Press release

Hydrogen Price Trend Dip in Q2 2025 Amid Infrastructure Expansion and Policy Shifts

Hydrogen Price Trends in North America: Q2 2025 OverviewHydrogen Prices in United States:

In Q2 2025, hydrogen prices in the United States averaged US$ 3,865/MT, supported by rising demand from clean energy and industrial sectors. The Hydrogen Price Trend remained steady, reflecting balanced supply and technological advancements. Reviewing the Hydrogen History Price Chart highlights consistent growth in U.S. pricing, helping stakeholders forecast future costs and align with the nation's renewable energy transition.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/Hydrogen-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific needs.

Hydrogen Price Trends in APAC: Q2 2025 Overview

Hydrogen Prices in Japan:

Japan recorded hydrogen prices at US$ 4,915/MT in Q2 2025, driven by strong adoption in fuel cells and clean mobility projects. The Hydrogen Price Trend showed an upward push due to high import reliance and infrastructure costs. Insights from the Hydrogen History Price Chart reveal Japan's consistently higher pricing levels, making long-term planning essential for industries navigating energy transition policies.

Regional Analysis: The price analysis can be extended to provide detailed Hydrogen price information for the following list of countries.

China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries.

Hydrogen Price Trends in Europe: Q2 2025 Overview

Hydrogen Prices in Netherlands:

Hydrogen prices in the Netherlands stood at US$ 5,352/MT during Q2 2025, reflecting Europe's focus on green hydrogen adoption. The Hydrogen Price Trend indicated cost pressure from renewable energy integration and supply limitations. Reviewing the Hydrogen History Price Chart highlights a steady climb in prices, positioning the Netherlands as a hub for Europe's clean energy transition despite elevated production costs.

Regional Analysis: The price analysis can be expanded to include detailed Hydrogen price data for a wide range of European countries:

such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

Hydrogen Price Trends in MEA: Q2 2025 Overview

Hydrogen Prices in United Arab Emirates:

In the UAE, hydrogen prices averaged US$ 6,260/MT in Q2 2025, among the highest globally due to heavy investments in green hydrogen projects. The Hydrogen Price Trend reflects premium costs tied to advanced infrastructure and large-scale clean energy goals. Insights from the Hydrogen History Price Chart show rapid growth, underlining the UAE's ambition to emerge as a global leader in hydrogen exports.

Hydrogen Prices in Saudi Arabia:

Saudi Arabia reported hydrogen prices at US$ 4,490/MT in Q2 2025, driven by large-scale projects such as NEOM. The Hydrogen Price Trend displayed steady upward momentum, supported by government-backed initiatives and energy diversification plans. The Hydrogen History Price Chart illustrates long-term growth potential, with Saudi Arabia positioning itself as a cost-competitive supplier for global hydrogen demand in the coming years.

Regional Analysis: The price analysis can be extended to provide detailed Hydrogen price information for the following list of countries.

Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries.

Hydrogen Price Trend, Index, History & Forecast - News & Developments

Q2 2025 Regional Highlights:

• USA: Hydrogen prices declined to $3,865/MT in June, with production costs eased by lower natural gas and renewable energy prices. Policy uncertainty around tax credits spurred a pivot toward blue hydrogen and affected investment sentiment.

• Japan: Prices remained high at $4,915/MT, driven by expensive imported energy for production and infrastructure limits.

• Netherlands: Hydrogen averaged $5,352/MT amid regulatory and infrastructure costs, while the UAE saw a drop to $6,260/MT as expanded production capacity and technology upgrades increased supply.

• Saudi Arabia: Prices moved lower to $4,490/MT thanks to large-scale green and blue hydrogen investments and surplus supply meeting steady industrial demand.

News & Recent Developments:

• Global hydrogen prices show strong regional variation, reflecting infrastructure maturity, feedstock costs, and policy support.

• Declining electrolyzer and renewable energy costs, along with growing government incentives, are supporting long-term price reductions in most regions.

• North America and the Middle East are ramping up capacity and exports, with major projects like NEOM in Saudi Arabia fueling international trade.

• Policy and market volatility-such as shifts in incentives or production standards-have a significant impact on project timelines and price trajectories.

Price Outlook & Forecast:

• The market is expected to expand quickly as infrastructure improves and production scales up, driving hydrogen prices gradually lower, especially for green hydrogen.

• Global value is projected to reach $300.6 billion by 2033, with demand boosted by clean energy requirements in industrial, power, and transport sectors.

Speak To an Analyst: https://www.imarcgroup.com/request?type=report&id=22312&flag=C

Key Coverage:

• Market Analysis

• Market Breakup by Region

• Demand Supply Analysis by Type

• Demand Supply Analysis by Application

• Demand Supply Analysis of Raw Materials

• Price Analysis

o Spot Prices by Major Ports

o Price Breakup

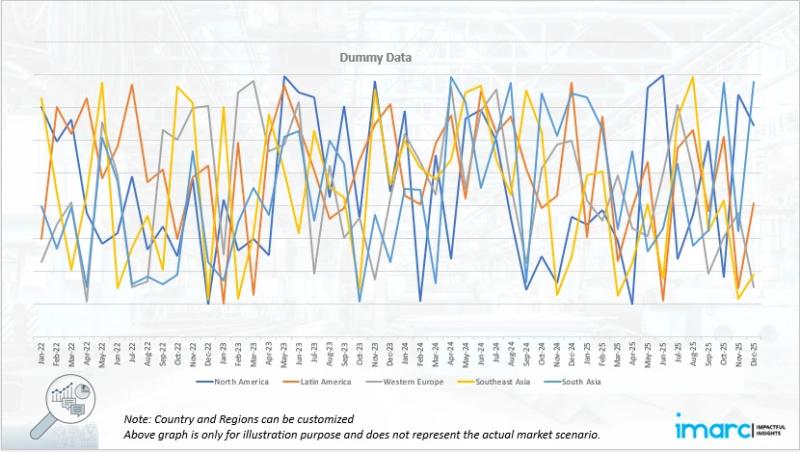

o Price Trends by Region

o Factors influencing the Price Trends

• Market Drivers, Restraints, and Opportunities

• Competitive Landscape

• Recent Developments

• Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, Hydrogen Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition, presents a detailed analysis of Hydrogen price trend, offering key insights into global Hydrogen market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Hydrogen demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC's data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Hydrogen Price Trend Dip in Q2 2025 Amid Infrastructure Expansion and Policy Shifts here

News-ID: 4178703 • Views: …

More Releases from IMACR Group

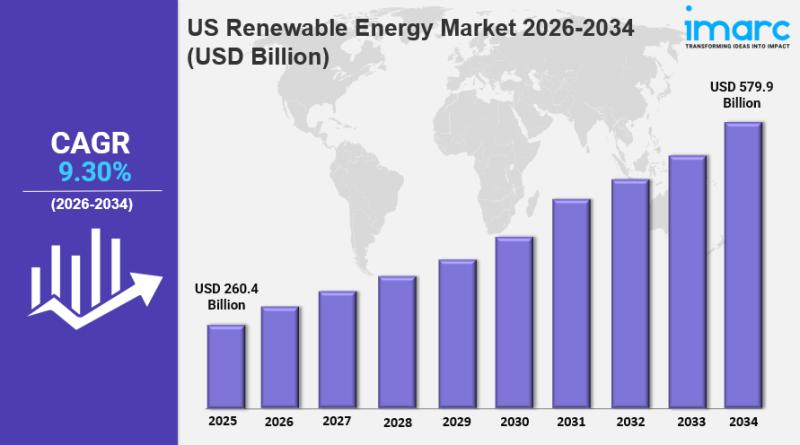

US Renewable Energy Market Size, Share, Trends & Forecast 2026-2034

IMARC Group has recently released a new research study titled "US Renewable Energy Market Report by Type (Hydro Power, Wind Power, Solar Power, Bioenergy, and Others), End User (Industrial, Residential, Commercial), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

NEW YORK, USA - The United States renewable energy market is projected to grow…

Sodium Lauryl Ether Sulfate Prices Rise Amid Surging Detergent Industry Demand

North America Sodium Lauryl Ether Sulfate (SLES) Prices Movement Q4 2025:

Sodium Lauryl Ether Sulfate (SLES) Prices in United States:

In Q4 2025, sodium lauryl ether sulfate (SLES) prices in the USA averaged USD 812/MT, supported by steady demand from personal care and household cleaning product manufacturers. Stable supply of ethylene oxide and fatty alcohol feedstocks helped maintain balanced production costs. Consistent domestic consumption contributed to relatively stable market conditions.

Get the Real-Time…

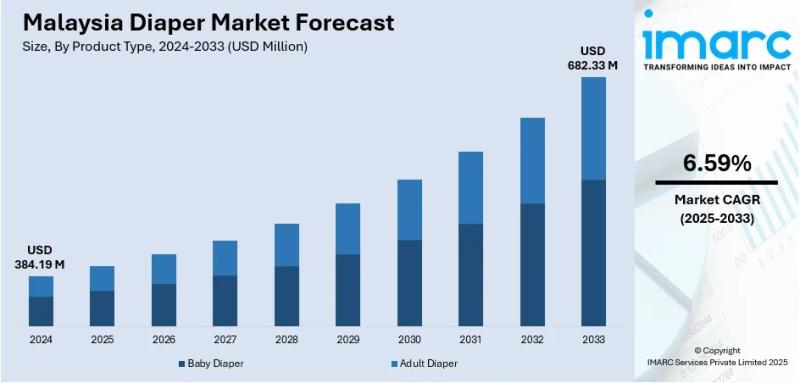

Malaysia Diaper Market to Reach USD 682.33 Million by 2033, Growing at 6.59% CAG …

Source: IMARC Group | Category: Consumer Goods | Author Name: Gaurav

Report Introduction

According to IMARC Group's latest report titled "Malaysia Diaper Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and State, 2025-2033", the market is growing steadily due to the rising awareness regarding infant hygiene and the increasing number of working parents opting for convenient baby care solutions. The study offers a profound analysis of the industry, encompassing…

Mineral Water Processing Plant DPR - 2026: Investment Cost, Market Growth and Ma …

The global beverage and safe drinking water industry is experiencing transformative growth driven by rising awareness regarding safe drinking water, increasing urbanization, growth of the hospitality sector, and higher consumption of packaged beverages. At the forefront of this health and safety revolution stands mineral water-a drinkable water valued for its natural mineral content, consistent quality, and compliance with food safety standards across household consumption, hospitality and tourism sector, healthcare facilities,…

More Releases for Hydrogen

Green Hydrogen Boosting Hydrogen Generation Market Growth Worldwide

According to a new report published by Allied Market Research, the hydrogen generation market was valued at $136.3 billion in 2021 and is projected to reach $262.0 billion by 2031, growing at a CAGR of 6.8% from 2022 to 2031. The steady expansion of industrialization, growing environmental concerns, and strong government initiatives toward decarbonization are key factors accelerating the growth of the hydrogen generation market globally.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/1575

Hydrogen production…

White Natural Hydrogen Market Growth 2025-2032 | Clean & Renewable Hydrogen Sour …

New York, U.S. - Worldwide Market Reports unveils its latest evaluation of the White Natural Hydrogen Market, highlighting the growing interest in naturally occurring, untapped hydrogen resources that can support decarbonization initiatives and supplement green and blue hydrogen production. Increasing exploration in geological formations, coupled with rising demand for low-carbon energy carriers, is driving adoption across industrial, energy, and mobility sectors. Near-term growth is expected from subsurface hydrogen reservoirs, renewable…

Hydrogen Electrolyzer Market, Fueling the Green Hydrogen Revolution Worldwide

Overview of the Market

The hydrogen electrolyzer market is rapidly transforming into a cornerstone of the global clean energy transition, driven by increasing investments in sustainable technologies and government-led decarbonization efforts. A hydrogen electrolyzer is a device that splits water into hydrogen and oxygen using electricity, enabling the generation of green hydrogen when powered by renewable sources. This exponential rise is attributed to the surging demand for clean fuels, rising…

Hydrogen economy: hydrogen as an energy carrier is changing companies

The energy transition and climate protection have put the focus on a sustainable energy supply. Hydrogen is considered one of the most important energy sources of the future and plays a key role in the decarbonization of industry. Investments in the hydrogen economy are increasing worldwide. Germany is also increasingly focusing on promoting this technology.

But what impact will this have on companies, the labor market and the competitiveness of Germany…

Hydrogen Generator Market Growth: Powering the Green Hydrogen Economy

According to a new report published by Allied Market Research, The global hydrogen generator market size was valued at $1.2 billion in 2020, and hydrogen generator market forecast to reach $2.2 billion by 2030, growing at a CAGR of 5.8% from 2021 to 2030.

Global shift toward the use of eco-friendly and renewable resources and several government initiatives toward development of eco-friendly hydrogen production technologies, coupled with rapidly increasing demand for…

Hydrogen Generator Market Dynamics: Trends Shaping the Hydrogen Economy

According to a new report published by Allied Market Research, The global hydrogen generator market size was valued at $1.2 billion in 2020, and hydrogen generator market forecast to reach $2.2 billion by 2030, growing at a CAGR of 5.8% from 2021 to 2030.

Global shift toward the use of eco-friendly and renewable resources and several government initiatives toward development of eco-friendly hydrogen production technologies, coupled with rapidly increasing demand for…