Press release

Personal Loans Market on Track for Strong Growth, Estimated to Grow at 10.7% CAGR Through 2029

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Is the Expected CAGR for the Personal Loans Market Through 2025?

The personal loans industry has seen robust growth in recent years. The market size is projected to increase from $778.34 billion in 2024 to $854.94 billion in 2025, with a compound annual growth rate (CAGR) of 9.8%. Factors attributed to this historic growth include economic stability, lower interest rates, increased consumer confidence, debt consolidation patterns, and promotions and advertising strategies.

What's the Projected Size of the Global Personal Loans Market by 2029?

In the following years, the personal loans market's size is projected to experience a swift expansion. The market is anticipated to reach $1283.78 billion in 2029, with a compound annual growth rate (CAGR) of 10.7%. The growth within this predicted period can be credited to several factors such as the burgeoning fintech lenders, increasing education costs, borrowing due to pandemic recovery, attention on financial inclusion, and the growth of gig economy and self-employment. Some key trends during this forecast period encompass the digitalization of lending, usage of alternate data for credit scoring, tailored loan products, P2P lending amplification, and initiatives for financial inclusion.

View the full report here:

https://www.thebusinessresearchcompany.com/report/personal-loans-global-market-report

Top Growth Drivers in the Personal Loans Industry: What's Accelerating the Market?

The surge in desire for numerous loan-offering options is anticipated to propel the expansion of the personal loans market. This surge signifies a heightened demand and necessity for various conduits that people and businesses can use to secure credit or loans. The emergence and success of digital lending platforms and fintech firms have led to a heightened desire for personal loan conduits. Personal loans enable individuals to acquire funds for a range of personal requirements without having to give collateral in return. These loans help finance various expenditures, consolidate debt, or deal with unplanned monetary emergencies. Consequently, the expanded desire for lending channels is playing a significant role in the development of the personal loans market. Case in point, TransUnion, an information technology company based in the US, disclosed in their newly issued Q2 2022 Credit Industry Insights Report (CIIR) in August 2022, that total personal loan balances had reached a groundbreaking $192 billion in Q2 2022, escalating by 31% from the prior year. As a result, the personal loan market will experience growth due to the escalating demand for lending channels.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=10789&type=smp

Which Emerging Trends Are Transforming the Personal Loans Market in 2025?

Leading businesses in the personal loans market frequently leverage advancements in technology to maintain their competitive edge through the adoption of novel technologies. Amplifi Capital, a fintech firm situated in the UK, demonstrated this trend when they introduced the Reevo Money brand, specialized in personal loans, in September 2022. This brand provides on-the-spot loan quotes and preferential APRs compared to conventional lenders, using a combination of open banking and cloud-based infrastructure to cater to customers with unstable income or subpar credit history. Reevo Money, by employing intangible assets like cloud systems and open banking, seeks to extend their loan services not only to customers with poor credit or inconsistent income but also to first-time borrowers or those who don't match the usual criteria.

What Are the Main Segments in the Personal Loans Market?

The personal loansmarket covered in this report is segmented -

1) By Type: P2P Marketplace Lending, Balance Sheet Lending

2) By Loan Tenure: Long Term Loans, Medium Term Loans, Short Term Loans

3) By Tenure Period: Less Than 2 Years, 2 Years To 4 Years, More Than 4 Years

4) By Application: Debt Consolidation, Home Improvement, Education, Other Applications

5) By End User: Employed Individuals, Professionals, Students, Entrepreneur, Other End Users

Subsegments:

1) By P2P Marketplace Lending: Consumer Loans, Business Loans, Debt Consolidation Loans, Student Loans

2) By Balance Sheet Lending: Secured Personal Loans, Unsecured Personal Loans, Line of Credit, Home Equity Loans

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=10789&type=smp

Which Top Companies are Driving Growth in the Personal Loans Market?

Major companies operating in the personal loans market include Wells Fargo & Company, Marcus by Goldman Sachs, The Goldman Sachs Group Inc., Barclays PLC, Truist Financial Corporation, DBS Bank Ltd, Discover Financial Services, Citizens Financial Group Inc., Navy Federal Credit Union, Rocket Loans, OneMain Financial, SoFi Technologies Inc., PenFed Credit Union, Social Finance Inc., LendingClub Bank, Freedom Financial Network LLC, Upstart, Payoff Inc., LendingPoint, Best Egg, FreedomPlus, Earnest, Laurel Road, Avant LLC, Prosper Funding LLC, LightStream, Upgrade, Universal Credit, United Services Automobile Association, PNC Financial Services Group Inc, Toronto-Dominion Bank

Which Regions Will Dominate the Personal Loans Market Through 2029?

North America was the largest region in the personal loans market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global personal loans market size forecast period. The regions covered in the personal loans market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=10789

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

"

#Reach Out to Us#

Speak With Our Expert:

Saumya Sahay

Americas +1 310-496-7795

Asia +44 7882 955267 & +91 8897263534

Europe +44 7882 955267

Email: saumyas@tbrc.info

The Business Research Company - www.thebusinessresearchcompany.com

Follow Us On:

• LinkedIn: https://in.linkedin.com/company/the-business-research-company

Learn More About The Business Research Company

The Business Research Company provides in-depth research and insights through a vast collection of 15,000+ reports spanning 27 industries and over 60 geographies. Backed by 1,500,000 datasets, extensive secondary research, and expert insights from industry leaders, we equip you with the knowledge needed to stay ahead in the market.

Our flagship offering, the Global Market Model, is a leading market intelligence platform that delivers comprehensive and up-to-date forecasts to support strategic decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Personal Loans Market on Track for Strong Growth, Estimated to Grow at 10.7% CAGR Through 2029 here

News-ID: 4192285 • Views: …

More Releases from The Business Research Company

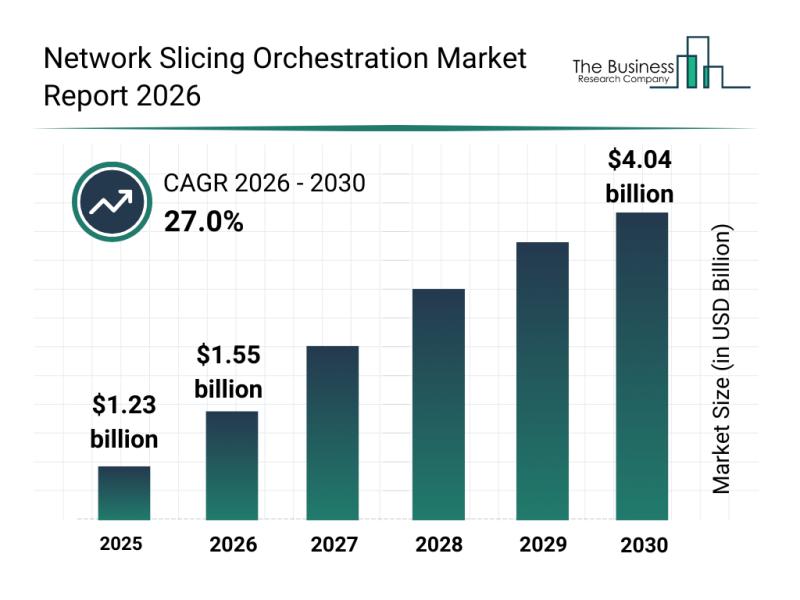

Global Trends Overview: The Rapid Development of the Network Slicing Orchestrati …

The network slicing orchestration market is positioned for remarkable expansion over the coming years, driven by rapid advancements in telecommunications and evolving enterprise demands. As technologies like 5G and edge computing become more widespread, the market is set to transform how networks are managed and optimized, enabling more flexible and efficient connectivity solutions.

Projected Market Size and Growth Trajectory for Network Slicing Orchestration

The network slicing orchestration market is anticipated…

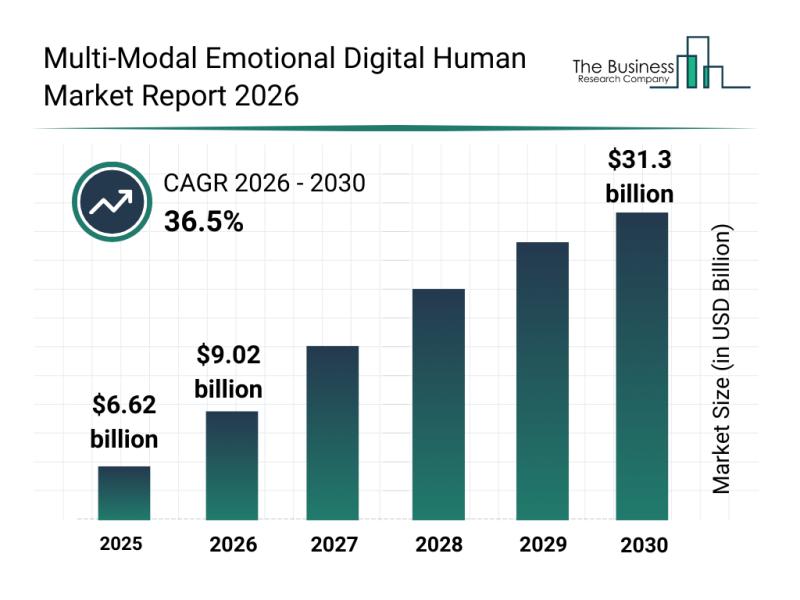

Segmentation, Major Trends, and Competitive Overview of the Multi-Modal Emotiona …

The multi-modal emotional digital human market is poised for remarkable expansion, transforming how digital entities interact with human emotions across various sectors. This emerging field combines advanced AI technologies and emotional intelligence to create digital humans capable of nuanced, empathetic interactions. Let's explore the market's growth outlook, key players, technological trends, and segment classifications shaping this evolving industry.

Projected Growth and Market Value of the Multi-Modal Emotional Digital Human Market …

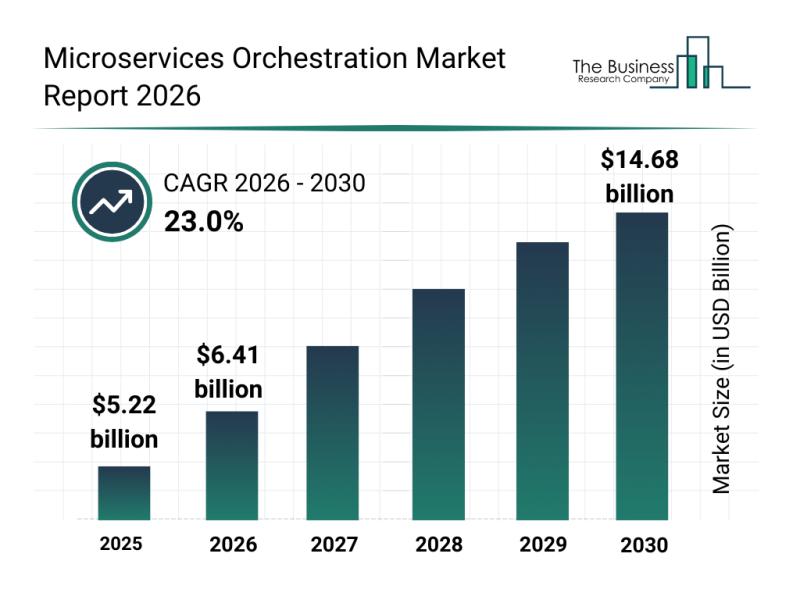

Market Trend Insights: The Impact of Recent Advances on the Microservices Orches …

The microservices orchestration market is rapidly gaining traction as organizations increasingly adopt cloud-native architectures to enhance agility and scalability. With the growing complexity of distributed systems, the need for efficient orchestration solutions that streamline service coordination and management has become critical. Let's explore the market's size, key players, emerging trends, and significant segments shaping its future.

Expected Growth and Market Size for Microservices Orchestration

The microservices orchestration market is projected…

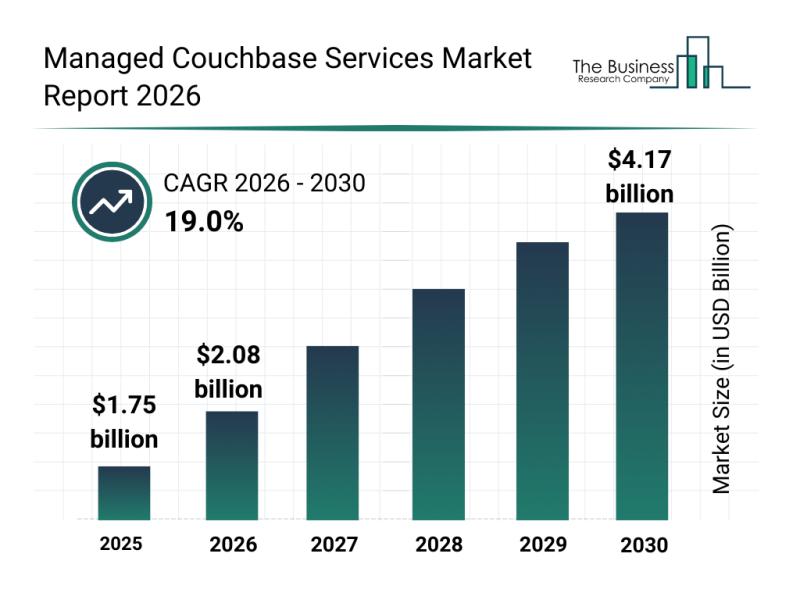

Analysis of Key Market Segments Influencing the Managed Couchbase Services Marke …

The managed couchbase services market is set for substantial expansion in the coming years as businesses increasingly turn to cloud-native solutions for their database needs. With a growing focus on scalability, performance, and security, this sector is becoming a critical component for enterprises managing complex data workloads. Let's explore the market's value projections, key players, emerging trends, and the main segments driving growth.

Anticipated Market Growth and Value of Managed Couchbase…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…