Press release

Biodiversity and Natural Capital Credit Market: Size, Growth, and Future Outlook (2025-2032)

Biodiversity and Natural Capital Credit Market Size and GrowthThe biodiversity and natural capital credit market has been gaining significant momentum in recent years as sustainability becomes central to corporate, government, and investor strategies. Valued at $6.0 billion in 2024, the market is projected to expand rapidly, reaching $7.42 billion in 2025 and soaring to $37.55 billion by 2032. This reflects a striking compound annual growth rate (CAGR) of 26.1% during the forecast period from 2025 to 2032.

The strong growth trajectory of this market is being driven by multiple forces. Increasing corporate ESG commitments, growing adoption of net-positive biodiversity goals, supportive government regulations, and rising investor interest in natural capital as an asset class are key contributors. Consumer demand for environmentally responsible products and global frameworks such as the Kunming-Montreal Global Biodiversity Framework are also providing a solid foundation for expansion.

Download Sample Report Here : https://www.meticulousresearch.com/download-sample-report/cp_id=6154

Key Drivers Behind Market Expansion

Companies across industries are under greater pressure from regulators, investors, and customers to go beyond reducing carbon emissions and address broader environmental challenges. This shift has led to a surge in corporate investment in biodiversity and natural capital initiatives. Many organizations are now embedding biodiversity considerations into their ESG strategies, targeting not just emission reductions but also ecosystem restoration, species protection, and maintenance of natural services such as pollination and soil fertility.

The biodiversity credit system offers businesses an opportunity to demonstrate environmental responsibility while achieving measurable conservation outcomes. By purchasing credits linked to habitat restoration or ecosystem services, companies can offset their impacts and show progress toward sustainability goals. This evolving market is increasingly viewed as a credible tool to foster nature-positive outcomes and align business practices with global biodiversity commitments.

Another major driver comes from international agreements such as the Kunming-Montreal Global Biodiversity Framework. Adopted in 2022, the framework sets ambitious global targets for halting biodiversity loss and restoring ecosystems by 2030. It has encouraged corporations and governments alike to align with these goals, using mechanisms like biodiversity credits as a way to channel finance into nature-based solutions.

Why are companies investing in biodiversity and natural capital credits instead of limiting their focus to carbon offsets?

While carbon offsets remain an important tool for climate strategies, biodiversity credits provide broader environmental benefits. Many carbon mitigation projects involve restoring forests or managing land sustainably, which inherently supports biodiversity. However, biodiversity credits go a step further, focusing on ecosystem restoration, habitat preservation, and species protection. For companies, investing in these credits demonstrates a deeper commitment to environmental stewardship, strengthens ESG performance, and provides reputational advantages. Moreover, as global frameworks increasingly recognize the economic value of natural capital, businesses adopting biodiversity credits position themselves at the forefront of the transition toward a sustainable economy.

Browse in Depth : https://www.meticulousresearch.com/product/biodiversity-and-natural-capital-credit-market-6154

Opportunities and Market Trends

The integration of biodiversity credits with carbon markets is one of the most promising opportunities. Bundled credits allow companies to offset carbon emissions while simultaneously investing in biodiversity conservation, creating efficient, holistic solutions for meeting sustainability goals. This combined approach attracts a wider pool of investors and enhances the environmental impact of corporate initiatives.

Technological innovations are also shaping the market. Tools such as remote sensing, AI-based monitoring, and environmental DNA analysis are improving the accuracy of biodiversity measurement and verification. Blockchain technology is emerging as a critical enabler of transparency and trust, ensuring that biodiversity credits are traceable, verifiable, and free from fraud. These innovations strengthen credibility and make biodiversity credits more appealing to investors and corporate buyers.

Another important trend is the development of biodiversity-linked financial instruments and credit rating systems. These mechanisms aim to standardize how biodiversity outcomes are measured and valued, which will help overcome one of the biggest challenges facing the market: the lack of consistent methodologies and metrics.

Regional Market Outlook

In 2025, Europe is expected to lead the biodiversity and natural capital credit market. The region benefits from strong regulatory frameworks, well-established sustainability policies, and significant financial commitments to conservation. The European Green Deal has further accelerated demand, while countries like Germany, France, and the Netherlands are pioneers in integrating natural capital into economic planning.

Looking ahead, the Asia-Pacific region is expected to record the fastest growth. Rapid urbanization, economic expansion, and increasing recognition of severe biodiversity challenges are fueling demand. Countries such as China, India, and Australia are scaling up biodiversity and carbon credit systems, supported by government policies and rising corporate sustainability commitments. This region's growing environmental awareness and financial support for green initiatives position it as a key driver of future market growth.

Buy the Complete Report with an Impressive Discount: https://www.meticulousresearch.com/view-pricing/1471

Competitive Landscape and Industry Developments

The market is characterized by a mix of international and regional players focusing on conservation finance, biodiversity monitoring, and credit trading. Key players include Terrasos SAS (Colombia), BioCarbon Partners (Zambia), Ekos Kāmahi Ltd (New Zealand), Climate Asset Management (U.K.), GreenCollar Group (Australia), South Pole (Australia), and DGB Group (Netherlands), among others. These organizations are pioneering innovative biodiversity projects, establishing credit registries, and building partnerships that enhance global market reach.

Recent developments highlight the pace of investment in natural capital. In 2024, Climate Asset Management raised more than $1 billion to finance biodiversity and regenerative agriculture projects. In the same year, Terra Natural Capital was launched to scale carbon removal and natural asset projects. Ekos Kāmahi Ltd introduced a biodiversity market in New Zealand, and ClimateTrade partnered with Terrasos SAS to promote voluntary biodiversity credits using blockchain technology for transparency.

Toward a Nature-Positive Global Economy

The biodiversity and natural capital credit market is still at an early stage, but it is evolving rapidly into a critical component of global sustainability efforts. As companies, governments, and investors increase their commitments, the market is positioned to become a major channel for financing conservation and ecosystem restoration.

While challenges remain, such as high transaction costs, lack of standardized methodologies, and concerns over long-term conservation outcomes, the accelerating demand for nature-based solutions provides strong growth momentum. By integrating biodiversity into corporate strategies and investment frameworks, the market signals a shift toward a nature-positive global economy-one where economic growth and environmental restoration progress hand in hand.

About Us:

We are a trusted research partner for leading businesses worldwide, empowering Fortune 500 organizations and emerging enterprises with actionable market intelligence tailored to drive revenue transformation and strategic growth. Our insights reveal forward-looking revenue opportunities, providing our clients with a competitive edge through a diverse suite of research solutions-syndicated reports, custom research, and direct analyst engagement.

Each year, we conduct over 300 syndicated studies and manage 60+ consulting engagements across eight key industry sectors and 20+ geographic markets. With a focus on solving the complex challenges facing global business leaders, our research enables informed decision-making that propels sustainable growth and operational excellence. We are dedicated to delivering high-impact solutions that transform business performance and fuel innovation in the competitive global marketplace.

Contact Us:

Meticulous Market Research Pvt. Ltd.

1267 Willis St, Ste 200 Redding,

California, 96001, U.S.

Email- sales@meticulousresearch.com

USA: +1-646-781-8004

Europe: +44-203-868-8738

APAC: +91 744-7780008

Visit Our Website: https://www.meticulousresearch.com/

For Latest Update Follow Us:

LinkedIn- https://www.linkedin.com/company/meticulous-research

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Biodiversity and Natural Capital Credit Market: Size, Growth, and Future Outlook (2025-2032) here

News-ID: 4182138 • Views: …

More Releases from Meticulous Research®

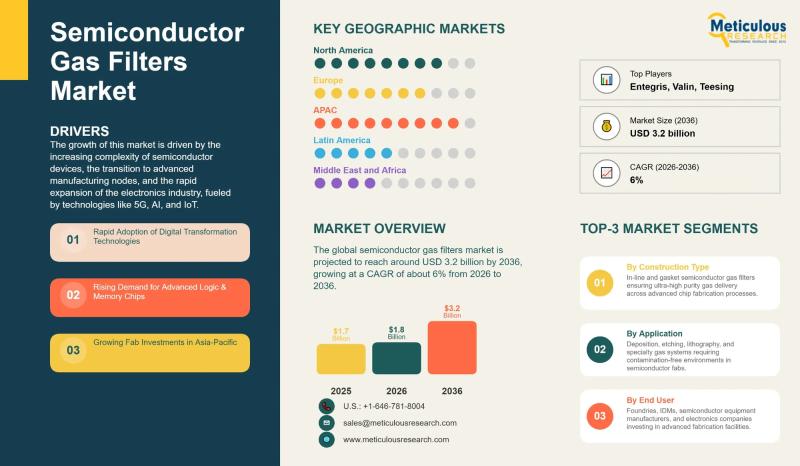

Semiconductor Gas Filters Market to Reach USD 3.2 Billion by 2036 | CAGR 6%

The global semiconductor gas filters market is estimated at USD 1.8 billion in 2026 and is expected to reach approximately USD 3.2 billion by 2036, expanding at an annual rate of 6% over the forecast period. This growth is being driven by the increasing complexity of semiconductor devices, the ongoing transition toward more advanced manufacturing nodes, and rapid expansion in applications like artificial intelligence, 5G, the Internet of Things, and…

Spatial Computing Market to Reach USD 1,231.1 Billion by 2036 | CAGR 21.8%

The global spatial computing market was valued at USD 142.4 billion in 2025 and is expected to reach USD 1,231.1 billion by 2036, growing at an annual rate of 21.8% over the period from 2026 to 2036. This rapid expansion is being driven by the widespread adoption of mixed reality, the integration of spatial AI, the continued rollout of 5G networks, and growing demand for technologies that blur the line…

Data Center Cooling Market to Reach USD 79.64 Billion by 2036 | CAGR 14.0%

The global data center cooling market was valued at USD 18.84 billion in 2025 and is expected to reach USD 79.64 billion by 2036, growing at an annual rate of 14.0% over the period from 2026 to 2036. This expansion is being driven by the rapid deployment of artificial intelligence, the integration of high-performance computing, the continued buildout of hyperscale data centers, and the growing need for cooling solutions that…

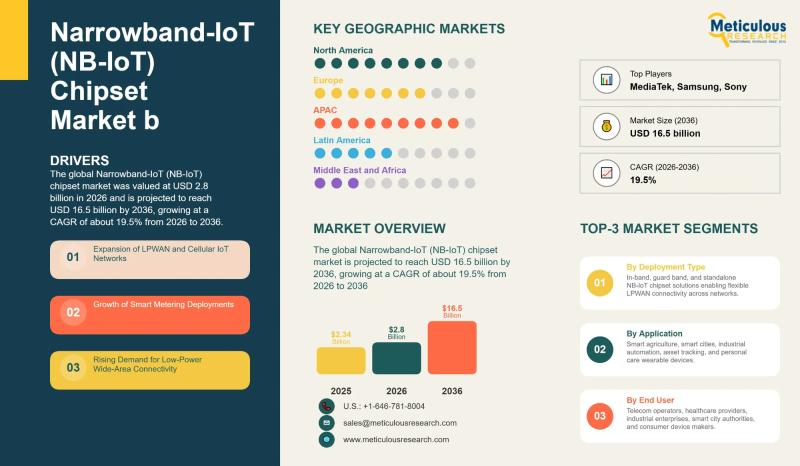

Narrowband-IoT (NB-IoT) Chipset Market to Reach USD 16.5 Billion by 2036 | CAGR …

The global Narrowband-IoT chipset market was valued at USD 2.8 billion in 2026 and is expected to reach USD 16.5 billion by 2036, growing at an annual rate of 19.5% over that period. This expansion is being driven by the rapid spread of IoT technology across industries, growing machine-to-machine communication, increasing use of wearable health monitoring devices, and smart city projects rolling out around the world.

Market Overview

NB-IoT chipsets provide low-power…

More Releases for Biodiversity

Biodiversity Conservation in Mining Market Outlook Supported by Regulatory Compl …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Biodiversity Conservation In Mining Market Size, Share & Trends Analysis Report By Component (Rehabilitation & Ecological Restoration, Mitigation & Biodiversity Offsets, Consulting, Permitting & Biodiversity Action Planning, Monitoring, Surveillance & Verification, and Others),-Market Outlook And Industry Analysis 2035"

Biodiversity Conservation In Mining Market is valued at US$ 3.24 Bn in 2025 and it is expected to…

Biodiversity Conservation in Mining Market Challenges in High Implementation Cos …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Biodiversity Conservation In Mining Market Size, Share & Trends Analysis Report By Component (Rehabilitation & Ecological Restoration, Mitigation & Biodiversity Offsets, Consulting, Permitting & Biodiversity Action Planning, Monitoring, Surveillance & Verification, and Others),-Market Outlook And Industry Analysis 2034"

Biodiversity Conservation In Mining Market is valued at US$ 3.0 Bn in 2024 and it is expected to…

Ten New Species Recorded in Liandu, Lishui, Zhejiang: Biodiversity Database Cont …

The Baer's Pochard, Oujiang Schizothoracin, Orange-vented Newt, Spotted-backed Forktail, Oriental Newt, Tiantai Rough-skinned Frog, Web-toed Gecko, Gunther's Grass Lizard, Taiwan Slug Snake, and Hook-billed Shrike... These wild animals have all been discovered in Liandu District, Lishui City, Zhejiang Province. Recently, the local authorities released the results of a wildlife resource survey, which recorded 10 new species, further enriching the biodiversity database. This discovery showcases the unique charm of nature and…

Recognizing Commitment to Biodiversity Promotion in Public and Private Sectors

On 22nd May, which marks the International Day for Biological Diversity, TAISE and the Forestry Bureau of the Council of Agriculture jointly organized the '2023 Taiwan Biodiversity Forum', in recognition of the global significance of biodiversity. Furthermore, TAISE established the inaugural 'Taiwan Biodiversity Awards' to acknowledge the endeavours of businesses, government agencies, and schools in biodiversity conservation. A total of twelve entities were honored with these awards.

The winners of the…

Creta Maris Beach Resort celebrates Biodiversity by holding special activities

Guided tour in the resort’s gardens, Information on the resort’s participation in Stray Animals’ Program, Traditional Sheep Shearing and Cheese-MakingOn the occasion of the International Day for Biological Diversity, Creta Maris Beach Resort’ Green Team organized a series of events during the last week of May, aiming to inform the resort’s guests about Creta Maris’ multi-level initiatives on environmental protection and the "We do local" standard.

The Biodiversity Week began with…

Assessing corporate impacts on the environment and biodiversity

Munich, 18 May 2011 - More and more companies are becoming EMAS or ISO 14.001 certified: companies becoming sustainable is not just a question of ensuring theirgood reputation, but is also intimately intertwined with strategic corporate processes. However, when it comes to the responsibility of companies for biodiversity, most companies lose their bearings. As part of the European Business and Biodiversity Campaign, the first ten companies performed a Biodiversity Check…