Press release

Securities Brokerage And Stock Exchange Services Market Poised to Hit $3023.31 Billion by 2029 with Accelerating Growth Trends

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Securities Brokerage And Stock Exchange Services Market Size Growth Forecast: What to Expect by 2025?

The market size of securities brokerage and stock exchange services has seen significant growth in the past years. The expansion is expected to continue, rising from $2074.24 billion in 2024 to $2218.92 billion in 2025, reflecting a compound annual growth rate (CAGR) of 7.0%. The historical growth can be credited to increased demand for investment possibilities, changes in demographics and investor behavior, the emergence of high-frequency trading, and a growing interest in exchange-traded funds (ETFs).

How Will the Securities Brokerage And Stock Exchange Services Market Size Evolve and Grow by 2029?

In the upcoming years, the market for securities brokerage and stock exchange services is projected to witness robust growth, ballooning to $3023.31 billion by 2029 with an 8.0% compound annual growth rate (CAGR). Factors contributing to the growth predicted for the forecast period include global regulatory changes, emphasis on cybersecurity, shifts in investor preferences, initiatives in cross-border trading, and the utilization of tokenized securities. The forecast period will also see prevalent trends like algorithmic trading, participation from retail investors, the inclusion of ESG investing, market data analytics, and cross-border trading.

View the full report here:

https://www.thebusinessresearchcompany.com/report/securities-brokerage-and-stock-exchange-services-global-market-report

What Drivers Are Propelling the Growth of Securities Brokerage And Stock Exchange Services Market Forward?

Anticipations of economic expansion and wealth accumulation are propelling the development of the security brokerage and stock exchange services markets. This escalation refers to the surge in a nation's production of goods and services over a certain period, which results in elevating income levels and enhancing citizens' quality of life. Accumulation of wealth and economic growth escalates disposable income, resulting in an increased involvement in financial markets and a robust demand for security brokerage and stock exchange services. For instance, the Office for National Statistics, a government department in the UK, reported that in September 2024, the country's GDP likely experienced a growth of 0.5% in the second quarter of the year, though it was a downward revision from the initially presumed increase of 0.6%. Hence, wealth build-up and economic advancement are the propelling forces behind the growth of the security brokerage and stock exchange services markets.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=3538&type=smp

Which Emerging Trends Are Transforming the Securities Brokerage And Stock Exchange Services Market in 2025?

Leading firms in the stock exchange and securities brokerage markets are turning to new technologies such as Brokerage as a Service (BaaS) for better accessibility, smoother operations, and a wider customer spread. BaaS is a service provided via the cloud, enabling fintech companies, financial institutions, and other external bodies to provide trading and brokerage services without the necessity of constructing the foundational infrastructure. For example, HDFC Securities, a financial services firm from India, introduced HDFC FinX - a BaaS solution in August 2024, aiming to aid banks, fintech institutions, and other organizations in delivering integrated trading services. HDFC's trading app, HDFC SKY, assimilated through SDKs and APIs, allows partners to facilitate a smooth trading process sans extensive development. The platform introduces several revenue-sharing setups, such as brokerage revenue sharing, hybrid models, and referral-only methods.

What Are the Key Segments in the Securities Brokerage And Stock Exchange Services Market?

The securities brokerage and stock exchange servicesmarket covered in this report is segmented -

1) By Type: Derivatives And Commodities Brokerage, Stock Exchanges, Bonds Brokerage, Equities Brokerage, Other Stock Brokerage

2) By Type of Establishment: Exclusive Brokers, Banks, Investment Firms, Other Type of Establishments

3) By Mode: Online, Offline

Subsegments:

1) By Derivatives And Commodities Brokerage: Futures Contracts, Options Trading, Commodity Trading

2) By Stock Exchanges: National Exchanges, Regional Exchanges, Over-The-Counter (OTC) Markets

3) By Bonds Brokerage: Corporate Bonds, Municipal Bonds, Government Bonds

4) By Equities Brokerage: Common Stocks, Preferred Stocks, Exchange-Traded Funds (ETFs)

5) By Other Stock Brokerage: Foreign Exchange Trading, Investment Advisory Services, Margin Trading Services

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=3538&type=smp

Who Are the Key Players Shaping the Securities Brokerage And Stock Exchange Services Market's Competitive Landscape?

Major companies operating in the securities brokerage and stock exchange services market include Bank of America Corporation, Northwestern Mutual Life Insurance Company, INVEST Financial Corporation, Ameriprise Financial Services Inc., Edward Jones & Co. L.P., Raymond James Financial Inc., Genworth Financial Inc., Wells Fargo Advisors LLC, H.D. Vest Financial Services Inc., Ameritas Investment Corp., Associated Securities Corporation, Commonwealth Financial Network Inc., Aura Financial Services Inc., Cambridge Investment Research Inc., Lincoln Investment Planning Inc., Geneos Wealth Management Inc., Cadaret Grant & Co. Inc., Berthel Fisher & Company Financial Services Inc., First Allied Securities Inc., Capital Financial Group Inc., Investacorp Inc., InterSecurities Inc., Capital Analysts Incorporated, Investment Centers of America Inc., Investors Capital Corporation

What Geographic Markets Are Powering Growth in the Securities Brokerage And Stock Exchange Services Market?

North America was the largest region in the securities brokerage and stock exchange services in 2024. South America was the second largest region in the securities brokerage and stock exchange services. The regions covered in the securities brokerage and stock exchange services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=3538

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Securities Brokerage And Stock Exchange Services Market Poised to Hit $3023.31 Billion by 2029 with Accelerating Growth Trends here

News-ID: 4193769 • Views: …

More Releases from The Business Research Company

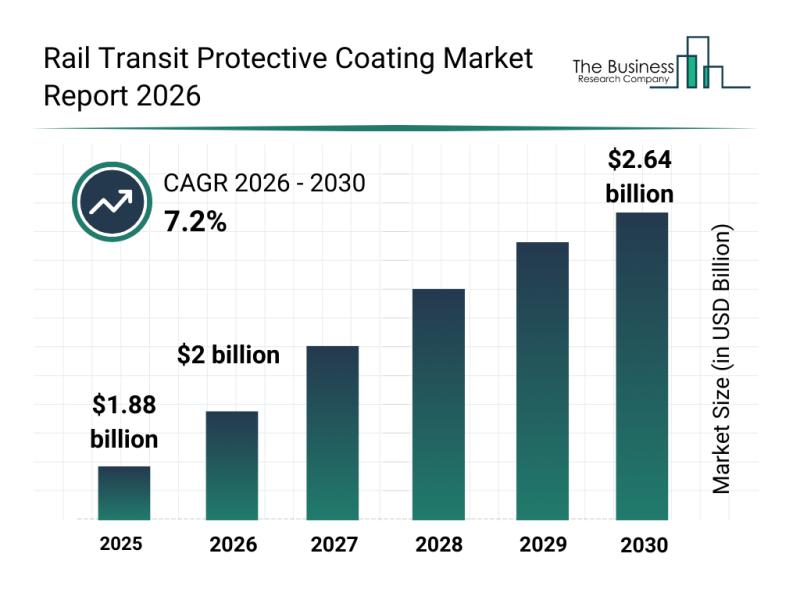

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

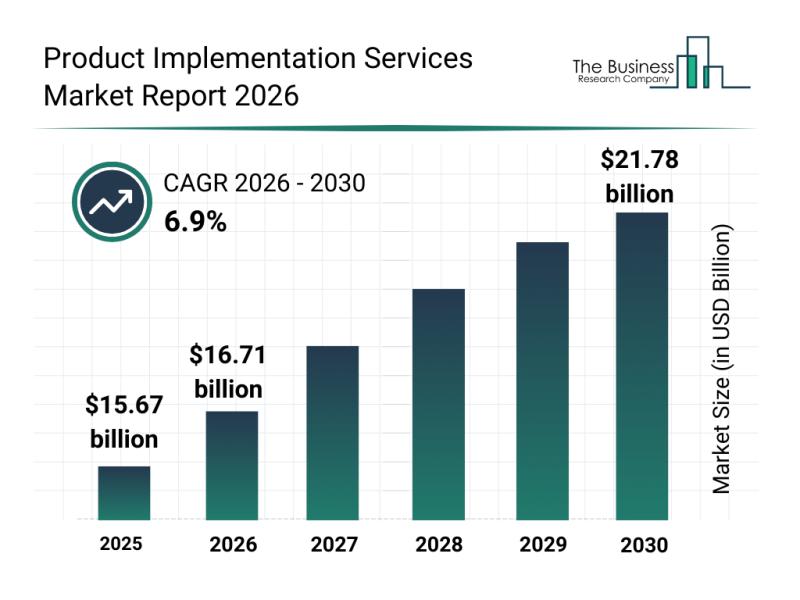

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

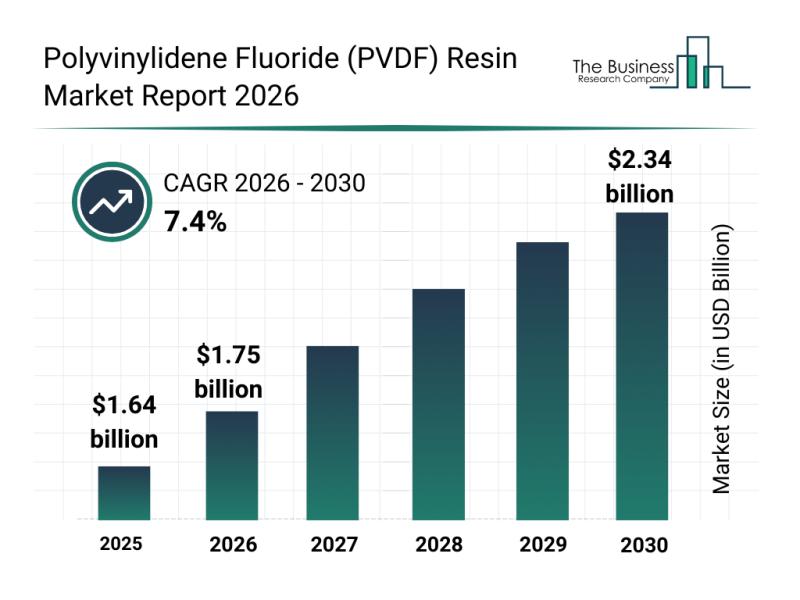

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

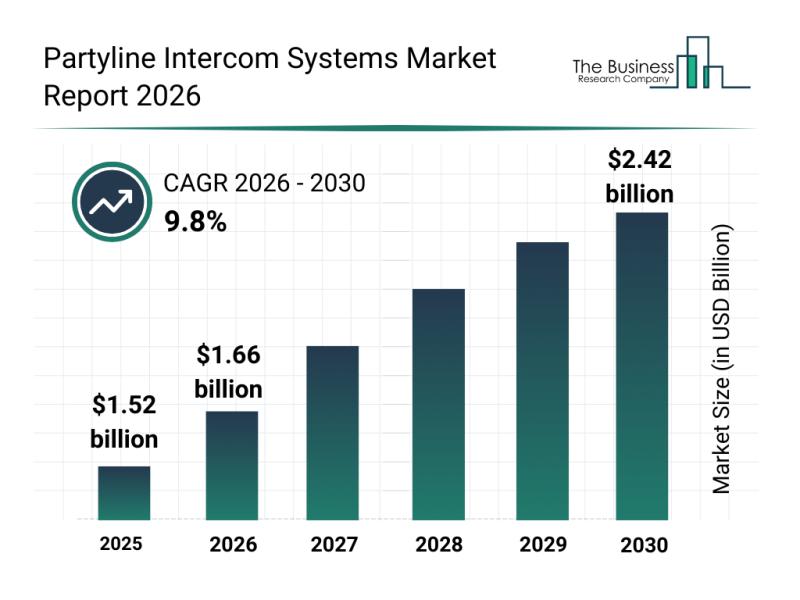

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for Brokerage

Prominent Mortgage Brokerage Services Market Trend for 2025: Technological Advan …

How Are the key drivers contributing to the expansion of the mortgage brokerage services market?

The increasing need for personalized financial guidance is likely to fuel the growth of the mortgage brokerage services market in the coming years. Personalized financial guidance involves creating financial strategies based on an individual's financial needs and goals. This demand is growing due to factors such as inflation, economic growth, interest rates, and technological progress. Mortgage…

Prediction market Kalshi launches brokerage integrations

Image: https://www.globalnewslines.com/uploads/2025/01/1738333447.jpg

New York, NY - Feb 3, 2025 - Kalshi, America's largest regulated prediction market, today announced the capability to integrate prediction markets with traditional financial brokerages.

The ability to integrate event contracts with brokerages significantly increases the number of Americans who will have access to prediction markets, signifying that further growth for the industry is imminent.

"A few years ago, prediction markets were a niche corner of the internet. We built…

Insurance Brokerage Market Size and Forecast

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- The global Insurance Brokerage Market is expected to record a CAGR of XX.X% from 2024 to 2031 In 2024, the market size is projected to reach a valuation of USD XX.X Billion. By 2031 the valuation is anticipated to reach USD XX.X Billion.

Insurance Brokerage Market Size and Scope

The insurance brokerage market is substantial and continues to expand, driven by the increasing demand for insurance solutions across various…

Online Financial Brokerage Market Next Big Thing | Major Giants- Financial Broke …

Advance Market Analytics published a new research publication on "Online Financial Brokerage Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Online Financial Brokerage market was mainly driven by the increasing R&D spending across the world.

Some of the key players…

Online Financial Brokerage Market, Online Discount Brokerage Market: Ken Researc …

Financial Brokerage Market –during the recent trend the financial market across the Philippines is one of the most fortunate financial markets in the South-Asia region with the very few financial products recommended for trading at recent but will enhance during a few years. In addition, the Trading activities across the Philippines region is exceedingly delimited owing to very low trading capacity and reasonably fewer trading accounts, most of the brokerage…

Cloud Services Brokerage Market Report 2018: Segmentation by Service Type (Catal …

Global Cloud Services Brokerage market research report provides company profile for Accenture (Ireland), DoubleHorn (US), Jamcracker (US), IBM (US), HPE (US), RightScale (US), Dell (US), Wipro (India), Arrow Electronics (US), ActivePlatform (Belarus), Cloudmore (Sweden) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate,…