Press release

The Transaction Monitoring Market is Set to Reach USD 44.3 Billion by 2035, Driven by AI Innovation, Regulatory Compliance, and Cybersecurity Demand

The global Transaction Monitoring Market is forecast to reach USD 44.3 billion by 2035, growing from USD 11.8 billion in 2025 at a compound annual growth rate (CAGR) of 14.2%, according to a new market report. This robust growth reflects the increasing need for advanced monitoring solutions to address rising incidences of financial fraud, money laundering, and terrorism financing, alongside stringent regulatory mandates.Full Market Report Available. Inquire for Customization or Purchase:

https://www.futuremarketinsights.com/reports/sample/rep-gb-13149

Transaction monitoring solutions play a critical role in preventing illicit financial activities and ensuring compliance with global regulations. As the financial sector undergoes digital transformation, the market for these solutions is experiencing significant expansion. Technologies such as artificial intelligence (AI), machine learning (ML), and cloud-based platforms are revolutionizing the sector, enhancing real-time fraud detection, anomaly identification, and regulatory reporting.

Key Drivers of Growth

The demand for transaction monitoring is primarily driven by several factors:

Rising Financial Crimes: The global surge in cybercrime, including identity theft and fraud, has fueled the need for proactive transaction monitoring. Advanced systems help detect suspicious activities and secure digital payments, which are becoming more prevalent in today's economy.

Regulatory Pressures: Governments worldwide are enforcing stricter anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. Institutions must implement robust transaction monitoring systems to stay compliant with these regulations, further driving market growth.

Technological Advancements: AI-powered analytics and cloud computing are enhancing the scalability and flexibility of transaction monitoring solutions. By leveraging machine learning, these systems can predict and identify fraudulent patterns more effectively, improving both efficiency and accuracy.

SME Adoption: Small and medium-sized enterprises (SMEs) are increasingly adopting transaction monitoring solutions. These businesses, which are particularly vulnerable to cyber threats and regulatory pressures, benefit from affordable, scalable, cloud-based solutions that protect against fraud without significant infrastructure investment.

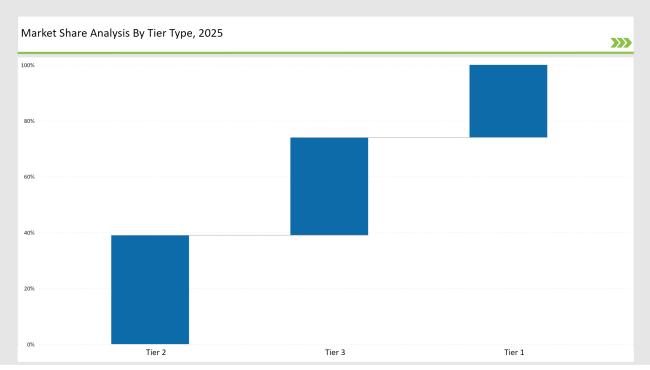

Segment Analysis

1. Transaction Monitoring Software:

The Transaction Monitoring Software segment is expected to dominate, accounting for 54.2% of market revenue by 2025. This segment's growth is driven by the increasing complexity of digital payment systems and cross-border transactions. The software's ability to offer automated, real-time monitoring, fraud detection, and regulatory compliance capabilities has made it a go-to solution for enterprises of all sizes.

2. SME Market Focus:

Small and medium-sized enterprises (SMEs) are projected to represent 47.6% of market revenue by 2025. With rising exposure to digital payment fraud, SMEs are increasingly adopting cost-effective, cloud-based monitoring solutions tailored to their specific needs. This market segment is expected to continue its growth trajectory, fueled by regulatory compliance demands and the need to mitigate fraud risks.

3. Customer Identity Management:

The Customer Identity Management segment, which helps verify customer identities and prevent fraudulent transactions, is projected to hold 42.9% of the market revenue by 2025. As identity theft and fraud become more common in digital transactions, this segment is poised for continued growth, with innovations in biometric authentication and Know-Your-Customer (KYC) compliance driving demand.

Regional Outlook: North America, Asia-Pacific, and Europe Lead

North America will remain the largest market for transaction monitoring solutions due to the increasing adoption of advanced digital technologies and stringent regulations regarding financial crimes. The U.S., in particular, is expected to see substantial market growth, bolstered by government policies focused on combatting money laundering and fraud.

Asia-Pacific is emerging as a key growth region, driven by expanding digital payment infrastructures and rising concerns over cybersecurity. Countries like India, Indonesia, and Malaysia are witnessing strong demand for transaction monitoring solutions, particularly in the banking, financial services, and insurance (BFSI) sectors.

Europe is also a significant player in the market, with financial institutions adopting sophisticated monitoring tools to comply with the European Union's regulatory requirements on money laundering and terrorist financing.

Competitive Landscape

The transaction monitoring market is highly competitive, with leading players such as Oracle Corporation, FICO, Fiserv, Inc., BAE Systems, Software AG, SAS, Experian plc, FIS, and Infrasoft Technologies dominating the market. These companies are investing heavily in R&D to incorporate advanced AI, machine learning, and cloud technologies into their solutions, ensuring they remain competitive in a rapidly evolving market.

Additionally, many companies are targeting SMEs with affordable, scalable solutions tailored to meet their specific needs, creating opportunities for further market expansion. The convergence of regulatory compliance and cybersecurity concerns is expected to drive further innovation and competition in the years to come.

Get Full Access of this Report:

https://www.futuremarketinsights.com/reports/transaction-monitoring-market

Explore Related Research Reports on Technology Domain

Mobile Analytics Market:

https://www.futuremarketinsights.com/reports/mobile-analytics-market

Online To Offline Commerce Market:

https://www.futuremarketinsights.com/reports/online-to-offline-commerce-market

Automotive Cyber Security Market:

https://www.futuremarketinsights.com/reports/automotive-cyber-security-market

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Transaction Monitoring Market is Set to Reach USD 44.3 Billion by 2035, Driven by AI Innovation, Regulatory Compliance, and Cybersecurity Demand here

News-ID: 4180216 • Views: …

More Releases from Future Market Insights Inc.

Degassing Valves - Top Europe Industry Trends in 2026

The global degassing valves market is on a steady growth trajectory, projected to reach USD 262.20 million by 2035, expanding at a 5% CAGR from 2025 to 2035. This momentum is fueled by rising demand for packaging solutions that preserve freshness, extend shelf life, and align with sustainability goals across industries such as coffee, processed foods, and pharmaceuticals. With coffee alone accounting for 55% of end-use demand, the market's expansion…

Active Packaging - Top Europe Industry Trends in 2026

The global Active Packaging market, long a quiet but vital enabler of product safety, is now drawing real spotlight: from an estimated USD 6.4 billion in 2024, it is projected to surge to USD 11.6 billion by 2034, growing at a robust compound annual growth rate (CAGR) of 6.1%. This data-rich narrative underscores how next-generation packaging technologies are reshaping supply chains, sustainability, and consumer trust.

Key Market Insights at a Glance

Active…

Japan Flexible Plastic Packaging Market to Reach USD 5.18 Bn by 2035 - Growth Su …

The Japan flexible plastic packaging market is undergoing a remarkable transformation, driven by a strong push toward sustainability, innovative materials, and high consumer demand for lightweight and eco-friendly packaging solutions. Market analysts project the industry to reach USD 11.6 billion by 2034, expanding at a CAGR of 4.5% from 2024 to 2034.

This growth reflects Japan's evolving consumer landscape and the increasing preference for recyclable and bio-based packaging materials across food,…

NCR Printers Market to Reach USD 3.6 Bn by 2035 - APAC, Europe, USA & Saudi Arab …

The global non-carbon‐receiving (NCR) printers market is accelerating, with market value projected to rise from approximately US $2.2 billion in 2025 to US $3.6 billion by 2035, reflecting a compound annual growth rate (CAGR) of around 5.1 percent. Driven by demand for real-time documentation, digital printing workflows and improved operational efficiencies, the NCR printers segment is rapidly evolving.

Key Market Insights at a Glance

• Market value estimated at ~US $2.2 billion in…

More Releases for Transaction

Key Trend Reshaping the Digital Transaction Management Market in 2025: Advanceme …

What Are the Projections for the Size and Growth Rate of the Digital Transaction Management Market?

The digital transaction management market will grow from $14 billion in 2024 to $17.36 billion in 2025, at a CAGR of 23.9%. This is driven by the digitization of business processes, advancements in mobile technology, cloud computing, e-signature legislation, and increasing concerns around cybersecurity and compliance.

The digital transaction management market is expected to experience exponential…

Key Trend Reshaping the Digital Transaction Management Market in 2025: Advanceme …

What Are the Projections for the Size and Growth Rate of the Digital Transaction Management Market?

The digital transaction management market will grow from $14 billion in 2024 to $17.36 billion in 2025, at a CAGR of 23.9%. This is driven by the digitization of business processes, advancements in mobile technology, cloud computing, e-signature legislation, and increasing concerns around cybersecurity and compliance.

The digital transaction management market is expected to experience exponential…

Transaction Monitoring Software Market

The Transaction Monitoring Software Market Perspective, Comprehensive Analysis along with Major Segments and Forecast, 2020-2026. The Transaction Monitoring Software Market report is a valuable source of insightful data for business strategists. It provides the industry overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). Report explores the current outlook in global and key regions from the perspective of players, countries, product types and…

Mobile Payment Transaction Market: Rising Demand For Mobile Payment Transaction …

The urge of a faster and convenient payment method has resulted in the evolution of mobile payment transaction market. Further, the involvement of the giant industry veterans has given a kick start to the emergence of the mobile transaction market. Major credit to this rapidly growing industry goes to the advanced technologies involved in the field. Their contribution in easing out the payment processes has multiplied growth in the…

Contactless Payment Transaction Market Outlook 2025

Global Contactless Payment Transaction Market: Snapshot

Contactless payment is increasingly becoming an inseparable part of the payments procedure across a large number of industries. Businesses as well as consumers are increasingly embracing a wide variety of highly convenient and safe ways of paying for their purchases through contactless methods such as contactless card (NFC/RFID), contactless wearable devices, and dedicated contactless mobile payment apps, by using the NFC or RFID technologies. The…

Welded Steel Pipe Market Transaction Costs

With the slowdown in China's economic growth, the steel industry and imports of iron supply market demand is further extended, steel futures varieties offer a larger decline. From the recent operation of the rebar futures market, the small changes in the price per ton effectively take into account the needs of the market depth and liquidity, in line with the majority of market participants trading habits, and the recent market…