Press release

Global Wedding Loans Market Size, Share, Forecast 2023 - 2033 | Top key players : LightStream, Lending Club, Discover Personal Loans, Earnest, SunTrust, Prosper Marketplace, Oportun, Finance of America, Marcus by Goldman Sachs, American Express, SoFi, Ups

According to a research report published by Spherical Insights & Consulting, the Global Wedding Loans Market Size Expected to Grow from USD 3.75 Billion in 2023 to USD 6.85 Billion by 2033, at a CAGR of 6.21% during the forecast period 2023-2033.Request To Download Free Sample copy of the report @ -

https://www.sphericalinsights.com/request-sample/7746

A wedding loan, often referred to as a marriage loan, is a sort of personal loan meant to enable consumer who need money to pay for wedding-related obligations. It can make it simpler for insurers to manage wedding-related expenditures, whether they are related to venue reservations, catering, décor, or buying bridal gowns and jewellery. Furthermore, the primary drivers of the wedding loans market are the growing acceptance of non-traditional weddings, the growing cost of weddings, and the growing appeal of destination weddings. Destination weddings have become more and more popular in recent years as couples look to create unique and memorable experiences for both themselves and their guests. Additionally, wedding costs have been increasing, as seen by the fact that the average wedding in the US currently costs over $30,000. However, the high interest rates on wedding loans are limiting the market's growth by making them a less desirable option for couples looking to finance their wedding.

Buy Now this report:

https://www.sphericalinsights.com/checkout/7746

The small loans segment is expected to hold the largest share of the global wedding loans market during the projected timeframe.

Based on loan amount, the global wedding loans market is categorized as small loans, medium loans, and large loans. Among these, the small loans segment is expected to hold the largest share of the global wedding loans market during the projected timeframe. Large loans are the most prevalent in this category, allowing couples to plan extravagant weddings with all the extras and luxuries that guests want. The increasing trend of wedding personalization, which drives couples to look for specialized financial solutions to realize their dream celebrations, is driving market growth.

The fixed interest rate segment is expected to grow at the fastest CAGR during the projected timeframe.

Based on the interest rate, the global wedding loans market is categorized as fixed interest rate and floating interest rate. Among these, the fixed interest rate segment is expected to grow at the fastest CAGR during the projected timeframe. This is because it provides clients with a clear view of the monthly payments and the total loan amount. Predictability and transparency are advantageous to couples organizing a wedding since they help them better manage their money and steer clear of unforeseen expenses.

North America is projected to hold the largest share of the global wedding loans market over the forecast period.

North America is projected to hold the largest share of the global wedding loans market over the forecast period. Rising wedding costs are currently drive the wedding loan business in North America and escalating the desire for the perfect wedding among many couples. Since many couples in North America are searching for brides and appropriate venues for the ceremony, the cost of the wedding has gone up. The number of North Americans trying to get loans to pay for these costs rises dramatically as a result.

Asia-Pacific is expected to grow at the fastest CAGR growth of the global wedding loans market during the forecast period. The convenience, speed, and personalized solutions offered by lenders have led to an increase in the local wedding loan market. This is due to the flexibility of loan amounts and conditions; couples can now more easily obtain the funds they require to finance their dream weddings. Since they offer an alternate perspective on this age-old problem that can be tailored to meet various financial goals and mindsets, stretch loans have grown in popularity as an alternative to traditional wedding financing.

Major vendors in the global wedding loans market are LightStream, Lending Club, Discover Personal Loans, Earnest, SunTrust, Prosper Marketplace, Oportun, Finance of America, Marcus by Goldman Sachs, American Express, SoFi, Upstart, Avant, and others.

Key Target Audience

Market Players

Investors

End-users

Government Authorities

Consulting and Research Firm

Venture capitalists

Value-Added Resellers (VARs)

Key Market Development

In December 2023, a prominent financial services company and part of the prestigious Tata Group, Tata Capital, unveiled a state-of-the-art new loan app that offers customized wedding finance. The app offers instant paperless approval for loans for which customers are pre-qualified. By following a simple application, check, and fund transfer process, borrowers can get funds without having to deal with time-consuming paperwork.

Access Full Report:

https://www.sphericalinsights.com/reports/wedding-loans-market

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global wedding loans market based on the below-mentioned segments:

Global Wedding Loans Market, By Loan Amount

Small Loans

Medium Loans

Large Loans

Global Wedding Loans Market, By Interest Rate

Fixed Interest Rate

Floating Interest Rate

Global Wedding loans Market, By Regional

North America

US

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

Russia

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

Australia

Rest of Asia Pacific

South America

Brazil

Argentina

Rest of South America

Middle East & Africa

UAE

Saudi Arabia

Qatar

South Africa

Rest of the Middle East & Africa

Industry Related Reports

Germany Compound Feed Market Size

https://www.sphericalinsights.com/reports/germany-compound-feed-market

Germany Compressed Biscuit Market Size

https://www.sphericalinsights.com/reports/germany-compressed-biscuit-market

South Korea Copper Oxychloride Fungicides Market Size

https://www.sphericalinsights.com/reports/south-korea-copper-oxychloride-fungicides-market

South Korea Copra Cake Market Size

https://www.sphericalinsights.com/reports/south-korea-copra-cake-market

France Contract Research Organization Market Size

https://www.sphericalinsights.com/reports/france-contract-research-organization-market

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Wedding Loans Market Size, Share, Forecast 2023 - 2033 | Top key players : LightStream, Lending Club, Discover Personal Loans, Earnest, SunTrust, Prosper Marketplace, Oportun, Finance of America, Marcus by Goldman Sachs, American Express, SoFi, Ups here

News-ID: 4182577 • Views: …

More Releases from Spherical Insights LLP

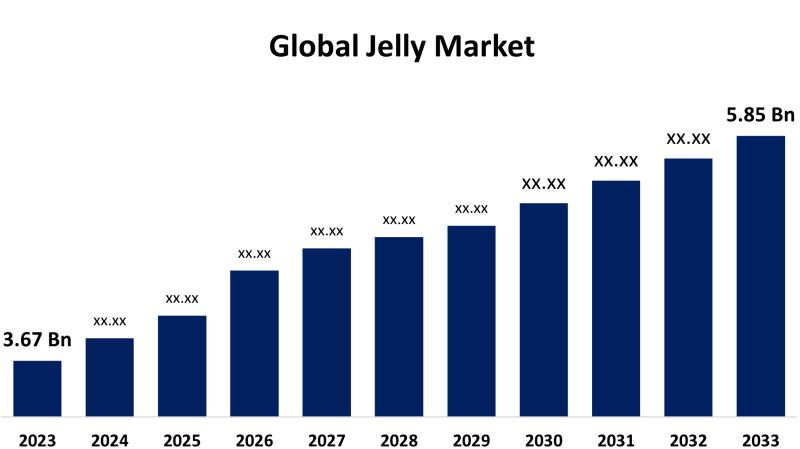

Global Jelly Market Size, Share, Forecasts 2023 - 2033 | Top key players: Bonne …

According to a research report published by Spherical Insights & Consulting, the Global Jelly Market is Expected to Grow from USD 3.67 Billion in 2023 to USD 5.85 Billion by 2033, at a CAGR of 4.77% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report: https://www.sphericalinsights.com/request-sample/8511

The jelly industry comprises the international sector dealing with the manufacture, distribution, and sale of jelly products. Such products cover…

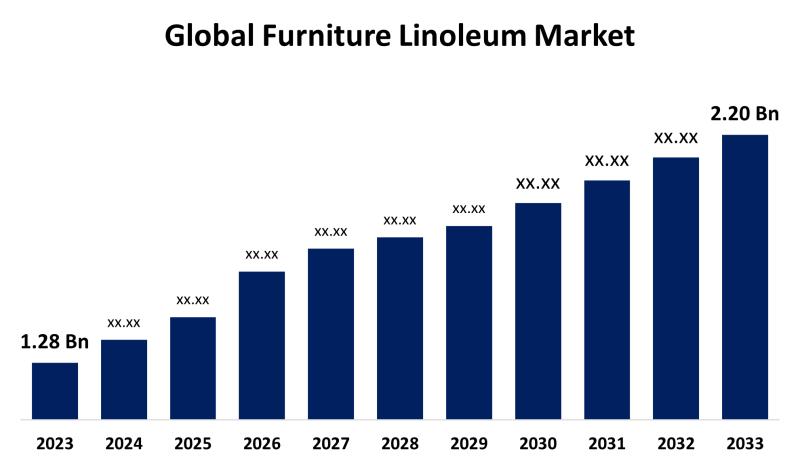

Global Furniture Linoleum Market Size, Share, Forecasts 2023 - 2033 | Top key pl …

According to a research report published by Spherical Insights & Consulting, the Global Furniture Linoleum Market Size is Estimated to Grow from USD 1.28 billion in 2023 to USD 2.20 billion by 2033, Growing at a CAGR of 5.57% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report: https://www.sphericalinsights.com/request-sample/8455

The industry engaged in the manufacture, marketing, and distribution of linoleum products, especially made for furniture…

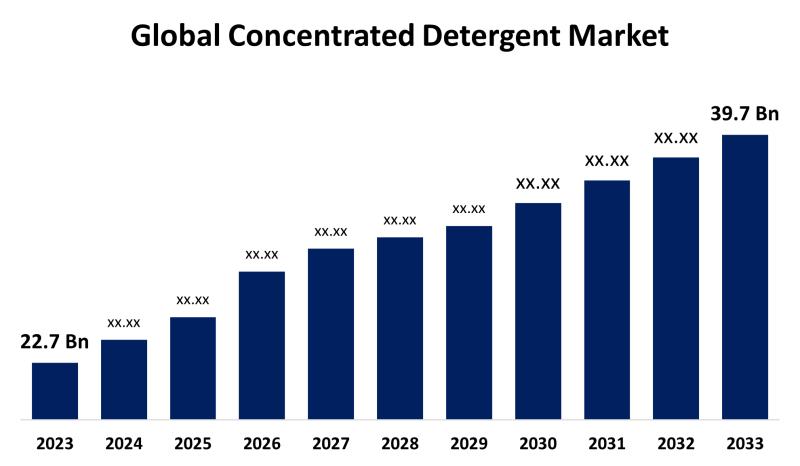

Global Concentrated Detergent Market Size, Share, Forecasts 2023 - 2033 | Top ke …

According to a research report published by Spherical Insights & Consulting, the Global Concentrated Detergent Market Size Expected to Grow from USD 22.7 Billion in 2023 to USD 39.7 Billion by 2033, at a CAGR of 5.75% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report: https://www.sphericalinsights.com/request-sample/8439

The division of the detergent industry that produces and markets highly concentrated…

Global Wireless Home Weather Station Market Size, Share, Forecast 2023 - 2033 | …

According to a research report published by Spherical Insights & Consulting, the Global Wireless Home Weather Station Market Size is Expected to Grow from USD 249 Million in 2023 to USD 508 Million by 2033, at a CAGR of 7.39% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report @ -

https://www.sphericalinsights.com/request-sample/7694

A system that measures and sends environmental data from outside to within, including temperature,…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…