Press release

Daratumumab Injection Market to Reach USD 1,818 Million by 2031 Top 10 Company Globally

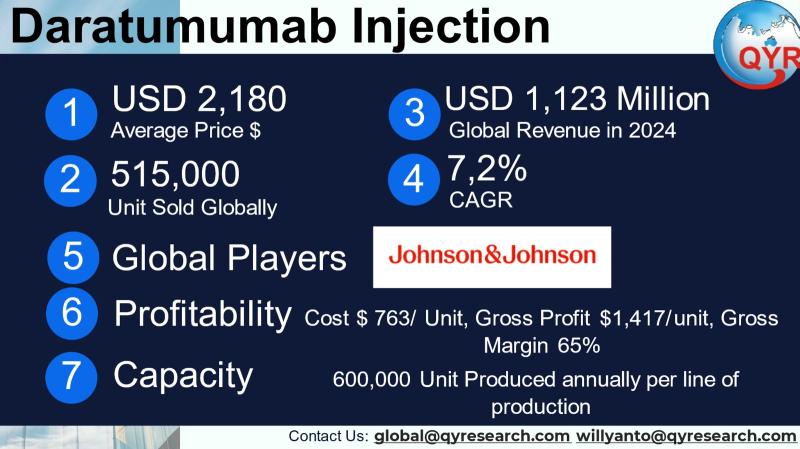

Daratumumab is a CD38-directed monoclonal antibody used primarily to treat multiple myeloma and related plasma-cell disorders; marketed as DARZALEX® (intravenous) and DARZALEX FASPRO® (subcutaneous coformulation with hyaluronidase), the medicine transformed the myeloma treatment landscape by moving from a late-line to a broad frontline and maintenance role in combination regimens, and by offering an SC formulation that materially shortens administration time and improves clinic throughput. Commercial value is driven by labeled indications (multiple myeloma across many lines of therapy and newer disease-modification uses such as high-risk smoldering myeloma), by route of administration (IV vs SC) which affects dosing and unit economics, and by product partnerships (Janssen/Johnson & Johnson markets the product while Genmab is a development/royalty partner and Halozyme supplies ENHANZE® technology for the SC formulation). These structural elements broad indications, an SC option, and strong clinical efficacy make daratumumab both a clinical cornerstone in hematology and a commercially dominant biologic.The Daratumumab Injection market in 2024 is value at USD 1,123 million with projection the market would grow to reach about USD 1,818 million in 2031 at CAGR pf 7,2%. In 2024. In 2024, daratumumab injection average selling price is around USD 2,180 per unit, total unit products reach 515,000 units.

To provide actionable per-unit economics we apply a conservative biologics gross-margin assumption common for high-value oncology monoclonal antibodies and then show the implied numbers. Assuming a 65% gross margin (a central, defensible benchmark for an established oncology biologic), the resulting per-unit figures are: Cost of Goods Sold (COGS) per unit ≈ USD 763.00, gross profit per unit ≈ USD 1,417.00, and gross margin ≈ 65%. On a 2024 volume of 515,000 units this implies total annual COGS ≈ USD 392.95 million and total gross profit ≈ USD 729.76 million. These per-unit COGS and margins are estimates for planning and investor assessment; actual COGS vary by manufacturer, formulation (IV vs SC), fill/finish location, and supply chain dynamics. (I used an explicit 65% gross margin assumption; alternate margin scenarios can be supplied on request.)

Using the 2024 unit demand (515,000 units) as a base and industry CDMO signals (large biologics contract awards and expansion of capacity across leading contract manufacturers), a conservative estimate for current full commercial production capacity for daratumumab (global network of Janssen internal sites + external CDMOs) is roughly ~600,000 units/year under normal operations, with scalable headroom to ~800,000 units/year if additional CDMO lots or an extra manufacturing line are brought online. This estimate reflects that large CDMOs (e.g., Samsung Biologics and others) have been winning multiyear biologics production contracts and expanding capacity across Asia, enabling pharma partners to scale supply rapidly when needed. Actual validated capacity is proprietary to Janssen and its CMOs and will vary by fill/finish vial type, batch yield, and lot release timing

Latest Trends and Technological Developments

Commercial and clinical activity in 2024 to 2025 shows three linked plays: label expansion into earlier disease settings (including smoldering myeloma), convenience and line-of-therapy substitution via the subcutaneous formulation, and the entering of biosimilar/commercial license arrangements that will affect pricing over time. Manufacturer and partner announcements reported that DARZALEX generated about USD 11.611.7 billion in 2024 (Genmab/J&J disclosure, published January 2025), underlining scale and market momentum. Regulatory movement and trial readouts in late 2024 and 2025 strengthened the franchise: a December 2024 international trial report showed daratumumab significantly reduced progression in high-risk smoldering multiple myeloma, and the European Commission issued approvals expanding certain indications (announced by Janssen in 2025), supporting earlier line uptake. On the commercialization/competitive front, biosimilar development and licensing accelerated in 20242025: Henlius reported favorable early clinical comparability for HLX15 (a daratumumab biosimilar candidate) and in February 2025 entered a licence agreement with Dr. Reddys to commercialize HLX15 in certain territories, signaling that biosimilar competition and geographic licensing are now active dynamics. More recent corporate reporting (Reuters/J&J releases, January 2025 and mid-2025 quarter updates) shows daratumumab continuing to deliver rising quarterly sales into 2025, with Q2 2025 sales again in the multi-billion-dollar per-quarter range evidence of sustained demand through labeled expansions. These dated items reported 2024 net sales (Jan 2025 disclosure), the Dec 2024 trial results for smoldering disease, and the Feb 2025 Henlius/Dr. Reddys licensing deal are the most material recent events that shape near-term demand and competitive pressure.

Asia represents a major and fast-growing revenue region for daratumumab due to population size, rising cancer-care access, and expanding hematology oncology services. In 2024-2025 the United States remained the largest single market by sales (J&J reported more than half of 2024 sales from the U.S.), but Asia particularly China, Japan, South Korea and parts of Southeast Asia showed accelerating adoption as reimbursement pathways, hospital capacity and combination-therapy protocols matured. Local clinical trials, regional guideline inclusion and growing availability of the SC formulation (which simplifies administration in clinics with constrained infusion capacity) have supported adoption. At the same time, Asia is an active geography for biosimilar development (Chinese and Korean developers such as Henlius and other biologics houses are progressing daratumumab biosimilar programs), which means price and access dynamics in Asia will evolve faster than in markets without active biosimilar entrants. For investors and suppliers, Asias mix of premium markets (Japan, Korea) and high-volume emerging markets (China, parts of ASEAN) implies differing commercial models: premium pricing and hospital formulary access in developed APAC, versus tendering and cost-sensitive procurement in lower-income jurisdictions.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5050082

Daratumumab Injection by Type:

100mg/5ml/Bottle

400mg/20ml/Bottle

Daratumumab Injection by Application:

Hospital

Clinic

Global Top 10 Key Companies in the Daratumumab Injection Market

Johnson & Johnson

Henlius Biotech

Chia Tai Tianqing Pharmaceutical Group

Hangzhou Jiuyuan Gene Engineering

CSPC Pharmaceutical Group Limited

Genmab A/S

Celltrion

Dr. Reddys

Biocad

Catelent

Regional Insights

In ASEAN the daratumumab opportunity is segmentation-driven: Singapore and Malaysia act as early adopters with advanced hematology infrastructure and private-payer access to novel agents, while Indonesia, the Philippines and Vietnam follow as hospital capacity and national insurance programs expand. Indonesia ASEANs largest population market shows growing hematology service networks and increasing procurement for oncology biologics, but price sensitivity and reimbursement limits mean penetration of high-cost biologics like daratumumab typically lags wealthier ASEAN peers without substantial public subsidy or private-insurance uptake. Practical adoption in ASEAN will therefore be staged: initial sales concentrate in private and tertiary centers (using IV or SC forms for eligible patients), then broaden as regional payer schemes expand and as biosimilars and licensing arrangements (e.g., Henlius/Dr. Reddys type deals) reduce net cost. Distributor partnerships, hospital formulary education and patient-support programs are essential commercial playbooks for these markets. Public filings and regional market analyses from 20242025 document rising tender activity and increased import/distribution agreements across Southeast Asia that support modest but accelerating volume there.

The daratumumab commercial picture has strong tailwinds but also important headwinds. First, cost and affordability are major constraints: daratumumab is expensive per dose and many health systems impose strict HTA and cost-effectiveness thresholds that can limit rapid, universal uptake in public formularies. Second, biosimilar development and geographic licensing (companies such as Henlius and others progressing HLX15 and similar candidates) will create pricing pressure over the medium term as entrants secure approvals and commercial partnerships. Third, competition within myeloma is intensifying: other monoclonal antibodies, antibodydrug conjugates, CAR-T and BCMA-targeted agents have meaningful clinical momentum and may alter treatment algorithms in ways that reduce daratumumabs share in some lines. Fourth, logistics and administration capacity while SC helps still require oncology infrastructure for safe delivery and monitoring, especially when daratumumab is used in combination regimens. Finally, payer negotiation complexity and rebate/discounting structures mean reported list sales are not uniform across geographies; actual net realized price differs markedly by contract and market. These constraints are visible in payer reviews, cost-effectiveness literature and the active biosimilar licensing landscape.

For Janssen and incumbent stakeholders the strategic priorities are clear: defend and extend frontline and maintenance indications through ongoing trials and label expansions, support SC adoption to reduce clinic burden and secure formulary preference, and manage biosimilar erosion with lifecycle management (new indications, fixed-dose combinations, patient-support programs and possible access-price tiering). For potential biosimilar entrants and licensees, the practical strategy is to secure rapid regulatory approvals in lower-cost jurisdictions, negotiate distribution deals (as Henlius/Dr. Reddys exemplifies), and compete first in markets where price sensitivity is highest; partnering with local distributors and offering patient-assistance programs can accelerate uptake. For investors, attractive plays include companies or licensees that secure early commercial rights in large emerging markets, service providers that deliver outpatient SC administration at scale, and technology partners (e.g., Halozyme) whose enabling technologies add switching costs to incumbents. Conservative modeling of future revenues should include explicit scenarios for biosimilar price penetration and for continued label expansion into earlier disease settings.

Product Models

Daratumumab injection is a monoclonal antibody used in the treatment of multiple myeloma and related hematologic conditions. It works by targeting the CD38 protein found on the surface of cancer cells, helping the immune system destroy them.

100mg/5ml vials A smaller dose vial, usually used for low-dose treatments, dose adjustments, or initial infusions. It offers flexibility in preparing personalized doses. Notable products include:

Henlius Daratumumab 100mg/5ml Shanghai Henlius Biotech: Biosimilar option developed for the Chinese oncology market.

Dr. Reddys Laboratories Daratumumab 100mg/5ml Dr. Reddys: Oncology biosimilar portfolio expansion in hematology.

Zhejiang Hisun Pharma Daratumumab 100mg/5ml Hisun Pharmaceutical: Biosimilar candidate in clinical development for oncology.

Reliance Life Sciences Daratumumab 100mg/5ml Reliance Life Sciences: Indian-developed biosimilar aimed at affordable access.

Intas Pharmaceuticals Daratumumab 100mg/5ml Intas Pharma: Biosimilar version under development for global markets.

400mg/20ml vials larger dose vial, commonly chosen for high-dose treatments and maintenance therapy, reducing the number of vials needed and saving preparation time in hospitals. Examples include:

Dr. Reddys Daratumumab 400mg/20ml Dr. Reddys Laboratories: Larger vial biosimilar option for streamlined treatment.

Intas Daratumumab 400mg/20ml Intas Pharmaceuticals: Oncology biosimilar supporting high-dose treatments.

Reliance Life Sciences Daratumumab 400mg/20ml Reliance Life Sciences: Cost-efficient biosimilar for hospitals and cancer centers.

Zydus Cadila Daratumumab 400mg/20ml Zydus Lifesciences: Large-volume biosimilar vial for advanced treatment protocols.

Emcure Daratumumab 400mg/20ml Emcure Pharmaceuticals: Oncology solution designed for broader dosage flexibility

Daratumumab is a clinically transformative and commercially dominant monoclonal antibody in multiple myeloma, with reported worldwide sales of about USD 1,123 million in 2024 that effectively represent the global daratumumab market at that time. Near-term growth will be driven by label expansions (earlier disease, maintenance), the convenience and adoption of the subcutaneous formulation, and geographic expansion, while medium-term dynamics will be tempered by biosimilar entry and competitive modalities. Under a central scenario that assumes continued label expansion and managed biosimilar erosion, we model a nominal CAGR of 7,2% to 2031, producing a franchise roughly in the low-to-mid tens of billions by the end of the decade; actual trajectories will depend on the timing and scope of biosimilar approvals and on new competitor launches that change treatment algorithms. Key strategic focus areas for right-shoring access and protecting value are SC adoption, evidence generation for earlier-line disease modification, and commercial strategies to manage price competition in emerging markets.

Investor Analysis

What matters to investors is that daratumumab represents a high-margin, large-scale biologic franchise with multi-year revenue visibility because of durable clinical demand across lines of therapy and strong real-world use; how investors can capture value is by backing constrained upstream or enabling assets (manufacturing sites, fill/finish capacity for biologics, distribution partners with hospital access in large emerging markets), by investing in biosimilar developers that secure early territorial rights and cost advantages, or by supporting service providers that scale outpatient SC administration and patient-support programs. Why act now: the 2024 sales base (~USD 11.7B) plus ongoing label expansions and SC rollout create a clear near-term revenue runway, while the 20242025 acceleration of biosimilar licensing and development (e.g., Henlius/Dr. Reddys activity) marks the beginning of an era where market share and price erosion become key valuation sensitivities; successful investors will therefore prioritize counterparties with binding territory offtake rights, validated CMO capacity for complex biologics, or unique service-delivery models that raise switching costs. Diligence should focus on commercial exclusivity windows, approved indications across target markets, payer pathways and reimbursement timelines, and any manufacturing or regulatory contingencies that could accelerate or delay biosimilar competition.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5050082

5 Reasons to Buy This Report

It anchors the daratumumab market to the manufacturer-reported 2024 sales figure, giving investors and procurement teams a fact-based revenue baseline.

It translates revenue into pragmatic dose/vial shipment ranges using conservative blended-ASP scenarios so stakeholders can model volume, COGS and fill/finish throughput needs.

It documents dated, material developments that change near-term adoption and competitive timelines.

It offers regional commercial insight for Asia and ASEAN so market-entry, pricing and distribution decisions can be tailored to local payer realities and biosimilar timing.

It flags strategic investment levers manufacturing capacity, territorial biosimilar licenses, and SC-administration service models that meaningfully alter ROI and downside risk for investors.

5 Key Questions Answered

What was the best-supported global market size for daratumumab in 2024 and what baseline revenue should models use?

What realistic price-per-dose/vial ranges apply to IV versus SC daratumumab and what do those prices imply for units sold in 2024?

Which dated clinical or regulatory events (late-2024/early-2025) materially change daratumumab uptake and label breadth?

How will Asia and ASEAN adoption and biosimilar development alter pricing and volume dynamics over the next five years?

Which commercial and technical strategies best defend value or capture upside for investors?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Daratumumab Injection Market to Reach USD 1,818 Million by 2031 Top 10 Company Globally here

News-ID: 4187245 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for Daratumumab

Rising Incidence Of Bone Marrow Cancer Fuels Growth Of Daratumumab/Darzalex Mark …

What combination of drivers is leading to accelerated growth in the daratumumab or darzalex market?

The escalation of bone marrow cancer occurrences is anticipated to stimulate the expansion of the daratumumab or darzalex market. Bone marrow cancer entails cancers initiating in the bone marrow like multiple myeloma and leukemia which disrupt normal bodily functions due to abnormal blood cell production. The surge in bone marrow cancers is linked to an ageing…

Rising Incidence Of Bone Marrow Cancer Fuels Growth Of Daratumumab/Darzalex Mark …

What combination of drivers is leading to accelerated growth in the daratumumab or darzalex market?

The escalation of bone marrow cancer occurrences is anticipated to stimulate the expansion of the daratumumab or darzalex market. Bone marrow cancer entails cancers initiating in the bone marrow like multiple myeloma and leukemia which disrupt normal bodily functions due to abnormal blood cell production. The surge in bone marrow cancers is linked to an ageing…

Key Trend Reshaping the Daratumumab Or Darzalex Market in 2025: Focus On Transme …

What Are the Projections for the Size and Growth Rate of the Daratumumab Or Darzalex Market?

The market for daratumumab, also known as darzalex, has experienced swift expansion in the last few years. It is projected to escalate from $5,093.04 million in 2024 to $5,618.30 million in 2025 with a compound annual growth rate (CAGR) of 10.3%. This substantial growth during the historic period is primarily due to the use of…

Genmab/Janssen Biotech's Daratumumab market size expected to increase many folds …

DelveInsight has recently published a report on "Daratumumab Market Forecast Report" providing an in-depth analysis of the Daratumumab market analysis and forecasts up to 2032 in the seven major markets (7MM) (i.e. the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan. The comprehensive report provides an analysis of Daratumumab market potential and market share analysis in the AL Amyloidosis therapeutics space across the 7MM from…

Daratumumab Market Size, SWOT Analysis, Growth Statistics, Prominent Players Str …

This comprehensive Report of the Daratumumab Market provides real information about the statistics and state of the global and regional market. Its scope study extends from the market situation to comparative pricing between the main players, spending in specific market areas, and profits. It represents a comprehensive and succinct analysis report of the main competitor and price statistics with a view to helping beginners establish their place and survive in…

Global and United States Daratumumab Injection Market Report & Forecast 2022-202 …

This report focuses on global and United States Daratumumab Injection market, also covers the segmentation data of other regions in regional level and county level.

Global Daratumumab Injection Scope and Market Size

Daratumumab Injection market is segmented by region (country), players, by Type and by Application. Players, stakeholders, and other participants in the global Daratumumab Injection market will be able to gain the upper hand as they use the report as a powerful resource. The segmental…