Press release

Emerging Trends to Drive Payments Market Growth at 9.5% CAGR Through 2029

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Payments Market Size Growth Forecast: What to Expect by 2025?

In recent years, the payment market has witnessed significant growth. Projected to expand from $724.52 billion in 2024 to $788.06 billion in 2025, it is expected to have a Compound Annual Growth Rate (CAGR) of 8.8%. The increase in the past period is credited to factors such as e-commerce expansion, globalization and transactions across borders, digital transformation in financial services, ease and speed for consumers, as well as regulatory modifications and compliance.

How Will the Payments Market Size Evolve and Grow by 2029?

The sector of payments is predicted to experience significant expansion in the foroming years, with an estimated growth to $1131.49 billion in 2029, marking a compound annual growth rate (CAGR) of 9.5%. This expected upswing in the prediction span can be credited to the increasing embracement of contactless and mobile payments, the emergence of digital currencies and cs, efforts towards financial inclusion, the rise of open banking and APIs, as well as cybersecurity and fraud prevention. Notable upcoming trends within this predictive frame include, buy now, pay later services, international and cross-border payments, the integration of open banking and api, subscription-driven payment models, regulatory interventions, and compliance.

View the full report here:

https://www.thebusinessresearchcompany.com/report/payments-global-market-report

What Drivers Are Propelling the Growth of Payments Market Forward?

The boom in contactless payments is projected to spur the expansion of the payments market in the future. Transactions made with a debit or credit card, smartphone, or any wearable device that only necessitates a tap or wave near a payment terminal are referred to as contactless payments. Factors such as ease of use, higher spending limits, health benefits, universal acceptance, advancements in technology, and improved security are contributing to the increase in their usage. Contactless payments simplify transactions in the payments sector by allowing quick, secure purchases with a single tap, enhancing convenience and reducing the dependence on cash. For instance, UK Finance, a trade association of the United Kingdom, reported in July 2024 that the UK witnessed 18.3 billion contactless payments in 2023, a rise of seven percent from 17.0 billion in 2022. Thus, the surge in contactless payments is fueling the growth of the payments market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=107&type=smp

What Are the Key Trends Driving Payments Market Growth?

One key trend gaining traction in the payments market is the incorporation of biometric authentication technology in payment methods. Biometric authentication combines accuracy, efficiency, and security in a unique payment method. This includes identification methods such as fingerprint scanning, face recognition, iris detection, pulse monitoring, and vein mapping. For instance, in January 2022, Apple Inc., a US-based payments company, launched an iOS 15.4 beta periocular biometrics that enables Face ID to function with a mask and without the need for an Apple Watch for biometric verification.

What Are the Key Segments in the Payments Market?

The paymentsmarket covered in this report is segmented -

1) By Type: Credit Transfer, Direct Debit, Check Payment, Cash Deposit

2) By Application: Banks, Non-Banking Financial Institutions, Other Applications

3) By End-user Industry: Retail, Banking and Financial Service, Telecommunication, Government, Transportation, Other End Users

Subsegments:

1) By Credit Transfer: Electronic Funds Transfer (EFT), Wire Transfers, Online Bank Transfers

2) By Direct Debit: Recurring Payments, One-Time Payments

3) By Check Payment: Personal Checks, Business Checks, Certified Checks

4) By Cash Deposit: Over-the-Counter Cash Deposits, ATM Cash Deposits

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=107&type=smp

Who Are the Key Players Shaping the Payments Market's Competitive Landscape?

Major companies operating in the payments market include Amazon Payments Inc., Apple Inc., Google Pay Inc., Samsung Electronics Co. Ltd., Industrial and Commercial Bank of China Limited, Alipay Co. Ltd., JPMorgan Chase & Co., Bank of America, National Merchants Association, Citibank, Wells Fargo and Company, American Express Company, Capital One Financial Corporation, Visa Inc., PayPal Holdings Inc., Flagship Merchant Services, Mastercard Inc., Fiserv Inc., Square Inc., Fidelity National Information Services Inc., Stripe Inc., Global Payments Inc., Payline Data Services LLC, Worldline SA, Adyen N.V., ACI Worldwide Inc., X-Payments, First Data Corporation, Bitpay Inc., Braintree Technology solutions LLC, GoCardless Ltd.

What Geographic Markets Are Powering Growth in the Payments Market?

Asia-Pacific was the largest region in the payments market in 2024. Western Europe was the second largest region in the global payments market share. The regions covered in the payments market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=107

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Speak With Our Expert:

Saumya Sahay

Europe - +44 7882 955267,

Asia: +91 88972 63534,

Americas - +1 310-496-7795 or

Email:saumyas@tbrc.info

Follow Us On:

• LinkedIn: https://in.linkedin.com/company/the-business-research-company

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Emerging Trends to Drive Payments Market Growth at 9.5% CAGR Through 2029 here

News-ID: 4193257 • Views: …

More Releases from The Business Research Company

Trends in Growth, Segment Analysis, and Competitive Strategies Influencing the M …

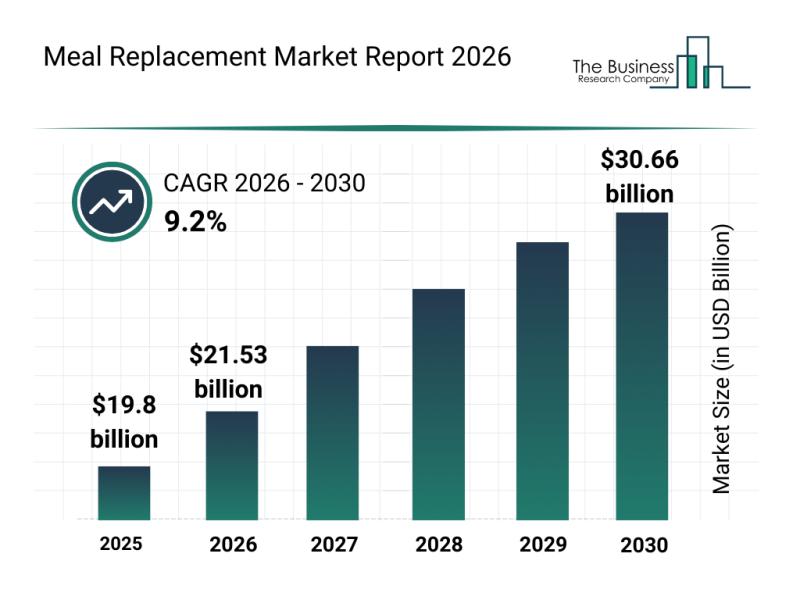

The meal replacement market is gaining significant momentum as consumer preferences shift toward convenient and health-focused nutrition solutions. With rising awareness about preventive healthcare and personalized diets, this sector is set for considerable expansion. Let's explore how the market size is expected to evolve, who the key players are, emerging trends, and the main segments driving this growth.

Projected Growth Trajectory of the Meal Replacement Market Size

The meal replacement…

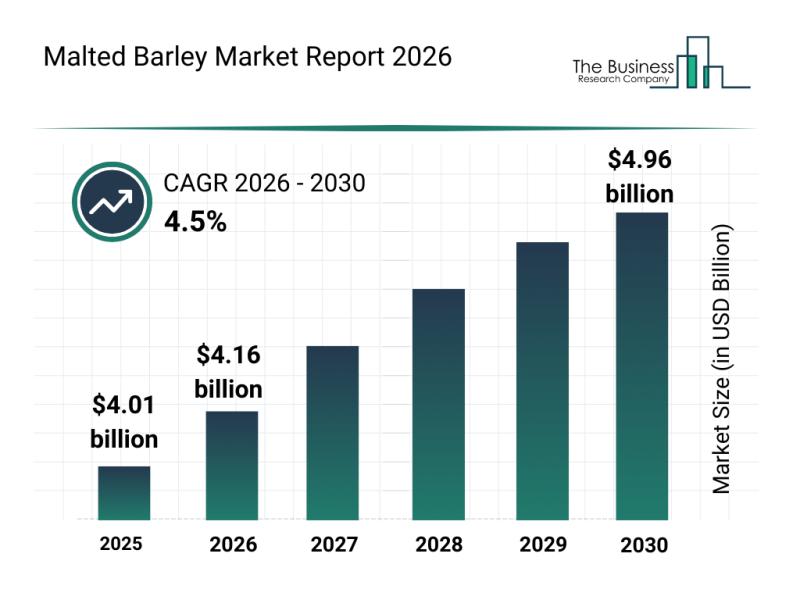

Leading Companies Reinforcing Their Presence in the Malted Barley Market

The malted barley industry is positioned for steady expansion as demand grows across various sectors. With increasing interest from craft brewers and functional food producers, this market is set to experience meaningful growth driven by innovation and sustainability efforts. Let's dive into the current market size, key players shaping the industry, trends influencing its trajectory, and detailed segment insights.

Projected Market Size and Growth Outlook of the Malted Barley Market …

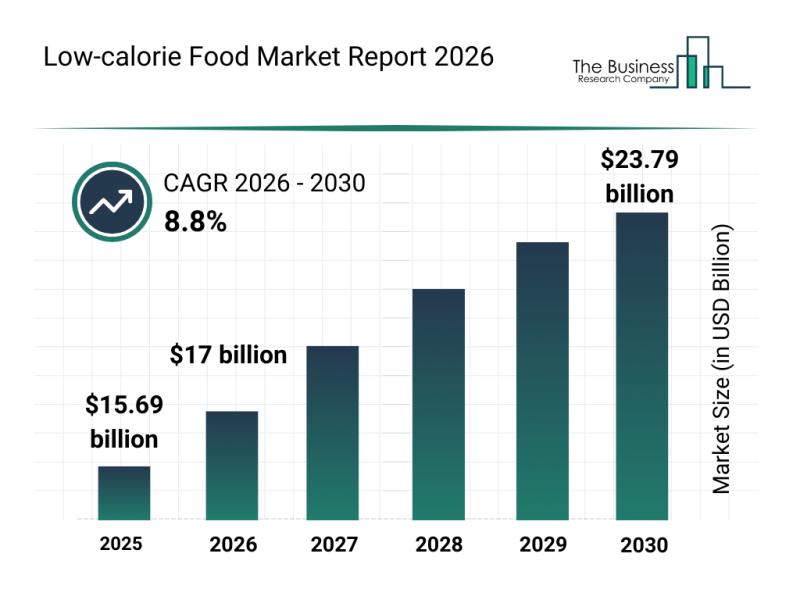

Future Perspective: Key Trends Shaping the Low-calorie Food Market up to 2030

The low-calorie food market is poised for significant expansion as consumer preferences shift toward healthier eating habits and more personalized nutrition options. Advances in product innovation and supportive regulatory frameworks are expected to drive rapid growth over the coming years. Here's an overview of the market size, key players, emerging trends, and segmentation shaping this evolving industry.

Projected Expansion of the Low-calorie Food Market Size Through 2030

The low-calorie food…

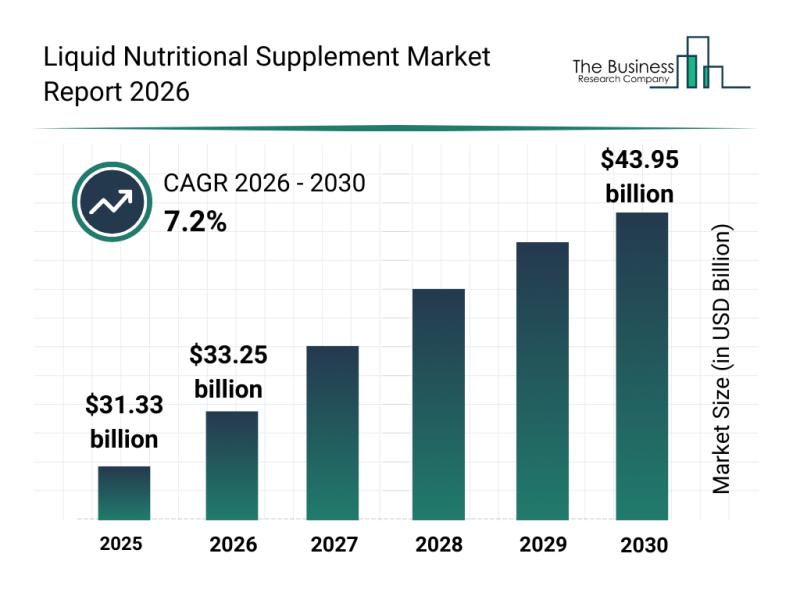

Competitive Landscape: Leading Companies and New Entrants in the Liquid Nutritio …

The liquid nutritional supplement sector is on the rise, driven by evolving consumer preferences and innovations in health and wellness. With growing awareness about personalized nutrition and preventive healthcare, this market is set to witness substantial growth over the coming years. Let's explore the market's projected size, major players, emerging trends, and key segments shaping this dynamic industry.

Projected Market Value and Growth Trajectory of the Liquid Nutritional Supplement Market …

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…