Press release

Tax Tech Market Challenges in Emerging Markets Due to Limited Digital Infrastructure and SME Adoption Barriers

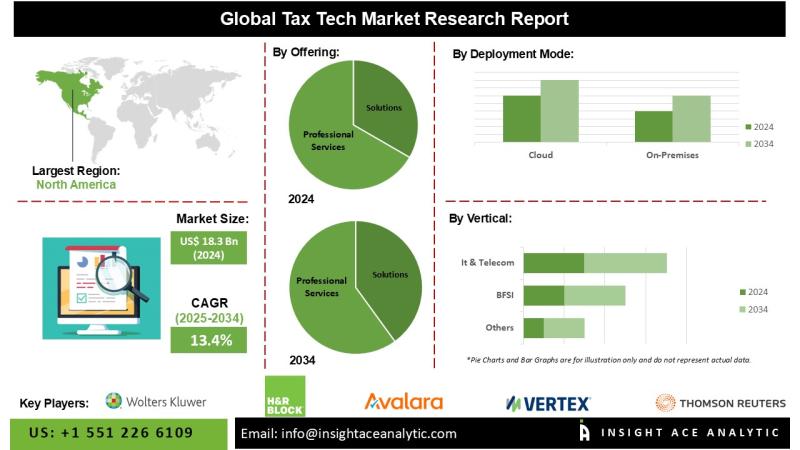

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the " Tax Tech Market- (By Offering (Solutions (Tax Compliance & Reporting (Corporate tax compliance (direct & indirect taxes), Sales and use tax automation, VAT/GST compliance, E-filing and tax return preparation), Tax Analytics & AI-Driven Solutions (Predictive analytics for tax planning, AI-powered tax audits and risk assessment, Tax data visualization and decision support), Tax Workflow & Document Management (Tax document automation and e-signatures, Tax workflow collaboration platforms, Audit trail and regulatory documentation)), Professional Services (Consulting & Training, Integration & Deployment, Support and Maintenance)), By Deployment Mode (Cloud, On-premises), By Tax Type (Direct Tax (Corporate Income Tax, Capital Gains Tax, Property Tax, Other Direct Taxes), Indirect Tax (Value-Added Tax (VAT) and Goods & Services Tax (GST), Sales & Use Tax, Excise Tax, Customs Duties & Tariffs, Other Indirect Taxes)), By Organization Size (Large Enterprises, SMEs), By Vertical (BFSI, IT & Telecom, Retail & E-commerce, Manufacturing, Energy & Utilities, Healthcare & Life Sciences, Government & Public Sector, Other Verticals)), Trends, Industry Competition Analysis, Revenue and Forecast To 2034."According to the latest research by InsightAce Analytic, the Tax Tech Market is valued at USD 18.3 Bn in 2024 , and it is expected to reach USD 61.9 Bn by the year 2034, with a CAGR of 13.4% during the forecast period of 2025-2034.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/3005

Tax technology, commonly referred to as "tax tech," encompasses the deployment of advanced digital tools and automated software solutions to enhance the precision, efficiency, and compliance of tax-related operations. This domain integrates a diverse set of technologies-including blockchain, cloud computing, artificial intelligence (AI), machine learning, and data analytics-to streamline and optimize key tax functions such as filing, reporting, auditing, and regulatory compliance.

The tax technology market is poised for substantial growth, driven primarily by the increasing complexity of global tax regulations and the evolving landscape of international trade. As organizations expand their operations across multiple jurisdictions, they encounter heightened challenges in adhering to varied regulatory requirements. This environment has created a rising demand for intelligent, adaptive, and real-time tax management platforms capable of addressing regulatory complexities while supporting efficient, compliant operations on a global scale.

List of Prominent Players in the Tax Tech Market:

• Wolters Kluwer

• H&R Block

• Avalara

• Vertex

• Thomson Reuters

• SAP

• ADP

• SOVOS

• Intuit

• Xero

• TaxBit

• Ryan

• TaxAct

• Anrok

• Corvee

• TaxSlayer

• Fonoa

• Token Tax

• Drake Software

• TaxJar

• Picnic Tax

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-04

Market Dynamics:

Drivers:

The expansion of the tax technology (tax tech) market is primarily driven by increasing regulatory complexity, widespread adoption of cloud-based platforms, and the global implementation of digital tax reform initiatives. Sectors such as retail, e-commerce, financial services, and information and communications technology are increasingly leveraging tax tech solutions to manage compliance across multiple jurisdictions.

As tax regulations become more detailed and region-specific, organizations are turning to automated systems to enhance accuracy, improve operational efficiency, and ensure timely adherence to legal requirements. The imperative to modernize tax functions, reduce manual errors, and stay aligned with rapidly evolving legislative frameworks is significantly contributing to the growing adoption of advanced digital tax solutions.

Challenges:

Despite strong market potential, several challenges constrain broader adoption, particularly in emerging regions where digital infrastructure is limited and awareness of tax technology remains low. Small and medium-sized enterprises (SMEs) frequently rely on traditional methods such as spreadsheets and manual recordkeeping due to limited technical expertise and resistance to digital transformation.

Furthermore, the dynamic nature of global tax legislation necessitates frequent updates to tax technology platforms to accommodate changes in tax rates, reporting requirements, and compliance standards. This need for continual system customization and upgrades adds complexity and increases the costs associated with both implementation and ongoing maintenance for providers and end users.

Regional Trends:

North America is expected to maintain a dominant position in the global tax tech market, supported by a mature digital tax infrastructure, regulatory mandates for electronic filing, and strong uptake of automation technologies. The region's focus on operational efficiency and compliance is driving continued innovation within the tax technology sector. Investments in emerging technologies, including blockchain and cloud computing platforms, further strengthen North America's leadership in this domain.

Conversely, the Asia-Pacific region is projected to experience the fastest growth over the forecast period. Rapid digital transformation, evolving regulatory frameworks, and increasing adoption of cloud-based solutions are fueling demand for tax technology in the region. Government-driven initiatives, such as mandatory e-invoicing and digital tax reporting, are encouraging enterprises of all sizes to modernize their tax operations, creating a favorable environment for accelerated market expansion across key economies.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/3005

Recent Development:

• March 2025: Parolla and Xero collaborated to provide Irish users with free VAT3 return and SEPA payment options. With SEPA-compliant files, the Parolla Plugins made it easier to pay suppliers and allowed direct VAT3 filings to Revenue Online Services (ROS).

• December 2024: Avalara expanded its global e-invoicing capabilities by acquiring Oobj Tecnologia da Informação Ltda, a Brazilian software company. Through this acquisition, Avalara's e-invoicing reach is extended to six Latin American nations, and its endpoint connection in Brazil has been improved.

Segmentation of Tax Tech Market-

By Offering-

• Solutions

o Tax Compliance & Reporting

Corporate tax compliance (direct & indirect taxes)

Sales and use tax automation

VAT/GST compliance

E-filing and tax return preparation

o Tax Analytics & AI-Driven Solutions

Predictive analytics for tax planning

Al-powered tax audits and risk assessment

Tax data visualization and decision support

o Tax Workflow & Document Management

Tax document automation and e-signatures

Tax workflow collaboration platforms

Audit trail and regulatory documentation

• Professional Services

o Consulting & Training

o Integration & Deployment

o Support and Maintenance

By Deployment mode-

• Cloud

• On-premises

By Tax type-

• Direct Tax

o Corporate Income Tax

o Capital Gains Tax

o Property Tax

o Other Direct Taxes

• Indirect Tax

o Value-Added Tax (VAT) And Goods & Services Tax (GST)

o Sales & Use Tax

o Excise Tax

o Customs Duties & Tariffs

o Other Indirect Taxes

By Organization Size-

• Large Enterprises

• SMEs

By Vertical-

• BFSI

• IT & Telecom

• Retail & E-commerce

• Manufacturing

• Energy & Utilities

• Healthcare & Life Sciences

• Government & Public Sector

• Other Verticals

By Region-

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of the Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/tax-tech-market/3005

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Tech Market Challenges in Emerging Markets Due to Limited Digital Infrastructure and SME Adoption Barriers here

News-ID: 4185912 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

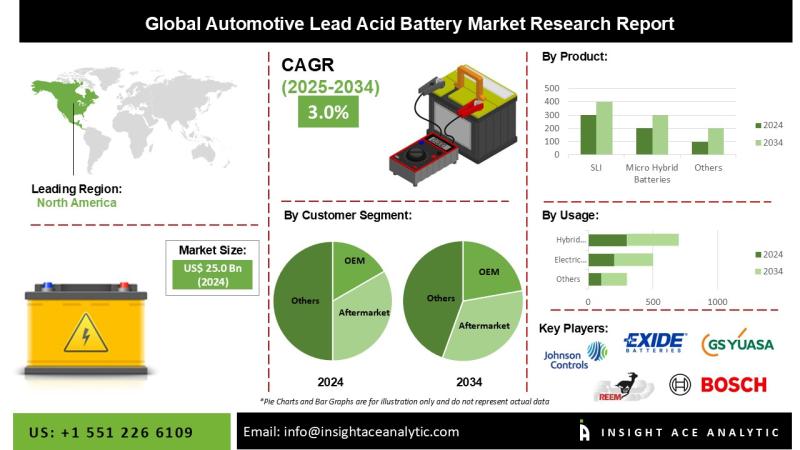

Automotive Lead Acid Battery Market Strategic Growth Drivers and Outlook 2026 to …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Lead Acid Battery Market Size, Share & Trends Analysis Report By Product (SLI and Micro-Hybrid Batteries), Type (Flooded, Enhanced Flooded, and VRLA), Customer Segment (OEM and Aftermarket), End User (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheeler, and Three-Wheeler), and Application (Hybrid Vehicles, Electric Vehicles, Light Motor Vehicles, and Heavy Motor Vehicles)- Market…

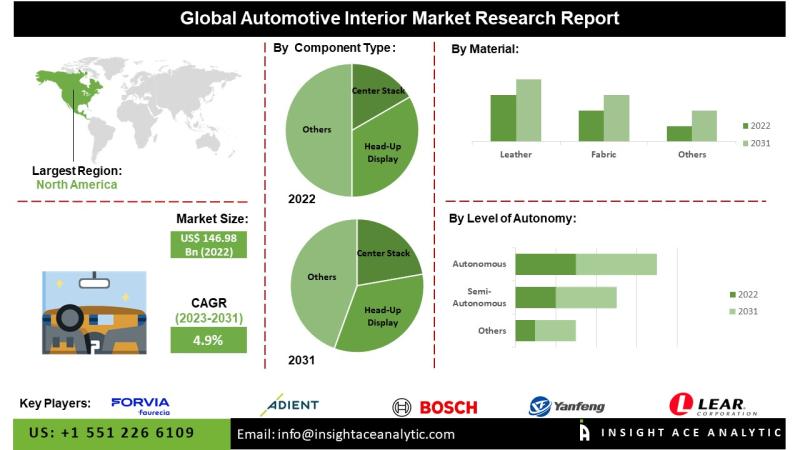

Automotive Interior Market Investment Opportunities and Forecast 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Interior Market- (By Component Type (Center Stack, Head-up Display, Instrument Cluster, Rear Sear Entertainment, Dome Module, Headliner, Seat, Interior Lighting Door Panel, Center Console, Adhesives & Tapes, Upholstery, Others), By Material (Leather, Fabric, Vinyl, Wood, Glass Fiber Composite, Carbon Fiber Composite, Metal), By Level of Autonomy (Semi-Autonomous, Autonomous, Non-Autonomous),By Electric Vehicle (Battery Electric Vehicle…

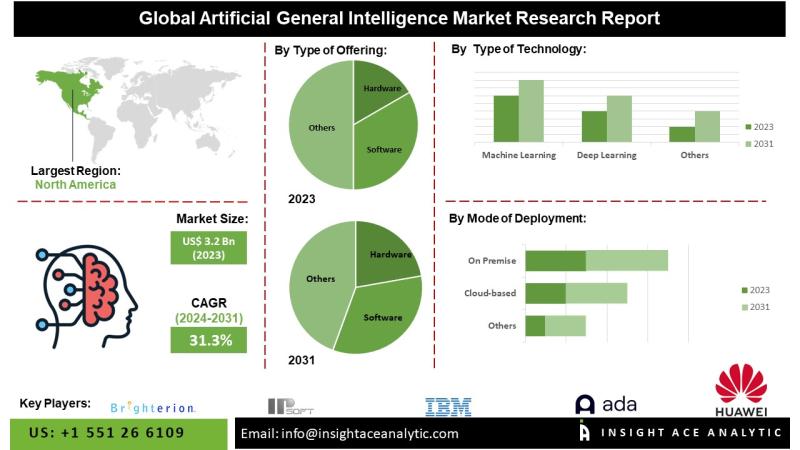

Artificial General Intelligence Market Future Landscape and Industry Evolution 2 …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Artificial General Intelligence (AGI) Market - (By Type of Offering (Hardware, Software and Service), Type of Technology (Machine Learning, Deep Learning, Natural Language Processing and Robotics), Mode of Deployment (Cloud-based, On Premise and Web-based), Type of AI (Weak AI, Strong AI and Superintelligence), Type of Processing (Image, Text and Voice Processing), Company Size (SMEs and…

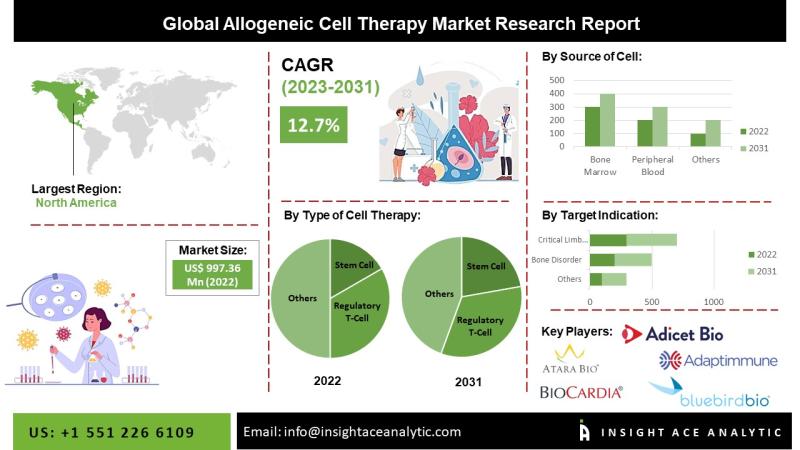

Allogenic Cell Therapies Market Revenue Trends and Growth Potential 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Allogenic Cell Therapies Market- by Cell Type(Cardiosphere-Derived Cells (CDCs), Fibroblasts, T-cells, Mesenchymal Stem Cells (MSCs), Hematopoietic Stem Cells (HSCs) and Others),Tissue Source(Skin, Blood, PBC, BM and Others), Indication (Acute graft-versus-host disease (GVHD), Chronic Ulcers and Diabetic Foot Ulcers, Osteoarthritis, Crohn's Disease, Cardiovascular Disease, Solid Tumors/Cancers and Others (Alzheimer's Disease, etc.)), Trends, Industry Competition Analysis, Revenue…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…