Press release

Revenue-Based Financing Market Report 2024 - Revenue-Based Financing Market Size, Insights And Analysis

"The Business Research Company recently released a comprehensive report on the Global Revenue-Based Financing Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of Our Research Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=12681&type=smp

According to The Business Research Company's, The revenue-based financing market size has grown exponentially in recent years. It will grow from $3.38 billion in 2023 to $5.78 billion in 2024 at a compound annual growth rate (CAGR) of 70.9%. The growth in the historic period can be attributed to start-up growth, access to capital, entrepreneurial ecosystem, risk mitigation, flexible repayment.

The revenue-based financing market size is expected to see exponential growth in the next few years. It will grow to $41.81 billion in 2028 at a compound annual growth rate (CAGR) of 64.0%. The growth in the forecast period can be attributed to investor interest, rise of impact investing, global economic conditions, market maturation, data analytics for risk assessment. Major trends in the forecast period include tech-enabled due diligence, partnerships with financial institutions, innovation in contract structures, blockchain integration, sustainability-linked financing.

Get The Complete Scope Of The Report @

https://www.thebusinessresearchcompany.com/report/revenue-based-financing-global-market-report

Market Drivers and Trends:

The rising number of startups is expected to propel the growth of the revenue-based financing market going forward. Startups refer to newly formed companies that are usually started by one or more entrepreneurs who focus on capitalizing upon a perceived market demand by developing a viable product, service, or platform. Startups help build the revenue-based financing industry by delivering innovative financial products and platforms that cater to the needs of small businesses, such as providing them with accessible and flexible finance options to help them grow and increase revenue streams. For instance, in June 2022, according to Startup Genome LLC, a US-based policy advisory and research firm, North America dominated the global rankings of startups, with 47% of the top 30 ecosystems. Further, in 2021, there will be 312 unicorns in North America, up from 83 in 2020. Therefore, the rising number of startups is driving the revenue-based financing market.

Integration with technology is a key trend gaining popularity in the revenue-based financing market. Major companies operating in the revenue-based financing market are adopting new technologies to sustain their position in the market. For instance, in August 2021, Uncapped Ltd., a UK-based provider of revenue-based financing, launched an innovative funding and growth platform to provide access to unbiased and remote capital to local early-stage founders. This prompted Uncap to create a new, entirely remote, data-driven, and highly simplified funding strategy, as well as an innovative investment concept. They will provide current enterprises needing funding ranging from $10,000 to $50,000.

Key Benefits for Stakeholders:

• Comprehensive Market Insights: Stakeholders gain access to detailed market statistics, trends, and analyses that help them understand the current and future landscape of their industry.

• Informed Decision-Making: The reports provide crucial data that support strategic decisions, reducing risks and enhancing business planning.

• Competitive Advantage: With in-depth competitor analysis and market share information, stakeholders can identify opportunities to outperform their competition.

• Tailored Solutions: The Business Research Company offers customized reports that address specific needs, ensuring stakeholders receive relevant and actionable insights.

• Global Perspective: The reports cover various regions and markets, providing a broad view that helps stakeholders expand and operate successfully on a global scale.

Major Key Players of the Market:

Silvr Co, Wayflyer, Funding Circle Holdings PLC, NerdWallet, Novel Capital, Kapitus, Saratoga Investment Corp, Decathlon Capital Partners LLC, MYOS, Liberis Ltd., FasterCapital, Capchase, GetVantage Tech Pvt Ltd., Lighter Capital Inc., Mercury Financial, Flow Capital Corp., Kruze Consulting, KredX, Timia Capital Corporation, Feenix Venture Partners LLC, Burkland Associates, ArK Kapital, Earnest Capital Ltd., Sabine Capital Partners LLC, Ritmo

Revenue-Based Financing Market 2024 Key Insights:

• The revenue-based financing market size is expected to see exponential growth in the next few years. It will grow to $41.81 billion in 2028 at a compound annual growth rate (CAGR) of 64.0%.

• Startups Fueling The Surge Driving Growth In The Revenue-Based Financing Market

• Tech-Driven Platform Revolutionizing The Revenue-Based Financing Landscape

• North America was the largest region in the revenue-based financing market in 2023

We Offer Customized Report, Click @

https://www.thebusinessresearchcompany.com/Customise?id=12681&type=smp

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ"

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Revenue-Based Financing Market Report 2024 - Revenue-Based Financing Market Size, Insights And Analysis here

News-ID: 3766025 • Views: …

More Releases from The Business research company

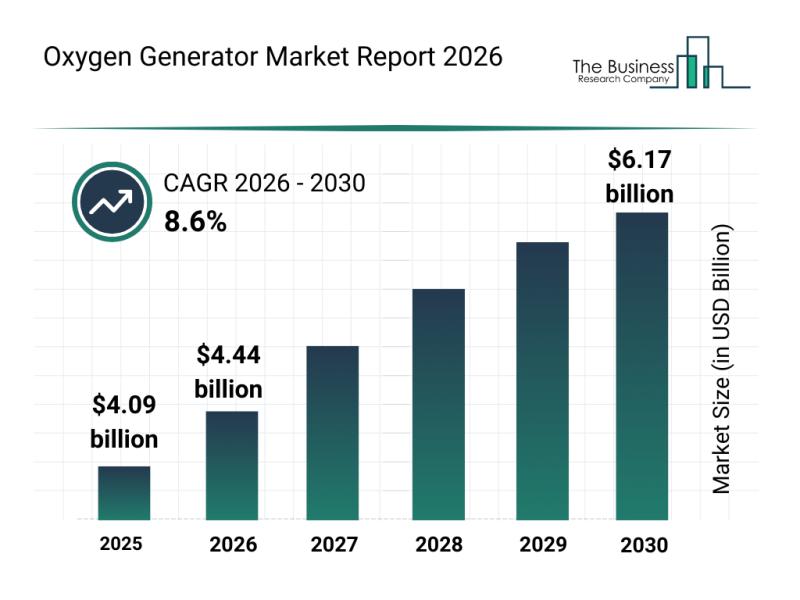

Worldwide Insights: The Rapid Development of the Oxygen Generator Market

"The oxygen generator market is positioned for significant expansion over the coming years, driven by diverse industrial and healthcare demands. With advancements in technology and increasing applications across various sectors, this market is set to witness robust growth as it adapts to evolving needs and innovations.

Projected Expansion and Market Size of Oxygen Generators Through 2030

The oxygen generator market is anticipated to grow steadily, reaching a value of $6.17 billion…

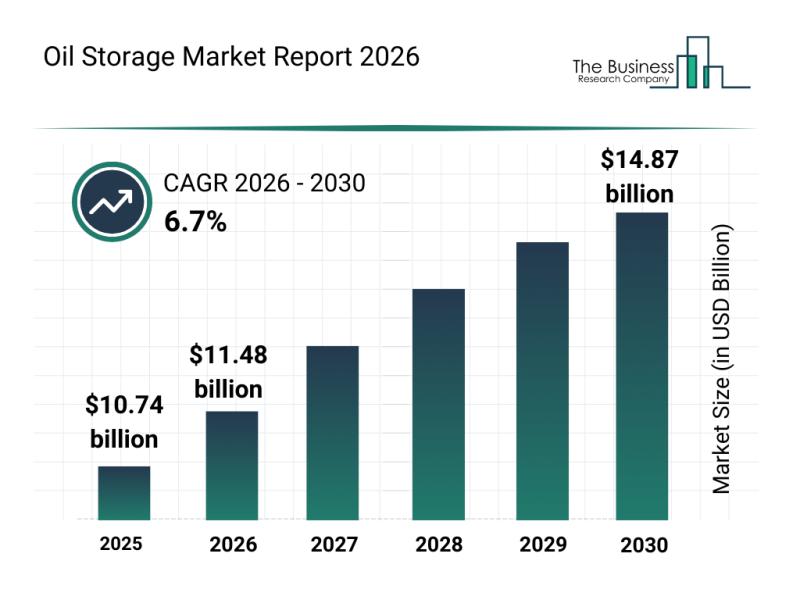

Segmentation, Major Trends, and Competitive Overview of the Oil Storage Market

"The oil storage sector is poised for notable expansion in the coming years, driven by increasing global energy needs and infrastructure development. As demand for efficient and secure storage solutions grows, the market is evolving with advanced technologies and strategic initiatives designed to meet the challenges of modern oil consumption and reserves management. Here's an overview of the market size, key players, emerging trends, and segmentation that define this industry's…

Worldwide Trends Examination: The Fast-Paced Development of the Motion Control M …

The motion control market is poised for significant expansion as industries increasingly adopt advanced automation technologies. With rising investments and technological breakthroughs, this sector is set to transform manufacturing and related fields by 2030. Let's explore the market's size, leading companies, emerging trends, and segment forecasts to understand its evolving landscape.

Expected Growth and Market Size of the Motion Control Market by 2030

The motion control market is on track for…

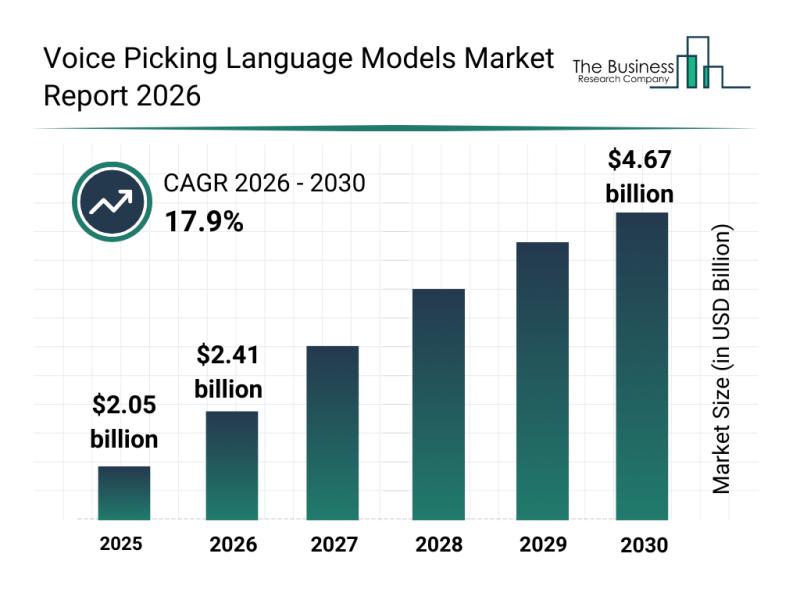

Global Trends Overview: The Rapid Evolution of the Voice Picking Language Models …

The voice picking language models market is poised for significant expansion in the coming years, driven by technological advancements and increasing adoption in logistics and warehouse environments. This sector is rapidly evolving as businesses prioritize efficiency and accuracy in their operations. Let's explore the market's size, growth factors, key companies, segmentation, and emerging trends shaping its future.

Projected Market Size and Growth Trajectory for the Voice Picking Language Models Market …

More Releases for Financing

Financing and digitalization: CONFIDEX builds a networked financing system

Companies rely on system financing instead of individual products

With an integrated financing system, CONFIDEX combines consulting, technology and access to capital directly at the digital interfaces of the industry. Through platform partners and the subsidiary VENDORMAX, a closed financial ecosystem is created that enables financing where investments are made - quickly, transparently and efficiently.

Combining experience and real time

CONFIDEX GmbH has been supporting companies from industry and SMEs in structuring complex…

Education Financing Platforms Market Is Going to Boom | Major Giants MPOWER Fina …

HTF MI just released the Global Education Financing Platforms Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2024-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Education Financing Platforms Market are: MPOWER…

Efficient real estate financing: Wandl.Immobilien presents new financing calcula …

Munich, May 23, 2024 - Wandl.Immobilien, a family-run real estate agency that has been successfully selling residential properties in Munich and the surrounding area for over 30 years, has introduced an impressive new addition to its range of services. An innovative real estate financing tool has been added to the extensive portfolio, which now also covers this increasingly important area.

Charting New Territories in real estate financing

The introduction of the new…

Film Marketing & Film Financing

Film Sales Agency TheMovieAgency.com is now offering extra assistance to filmmakers. If you are looking for raising funds for your next feature film or simply looking for assistance in marketing your completed feature film on the road to distribution, The Movie Agency might be able to help you with no upfront fee and no hidden fee!!!

We offer:

Free consultation.

Sourcing investors and future distributors, film buyers.

North American Distribution for the feature…

INVESTOR LOAN FINANCING PRODUCTS NATIONWIDE

We at KIS Lending believe in the art of word of mouth recommendations. Please see below with a variety of programs clients can take advantage of. We can assist in a variety of ways to finance the next home purchase or investment property NATIONWIDE for you or your clients. DSCR is the latest best option for investors.

• RESIDENTIAL FIX & FLIP + BRRRR LOANS: 90% of purchase, 100% of…

Shaw Capital Management and Financing Benefits from Factoring Financing

How Distribution Companies can benefit from Factoring Financing

Product distribution companies can be very capital intensive businesses. Read this article to learn how to get working capital for your distribution company and avoid scam.

Shaw Capital Management and Financing provide same-day-funding. We can help you meet your cash flow needs immediately without entering into a long term factoring relationship. The money you get for the freight bills we purchase is payment in…