Press release

Commercial Bank Market Size Worth US$ 8,920.35 Billion by 2034 at a CAGR of 11.2% | Fact.MR

The global commercial bank market is estimated to generate revenue worth US$ 3,093.42 billion in 2024 and has been thoroughly analyzed to expand at a remarkable CAGR of 11.2% to touch a value of US$ 8,920.35 billion by the end of 2034.The continuous digital revolution in banking is completely changing how businesses and consumers are using financial services. By implementing advanced digital technologies, such as online and mobile banking, commercial banks are improving accessibility and convenience, satisfying the demands of tech-savvy consumers looking for quick and adaptable financial answers. With 24/7 access and simplified services, this change not only lowers operational costs by automating procedures and reducing reliance on physical branches, but it also improves client satisfaction. Strengthening digital infrastructure and integrating fintech solutions are allowing banks to serve a larger customer base, fueling growth in a highly competitive industry.

Market Overview

The commercial bank market includes diverse services such as commercial and industrial mortgages, other business loans, residential mortgages, home equity and vehicle loans, government loans, and other financial products. Demand is driven by rising corporate investment, consumer credit requirements, and a growing interest in wealth management and sustainable financing solutions. Regulatory reforms ensuring risk management and capital adequacy further strengthen confidence, attracting both corporate and individual clients.

Key Trends and Drivers

Digital banking has become a central growth driver, with banks offering mobile apps, online platforms, and AI-driven advisory services. These tools enhance efficiency, reduce operational costs, and improve the customer experience.

Commercial banks are increasingly targeting small and medium-sized enterprises (SMEs), providing essential services like business accounts, credit facilities, and investment support during growth phases. Additionally, rising consumer wealth and demand for asset management, retirement planning, and financial advisory services are broadening revenue streams.

Another notable trend is the launch of green finance initiatives. Loans for renewable energy projects and eco-friendly corporate programs are gaining traction as both regulators and customers prioritize sustainability. These offerings not only meet compliance requirements but also cater to socially conscious investors.

Recent Developments

Key players like Bank of America, JPMorgan Chase, Citigroup, HSBC, and Deutsche Bank are expanding digital capabilities, leveraging AI-driven platforms to enhance customer engagement and streamline operations. Several banks are forming strategic alliances with fintech firms to offer faster, more personalized services while staying competitive against digital-only neobanks.

In the U.S., banks are focusing on AI-based customer service, mobile banking innovations, and improved digital infrastructure to attract younger, tech-savvy clients. In South Korea, the emphasis is on wealth management and personalized investment services, reflecting rising demand for tailored financial solutions.

Full Market Report available for delivery. For purchase or customization, please request here - https://www.factmr.com/connectus/sample?flag=S&rep_id=10486

Regional Insights

North America: Leads in market share due to strong digital adoption and regulatory stability.

Europe: Driven by regulatory compliance and sustainable finance initiatives.

Asia-Pacific: Growing rapidly due to increasing consumer credit demand, urbanization, and SME financing needs.

Middle East & Africa: Gradual adoption fueled by infrastructure investments and business expansion.

Product and Service Segmentation

Commercial & Industrial Mortgages: High demand from capital-intensive businesses investing in real estate and facilities. Projected to grow significantly through 2034.

Other Business Loans: Supports corporate expansion, working capital needs, and operational investments.

Residential Mortgages: Growth driven by low interest rates and government incentives for first-time buyers.

Home Equity & Vehicle Loans: Expanding as consumer confidence and disposable income increase.

Government Loans and Others: Targeted financing to support public sector projects and specialized sectors.

Browse Full Report: https://www.factmr.com/report/commercial-bank-market

Competitive Landscape

The market is highly competitive with established global banks and emerging digital-only neobanks challenging traditional models. Collaboration with fintech, adoption of AI, and innovative product offerings are critical for maintaining market share and profitability. Key players are focusing on expanding digital channels, enhancing operational efficiency, and delivering personalized banking experiences to meet evolving customer expectations.

Conclusion

The commercial bank market is poised for strong growth over the next decade, fueled by digital transformation, increasing demand for financial services, and the adoption of sustainable finance initiatives. Banks that effectively integrate technology, regulatory compliance, and customer-centric services will capture market opportunities and ensure long-term competitiveness in the evolving financial landscape.

Check out More Related Studies Published by Fact.MR:

Wireline Logging Services Market

https://www.factmr.com/report/4131/wireline-logging-services-market

Trailer Refrigeration Unit Market

https://www.factmr.com/report/4132/trailer-refrigeration-unit-market

Liquefied Natural Gas (LNG) Vaporizers Market

https://www.factmr.com/report/4158/lng-vaporizers-market

Dioxin Analyzer Market

https://www.factmr.com/report/4159/dioxin-analyzer-market

Contact:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: sales@factmr.com

About Fact.MR

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client's satisfaction.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Commercial Bank Market Size Worth US$ 8,920.35 Billion by 2034 at a CAGR of 11.2% | Fact.MR here

News-ID: 4193048 • Views: …

More Releases from Fact.MR

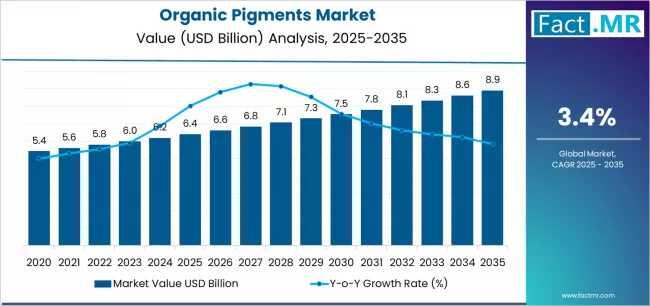

Organic Pigments Market Transformation Report 2036: Innovation Trends, Sustainab …

The global Organic Pigments Market is poised for robust transformation through 2036, driven by expanding industrial demand, heightened sustainability imperatives, and rapid innovation in colorant technologies. The market is forecast to expand significantly as manufacturers, formulators, and end-users pursue environmentally compliant, high-performance pigmentation solutions across coatings, plastics, and inks applications.

Market Growth Trajectory & Key Metrics

The organic pigments industry is currently valued in the billions and is projected to maintain a…

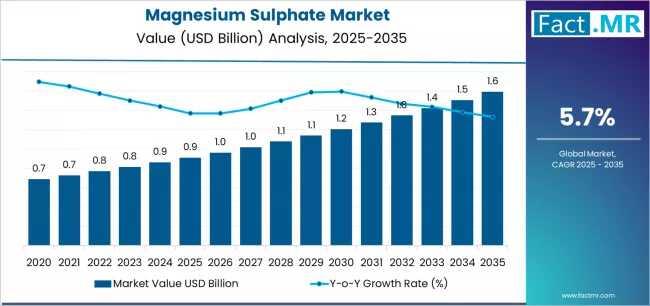

Magnesium Sulphate Market Valuation, ROI Potential & Long-Term Growth Prospects …

The global Magnesium Sulphate Market is poised for robust expansion over the next decade, reflecting sustained demand across agriculture, pharmaceuticals, industrial processes, and emerging end-use applications. The market is expected to grow from an estimated USD 0.91 billion in 2025 to USD 1.59 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

This growth translates to roughly USD 0.68 billion in incremental revenue by…

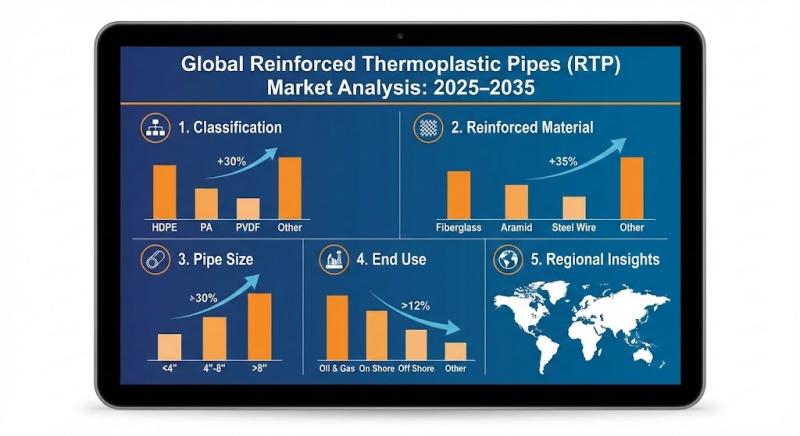

Global Reinforced Thermoplastic Pipes Market Dynamics 2026-2036: Risk Assessment …

The global Reinforced Thermoplastic Pipes (RTP) market is poised for sustained growth through 2036, driven by rising demand for corrosion‐resistant, lightweight pipeline solutions across oil & gas, water management, and industrial infrastructure. The market is projected to grow from an estimated USD 385.6 million in 2025 to USD 610.4 million by 2035, achieving a CAGR of 4.7 % over the forecast period.

Market Drivers & Growth Trajectory

The demand for RTPs is…

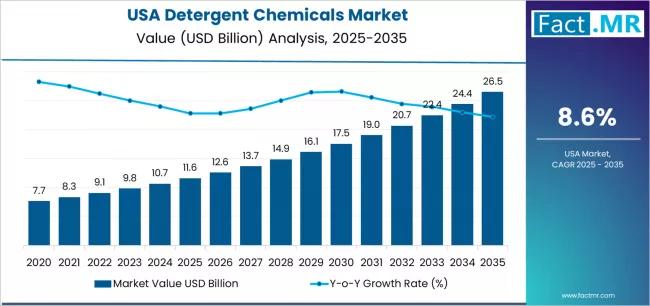

2036 USA Detergent Chemicals Industry Intelligence Report: Technology Shifts, De …

The demand for detergent chemicals in the United States continues to grow steadily, supported by rising hygiene awareness, expansion of household and industrial cleaning activities, and continuous innovation in formulation technologies. Detergent chemicals form the backbone of laundry detergents, dishwashing products, industrial cleaners, and institutional hygiene solutions, making them essential across residential, commercial, and industrial sectors.

In the U.S., strong consumer focus on cleanliness, coupled with stringent hygiene standards in healthcare,…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…