Press release

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article on Loan Modifications

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.In the article, the New Jersey loan modification lawyer explores various scenarios that may lead homeowners to consider altering their loan terms. These include significant life changes like illness, income loss, or other personal hardships. Straffi emphasizes the importance of seeking professional legal counsel to navigate these challenging situations. "Understanding your legal options and the process of loan modification is crucial in securing your financial stability and retaining your home," Straffi advises.

New Jersey loan modification lawyer Daniel Straffi further explains the technical aspects of loan modifications, such as interest rate reductions, extensions of repayment periods, and switches from adjustable-rate to fixed-rate mortgages. These adjustments can significantly impact a borrower's ability to manage payments and avoid default. "Our goal is to provide a pathway to financial relief and stability through strategic loan modifications," states Straffi.

The article by the New Jersey loan modification lawyer also highlights the role of federal government assistance programs and how they can aid eligible borrowers. It is pointed out that proactive measures, including consulting with a knowledgeable lawyer, can prevent the severe consequences of loan defaults such as poor credit scores, increased future loan costs, and potential legal actions.

Homeowners are encouraged to educate themselves on their rights and available strategies to manage or restructure their debt. As Straffi notes, "Each financial situation is unique, and personalized legal guidance is essential in determining the most beneficial course of action for loan modifications."

This comprehensive article not only equips New Jersey residents with essential knowledge but also reassures them of the possibility of regaining control over their financial health and protecting their homes from foreclosure.

About Straffi & Straffi Attorneys at Law:

Straffi & Straffi Attorneys at Law is a family-owned law firm based in Toms River, New Jersey, dedicated to assisting clients with a variety of legal issues including bankruptcy, debt restructuring, and loan modifications. With a compassionate approach and a deep understanding of the law, the firm strives to deliver personalized and effective solutions to those facing financial difficulties.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=QBwdJBCYEO0

GMB: https://www.google.com/maps?cid=18340758732161592314

Email and website

Email: familyclient@straffilaw.com

Website: https://www.straffilaw.com/

Media Contact

Company Name: Straffi & Straffi Attorneys at Law

Contact Person: Daniel Straffi

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=new-jersey-loan-modification-lawyer-daniel-straffi-releases-insightful-article-on-loan-modifications]

Phone: (732) 341-3800

Address:670 Commons Way

City: Toms River

State: New Jersey 08755

Country: United States

Website: https://www.straffilaw.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article on Loan Modifications here

News-ID: 3553637 • Views: …

More Releases from ABNewswire

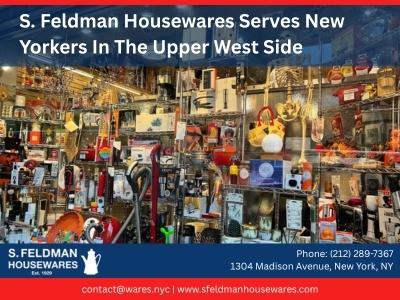

S. Feldman Housewares Serves New Yorkers In The Upper West Side With Kitchen Sup …

For 96 years, S. Feldman Housewares has been a trusted resource for Manhattan families seeking quality kitchen supplies, home goods, and hardware. Located at 1304 Madison Avenue, this fourth-generation, family-owned store serves customers throughout the city, including Upper West Side residents who appreciate shopping at a trusted hardware store Upper West Side families have relied on for nearly a century.

New York, NY - February 23, 2026 - S. Feldman Housewares…

Country Creek Animal Hospital Broadens Veterinarian Offerings Across Allen, TX, …

Country Creek Animal Hospital remains committed to providing dependable, locally focused care for pets and their owners throughout Allen and Plano. Through steady service growth and a focus on accessibility, Country Creek Animal Hospital continues to support community trust, reliable care standards, and meaningful relationships with the families it serves.

Introduction: Expanding Veterinarian Care in Allen, TX

Country Creek Animal Hospital continues to strengthen its role as a dependable veterinarian [https://www.countrycreekvets.com/#:~:text=The%20best-,veterinarian,-in%20Allen%2C%20TX] provider…

Country Creek Animal Hospital Strengthens Veterinarian Support in Allen, TX, Ext …

Country Creek Animal Hospital continues to support pet owners across Allen and Frisco by focusing on dependable care, consistent service coverage, and community-centered values. Through thoughtful growth and operational improvements, Country Creek Animal Hospital remains dedicated to providing reliable veterinary support that meets local needs while maintaining the trust of the families it serves.

Introduction: Expanding Vet Clinic Support in Allen, TX

Country Creek Animal Hospital continues to reinforce its role as…

Kids Dentist in Las Vegas and Centennial Offers Pain-Free, Needle-Free Laser Den …

Desert Kids Dental, led by pediatric dentist Dr. Sandra Thompson, is redefining the dental experience for children in Centennial and Las Vegas by offering advanced Solea Registered Laser dentistry, a modern technology designed to deliver truly pain-free and needle-free dental care. As a trusted Kids Dentist serving local families, Desert Kids Dental continues to focus on comfort, efficiency, and positive experiences for children of all ages.

For many children and parents…

More Releases for Straffi

New Jersey Bankruptcy Attorney Daniel Straffi, Jr. Explains Chapter 7 Income Lim …

TOMS RIVER, NJ - Individuals considering Chapter 7 bankruptcy in New Jersey must meet specific income requirements determined by the federal means test, which compares a six-month income average against state median income guidelines. New Jersey bankruptcy attorney Daniel Straffi, Jr. of Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/what-are-income-limits-chapter-7-bankruptcy/) explains how the income thresholds work, what counts as income in the calculation, and what options exist for those whose income…

New Jersey Bankruptcy Attorneys Straffi & Straffi Attorneys at Law Announce Guid …

Toms River, NJ - New Jersey bankruptcy attorneys at Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/how-long-after-filing-bankruptcy-can-you-buy-a-house-in-new-jersey/), led by attorney Daniel Straffi Jr., announce comprehensive guidance for residents seeking a path to homeownership after bankruptcy. The firm's new advisory explains practical timelines, loan options, and documentation standards for applicants rebuilding credit, providing clear steps for pursuing a mortgage in New Jersey following Chapter 7 or Chapter 13 proceedings.

The guidance details how…

New Jersey Emergency Bankruptcy Attorney Daniel Straffi Provides Clarity on Emer …

Understanding how to protect assets during a financial crisis is critical, particularly when swift legal action is required. New Jersey emergency bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-an-emergency-bankruptcy-filing-in-new-jersey/) explains how an emergency bankruptcy filing can provide immediate relief for those facing foreclosure, wage garnishment, or other urgent creditor actions. In a recent article published by Straffi & Straffi Attorneys at Law, Daniel Straffi outlines the essential steps and key considerations involved in…

Straffi & Straffi Attorneys at Law Publishes New Article on No Asset Bankruptcy …

New Jersey Chapter 7 bankruptcy lawyer Daniel Straffi of Straffi & Straffi Attorneys at Law has published an article discussing the concept and implications of a no asset bankruptcy New Jersey [https://www.straffilaw.com/new-jersey-chapter-7-bankruptcy-lawyer/no-asset/]. This type of bankruptcy is commonly filed by individuals who have little to no nonexempt assets available for creditors. As explained by Straffi, a no asset bankruptcy can be an effective path toward financial relief for those who…

New Jersey Bankruptcy Attorney Daniel Straffi Discusses Medical Debt Relief Thro …

Medical debt continues to be a leading cause of financial distress for many Americans, and New Jersey residents are no exception. In a detailed article titled "Can My Medical Debt Be Paid Off With Bankruptcy?", New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/can-my-medical-debt-be-paid-off-with-bankruptcy/) explains how individuals burdened with overwhelming healthcare expenses may find relief through the bankruptcy process. The article, published by Straffi & Straffi Attorneys at Law, provides a comprehensive…

New Jersey Bankruptcy Attorney Daniel Straffi Explains Debt Restructuring Soluti …

New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-debt-restructuring-in-new-jersey/) offers important insights into how individuals and businesses can regain control of their finances through debt restructuring. In a recent article titled "What is Debt Restructuring in New Jersey?", Straffi addresses the growing financial strain many face due to job loss, unexpected expenses, or business challenges, and outlines the available options for restructuring debt to avoid default. Straffi & Straffi Attorneys at Law…