Press release

Yeast Strains Market to Reach USD 3289 Million by 2031 Top 10 Company Globally

Yeast strains are the living heart of numerous industrial and food processes: they are specialized strains of Saccharomyces, Candida, Brettanomyces and other genera developed and supplied for applications that include baking, brewing, bioethanol/biofuels production, animal feed and feed additives, food ingredients (yeast extract and nutritional yeast), specialty fermentation (kefir, kombucha, non-alcoholic brewing) and biotechnology (precision fermentation and production of aroma compounds, enzymes and proteins). Companies supplying yeast strains sell whole-cell formats (active dry yeast, compressed cake yeast, liquid cultures), strain-licensed intellectual property, starter cultures and associated application technical services; buyers range from craft and industrial brewers to large bakery groups, fuel ethanol plants, feed integrators and ingredient formulators. The commercial value of the yeast-strain industry therefore combines volume commodity sales (bakers and feed yeast), higher-value specialty strains and licensing/support for high-margin biotechnology and beverage applications.The global yeast strains market size is approximately USD 2,022 million in 2024, with a modeled compound annual growth rate to 2031 of about 7,2%. The market reach USD 3,289 million in 2031. Total yeast strains sold in 2024 is 404,400 tons, with price per unit around USD 5,000 per ton.

Latest Trends and Technological Developments

The yeast-strain industrys recent developments cluster around strain innovation for higher yields and stress tolerance in biofuels, bespoke strains for non-alcoholic or flavor-diverse brewing, expansion of liquid-yeast craft capabilities, and investments in production capacity and downstream processing (extracts, proteins). A material commercial consolidation and capability-build example is AB Mauris acquisition of Omega Yeast Labs, completed on August 2024, which strengthened AB Mauris craft and liquid-yeast offering in North America and signaled larger players consolidating specialty strain expertise. On the product-innovation front, Novonesis (formerly Novozymes yeast assets/brands) and other enzyme/yeast innovators have been launching advanced fermentation yeasts that increase ethanol yield and fermentation robustness (announcements and industry coverage escalated through 2023 to 2024 and into 2025). More recently, global fermentation leader Lesaffre announced a significant production investment at its Ghent facility in a press release dated August 2025 that expands beer-yeast production and packaging capacity, a signal that industrial-scale capacity expansion for beverage strains continues into 2025. Other vendors such as Chr. Hansen and Lallemand have launched specialized strains for non-alcoholic brewing and protein/ingredient applications across 2023 to 2025, underscoring ongoing application diversification. These dated moves AB Mauri/Omega (Aug 2024), Novonesis/Novozymes product launches (ongoing 2023 to 2025), Lesaffre Ghent investment (Aug 2025) are commercially material because they demonstrate both consolidation and direct investment in strain capacity and R&D.

Asia-Pacific is the largest regional market by revenue and volume for yeast strains in 2024 owing to large bakery, brewing and feed sectors, intensive bioethanol activity in parts of Asia, and the growing role of Asia-based specialty suppliers and contract manufacturers. Regional market analyses indicate Asia-Pacific accounted for a very substantial share of yeast demand in 2024 and is forecast to grow faster than global averages in many reports because of rapid urbanization, growing QSR/bakery chains, rising meat and aquaculture production (which drives feed yeast and yeast-based feed supplements), and local R&D/strain development in China, Japan and South Korea. Chinas leading yeast companies (for example Angel Yeast) are investing in new biotech parks and production capacity in 2024 to 2025 to serve domestic and export demand, and international suppliers are expanding distribution and formulation labs across APAC to meet application and regulatory needs. Taken together, these factors make Asia the primary growth engine for both commodity yeast volumes and higher-value specialty strains.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5038023

Yeast Strains by Type:

Saccharomyces Cerevisiae Strains

Saccharomyces Pastorianus Strains

Others

Yeast Strains by Application:

Food and Beverages

Biotechnology

Pharmaceuticals and Healthcare

Others

Global Top 10 Key Companies in the Yeast Strains Market

White Labs Copenhagen ApS

Angel Yeast

Imperial Yeast

Lesaffre Group (Fermentis)

Wyeast Laboratories

AB Mauri North America (Omega Yeast)

Lallemand (Lalvin)

Cara Technology

Renissance

AB Biotek

Regional Insights

Southeast Asia is a high-growth subregion within APAC for yeast demand. ASEANs bakery sector, expanding food-service ecosystems, growing craft and industrial brewing scenes, and substantial feed and aquaculture production create consistent local demand for both commodity bakers yeast and specialized feed/ingredient yeasts. Indonesia, as the largest population market in ASEAN, shows increasing uptake of packaged and industrial bakery products, rising beer and beverage production, and expanding aqua-feed compounders that use yeast and yeast derivatives trends that are prompting local mills and distributors to stock more yeast strains and to form partnerships with global suppliers. FutureMarketInsights and other regional trackers highlight rising ASEAN yeast demand and predict steady CAGR for the region; suppliers such as Angel Yeast and regional branches of Lallemand and Lesaffre have launched local initiatives and partnerships to serve Indonesia and neighbouring ASEAN markets with both bulk and specialty formats. Over 20252031 we expect ASEAN to grow faster than mature markets, first absorbing imported specialty strains and then incrementally localizing packaging and distribution for cost efficiency.

Several cross-cutting challenges temper the sectors upside. Raw-material and energy price volatility affects manufacturing economics for large bakers-yeast and extract producers, and pulp/fermentation input cost variability can compress margins on commodity lines. Regulatory and food-safety requirements differ by region (for example, strain approvals, labeling for probiotic claims, or novel-food pathways) and can delay market entry for new strains. Intellectual property and strain-licensing complexity present commercial friction buyers often demand long-term licensing and technical support which raises sales-cycle duration. Environmental and sustainability pressures also create tensions: while yeast is biologically sustainable, buyers increasingly demand lower carbon footprints and transparent supply chains; producers must invest in more energy-efficient fermentation and downstream drying/packaging to meet those demands. Finally, talent and R&D capacity are limiting factors in some markets: strain development requires specialist microbiology and process engineering teams, and not every supplier can scale both lab breakthroughs and industrial fermentation yields reliably. These challenges are visible across sector reporting and vendor disclosures.

Suppliers and investors should prioritize three strategic themes: first, capture specialty and higher-margin growth by investing in strain R&D that addresses climate-stress tolerance (e.g., high-temperature bakers yeast), flavor and aroma modulation for craft and non-alcoholic beverages, and yield-improving biofuel yeasts. Second, secure upstream supply and regional distribution: vertical integration (production + packaging + local distribution) reduces landed cost risk in ASEAN and Africa and shortens lead times for high-volume bakery clients. Third, monetize services and IP via licensing, application support and ingredient co-development agreements with large QSRs, breweries and biofuels customers; recurring technical service and co-development revenues reduce reliance on commodity volume sales. For ASEAN markets like Indonesia, low-capex partnerships (local packaging + imported mother cultures) and distributor training programs unlock faster adoption while limiting capex exposure. Strategic M&A and bolt-on acquisitions (as AB Mauris Omega deal demonstrates) accelerate specialization capabilities and market access in key segments.

Product Models

Yeast strains play a fundamental role in brewing, baking, and biotechnology by driving fermentation and shaping flavor, aroma, and product quality.

Saccharomyces cerevisiae strains often employed in ale brewing, winemaking, and baking. Notable products include:

US-05 Fermentis (Lesaffre Group): Popular American ale yeast, known for clean, crisp fermentation in craft beers.

WLP001 California Ale White Labs: A versatile strain that produces balanced ales with good hop character.

SafAle S-04 Fermentis: English ale yeast offering fast fermentation and a malty profile.

Wyeast 1056 American Ale Wyeast Laboratories: Clean, neutral strain widely used in American pale ales and IPAs.

Nottingham Ale Yeast Lallemand: High-performance yeast for a broad range of ale styles with neutral flavor.

Saccharomyces pastorianus strains which are hybrid yeasts specialized for lager brewing. Examples include:

W-34/70 Fermentis: Classic German lager yeast, widely used for clean, crisp lagers worldwide.

Diamond Lager Yeast Lallemand: Known for producing authentic, clean lagers with minimal sulfur.

WLP830 German Lager White Labs: Produces balanced lagers with a malty backbone and smooth finish.

Wyeast 2124 Bohemian Lager Wyeast: Traditional lager strain from Weihenstephan, versatile and robust.

SafLager S-23 Fermentis: Derived from Berlin breweries, producing fruity, estery lagers.

The global market for yeast strains is large, diversified and structurally resilient: with an estimated USD 2,022 million market in 2024 and a modeled 7,2% CAGR to 2031, the sector combines high-volume commodity demand faster-growing specialty and biotech yeast segments. Asia Pacific, led by China and supported by strong ASEAN growth, will remain the primary engine of volume and revenue growth, and recent M&A and capacity investments for example AB Mauris Aug 2024 acquisition of Omega Yeast and Lesaffres production investment announced Aug 2025 illustrate how incumbents are consolidating specialty capabilities. Key upside will come from strain innovation for biofuels, speciality beverages, and yeast-derived protein/ingredient applications, while risks are linked to raw-material costs, regulatory pathways and the ability to industrialize lab strains at commercial yield.

Investor Analysis

What investors should see is a market that pairs durable staples (bakers and feed yeast) with high-growth specialty and biotech applications where proprietary strains, licensing and co-development command premium margins. How value is captured includes equity stakes in global producers (scale matters for commodity margins), strategic investments in specialty-strain developers and enzyme/strain integrators (higher margin, faster growth), and platform plays in regional distribution and application services (recurring technical contract revenues). Why act now: specialty strain launches and capacity investments announced in 20242025 indicate a two-to-five-year commercialization runway where validated strains and new production capacity will convert R&D into higher-margin sales. Due diligence should prioritize proven industrialization track records (lab→plant yield), signed offtake or distribution contracts in target regions (ASEAN, China), patent/strain-protection positions, and ESG metrics around energy and water use for fermentation plants these factors materially influence valuation multiples and de-risk market entry.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5038023

5 Reasons to Buy This Report

Consolidates and reconciles multiple public market estimates into a defensible 2024 baseline and a transparent CAGR to 2031, enabling credible financial modelling.

Converts monetary value into practical physical volume using transparent price-per-kg ranges and shows the implied shipment range, which is essential for capacity and logistics planning.

Documents dated, load-bearing industry events and product launches that change competitive positioning and capacity.

Provides actionable Asia and ASEAN intelligence including Indonesias demand vectors so investors can prioritize regional manufacturing, partnership and distribution strategies.

Profiles leading players and commercial levers, enabling M&A and partnership screening focused on high-margin specialty segments.

5 Key Questions Answered

What is a defensible global market size for yeast strains and related products in 2024 and what CAGR should be used to model growth to 2031?

What are realistic price-per-unit ranges by product format and what global unit/tonnage ranges do those prices imply?

Which recent dated corporate moves and product launches materially alter capacity, specialty capability or regional distribution?

How do Asia and ASEAN demand and supply dynamics differ and what distribution/production models work best for Indonesia and neighbouring markets?

Which players and business models are best positioned to produce durable margins and why?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Yeast Strains Market to Reach USD 3289 Million by 2031 Top 10 Company Globally here

News-ID: 4180044 • Views: …

More Releases from QY Research

Top 30 Indonesian Beverages Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Multi Bintang Indonesia Tbk (MLBI) Beer & alcoholic beverages

PT Delta Djakarta Tbk (DLTA) Beer brands like Anker & Carlsberg

PT Sariguna Primatirta Tbk (CLEO) Non-alcoholic beverages

PT Akasha Wira International Tbk (ADES) Beverage producer including water & drinks

PT Ultrajaya Milk Industry & Trading Company Tbk (ULTJ) Milk products, juices & drinks

PT Mayora Indah Tbk (MYOR) Coffee,…

Behind the Paint: Cost Structures, Technology Trends, and Strategic Growth in An …

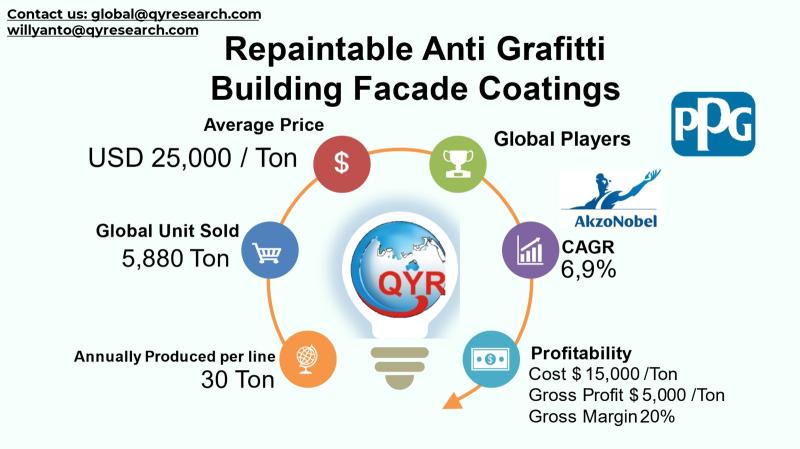

The global repaintable anti-graffiti building facade coatings industry is a specialized segment of the broader protective coatings market concentrating on products that protect exterior architectural surfaces from vandalism and urban environmental wear. Repaintable anti-graffiti coatings are engineered to allow repeated graffiti removal and overpainting without degrading the underlying surface, making them critical for durable facade protection in urban environments that demand aesthetic preservation and reduced lifecycle maintenance costs. Against a…

Ensuring Compliance and Growth: Asia Pacifics Role in the Future of Food Contact …

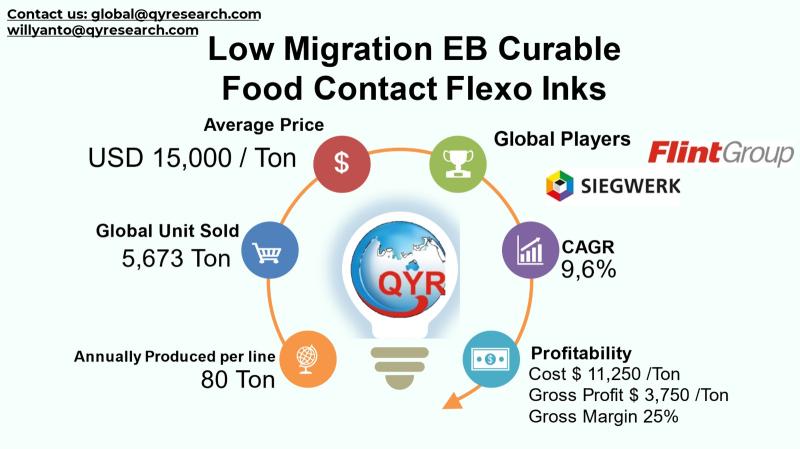

The global Low-Migration Electron Beam (EB) Curable Food Contact Flexo Inks industry encompasses specialized flexographic ink formulations that are designed to minimize chemical migration into food packaging, satisfying stringent regulatory safety standards. These inks cured via electron beam technology eliminate the need for photoinitiators and solvents that could potentially transfer into food or sensitive products, thereby addressing both regulatory and consumer safety concerns. The industry supports a broad range of…

From Flavor to Fortune: Market Dynamics in Global Fruit Syrups Explained

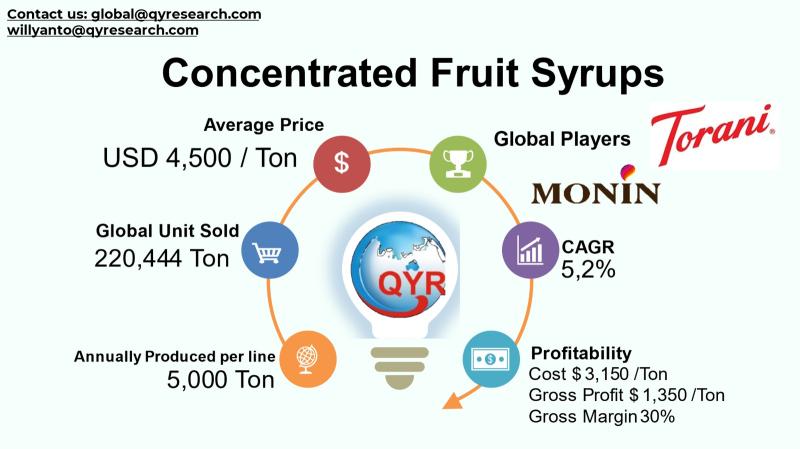

The global concentrated fruit syrups market represents a crucial niche within the broader non-alcoholic concentrated syrup and flavorings industry. These syrups, made by reducing fruit juice to a dense, highly flavorful liquid, serve as key ingredients across beverages, confectionery, bakery, dairy, and sauces, enhancing sweetness, flavor, and product versatility. The industry is influenced by rising consumer demand for natural, clean-label ingredients and the rapid expansion of the global food and…

More Releases for Yeast

Instant Yeast Market Is Booming Worldwide | Angel Yeast, Oriental Yeast, Lesaffr …

A Latest intelligence report published by MR Forecast with title "Global Instant Yeast Market Outlook to 2032". A detailed study accumulated to offer Latest insights about acute features of the Instant Yeast market. This report provides a detailed overview of key factors in the Global Instant Yeast Market and factors such as driver, restraint, past and current trends, regulatory scenarios and technology development. Some of the Major Players in this…

Brewer's Yeast Market Regaining Its Glory: Lallemand, Angel Yeast, Alltech

The latest study released on the Global Brewer's Yeast Market by HTF MI evaluates market size, trend, and forecast to 2030. The Brewer's Yeast market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Key Players in…

High Sugar Resistant Yeast Industry is Expected to Reach $ 1,506.7 by 2031 - Ang …

DataM Intelligence has published a new research report on "High Sugar Resistant Yeast Market Size 2024". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Get a Free Sample Research…

Yeast Yield: Brewer's Yeast Market Demand Analysis 2024-2032

"Global Brewer's Yeast Market size and share is currently valued at USD 7.20 billion in 2024 and is anticipated to generate an estimated revenue of USD 15.01 billion by 2032, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 9.6% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2024 - 2032"

Polaris Market Research, a leading global market research company,…

High Sugar Resistant Yeast Market, Revolutionizing Food and Beverage Industry | …

Global High Sugar Resistant Yeast Market Overview:

The current market size of High Sugar Resistant Yeast Market was valued at USD 845 million in 2022 and estimated to reach at USD 1.68 billion by 2028 at CAGR of 8.12% from 2022 to 2028. The High Sugar Resistant Yeast market is a broad category that includes a wide range of products and services related to various industries. This market comprises companies that…

Yeast and Yeast Extract Market 2022 | Detailed Report

ReportsnReports publishes the report titled Yeast and Yeast Extract that presents a 360-degree overview of the market under one roof. The report is developed with the meticulous efforts of an enthusiastic and experienced team of experts, analyts, and researchers that makes the report a valuable asset for stakeholders to make robust decisions. This report also provides an in-depth overview of product type, specification, technology, and production analysis considering vital factors…