Press release

Robo-Advisory Market Growth Fueled By Financial Services' Digital Evolution: The Driving Engine Behind Robo Advisory Market Evolution in 2025

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Robo Advisory Market Size Growth Forecast: What to Expect by 2025?

Over the last few years, the robo advisory market has seen substantial expansion. It's projected to increase from $61.75 billion in 2024 to $92.23 billion in 2025, boasting a compound annual growth rate (CAGR) of 49.4%. The remarkable growth during the previous period can be credited to efficient cost management, financial democratization, increased market awareness, and acceptance.

How Will the Robo Advisory Market Size Evolve and Grow by 2029?

In the upcoming years, the robo advisory market is projected to experience significant expansion. The expected growth rate is projected to rise to $470.91 billion by 2029, with a Compound Annual Growth Rate (CAGR) of 50.3%. The projected growth for this period can be credited to factors such as the regulatory environment, incorporation with conventional services, worldwide economic trends, and cybersecurity precautions. Key trends expected to shape this period include customization and personalization, technological progress, hybrid models, advances in AI and machine learning, sustainable and ESG investing, crypto and alternative investments, as well as partnerships and collaborations.

View the full report here:

https://www.thebusinessresearchcompany.com/report/robo-advisory-global-market-report

What Drivers Are Propelling the Growth of Robo Advisory Market Forward?

The increasing integration of digital technologies in financial services is fuelling the expansion of the robo advisory market. Digital advancements such as artificial intelligence (AI), cloud computing, blockchain, and fintech simplify fund accessibility and help the financial industry enhance customer experience through automation. For instance, the Australian Banking Association, a trade group representing Australia's banking sector, revealed in June 2023 that Australians have definitively embraced digital banking, with 98.9% of transactions occurring digitally. So, the surge in digital involvement in financial services is propelling the market's growth.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=5810&type=smp

What Long-Term Trends Will Define the Future of the Robo Advisory Market?

Technological advancements are playing a key role in shaping the robo advisory market. Developments in areas like advanced analytics, artificial intelligence, and natural language processing are expected to enhance the effectiveness of robo-advisories. This in turn will allow robo-advisors to bolster their value proposition and affect more influence throughout the value chain. For example, in March 2022, flatexDEGIRO AG, an online broker based in Germany, unveiled that it has entered into a Memorandum of Understanding (MoU) to prolong its existing B2B partnership with digital asset management firm, Whitebox. The two companies are collaborating to offer FlatexDEGIRO customers a fully digitalized investment solution, which is slated to be introduced at Flatex Germany in the summer of 2022. Whitebox operates as an independent robo-advisor for retail investors out of the US.

What Are the Key Segments in the Robo Advisory Market?

The robo advisory market covered in this report is segmented -

1) By Service Type: Direct Plan-Based Or Goal-Based, Comprehensive Wealth Advisory

2) By Provider: Fintech Robo Advisors, Banks, Traditional Wealth Managers, Other Providers

3) By Business Model: Pure Robo Advisors, Hybrid Robo Advisors

4) By End User: Healare, Education, Retail, Other End Users

Subsegments:

1) By Direct Plan-Based Or Goal-Based: Retirement Planning, Education Savings Plans, Investment Goal Setting, Tax Optimization Strategies

2) By Comprehensive Wealth Advisory: Holistic Financial Planning, Asset Management Services, Estate Planning, Portfolio Diversification Strategies

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=5810&type=smp

Who Are the Key Players Shaping the Robo Advisory Market's Competitive Landscape?

Major companies operating in the robo advisory market include Betterment LLC, Charles Schwab & Co. Inc., Wealthfront Corporation, Personal Capital Corporation, Bambu Labs Inc., Blooom Inc., Ellevest Inc., FutureAdvisor Inc., Nutmeg Saving and Investment Limited, SigFig Wealth Management LLC, The Vanguard Group Inc., Social Finance Inc., Hedgeable Inc., WiseBanyan Inc., AssetBuilder Inc., Ally Financial Inc., Axos Invest Inc., Scalable Capital Limited, Moneyfarm Ltd., Acorns Grow Incorporated, United Income LLC, T. Rowe Price Associates Inc., Rebellion Research, Ginmon Vermogensverwaltung GmbH, Invesco Ltd., WisdomTree Investments Inc., Northern Trust Corporation, First Trust Advisors LP, VanEck Associates Corporation, ProShares Advisors LLC, Global X Management Company LLC, Direxion Investments

What Geographic Markets Are Powering Growth in the Robo Advisory Market?

North America will be the largest region in the robo advisory market in 2024. Asia-Pacific is expected to be the fastest growing region in the forecast period. The regions covered in the robo advisory market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=5810

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Speak With Our Expert:

Saumya Sahay

Europe - +44 7882 955267,

Asia: +91 88972 63534,

Americas - +1 310-496-7795 or

Email:saumyas@tbrc.info

Follow Us On:

• LinkedIn: https://in.linkedin.com/company/the-business-research-company

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Robo-Advisory Market Growth Fueled By Financial Services' Digital Evolution: The Driving Engine Behind Robo Advisory Market Evolution in 2025 here

News-ID: 4179180 • Views: …

More Releases from The Business Research Company

Trends in Growth, Segment Analysis, and Competitive Strategies Influencing the M …

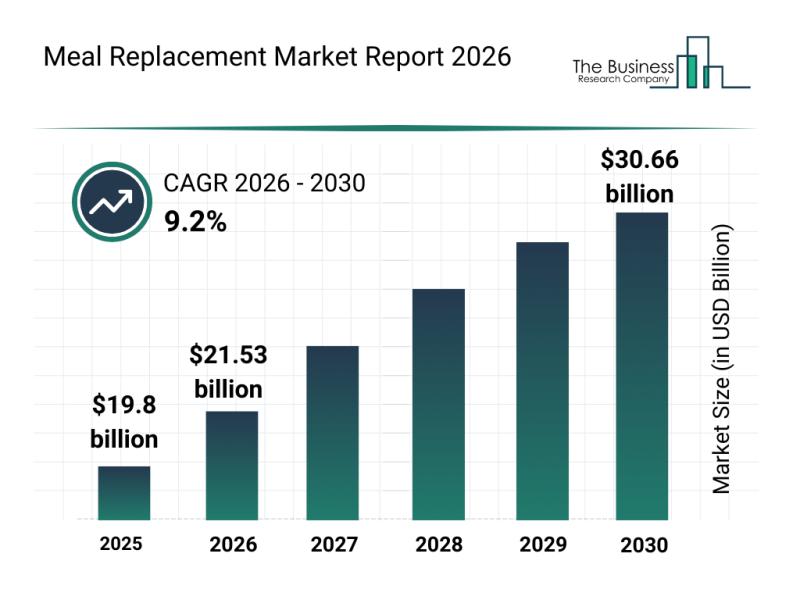

The meal replacement market is gaining significant momentum as consumer preferences shift toward convenient and health-focused nutrition solutions. With rising awareness about preventive healthcare and personalized diets, this sector is set for considerable expansion. Let's explore how the market size is expected to evolve, who the key players are, emerging trends, and the main segments driving this growth.

Projected Growth Trajectory of the Meal Replacement Market Size

The meal replacement…

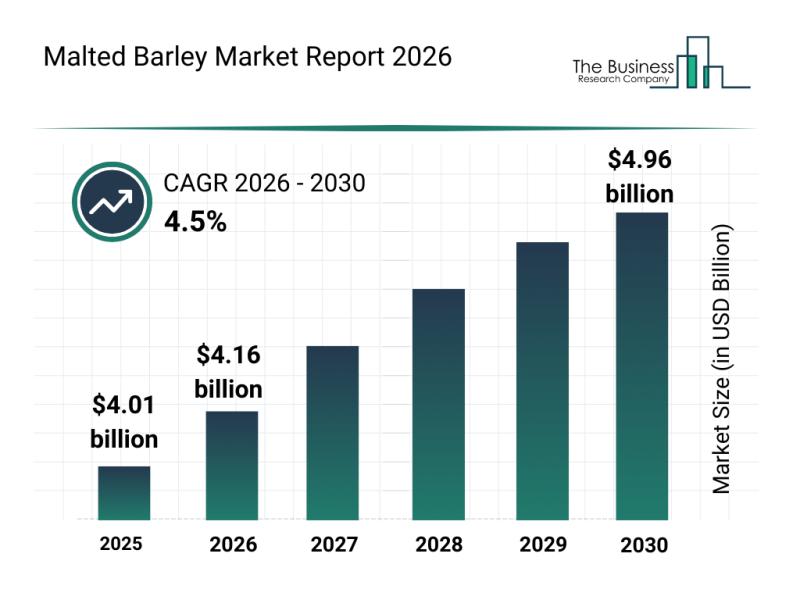

Leading Companies Reinforcing Their Presence in the Malted Barley Market

The malted barley industry is positioned for steady expansion as demand grows across various sectors. With increasing interest from craft brewers and functional food producers, this market is set to experience meaningful growth driven by innovation and sustainability efforts. Let's dive into the current market size, key players shaping the industry, trends influencing its trajectory, and detailed segment insights.

Projected Market Size and Growth Outlook of the Malted Barley Market …

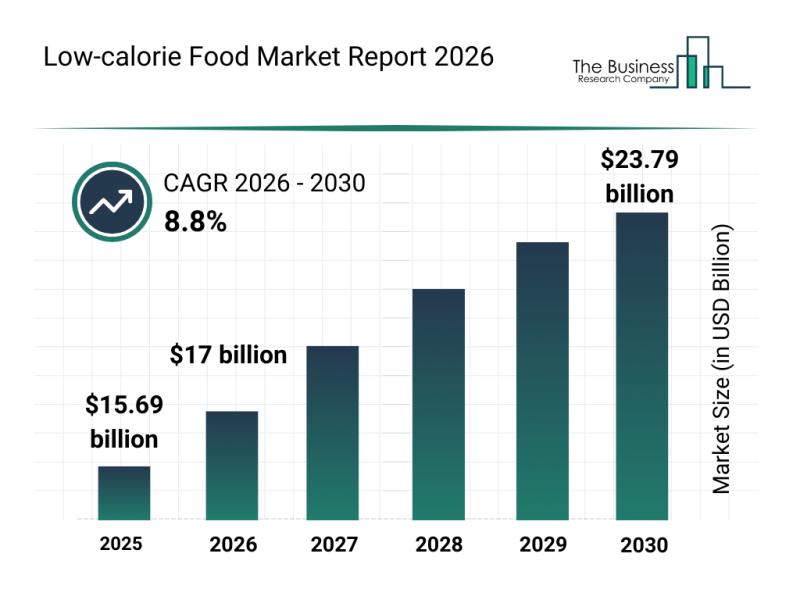

Future Perspective: Key Trends Shaping the Low-calorie Food Market up to 2030

The low-calorie food market is poised for significant expansion as consumer preferences shift toward healthier eating habits and more personalized nutrition options. Advances in product innovation and supportive regulatory frameworks are expected to drive rapid growth over the coming years. Here's an overview of the market size, key players, emerging trends, and segmentation shaping this evolving industry.

Projected Expansion of the Low-calorie Food Market Size Through 2030

The low-calorie food…

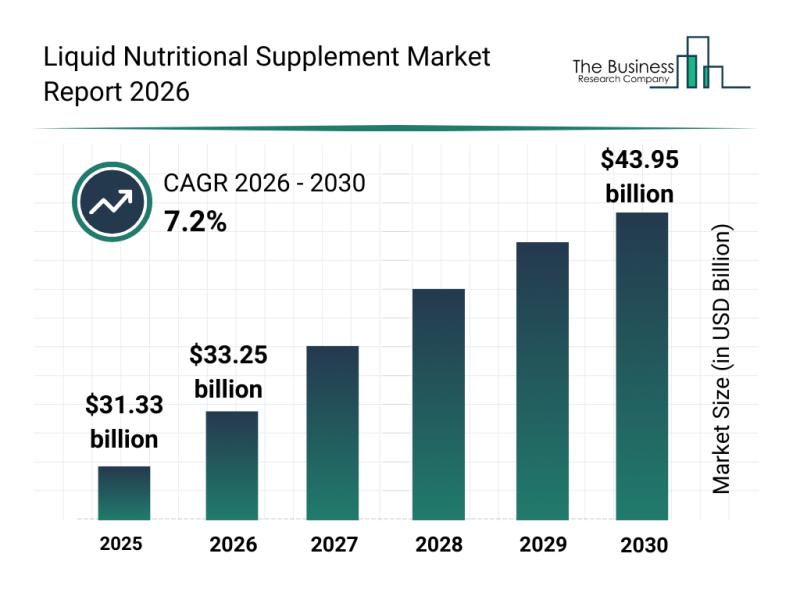

Competitive Landscape: Leading Companies and New Entrants in the Liquid Nutritio …

The liquid nutritional supplement sector is on the rise, driven by evolving consumer preferences and innovations in health and wellness. With growing awareness about personalized nutrition and preventive healthcare, this market is set to witness substantial growth over the coming years. Let's explore the market's projected size, major players, emerging trends, and key segments shaping this dynamic industry.

Projected Market Value and Growth Trajectory of the Liquid Nutritional Supplement Market …

More Releases for Robo

Robo Advisory Market is Rising

According to the latest research report published by Market Data Forecast, the global robo advisory market is expected to grow at a CAGR of 54.2% from 2024 to 2029, and the global market size is anticipated to be worth USD 154.6 billion by 2029 from USD 17.73 billion in 2024.

The robo advising market is expanding rapidly, fueled by technical developments and rising demand for automated financial solutions. These platforms use…

Global Robo-Advisory Market, Global Robo-Advisory Industry, Covid-19 Impact Glob …

The Robo-advisory market is expected to grow from USD X.X million in 2020 to USD X.X million by 2026, at a CAGR of X.X% during the forecast period. The Global Robo-Advisory Market report is a comprehensive research that focuses on the overall consumption structure, development trends, sales models and sales of top countries in the global Robo-advisory market. The report focuses on well-known providers in the global Robo-advisory industry, market…

Global Robo-Advisory Market (2015-2023)

Global robo-advisory market

Robo-advisors are independent financial planning services driven by algorithms and supported by a digital platform with no human intervention. They collect information from their customers at first through an online survey to understand their financial situations and ultimate goals. With this information they make portfolios of investments by calculating their risk and returns along with profits for long-term. The global robo-advisory market is expected to grow at an…

Global Robo-advisory Market (2015-2023)

Market Research Report Store offers a latest published report on Robo-advisory Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report. This report focuses on the key global Robo-advisory players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.To analyze the Robo-advisory with respect to individual growth trends, future…

Robo-Advisors: Mapping The Competitive Landscape

The wealth management industry has long been resilient to the digitization process observed in the wider financial services space. This has started to change, however, with interest in robo-advice platforms increasing in 2015. The automated investment management space is hence becoming ever-more competitive as new entrants launch propositions. Supported by software developers, traditional wealth managers have also started exploring the digital advice market. Competition will thus increase further, although robo-advisors…

Robo-Advisors: Mapping the Competitive Landscape

Summary

The wealth management industry has long been resilient to the digitization process observed in the wider financial services space. This has started to change, however, with interest in robo-advice platforms increasing in 2015. The automated investment management space is hence becoming ever-more competitive as new entrants launch propositions. Supported by software developers, traditional wealth managers have also started exploring the digital advice market. Competition will thus increase further, although robo-advisors…