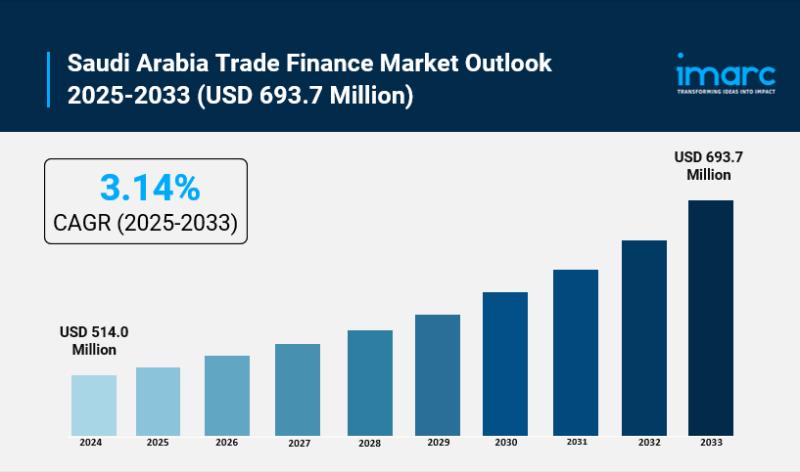

Saudi Arabia Trade Finance Market OverviewMarket Size in 2024: USD 514.0 Million

Market Size in 2033: USD 693.7 Million

Market Growth Rate 2025-2033: 3.14%

According to IMARC Group's latest research publication, "Saudi Arabia Trade Finance Market Report by Finance Type (Structured Trade Finance, Supply Chain Finance, Traditional Trade Finance), Offering (Letters of Credit, Bill of Lading, Export Factoring, Insurance, and Others), Service Provider (Banks, Trade Finance Houses), End User (Small and Medium-sized Enterprises, Large Enterprises), and Region 2025-2033", The Saudi Arabia trade finance market size reached USD 514.0 Million in 2024. The market is projected to reach USD 693.7 Million by 2033, exhibiting a growth rate (CAGR) of 3.14% during 2025-2033.

How AI is Reshaping the Future of Saudi Arabia Trade Finance Market

● AI-powered platforms accelerate trade finance approvals in Saudi Arabia, reducing processing times by up to 60%, enhancing cash flow and operational efficiency for businesses.

● Banks like Al Rajhi employ AI-driven fraud detection tools that analyze transaction patterns, cutting trade finance fraud incidents by over 35%, safeguarding ecosystem integrity.

● Saudi government's AI initiatives under Vision 2030 support the digitization of trade finance, enabling seamless cross-border transactions and real-time compliance monitoring.

● AI enhances risk assessment in trade finance by predicting default probabilities with over 85% accuracy, helping lenders minimize exposure and optimize credit allocation.

● Automated document processing using AI reduces paperwork bottlenecks by 50%, streamlining trade finance workflows and supporting Saudi Arabia's goal of becoming a digital trade hub.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-trade-finance-market/requestsample

Saudi Arabia Trade Finance Market Trends & Drivers:

● Saudi Arabia's Vision 2030 is a major growth driver, boosting trade finance by diversifying the economy beyond oil. Massive infrastructure projects like NEOM and the Riyadh Metro increase demand for letters of credit and supply chain finance, supporting import-export activities across construction, technology, and renewable energy sectors. These initiatives create a financial ecosystem encouraging regional and global trade partnerships, attracting foreign direct investment, and enhancing the market's liquidity and resilience through government-backed financing.

● Digitization is transforming Saudi trade finance, with banks and fintech platforms adopting blockchain, e-billing, and AI-driven automation to speed up processes and improve transparency. Institutions like Al Rajhi Bank are digitizing letters of credit and guarantees, enabling real-time tracking and reducing fraud risk. This digital shift supports SMEs by simplifying access and approvals, while facilitating compliance with regulatory frameworks. The modernization of trade finance increases efficiency, lowers transaction costs, and aligns with broader efforts to make Saudi Arabia a regional digital trade hub.

● Islamic trade finance is rising in prominence, responding to ethical, Sharia-compliant financing preferences that suit regional business practices. Instruments like Sukuk and asset-backed trade guarantees are widely used, especially in sectors such as petrochemicals, manufacturing, and agriculture. Saudi's strategic ports and free zones further enhance trade finance by streamlining document handling and customs clearance. This growing demand for Islamic trade finance structures supports sustainable and risk-managed trade, strengthening the Kingdom's position as a trusted global trading partner.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=20769&flag=E

Saudi Arabia Trade Finance Industry Segmentation:

The report has segmented the market into the following categories:

Finance Type Insights:

● Structured Trade Finance

● Supply Chain Finance

● Traditional Trade Finance

Offering Insights:

● Letters of Credit

● Bill of Lading

● Export Factoring

● Insurance

● Others

Service Provider Insights:

● Banks

● Trade Finance Houses

End User Insights:

● Small and Medium-sized Enterprises

● Large Enterprises

Regional Insights:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Trade Finance Market

● Sep 2025: Saudi Exports launched the Export Financing Initiative, offering SMEs streamlined access to trade finance, boosting export capacity by reducing approval times by 40%.

● Aug 2025: Al Rajhi Bank introduced AI-powered trade finance platforms, cutting transaction processing times by 60% and enhancing fraud detection with real-time analytics.

● Jul 2025: SAMA partnered with fintech firms to implement blockchain-based trade finance solutions, increasing transparency and reducing cross-border settlement times significantly.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Trade Finance Market: Size, Share, Emerging Trends, Current Growth Drivers & Forecast 2033 here

News-ID: 4195034 • Views: …

More Releases from IMARC Group

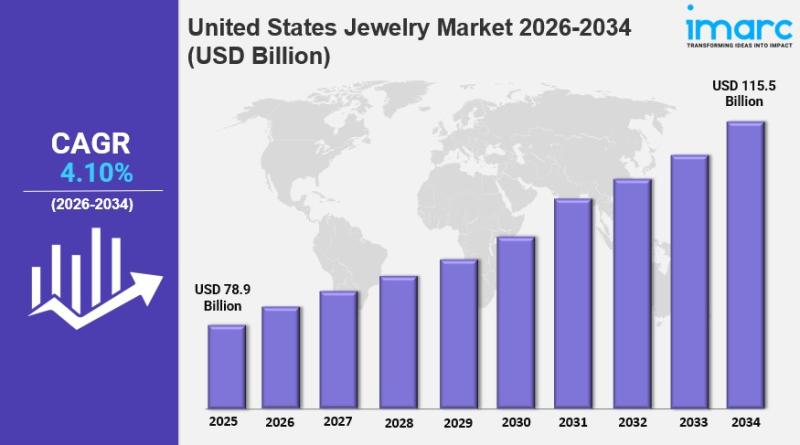

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

Saudi Arabia Pilates & Yoga Studios Market Size to Surpass USD 3.6 Billion by 20 …

Saudi Arabia Pilates & Yoga Studios Market Overview

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.6 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Pilates & Yoga Studios Market Size, Share, Trends and Forecast by Activity Type, Application, and Region, 2025-2033", the Saudi Arabia pilates & yoga studios market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…