Press release

Rising Demand For Loans Fuels Growth In The Asset-Based Lending Market: Powering Innovation and Expansion in the Asset-Based Lending Market by 2025

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Is the Expected CAGR for the Asset-Based Lending Market Through 2025?

In recent times, there's been a significant expansion in the size of the asset-based lending market. This increase will continue from $785.6 billion in 2024 to $891.89 billion in 2025, with a compound annual growth rate (CAGR) of 13.5%. Economic downturns and credit challenges, the need for financing working capital, the cyclical nature of business sectors, corporate restructuring and revival, along with instances of businesses possessing substantial assets but low cash reserves, all contributed to this historical growth trend.

What's the Projected Size of the Global Asset-Based Lending Market by 2029?

There is an anticipated swift expansion in the asset-based lending market over the approaching years, with projections reaching $1423.83 billion by 2029, reflecting a compound annual growth rate (CAGR) of 12.4%. This projected growth during the forecast period is tied to global economic fluctuations and trends, a surge in the need for unconventional financing, a growing role in international transactions, an emphasis on optimizing working capital, and industry-specific customization. Key trends within this period envisage an expansion of asset-based lending across borders, the use of artificial intelligence (AI) in making credit decisions, partnerships between traditional lending institutions and fintech companies, a focus on non- conventional types of collateral, and the incorporation of risk management analytics.

View the full report here:

https://www.thebusinessresearchcompany.com/report/asset-based-lending-global-market-report

Top Growth Drivers in the Asset-Based Lending Industry: What's Accelerating the Market?

The escalating need for loans is anticipated to spur the expansion of the asset-based lending market in the near future. A loan involves a financial agreement where one party known as the lender, usually a bank or a financial institution, offers a certain amount of cash or other assets to a second party, the borrower. Asset-based lending provides multiple benefits as it delivers loans with adaptable financing, improved liquidity, and scope for expansion. For example, in April 2024, a report from UN trade and development, which is based in Switzerland, stated that since 2022, escalating global interest rates have imposed pressure on public budgets. The net interest payments of developing countries reached $847 billion in 2023, marking a 26% growth from 2021. A record of 54 developing countries, or 38%, apportioned 10% or more of their revenues towards interest costs. As a result, the escalating need for loans is propelling the expansion of the asset-based lending market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=13118&type=smp

What Are the Key Trends Driving Asset-Based Lending Market Growth?

Leading companies in the asset-based lending market are concentrating their efforts on creating platforms that incorporate advanced technologies, such as data analytics, to enhance their decision-making processes, improve risk analysis and simplify the process of originating loans. This technology allows for a more thorough assessment of a borrower's credit rating and real-time asset tracking. Data analytics refers to the analysis of data to gain insights and back up decision-making. It uses methods to scrutinize and decipher data to detect patterns and trends. For example, Compass Business Finance, a financial firm based in the UK, launched "Unlocking Capital Strategic Advantages of Asset-Based Lending" in September 2024. The program emphasizes that asset-based lending (ABL) grants businesses flexible capital access by leveraging their assets, which allows for quicker funding and larger loan amounts. It supports cash flow management, growth plans, and financial stability, all while reducing risk to lenders.

What Are the Main Segments in the Asset-Based Lending Market?

The asset-based lendingmarket covered in this report is segmented -

1) By Type: Inventory Financing, Receivables Financing, Equipment Financing, Other Types

2) By Interest Type: Fixed Rate, Floating Rate

3) By End User: Large Enterprises, Small And Medium-Sized Enterprises

Subsegments:

1) By Inventory Financing: Raw Material Financing, Finished Goods Financing

2) By Receivables Financing: Invoice Financing, Factoring

3) By Equipment Financing: Heavy Machinery Financing, Office Equipment Financing

4) By Other Types: Real Estate Financing, Vehicle Financing, Intellectual Property Financing

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=13118&type=smp

Which Top Companies are Driving Growth in the Asset-Based Lending Market?

Major companies operating in the asset-based lending market report are JPMorgan Chase and Co., Wells Fargo And Company, HSBC Holdings PLC, Goldman Sachs Group Inc., BMO Harris Bank N.A., Barclays Bank PLC, Hilton-Baird Group, KeyCorp Limited, Huntington Business Credit, Lloyds Bank PLC, BB&T Corporation, CoreVest Finance, Crystal Financial LLC, Triumph Commercial Finance, CIT Group, Bibby Financial Services, Sterling National Bank, Berkshire Bank N.A., White Oak Financial LLC, Porter Capital Corporation, First Capital Federal Credit Union, LSQ Funding Group L.C., Action Capital Corporation, LQD Business Finance LLC, Capital Funding Solutions Inc.

Which Regions Will Dominate the Asset-Based Lending Market Through 2029?

North America was the largest region in the asset-based lending market in 2024. The regions covered in the asset-based lending market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=13118

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Saumya Sahey

Europe: +44 7882 955267,

Asia: +44 7882 955267 & +91 8897263534,

Americas: +1 310-496-7795

Email: saumyas@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Rising Demand For Loans Fuels Growth In The Asset-Based Lending Market: Powering Innovation and Expansion in the Asset-Based Lending Market by 2025 here

News-ID: 4191586 • Views: …

More Releases from The Business Research Company

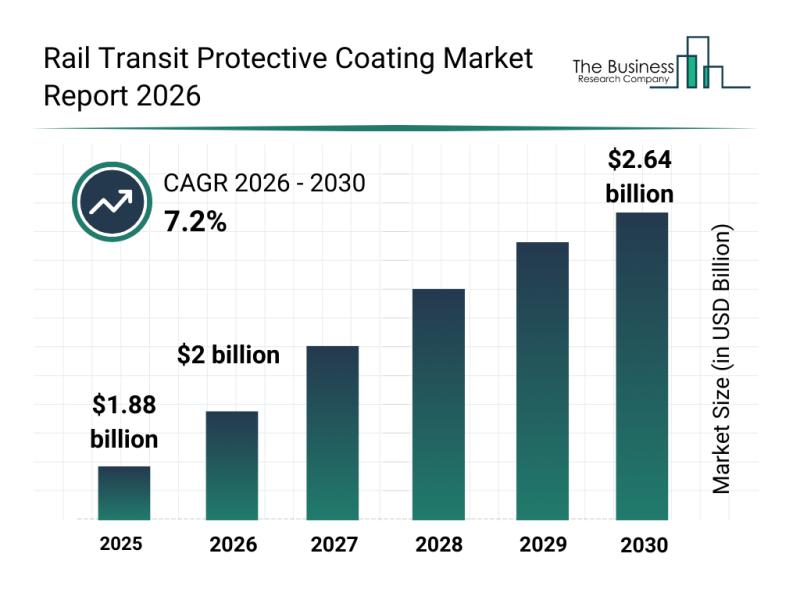

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

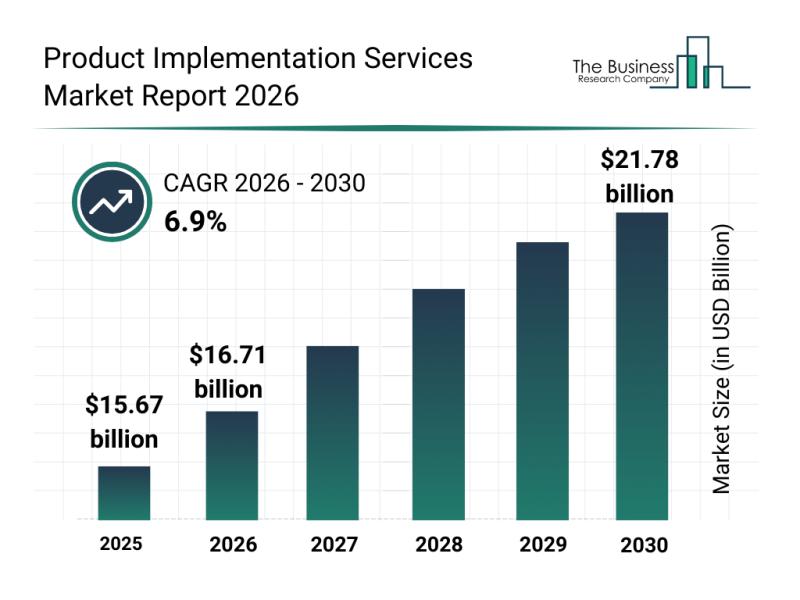

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

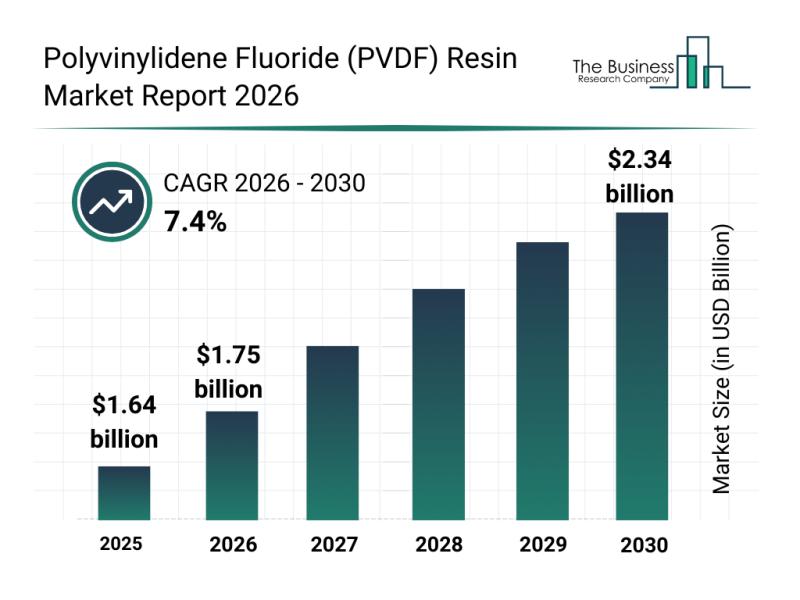

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

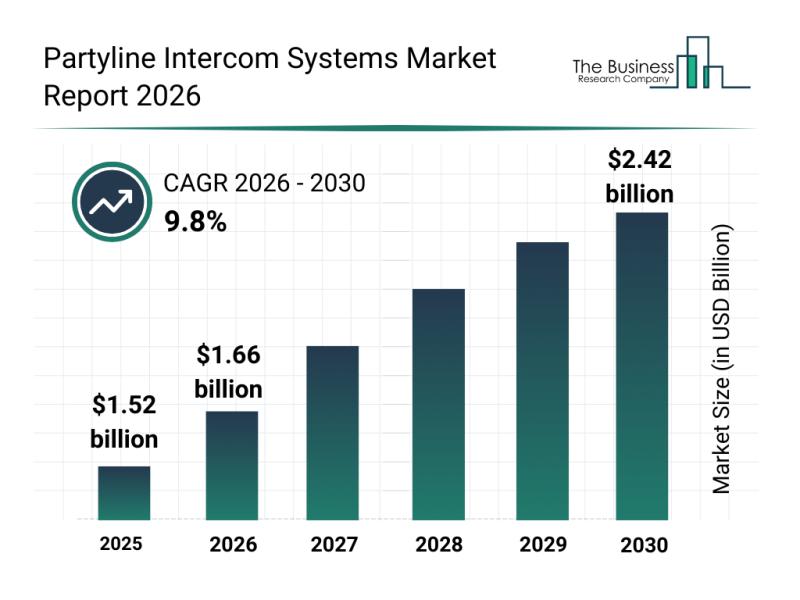

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for Financing

Financing and digitalization: CONFIDEX builds a networked financing system

Companies rely on system financing instead of individual products

With an integrated financing system, CONFIDEX combines consulting, technology and access to capital directly at the digital interfaces of the industry. Through platform partners and the subsidiary VENDORMAX, a closed financial ecosystem is created that enables financing where investments are made - quickly, transparently and efficiently.

Combining experience and real time

CONFIDEX GmbH has been supporting companies from industry and SMEs in structuring complex…

Education Financing Platforms Market Is Going to Boom | Major Giants MPOWER Fina …

HTF MI just released the Global Education Financing Platforms Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2024-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Education Financing Platforms Market are: MPOWER…

Revenue-Based Financing Market Report 2024 - Revenue-Based Financing Market Size …

"The Business Research Company recently released a comprehensive report on the Global Revenue-Based Financing Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Efficient real estate financing: Wandl.Immobilien presents new financing calcula …

Munich, May 23, 2024 - Wandl.Immobilien, a family-run real estate agency that has been successfully selling residential properties in Munich and the surrounding area for over 30 years, has introduced an impressive new addition to its range of services. An innovative real estate financing tool has been added to the extensive portfolio, which now also covers this increasingly important area.

Charting New Territories in real estate financing

The introduction of the new…

Film Marketing & Film Financing

Film Sales Agency TheMovieAgency.com is now offering extra assistance to filmmakers. If you are looking for raising funds for your next feature film or simply looking for assistance in marketing your completed feature film on the road to distribution, The Movie Agency might be able to help you with no upfront fee and no hidden fee!!!

We offer:

Free consultation.

Sourcing investors and future distributors, film buyers.

North American Distribution for the feature…

INVESTOR LOAN FINANCING PRODUCTS NATIONWIDE

We at KIS Lending believe in the art of word of mouth recommendations. Please see below with a variety of programs clients can take advantage of. We can assist in a variety of ways to finance the next home purchase or investment property NATIONWIDE for you or your clients. DSCR is the latest best option for investors.

• RESIDENTIAL FIX & FLIP + BRRRR LOANS: 90% of purchase, 100% of…