Press release

Anti-Money Laundering Market to Reach USD 22.7 Billion by 2035 Driven by AI and Digital Compliance

The global anti-money laundering (AML) market is entering a period of exceptional growth, reflecting a convergence of strict regulatory frameworks, rising financial crime risks, and the acceleration of digital banking. Estimated at USD 4.4 billion in 2025, the market is projected to expand nearly fivefold, reaching USD 22.7 billion by 2035 at an impressive CAGR of 17.8%.Financial institutions are under mounting pressure to enhance compliance infrastructure. From real-time monitoring of transactions to advanced customer identity management, organizations are embracing sophisticated AML solutions that protect reputations, meet international standards, and mitigate the risks posed by increasingly complex digital financial crimes.

Customer Identity Management Takes the Lead

Among solutions, customer identity management is expected to emerge as the dominant segment, accounting for 38.6% of the market share in 2025. The rise of digital transactions and remote banking has made identity verification critical. Financial institutions are prioritizing accurate customer due diligence, real-time onboarding, and robust know-your-customer (KYC) processes.

Full Market Report available for delivery. For purchase or customization, please request here: https://www.futuremarketinsights.com/reports/sample/rep-gb-16705

The segment is being further strengthened by innovations in biometric authentication, continuous monitoring, and risk scoring. These features are not only reducing fraud but also improving the customer experience. With governments reinforcing KYC requirements worldwide, identity management is set to anchor AML strategies throughout the forecast period.

Professional Services Gain Ground

The professional services segment is forecasted to capture 57.2% of total service revenue in 2025. As compliance becomes increasingly complex, enterprises are turning to consultants, system integrators, and advisory experts to ensure effective deployment of AML frameworks.

These services provide tailored support across jurisdictions, helping organizations adapt to constant regulatory updates. By leveraging specialized expertise, companies are reducing implementation risks, training employees efficiently, and aligning systems with international compliance standards. This reliance on professional services underscores their role as a cornerstone of the AML industry.

On-Premise Deployment Still Preferred

Despite growing interest in cloud-based models, the on-premise deployment model will continue to dominate, holding 46.3% of market revenue in 2025. Financial institutions with established IT infrastructure prefer on-premise systems due to greater control, security, and the ability to integrate with legacy systems.

Sensitive customer data and strict regulatory frameworks in markets such as North America and Europe reinforce the appeal of on-premise solutions. While cloud adoption is rising, the enduring preference for data control and customization keeps on-premise models firmly in play.

Regional Outlook

North America

North America will maintain its lead, supported by advanced financial systems, significant technology investment, and strict regulatory frameworks. The Anti-Money Laundering Act of 2024 has intensified compliance requirements, stimulating demand for advanced AML tools. Key players in the region, such as FICO, SAS Institute, and ACI Worldwide, are expanding offerings with AI-enabled compliance technologies.

Europe

Europe is set to follow closely, benefitting from strong regulatory structures and cross-border financial activity. Increasing collaborations between solution providers and financial institutions highlight Europe's role as a center for AML innovation. Regulations modeled on global standards ensure compliance becomes an integral part of operations across the region.

Asia-Pacific

Asia-Pacific is projected to post the fastest growth rate. The region's booming digital payments sector, especially in China and India, is driving the adoption of AML systems. Governments are actively implementing stringent frameworks like India's Prevention of Money Laundering Act, 2002, and regional players are embracing AI-driven AML platforms. For instance, 3i Infotech launched AMLOCK Analytics in 2024, an AI and ML-powered solution that demonstrates the region's growing leadership in innovation.

Middle East and Africa

The Middle East and Africa present more modest opportunities due to infrastructural limitations and slower adoption of advanced technologies. However, rising awareness and the gradual introduction of global compliance frameworks are expected to stimulate steady demand in coming years.

Strategic Alliances and Competitive Dynamics

The competitive landscape of the AML market is moderately fragmented, with global leaders coexisting alongside agile new entrants. Established firms such as ACI Worldwide, BAE Systems, Fiserv, LexisNexis Risk Solutions, and SAS Institute Inc. continue to expand product portfolios and global presence. These companies are leveraging AI, ML, and blockchain analytics to refine detection and strengthen compliance frameworks.

At the same time, emerging players like Dixtior, Feedzai, Sanction Scanner, and Finacus Solutions are carving out niches by offering innovative, cost-effective solutions. Their ability to tailor AML systems to regional requirements gives them an advantage in fast-growing markets.

Strategic alliances are also shaping industry dynamics. In 2024, FICO partnered with MSG Group to enhance its financial crime compliance solutions in Europe, the Middle East, and Africa. Similarly, Experian launched upgraded fraud prevention technologies to support digital-first companies facing surging account fraud risks. These collaborations highlight the market's trend toward cooperative innovation.

Request Market Research Draft Report: https://www.futuremarketinsights.com/reports/anti-money-laundering-market

Opportunities Ahead

As AML solutions evolve, real-time monitoring will be a defining trend. Transaction monitoring systems that assess both historical and live data are enabling financial institutions to act proactively against suspicious activities.

Regulatory technology, or RegTech, is opening opportunities for automating compliance workflows, reducing manual intervention, and accelerating customer onboarding. With AI and ML integration, RegTech tools are transforming compliance from a burden into a strategic advantage.

Financial institutions that invest early in these advancements stand to gain not only compliance but also customer trust and operational efficiency.

Established and New Players Shaping the Future

The anti-money laundering industry is characterized by a balance of established leaders and rising innovators. Giants such as NICE Systems Ltd., Wolters Kluwer Limited, Temenos AG, and Tata Consultancy Services Ltd. are setting global standards, while new players like Nelito Systems, Featurespace, and CaseWare RCM bring fresh perspectives and agility.

The interplay of these players ensures a competitive and innovative market. Established companies continue to strengthen their global footprints, while new entrants bring disruptive ideas and technologies, ensuring the industry adapts quickly to evolving financial crime threats.

Related Reports:

Inventory Management Software Market: https://www.futuremarketinsights.com/reports/inventory-management-software-market

Eye Tracking System Market: https://www.futuremarketinsights.com/reports/eye-tracking-systems-market

Automotive SoC Market: https://www.futuremarketinsights.com/reports/automotive-soc-market

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Anti-Money Laundering Market to Reach USD 22.7 Billion by 2035 Driven by AI and Digital Compliance here

News-ID: 4186636 • Views: …

More Releases from Future Market Insights

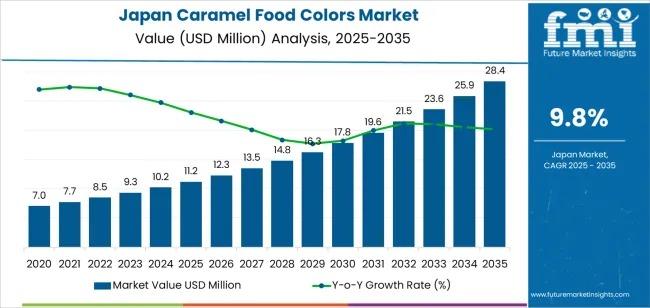

Japan Caramel Food Colors Industry Outlook to 2036: Strategic Insights for R&D, …

The Japanese caramel food colors market is on a steady growth trajectory, with demand projected to rise from USD 11.2 million in 2025 to USD 28.4 million by 2035, registering a CAGR of 9.8%. The initial phase of the forecast period (2025-2030) anticipates a steady increase in demand, reaching approximately USD 17.8 million by 2030, driven by the expanding use of caramel colors across confectionery, dairy, and baked goods.

The market's…

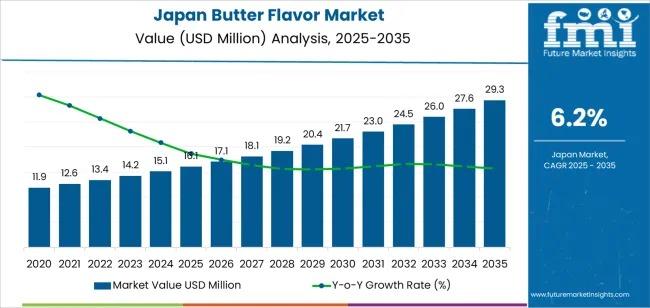

Comprehensive Analysis of the Japan Butter Flavor Market: Technology Evolution, …

The demand for butter flavor in Japan is projected to rise from USD 16.1 million in 2025 to USD 29.4 million by 2035, reflecting a steady compound annual growth rate (CAGR) of 6.2%. This growth is underpinned by increasing adoption across bakery products, confectionery items, and dairy-based preparations, as manufacturers seek to enhance taste experiences and deliver authentic dairy character in a wide range of food offerings.

The Japanese bakery and…

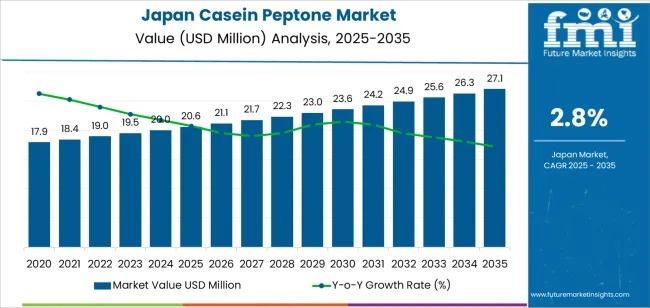

Japan Casein Peptone Market Deep-Dive 2026-2036: Strategic Forecasts, Market Ent …

The demand for casein peptone in Japan is projected to grow steadily, reaching USD 27.1 million by 2035, up from USD 20.6 million in 2025, reflecting a compound annual growth rate (CAGR) of 2.8%. During the early forecast period (2025-2030), demand is expected to rise from USD 20.6 million to approximately USD 23.6 million, supported by its widespread applications in biotechnology, pharmaceuticals, and food industries. Casein peptone continues to play…

Global Boride Powder Market Size, Share & Forecast: High-Growth Segments, Value …

The global boride powder market is valued at USD 19.7 billion in 2025 and is projected to reach USD 32.2 billion by 2035, advancing at a steady 5.0% CAGR over the forecast period. This upward trajectory reflects increasing adoption of boride-based compounds in aerospace technology, high-temperature processing environments, and advanced coating applications, where exceptional thermal stability, corrosion resistance, and mechanical strength are essential for operational performance and product reliability.

Key Market…

More Releases for AML

Xepeng Emphasizes AML Screening in Platform Security

Platform details AML measures, including counterparty checks, to support secure conversions for merchants.

Denpasar, Bali, Indonesia, 30th Dec 2025 -- As digital value conversion systems evolve, enterprises like Xepeng recognize that robust anti-money laundering (AML) practices are essential to maintaining trust, safeguarding merchants, and aligning with regulatory expectations. AML encompasses a set of policies and practices intended to prevent, detect, and respond to financial activity that may be linked to illicit…

Top Trends Transforming the Hemato Oncology Testing Market Landscape in 2025: Ne …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the Hemato Oncology Testing Industry Market Size Be by 2025?

There has been a swift expansion in the hemato oncology testing market in the past few years. The market, which was valued at $3.5 billion in 2024, is predicted to surge to $3.96 billion in 2025, reflecting…

AML BitCoin Founder Asks President Trump to release their AML BITCOIN Classified …

The DOJ and the FBI should practice tough love while also providing financial incentives for government employees that uphold the constitution and obey the law. AG Bondi and Director Patel should ask President Trump for access to some of the billions of dollars that DOGE has saved us and utilize it for pay raises. Their employees need to be taken care of financially, or their hardships will make them the…

Anti-Money Laundering (AML) Software Market Is Booming So Rapidly with Thomson R …

The Latest published market study on Global Anti-Money Laundering (AML) Software Market provides an overview of the current market dynamics in the Anti-Money Laundering (AML) Software space, as well as what our survey respondents all outsourcing decision-makers predict the market will look like in 2032. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and…

Global Anti Money Laundering (AML) Software Market Size, Share and Forecast By K …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the Market Research Intellect, the global Anti Money Laundering (AML) Software market is projected to grow at a robust compound annual growth rate (CAGR) of 14.78% from 2024 to 2031. Starting with a valuation of 7.83 Billion in 2024, the market is expected to reach approximately 17.9 Billion by 2031, driven by factors such as Anti Money Laundering (AML) Software and Anti Money Laundering (AML)…

What is AML Verification? A Detailed Guide

With the rise of cryptocurrencies and the increasing adoption of digital assets, regulatory frameworks have become a critical component for ensuring that the cryptocurrency space remains secure and compliant. One of the most important elements in this regulatory framework is AML verification, which stands for Anti-Money Laundering.

Image: https://revbit.net/wp-content/uploads/2024/10/aml-in-crypto-3-1024x640.png

What is AML Verification?

AML (Anti-Money Laundering) verification [https://revbit.net/] refers to a set of procedures and regulations designed to prevent illegal activities such as…