Press release

Cold Chain Packaging Market to Reach USD 91,034 Million by 2031 Top 20 Company Globally

Cold chain packaging comprises the materials, insulated containers, refrigerants (gel packs, dry ice, phase-change materials), vacuum-insulated panels, active and passive shippers, and associated protective materials used to preserve temperature-sensitive products during storage and transport; it spans single-use insulated boxes and gel packs for e-commerce food delivery, multi-use reusable pallets and rigid shippers for pharmaceutical and biologics logistics, and engineered turnkey systems for long-duration international shipments. The category is function-driven: buyers choose solutions by required temperature window (frozen, frozen-deep, chilled 28 °C, or controlled-room), transit duration, regulatory/validation needs (ICH guidelines for pharma) and sustainability or cost targets. Suppliers therefore sell a wide palette of materials and services from low-cost EPS coolers plus ice/gel packs used by food retailers to high-value reusable pallet shippers, containerized active refrigeration, and validated pharmaceutical shippers with data-logging and qualification protocols. The economic value of the market sits at the intersection of growing perishable-food e-commerce, global biologics and vaccine distribution, and regulatory pressure to reduce spoilage and product loss across long, complex supply chains.The global cold chain packaging market in 2024 is approximately USD 37,057 million. With a central CAGR of 13,9% to 2031, the market value is projected to reach USD 91,034 million in 2031. The global average ASP is USD 600 per unit, the market implies 61,7 million packages in 2024.

Latest Trends and Technological Developments

The cold chain packaging sector in 2024 to 2025 is being reshaped by three linked trends: reusable systems and circular models, higher-performance passive materials (vacuum-insulated panels and advanced phase-change materials), and embedded digital monitoring and qualification services. Notable dated developments that illustrate these shifts include Sonoco ThermoSafes partnership activity and market repositioning (Sonoco and Saudia Cargo master lease agreement announced October 2024) and more recent commercial moves in 2025: ThermoSafe launched a biodegradable EPS pallet shipper on April 2025, demonstrating how suppliers are combining performance with improved end-of-life profiles, and Sonoco was reported for a possible sale in September 2025 as private equity interest rose an indicator of investor appetite for the segment. In 2025 there is also prominent industry emphasis on reusable programs and logistics partnerships: multiple suppliercarrier pilots and a SonocoDHL reusable packaging program reference in Q2 2025 highlight the operational pivot to leased reusables and master-lease programs that lower total cost of ownership. Additionally, supply-chain and tariff volatility reported in mid-2025 has accelerated near-shoring and rental fleets for passive shippers, while recent market commentary (June 2025) flags growth in pharma-grade validated shippers as biologics distribution expands. These dated signals show that sustainability, reusability, and validated pharma solutions are the most material near-term innovation vectors in the market.

Asia Pacific is both a major consumption market and a manufacturing hub for cold chain packaging components. The region hosts large food-processing, aquaculture and retail e-commerce volumes that drive high unit demand for single-use insulated shippers, gel packs and last-mile chilled packaging; it simultaneously accommodates expanding pharmaceutical manufacturing and biologics exports that increase demand for validated tertiary packaging and reusable systems. Country-level signals include rapid infrastructure investment in China and India for cold storage, Southeast Asias growing e-commerce and food-delivery ecosystems, and Malaysia, Thailand and Vietnams development of pharma-packaging and contract packaging capabilities. Several regional trackers show Asia Pacific taking a dominant share of unit volumes by virtue of food shipments, with higher-value pharma packaging increasingly sourced from global suppliers and local converters. For investors and suppliers, the implication is twofold: scale production and local distribution reduce landed costs for high-volume food shippers, while regional service and validation capabilities (calibration labs, rental depots) are required to capture premium pharmaceutical demand.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5046215

Cold Chain Packaging by Type:

Single use Packaging

Reusable Packaging

Cold Chain Packaging by Application:

Food

Agro Product

Healthcare

Pharmaceuticals

Others

Global Top 20 Key Companies in the Cold Chain Packaging Market

Sonoco ThermoSafe

Cryopak

Sofrigam

Polar Tech

Softbox

CSafe

IPC

Pallite

Tempack

Nordic Cold Chain Solutions

Atlas Modled Products

Cleangas

Therapak

Pelican BioThermal

Thermal Shield

Shanghai SCC Environmental Technology

Dryce

Thermal Shipping Solution

Sealed Air

PAC Worlwide

Regional Insights

Within Southeast Asia, ASEAN is an expanding opportunity where growth is driven by rapid urbanization, booming food-delivery services, expanding cold storage capacity and increasing regional manufacturing of consumer foods and pharmaceuticals. Indonesia ASEANs largest population market shows strong expansion in cold-chain logistics and rising demand for insulated shippers, palletized reusables for B2B food distribution and vaccine/biologics handling as domestic manufacturing scales. Country-level studies put Indonesias broader cold chain logistics market in the multi-billion USD range (various 2024 estimates around the low-single-digit billions), and this growth translates into higher unit demand for packaging in both single-use and reusable formats. Across ASEAN, price sensitivity pushes many buyers toward lower-cost passive systems and outsourced rental fleets, but pharmaceutical clients in Singapore and Malaysia demand validated, high-spec shippers; therefore a dual strategy local, low-cost production plus selective premium rental/validation services works best for suppliers targeting the region.

The cold chain packaging market must manage at least five headwinds that influence margins and adoption. First, sustainability and regulatory pressure are increasing: single-use EPS and plastics face brand and legislative pushback, driving R&D and higher cost for biodegradable, recyclable or reusable solutions. Second, supply-chain and tariff shifts in 20242025 have raised component and freight costs and encouraged near-shoring, which adds short-term capex and planning complexity for suppliers. Third, validated pharmaceutical shippers require expensive qualification, qualification-document management and high liability cover raising capital and working-capital needs for vendors serving biologics. Fourth, the sector mixes extremely low-ASP commodity sales with high-ASP reusable and active systems, which creates margin-management complexity and investment timing risk for firms that try to serve both ends of the market. Fifth, operational challenges in reuse models reverse logistics, cleaning/sterilization, and depot networks mean that reusables only become attractive at scale and require new commercial partnerships with logistics providers. These challenges are visible in supplier press and industry reports.

The companies that capture disproportionate value will be those that combine product engineering (high-performance passive materials and durable reusables), data and qualification services (end-to-end temperature validation, IoT sensors and telemetry), and logistics partnerships (carrier master-lease, depot networks). For food-centric volumes, low-cost local manufacturing and supply contracts with e-commerce platforms reduce landed cost and secure volume; for pharmaceutical and biologics customers, validated shippers, multi-temperature modular systems and managed rental fleets with full traceability create sticky, higher-margin revenue. Investors should therefore prioritize asset-light rental/lease platforms with signed carrier or buyer contracts, suppliers that have credible sustainability roadmaps (biodegradable EPS, recyclable PCMs) and firms that offer integrated digital traceability to prove chain integrity and reduce spoilage claims. Partnerships between packaging firms and major carriers or contract logistics providers have become a decisive strategic pattern in 20242025.

Product Models

Cold chain packaging is essential for ensuring the safe transport of temperature-sensitive goods such as pharmaceuticals, biologics, vaccines, and perishable foods. It maintains product integrity during storage and transportation by controlling thermal conditions.

Single Use Packaging designed for one-way shipping with cost efficiency. Notable products include:

TheraFlex Single-Use Shipper Softbox Systems (Now CSafe): Optimized for pharmaceuticals with pre-qualified thermal performance.

CoolGuard PCM Parcel Sonoco ThermoSafe: Provides controlled temperature using phase-change material panels.

Va-Q-One Single-Use Shipper va-Q-tec: Vacuum-insulated packaging designed for high-value goods.

BioCool EPS Single-Use Shipper Intelsius: Expanded polystyrene system for life science logistics.

Nordic Ice EPS Insulated Shipper Nordic Cold Chain Solutions: Designed for food and biologics shipments with gel packs.

Reusable Packaging built for durability and repeated use to reduce long-term costs and environmental impact. Examples include:

Credo Cube® Reusable Shipper Pelican BioThermal: Rugged reusable container with extended hold times.

CSafe RAP Reusable Container CSafe Global: Active temperature-controlled container for air cargo.

Envirotainer RKN e1 Envirotainer: Active reusable container with battery-powered cooling system.

Va-Q-Tainer Reusable System va-Q-tec: High-performance vacuum-insulated reusable packaging.

TheraPal Reusable Parcel Softbox Systems (CSafe): Sustainable solution for pharma logistics with PCM cooling.

Cold chain packaging is a large, fast-growing market driven by rising perishable food e-commerce, the expansion of biologics and vaccine logistics, and sustainability-driven shifts to reusables and recyclable materials. Our reconciled estimate places the 2024 market at approximately USD 37,057 million with a central modeled CAGR of 13,9% to 2031, producing substantial revenue growth opportunities for suppliers that can service both high-volume food channels and high-value pharmaceutical logistics. Asia Pacific led by China, India and expanding ASEAN hubs including Indonesia will supply the majority of unit volumes and will also be the staging ground for reusable depot networks and localized manufacturing that reduce landed cost. The near-term winners will be suppliers that pair validated pharma-grade systems and digital telemetry with commercial rental models and sustainability roadmaps that address EPR and customer ESG requirements.

Investor Analysis

For investors the what is exposure to a mission-critical, recurring revenue market that mitigates food waste and preserves high-value biologics; the how is to capture value through three repeatable plays: (1) invest in rental/lease platforms or depot networks that convert cyclical hardware purchases into recurring revenue and improve unit economics for buyers; (2) back specialty suppliers that sell validated, high-ASP pharma shippers and data-services (validation, IoT telemetry) where margins are higher and barriers are significant; and (3) finance local manufacturing or near-shoring initiatives that shorten lead times and insulate margins from tariff/freight shocks. The why is that rising biologics volumes, stricter regulatory validation needs, and food-delivery growth produce sustained unit demand and create natural lock-in for suppliers who can deliver validated, traceable solutions and manage reverse logistics for reusables. Diligence priorities should include a suppliers contract backlog with carriers or pharmaceutical customers, depot footprint and reverse-logistics capability, validated temperature-profile test results, and sustainability credentials (recyclable materials or effective reuse economics) because these factors materially affect lifetime value and price elasticity.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5046215

5 Reasons to Buy This Report

It reconciles leading public trackers into a defensible 2024 baseline and provides a clear CAGR to 2031 so investors and procurement teams can model demand and capex.

It translates revenue to practical shipment volumes using transparent ASP scenarios and shows implied unit ranges for 2024 useful for capacity, replacement and depot-planning.

It catalogs dated, material industry developments that affect procurement, sustainability and M&A timing.

It provides regionally granular insight for APAC and ASEAN (including Indonesia) so go-to-market plans can prioritize local assembly, depot networks and carrier partnerships to reduce landed cost.

It identifies strategic levers rental/lease models, validated pharma shippers, and digital telemetry that drive recurring revenues and premium pricing for suppliers and create defensible investment theses.

5 Key Questions Answered

What is a defensible global market size for cold chain packaging in 2024 and which CAGR should be used to model growth to 2031?

What realistic price-per-package bands apply across the market and what shipment volumes do those prices imply for 2024?

Which dated commercial and technology developments (20242025) are materially changing supply economics and sustainability expectations?

How will Asia and ASEAN influence unit growth and where should suppliers invest in depots, conversion and rental infrastructure?

Which business models create predictable cash flows and which supply-chain assets matter most for due diligence?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cold Chain Packaging Market to Reach USD 91,034 Million by 2031 Top 20 Company Globally here

News-ID: 4185387 • Views: …

More Releases from QY Research

Top 30 Indonesian Shampoo Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Unilever Indonesia Tbk (UNVR) Personal care leader with shampoo, body care & hygiene products.

PT Victoria Care Indonesia Tbk (VICI) Cosmetics & body care with hair care/shampoo lines.

PT Kino Indonesia Tbk (KINO) Broad personal care portfolio including shampoos.

PT Mandom Indonesia Tbk (TCID) Grooming & personal care products.

PT Mustika Ratu Tbk (MRAT) Heritage cosmetics & personal…

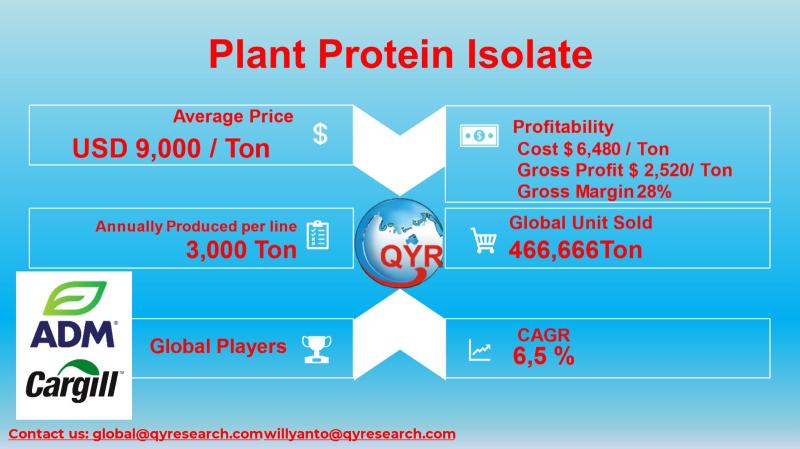

From Soy to Pea: Global Protein Isolate Demand & Strategic Investment Insights

Plant protein isolates are high-purity protein ingredients (≥90% protein) extracted from plant sources (e.g., soy, pea, rice, wheat) used in food, beverage, nutrition, and feed applications.

Rising global demand is driven by health consciousness, dietary shifts towards plant-based nutrition, sustainability concerns, and growth in functional foods.

Global Market Size (2025): USD 4,200 million

Global Market Size (2032): USD 6,420 million

CAGR (2025 to 2032): 6.5%

Average Global Price: USD 9,000/ton

Total Units Sold (Global): 466,666…

Infant Sleep Monitor Market to Reach USD 1.4B: AI, Asia Growth & 45% Margins Dri …

The global Infant Sleep Monitor market covers smart, connected devices designed to track infant breathing, heart rate, oxygen levels, sleep patterns, movement, and room conditions to improve neonatal safety and parental peace of mind.

Products range from wearable sock-based monitors, under-mattress sensors, camera-AI systems, and multi-sensor baby stations integrated with mobile apps and cloud analytics.

Adoption is accelerating due to rising parental awareness of sudden infant risks, increasing dual-income households, and rapid…

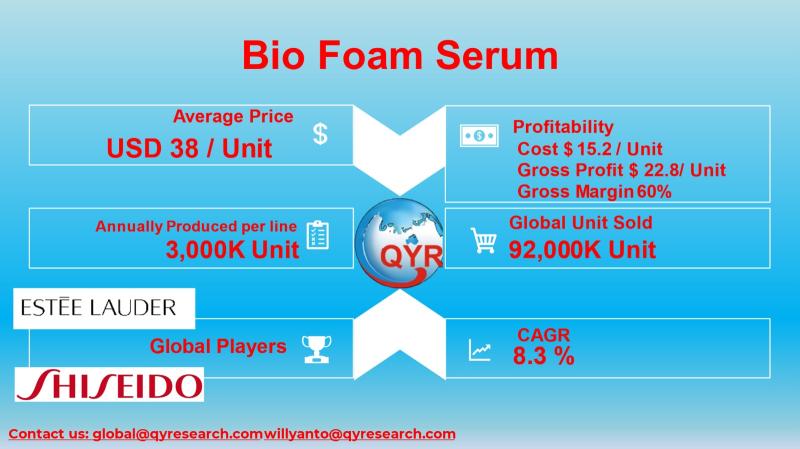

High Margin, Low Capex: Inside the Bio Foam Serum Manufacturing Boom

Bio Foam Serums are next-generation bio-based, lightweight, foaming personal care and dermatological treatment serums formulated using plant-derived surfactants, fermentation actives, and biodegradable foaming agents.

Products combine serum efficacy + mousse/foam delivery, enabling:

Faster absorption

Lower preservative load

Reduced packaging weight

Improved hygiene dosing

Widely adopted in skincare, cosmeceuticals, acne treatment, scalp therapy, wound care, and baby care.

Growing alignment with clean beauty, vegan, and sustainable packaging trends.

Global Industry Overview

2025 Global Market Size: USD 3,496 million

2031 Global Market…

More Releases for Cold

Cold Chain Market Growth 2025 | Global Cold Storage & Logistics Trends, Top key …

Cold Chain Market, as analyzed in the study by DataM Intelligence, presents a detailed overview of the industry with in-depth insights, historical data, and key statistics. The report thoroughly examines market dynamics, competitive strategies, and major players, highlighting their product lines, pricing structures, financials, growth plans, and regional outreach.

The Global Cold Chain Market ie estimated to reach at a CAGR of 9.28% during the forecast period 2024-2031.

Get a Premium Sample…

Cold Storage Construction Market Next Big Thing | Nichirei Logistics Group, Clov …

Latest Study on Industrial Growth of Cold Storage Construction Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Cold Storage Construction market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends…

Cold Forming and Cold Heading Market SWOT analysis, Growth, Share, Size and Dema …

The global cold forming and cold heading market was valued at US$ 18.0 billion in 2021 and it is anticipated to grow up to US$ 31.0 billion by 2031, at a CAGR of 5.3% during the forecast period.

New York, Global Cold Forming and Cold Heading Market report from Global Insight Services is the single authoritative source of intelligence on Cold Forming and Cold Heading Market . The report will provide…

Indonesia Cold Chain Logistics Market : Cold Storage and Cold Chain Transport In …

According to a recent report published by Allied Market Research, titled, "Cold Chain Logistics Market by Business Type, End-Use Industry, Product, and Technology: Indonesia Opportunity Analysis and Industry Forecast, 2022-2031," the Indonesia cold chain logistics market was valued at $4.97 billion in 2021, and is projected to reach $12.59 billion by 2031, registering a CAGR of 10.2% from 2022 to 2031.

Download Report Sample PDF : https://www.alliedmarketresearch.com/request-sample/4973

Indonesia cold chain logistics market…

Global Cold chain Market Forecast to 2025 | Industry Analysis By Cloverleaf Cold …

The Global Cold Chain Market is expected to see progress in the coming period from 2018 to 2025 due to growing demand at the end-user level. In 2018-2025, the Global Cold Chain Market will establish monumental growth. Global Cold Chain Market Report also provides the latest developments and contracts awarded across different regions in the Global Blood Screening industry. Using the SWOT analysis, market drivers and constraints are detected. This…

Cold Chain Monitoring Market to WItness Outstanding Growth | Cloverleaf Cold Sto …

The Executive outline consists of a comprehensive outline of the world Cold Chain Monitoring market. This comprehensive outline includes the general global Cold Chain Monitoring market outlook, and also the numerous trends within the supply and demand sides of the market. additionally, this section offers business growth-related recommendations and opportunities to appear forward to within the world Cold Chain Monitoring market. The forecast correlational analysis has been added at…