Press release

Steady Expansion Forecast for Tax Management Market, Projected to Reach $41.42 Billion by 2029

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Tax Management Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

There has been a swift expansion in the tax management market size over the last few years. The market, which was valued at $23.39 billion in 2024, is projected to reach $26.2 billion in 2025, growing at a compound annual growth rate (CAGR) of 12.0%. The development during the historical period is largely due to the robust economic development in developing markets, an increase in disposable income, escalating complications in tax codes, and a rise in digital financial transactions.

Tax Management Market Size Forecast: What's the Projected Valuation by 2029?

It is projected that the tax management market will witness a significant surge in the coming years. This market is expected to reach $41.42 billion in 2029, expanding at a compound annual growth rate (CAGR) of 12.1%. The upswing during this forecast period can be attributed to factors such as enhanced government backing, rapid urbanization and population growth, coupled with a rise in the use of digital mediums and cloud-based approaches. The period will also see key trends such as amplified investments in AI, an increased focus on digital business solutions, investment in cutting-edge technologies, emphasis on cloud-based tax return solutions for workflow optimization, and a focus on shaping client self-service platforms.

View the full report here:

https://www.thebusinessresearchcompany.com/report/tax-management-global-market-report

What Are the Drivers Transforming the Tax Management Market?

An escalating complexity in tax codes across most nations has been a significant catalyst for the growth of the tax management market. Tax management is centered around ensuring that there's compliance with these multifaceted tax codes. This implies that tax managers are tasked with consistent updates on the newest regulations, comprehending the finer details of various clauses, and making sure their organization adheres to all the relevant tax laws. The National Taxpayers Union Foundation, an impartial research and educational institution based in the US, in its report, highlighted the rising complexity and compliance burden of the tax code in recent years. In 2022, tax code compliance necessitated 6.55 billion hours dedicated to recordkeeping, knowing the law, accomplishing compulsory forms and schedules, and providing data to the IRS (Internal Revenue Service). The predicted expense of adherence to the tax code in 2022 stood at $364 billion, marking a $25 billion increase (7.4 percent) from the preceding year. Consequently, the growing intricacy of tax codes is anticipated to boost the demand for tax management products and services.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=8336&type=smp

What Long-Term Trends Will Define the Future of the Tax Management Market?

The emergence of technological advancements is a notable trend in the tax management market. The primary firms in this sector are emphasizing on these advancements to maintain their competitive advantage. To illustrate, J.P. Morgan, an American investment banking corporation, introduced a new Tax-Smart Separately Managed Account (SMA) Platform, in May 2022. The platform allows advisors to create tailored portfolios and secure increased after-tax profits for their clients, by leveraging J.P. Morgan's investment experience and 55ip's tax-smart technology.

Which Segments in the Tax Management Market Offer the Most Profit Potential?

The tax managementmarket covered in this report is segmented -

1) By Type: Software, Services

2) By Deployment Mode: Cloud, On-Premises

3) By Organization Size: Small And Medium Sized Enterprises (SMES), Large Enterprises

4) By Application: Corporate Banking Financial Services And Insurance (BFSI), Information Technology (IT) And Telecom, Manufacturing, Energy And Utilities, Retail, Healthcare And Life Sciences, Media And Entertainment, Other Verticals

Subsegments:

1) By Software: Tax Filing And Compliance Software, Tax Reporting Software, Tax Planning And Analytics Software, Document Management Software

2) By Services: Consulting Services, Implementation And Integration Services, Support And Maintenance Services, Training And Education Services

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=8336&type=smp

Which Firms Dominate the Tax Management Market by Market Share and Revenue in 2025?

Major companies operating in the tax management market include Intuit, Wolters Kluwer, Thomson Reuters, SAP,Avantax, Inc, Vertex Inc, Avalara, Sovos Compliance, Automatic Data Processing Inc, Meru Accounting, Whiz Consulting Private Limited, IMC Group, Savage & Palmer, Shoolin Consultancy, Nimblefincorp, Setindiabiz, BBNC, Valuenode, Invensis Inc, Sapience Pro, Zhongrui Yuehua, GFC Consulting Co Ltd Shanghai, Guangdong SILIQUE Group Co., Ltd, AVASK Accounting and Business Consultants Ltd, UTV Motion Pictures limited., Eros International, Dharma Productions, Red Chilies Entertainment, Makesworth Accountants, CJM Associates, The Accountancy Partnership, Salient Accounting & Finance, Burnt Orange Accounting, BBK Partnership, TaxAssist Accountants, Crowe Poland, PwC Poland, Konsu, Dezan Shira & Associates, Sberbank, Société Générale TKB Investment Partners, Alfa Capital, UFG Asset Management, PZU Group, Aviva Investors Poland, H&R Block, Ernst & Young, KPMG International Limited, Zeni AI, TOTVS, TPC Group, Al Tamimi & Company, RSM UAE, Baker Tilly South Africa, Mazars

Which Regions Offer the Highest Growth Potential in the Tax Management Market?

North America was the largest region in the tax management market in 2024. The regions covered in the tax management market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=8336

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Saumya Sahey

Europe: +44 7882 955267,

Asia: +44 7882 955267 & +91 8897263534,

Americas: +1 310-496-7795

Email: saumyas@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Steady Expansion Forecast for Tax Management Market, Projected to Reach $41.42 Billion by 2029 here

News-ID: 4191483 • Views: …

More Releases from The Business Research Company

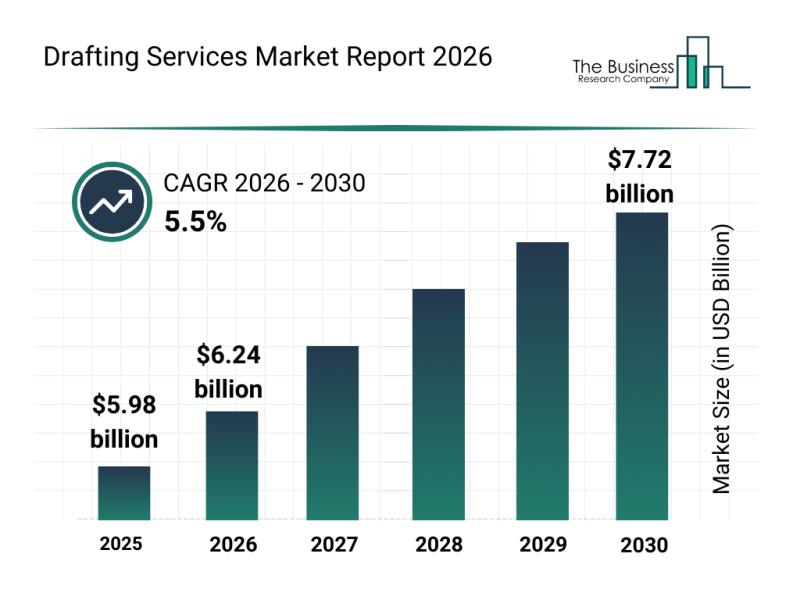

Future Perspective: Key Trends Shaping the Drafting Services Market Until 2030

The drafting services industry is poised for considerable expansion in the coming years as technological advancements and evolving construction needs drive demand. With a wide range of applications across sectors, this market is set to experience steady growth fueled by innovation and increasing adoption of digital tools. Let's explore the current market size, influential factors, key players, emerging trends, and segmentation in this dynamic field.

Projected Growth and Market Size of…

Emerging Sub-Segments Transforming the Digital Rights Management Market Landscap …

The digital rights management (DRM) market is positioned for remarkable expansion in the coming years, driven by technological advancements and increasing concerns over content security. As digital media consumption grows and new platforms emerge, DRM solutions are becoming essential to protect intellectual property and ensure the authorized use of digital assets. Let's explore the current market size, key players, prevailing trends, and the main segments shaping the future of this…

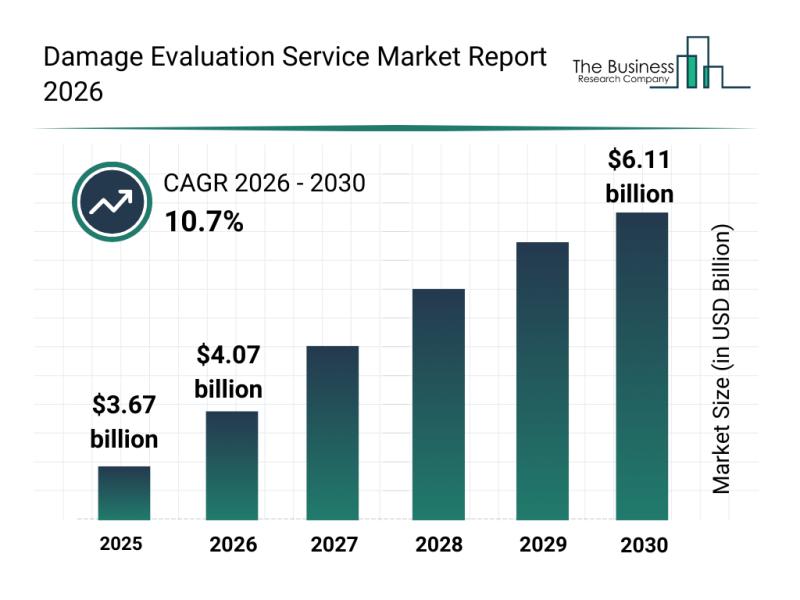

Market Trend Insights: The Impact of Recent Advances on the Damage Evaluation Se …

The damage evaluation service market is on the brink of substantial growth as advancements in technology and increasing demand for efficient damage assessment methods gain momentum. This sector is evolving rapidly with the integration of innovative tools and techniques that enhance accuracy and speed in evaluating damages across various industries.

Forecasted Market Size and Growth Trajectory of the Damage Evaluation Service Market

The damage evaluation service market is projected to…

Corporate Training Market: Segmentation Analysis, Market Trends, and Competitive …

The corporate training sector is on a path of significant growth as organizations increasingly recognize the importance of continuous employee development. With rapid technological advances and shifting workforce needs, this market is expected to expand steadily, driven by innovative solutions and evolving learning preferences. Below, we explore the market's size projections, key players, emerging trends, and segmentation insights to provide a comprehensive overview of the corporate training landscape.

Projected Growth and…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…