Press release

U.S. Fintech Market Projected to Reach USD 248.5 Billion by 2032 | Persistence Market Research

The U.S. fintech market is experiencing remarkable growth, fueled by rising digital adoption, innovation in financial services, and a shift towards cashless transactions. Valued at US$95.2 billion in 2025, the market is projected to reach US$248.5 billion by 2032, registering a robust CAGR of 14.7% during the forecast period. This growth is being driven by rapid technological advancements, changing consumer behavior, and a strong emphasis on secure, real-time financial solutions.Payment services dominate the market with over 35% share in 2025, reflecting increasing demand for seamless, secure, and fast transaction processing. Banks remain the leading end-user, holding more than 40% market share, due to their extensive customer networks, regulatory expertise, and rapid integration of fintech solutions to improve operational efficiency. Additionally, APIs are the most widely adopted technology, accounting for over 32% market share, as they enable real-time data exchange, improve transaction speed, and enhance customer experience.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/35605

Key Highlights from the Report

• The U.S. fintech market is projected to reach US$248.5 billion by 2032.

• Payment services dominate with more than 35% market share.

• API technology is the leading platform, holding over 32% market share.

• Banks lead end-users with over 40% share, driven by extensive customer bases.

• Mobile payments adoption reached 32% of total transactions in 2024.

• Fraud losses surged to US$12.5 billion, highlighting the need for secure fintech solutions.

Market Segmentation

The U.S. fintech market is segmented based on service type, technology, and end-user. Payment solutions dominate, reflecting the growing consumer preference for contactless, digital, and real-time transactions. Lending and insurance services are also gaining traction as banks and financial institutions increasingly leverage technology to offer instant loan approvals, credit scoring, and personalized insurance products. Wealth management and investment platforms are witnessing steady adoption due to increased consumer awareness of financial planning tools.

From a technology standpoint, APIs remain central, facilitating seamless integration of fintech services with existing banking systems. Blockchain, artificial intelligence (AI), and machine learning (ML) are also increasingly applied to ensure secure transactions, enhance fraud detection, and improve personalized financial services. End-user segmentation shows banks leading, followed by fintech startups, insurance companies, and consumers who directly access digital financial platforms.

Read More: https://www.persistencemarketresearch.com/market-research/us-fintech-market.asp

Regional Insights

North America, particularly the U.S., leads the global fintech market due to its mature financial ecosystem, high digital literacy, and strong technological infrastructure. The presence of numerous fintech startups and a favorable regulatory framework further supports market growth.

Emerging regions within the U.S., such as Silicon Valley, New York, and Chicago, are hotspots for fintech innovation. These areas attract significant venture capital investment and serve as incubators for new technologies, such as AI-driven fraud detection, blockchain-powered payment platforms, and mobile-based financial services.

Market Drivers

The U.S. fintech market is primarily driven by the widespread adoption of mobile payments, with seven in ten consumers using mobile platforms in 2024. The convenience, speed, and accessibility of digital payment solutions have shifted consumer behavior away from traditional banking. Growing demand for real-time transaction processing, personalized financial solutions, and secure platforms is prompting banks and fintech companies to invest heavily in technology and innovation.

Regulatory support for digital banking, combined with the increasing need for fraud prevention solutions, further accelerates market expansion. The surge in e-commerce, contactless payments, and online financial services has created a substantial growth opportunity for fintech companies to develop cutting-edge tools and platforms.

Market Restraints

Despite rapid adoption, high fraud risks and cybersecurity concerns pose significant challenges for the U.S. fintech market. In 2024, fraud losses reached US$12.5 billion, highlighting vulnerabilities in digital transactions. Compliance with evolving regulations and stringent cybersecurity standards requires significant investment, which can limit adoption, especially among smaller financial institutions and startups.

Additionally, consumer trust and data privacy concerns continue to hinder adoption of new fintech platforms. While banks are relatively established, fintech startups often face challenges in convincing users about the security and reliability of their digital offerings, especially in high-value transactions.

Market Opportunities

Emerging opportunities in the U.S. fintech market include AI-powered fraud detection, blockchain-enabled secure transactions, and embedded finance solutions. The rise of open banking and API-driven platforms allows third-party developers to offer innovative services, such as personalized lending, insurance, and investment management.

Additionally, the growing demand for contactless and digital payment solutions, coupled with increasing smartphone penetration, creates opportunities for mobile-first fintech applications. Strategic partnerships between banks and fintech startups are also providing a platform for growth, enabling rapid deployment of new financial products while reducing operational risk.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/35605

Frequently Asked Questions (FAQs)

How Big is the U.S. Fintech Market in 2025 and 2032?

Who are the Key Players in the U.S. Fintech Market?

What is the Projected Growth Rate of the U.S. Fintech Market?

What is the Market Forecast for the U.S. Fintech Industry in 2032?

Which Region in the U.S. is Driving Fintech Innovation and Adoption?

Company Insights

Key players operating in the U.S. fintech market include:

1. PayPal Holdings, Inc.

2. Square, Inc.

3. Stripe, Inc.

4. Fiserv, Inc.

5. Robinhood Markets, Inc.

6. Intuit Inc.

7. Coinbase Global, Inc.

8. Visa Inc.

Recent Developments:

• Stripe introduced enhanced API solutions for real-time payment processing across multiple financial platforms.

• PayPal launched a blockchain-based payment system to improve cross-border transaction security and reduce processing time.

The U.S. fintech market demonstrates a combination of rapid digital adoption, innovative technological integration, and strong regulatory support, making it one of the fastest-growing segments in the financial services landscape. With continued investment in AI, blockchain, and mobile-first solutions, the market is well-positioned to surpass US$248 billion by 2032, offering opportunities for established banks, fintech startups, and investors looking to capitalize on digital finance trends.

Related Reports:

LED Video Wall Display Market https://www.persistencemarketresearch.com/market-research/led-video-wall-display-market.asp

Smart Camera Market https://www.persistencemarketresearch.com/market-research/smart-camera-market.asp

Banking as a Service Market https://www.persistencemarketresearch.com/market-research/banking-as-a-service-market.asp

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release U.S. Fintech Market Projected to Reach USD 248.5 Billion by 2032 | Persistence Market Research here

News-ID: 4178801 • Views: …

More Releases from Persistence Market Research

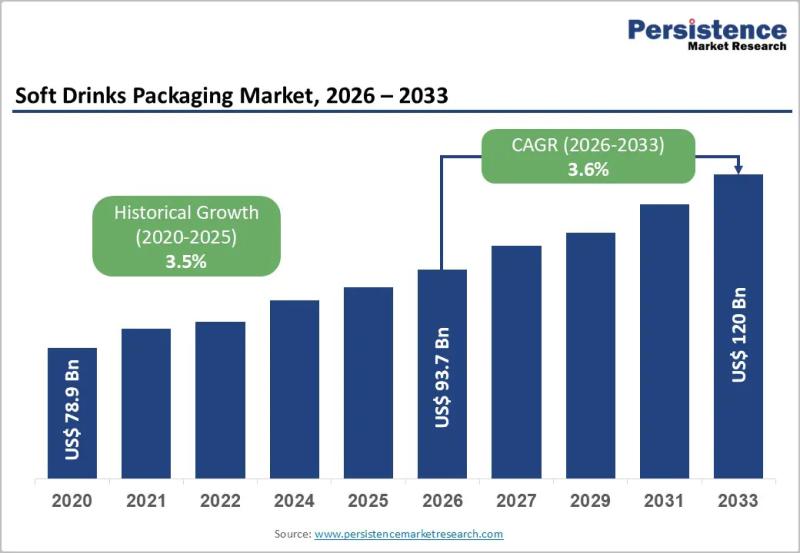

Soft Drinks Packaging Market to Reach US$120.0 Billion by 2033 - Persistence Mar …

The soft drinks packaging market plays a central role in the global beverage industry, serving carbonated drinks, juices, flavored water, energy drinks, and ready to drink teas and coffees. Packaging is no longer limited to containment and transportation; it has evolved into a critical component of branding, sustainability strategy, consumer convenience, and supply chain efficiency. Manufacturers are increasingly focusing on lightweight materials, recyclable packaging formats, and innovative designs that improve…

Christmas Tree Valves Market Size to Reach US$8.1 Billion by 2033 - Persistence …

The Christmas Tree Valves Market plays a critical role in the upstream oil and gas industry, serving as a central component in wellhead equipment systems. Christmas tree valves are installed on oil and gas wells to control pressure, regulate flow, and ensure safe extraction of hydrocarbons. These assemblies, commonly referred to as "Christmas trees," consist of multiple valves, spools, and fittings arranged in a structure that resembles a decorated tree.…

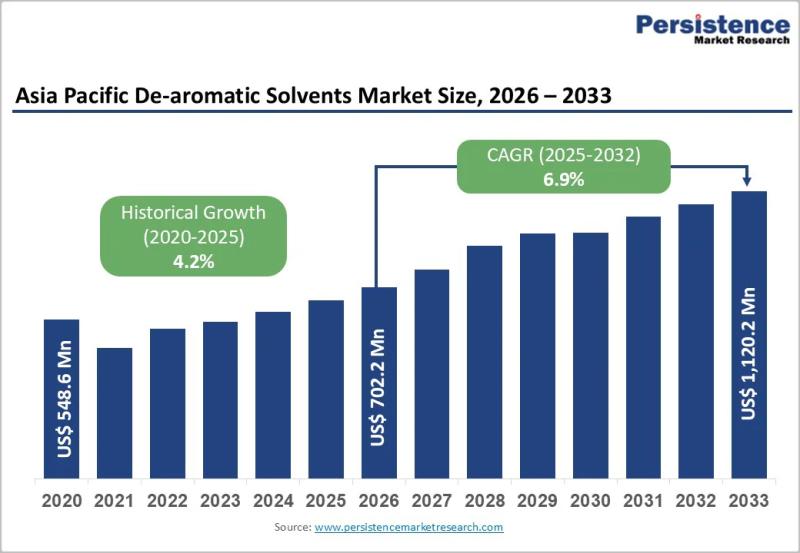

Asia Pacific De-aromatic Solvents Market to Reach US$1,120.2 Million by 2033 - P …

The Asia Pacific De-aromatic Solvents Market is gaining steady momentum as industries across the region increasingly shift toward low aromatic, high purity solvent formulations. De-aromatic solvents are hydrocarbon solvents that have significantly reduced aromatic content, making them suitable for applications requiring low odor, lower toxicity, and improved environmental performance. These solvents are widely used in paints and coatings, adhesives, inks, metalworking fluids, agrochemicals, and cleaning formulations. As regulatory scrutiny around…

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…