Press release

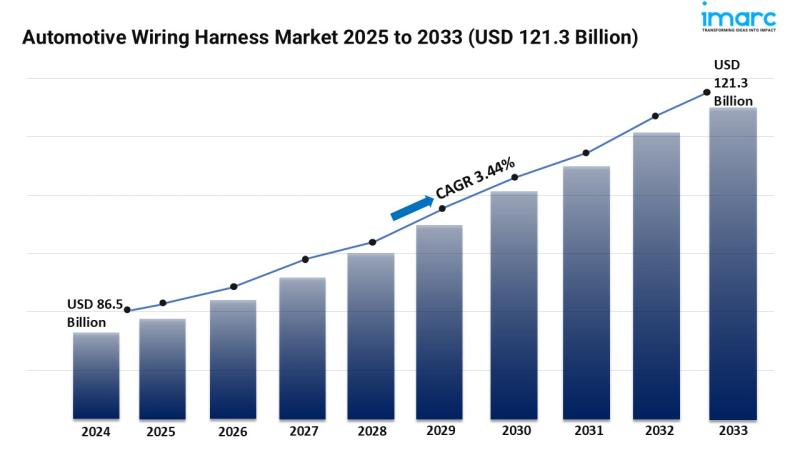

Automotive Wiring Harness Market Size Worth USD 121.3 Billion Globally by 2033 at a CAGR of 3.44%

Market Overview:The automotive wiring harness market is experiencing rapid growth, driven by Electrification and E/E Architecture Adoption, Increasing Electronic Content and ADAS Integration and Supplier Consolidation and Localization. According to IMARC Group's latest research publication, "Automotive Wiring Harness Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global automotive wiring harness market size was valued at USD 86.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 121.3 Billion by 2033, exhibiting a CAGR of 3.44% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report https://www.imarcgroup.com/automotive-wiring-harness-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends And Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors in the Automotive Wiring Harness Industry:

● Electrification and E/E Architecture Adoption

Electrification and new electrical/electronic architectures are pushing harness demand higher as vehicles add high-voltage wiring, battery-management connectors and greater sensor networks. Modern electrified powertrains introduce dozens of high-voltage runs and modular battery interconnects, meaning harness assemblies can contribute a notable share of vehicle electrical cost and weight - often representing a low-double-digit percentage of the electrical system bill of materials on a typical vehicle. National EV incentive programs and fleet purchase targets have also prompted OEMs to accelerate platform rollouts, which increases engineering work and volume for Tier 1 harness suppliers. Major suppliers report substantial order pipelines for high-voltage and shielded harnesses, and production lines are being retooled to produce longer, more complex assemblies per vehicle, lifting per-vehicle harness content and total industry unit volumes.

● Increasing Electronic Content and ADAS Integration

Advanced driver assistance systems, infotainment, and connectivity suites require a denser network of sensors, cameras, radar, ECUs and high-speed data lines, driving demand for specialized harnesses and shielded cabling. A mid-size passenger car can have dozens of camera and sensor connections plus multiple domain controllers, which multiplies the number of connectors, branching points and shielding requirements in the harness. OEMs' feature differentiation - from surround-view cameras to multi-zone climate controls - raises harness complexity and increases average harness part counts and connector types per vehicle. This trend also creates recurring aftermarket and warranty-related service opportunities for harness suppliers, since more connectors and data links mean greater maintenance and diagnostic needs over the vehicle lifecycle.

● Supplier Consolidation and Localization

Tier 1 and Tier 2 suppliers are consolidating capabilities and investing in automated assembly, laser welding, and modular plug-and-play systems to meet OEM demands for higher quality and shorter lead times. Suppliers are expanding local manufacturing footprints in major vehicle-producing regions, often spurred by government localisation incentives and procurement rules that reward domestic sourcing. Automation reduces labor variability on long, complex harness builds and enables higher first-pass yields, bringing down per-unit rework costs while allowing suppliers to scale output faster. Contract wins and capacity expansions announced by leading harness manufacturers reflect growing order books, and investment in inline testing and traceability increases throughput, helping suppliers convert larger OEM programs into reliable volume production.

Key Trends in the Automotive Wiring Harness Market

● Modular, Pre-tested Harness Solutions for Faster Assembly

OEMs increasingly request modular harness assemblies that arrive pre-tested and ready to plug into vehicle sub-assemblies, shortening final-line work and improving quality. Instead of long, vehicle-specific looms, suppliers deliver zone-based modules - for example, front module, cockpit module, rear module - each pre-validated to reduce line integration time. This trend is visible in factory layouts that move toward pre-assembly stations and just-in-sequence deliveries, and it reduces routing errors and assembly cycle time. Modular harness approaches also simplify repairs and upgrades, because individual modules can be swapped rather than replacing an entire loom. Suppliers that offer validated modular kits and digital traceability tools are winning larger OEM contracts and achieving lower warranty return rates on electrical issues.

● Rise of Lightweight Materials and High-Voltage Insulation Innovation

To meet vehicle weight and efficiency targets, harness makers are adopting lighter conductor designs, thinner insulation, and advanced high-voltage cable constructions that maintain safety while reducing mass. Use of aluminum conductors in select runs, advanced polymer insulations, and optimized conductor cross-sections lower harness weight without compromising electrical performance. For high-voltage battery interconnects, improved insulation systems and compact connector designs enable safer routing and reduced space usage. These material shifts reduce vehicle curb weight and can improve range in electrified vehicles, making harness design a measurable contributor to vehicle-level performance targets and offering OEMs another lever to optimize vehicle energy efficiency.

● Integration of Diagnostics, Over-The-Air Readiness and Smart Connectors

Harnesses are no longer passive bundles; they increasingly include smart connectors and embedded diagnostics to support over-the-air updates, domain controller swaps, and on-board fault isolation. Connectors with integrated sensing or encryption-compatible pins help ensure secure software and ECU updates, while built-in circuit monitoring allows rapid fault localization during service. This trend reduces diagnostic time at dealerships and supports remote troubleshooting workflows, improving uptime for fleet customers. Harness suppliers are embedding traceability features - serialized connectors and onboard test points - enabling faster root-cause analysis and making electrical systems more serviceable at scale, which is particularly valuable for connected fleets and shared mobility operators.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=2158&flag=E

Leading Companies Operating in the Global Automotive Wiring Harness Industry:

● Aptiv PLC

● Fujikura Ltd.

● Furukawa Electric Co., Ltd.

● Gebauer & Griller

● Lear Corporation

● Leoni AG

● Samvardhana Motherson International Ltd

● Spark Minda

● Sumitomo Electric Industries, Ltd.

● THB Group

● Yazaki Corporation

Automotive Wiring Harness Market Report Segmentation:

Analysis by Application:

● Body Wiring Harness

● Engine Wiring Harness

● Chassis Wiring Harness

● HVAC Wiring Harness

● Sensors Wiring Harness

● Others

Chassis wiring harnesses dominate (34.9% share) due to critical role in powering ABS, suspension, and steering systems, amplified by lightweight material adoption for fuel efficiency.

Analysis by Material Type:

● Copper

● Aluminum

● Others

Copper leads (86.2% share) for superior conductivity and recyclability, driven by EV demand for high-voltage systems and sustainability mandates.

Analysis by Transmission Type:

● Data Transmission

● Electrical Wiring

Electrical wiring holds 81.5% share as backbone for EVs and ADAS, supporting high-voltage power needs and smart connectivity integration.

Analysis by Vehicle Type:

● Two Wheelers

● Passenger Cars

● Commercial Vehicles

Passenger cars lead (52.2% share) via high production volumes, tech integration (ADAS, infotainment), and EV transition requiring complex harness architectures.

Analysis by Category:

General Wires

Heat Resistant Wires

Shielded Wires

Tubed Wires

General wires lead (40% share) for versatility in lighting/ignition systems, cost efficiency, and insulation advancements enhancing durability.

Analysis by Component:

● Connectors

● Wires

● Terminals

● Others

Wires dominate (42.2% share) as foundational elements for power/signal transmission, with innovations in aluminum alloys and heat-resistant materials.

Regional Insights:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

Asia-Pacific leads (37%+ share) due to manufacturing hubs, EV incentives, and cost-efficient supply chains bolstered by rising middle-class demand.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Automotive Wiring Harness Market Size Worth USD 121.3 Billion Globally by 2033 at a CAGR of 3.44% here

News-ID: 4191871 • Views: …

More Releases from IMARC Group

Supercapacitor Market Size to Reach $31.07B by 2033: Trends & Opportunities

Market Overview:

The supercapacitor market is experiencing rapid growth, driven by electrification of automotive systems, renewable energy and grid stabilization, and expansion of industrial automation and robotics. According to IMARC Group's latest research publication, "Supercapacitor Market Size, Share, Trends and Forecast by Product Type, Module Type, Material Type, End Use Industry, and Region, 2025-2033", the global supercapacitor market size was valued at USD 6.41 Billion in 2024. Looking forward, IMARC Group…

Bicycle Market Size to Surpass $102.05B by 2033: Growth & Insights

Market Overview:

The bicycle market is experiencing rapid growth, driven by global expansion of cycling infrastructure, rising health consciousness and preventative wellness, and technological advancements in e-bike propulsion. According to IMARC Group's latest research publication, "Bicycle Market Size, Share, Trends and Forecast by Type, Technology, Price, Distribution Channel, End User, and Region, 2025-2033", The global bicycle market size was valued at USD 67.42 Billion in 2024. Looking forward, IMARC Group estimates…

Baby Food and Infant Formula Market to Reach USD 84.06 Billion by 2033, Growing …

Market Overview:

The Baby Food and Infant Formula Market is experiencing steady expansion, driven by Increasing Awareness of Nutritional Needs for Infants, Rising Number of Working Women, and Technological Advancements and Product Innovation. According to IMARC Group's latest research publication, "Baby Food and Infant Formula Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global baby food and infant formula market size reached USD 53.73 Billion in 2024.…

Breakfast Cereals Market to Reach USD 149.07 Billion by 2033, Growing at a CAGR …

Market Overview:

The Breakfast Cereals Market is experiencing rapid growth, driven by Health and Wellness Awareness, Busy Lifestyles and On-the-Go Demand and Rising Disposable Incomes and Global Market Expansion . According to IMARC Group's latest research publication, "Breakfast Cereals Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global breakfast cereals market size was valued at USD 108.89 Billion in 2024. Looking forward, IMARC Group estimates…

More Releases for Harness

United States Automotive Wiring Harness Market Gains Momentum with Modular & Sma …

DataM Intelligence unveils its latest report on the "Automotive Wiring Harness Market Size 2025," offering an in-depth analysis of market trends, growth drivers, competitive landscape, and regional dynamics. The study covers market size in value and volume, CAGR forecasts, and emerging opportunities that can guide businesses in seizing growth potential and crafting winning strategies. Packed with data-driven insights on current developments and future trends, this report is essential for companies…

Wire Harness Get Complimentary PDF Guide

Comprehensive PDF Guide to Wire Harness

The automotive industry's rapid shift toward advanced technologies is significantly driving the growth of the global wire harness market. To remain competitive and meet evolving consumer expectations, automobile manufacturers are continuously integrating innovative features into new vehicle models. Key technological advancements such as adaptive cruise control, automatic high beam adjustment, self-driving capabilities, and hands-free liftgates are becoming increasingly standard in both premium and mid-range segments.…

The Complete Guide to Wire Harness

The wire harness market is projected to reach US$ 150.70 billion by 2030 from US$ 94,19 billion in 2023. It is expected to register a CAGR of 6.9% during 2023-2030.

𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝗣𝗗𝗙 ➜ https://www.premiummarketinsights.com/sample/TIP00073593?utm_source=Openpr&utm_medium=10694

In automobiles, wire harnesses weigh around 100-150 lbs depending on the size and vehicle model. Heavier the wire, higher the weight of equipment. In industries such as aerospace, weight is matter of concern. Due to…

Pawformance Gear unveils one harness: The ultimate versatile dog harness for eve …

Image: https://www.getnews.info/wp-content/uploads/2024/06/1717830743.png

Introducing the One Harness by Pawformance Gear, an adaptable dog harness designed to seamlessly transition between different outdoor activities, providing both comfort and security for every adventure with your canine companion.

Pawformance Gear is excited to announce the launch of its latest product, the One Harness, an all-in-one dog harness designed to simplify and enhance every adventure you and your furry friend undertake. From neighborhood strolls to rugged hikes,…

Pet Harness Mart Launches New Website

Pet Harness Mart announced the launch of its redesigned website pethm.com. Pet Harness Mart prime goal is to create a shop in which customer can easily find perfect pet harness that they need.

We are proud to launch the new Tracker Products website. With the new website, visitors can easily find perfect pet harness that they need, said Pet Harness Mart Team.

Pet Harness Mart gives new online shoppers fashionable and well-designed…

Railway Wiring Harness Market Value Projected to Expand by 2018 to 2028(Railway …

Railway Wiring Harness Market: Overview

Railway wiring harness is a complete electrical wiring system that caters to proper transmission of the signals and manages the flow of electrical power. Wiring harness was commonly used in railway manufacturing, automotives and in construction machineries. The railway wiring harness has an added advantage of binding many wires into a harness to avoid the possibility of a short circuit. The railway projects requires a lot…