Press release

Solar Array Simulator Market to Reach CAGR 10,4% by 2031 Top 10 Company Globally

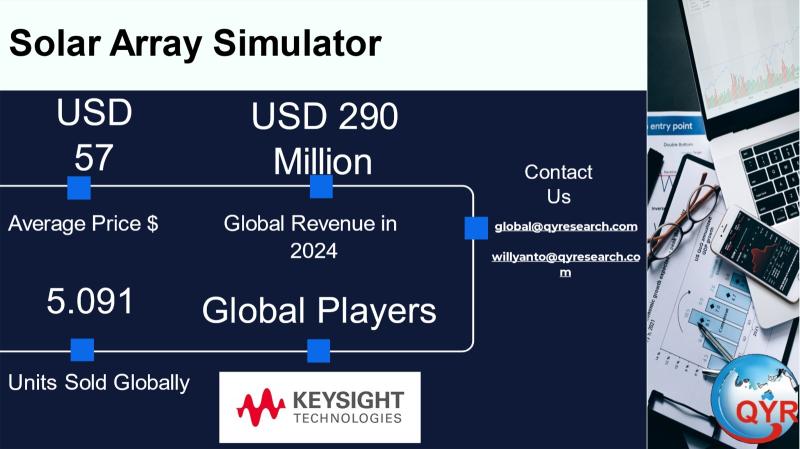

Solar array simulators (also called photovoltaic array simulators or PV simulators) are programmable DC power sources and software systems that mimic the IV behaviour of photovoltaic arrays to allow development, validation and production testing of inverters, MPPT controllers, microinverters, power optimizers, PV modules and related balance-of-system electronics without needing an actual PV field. They reproduce open-circuit voltage, short-circuit current, maximum-power-point dynamics, shading and irradiance transients and often include standards-mode tests (EN50530, Sandia/SAS profiles, IEC) and grid-emulation interfaces. Because modern inverter algorithms must react to quick irradiance changes and partial-shading events, high-fidelity array simulators with fast transient response, wide voltage ranges (up to 1,8002,000 V) and protocoled control are essential to R&D labs, manufacturing test lines and certification houses. Leading systems range from compact benchtop simulators used in component labs to modular, high-power rack systems for inverter DVT and production testing; many suppliers also offer rental and turn-key test cells for manufacturing customers.The solar array simulator market in 2024 baseline near USD 290 million and project growth to about USD 579 million by 2031, implying a CAGR of approximately 10,4% from 2024 to 2031. Average selling price of solar array simulators is USD 57 per unit, reaching 5,091 units sold in 2024.

Latest Trends and Technological Developments

The market is being driven by higher power-density modular platforms, faster transient response for realistic cloud-shade testing, integrated Sandia/EN50530/SAS profile libraries, bidirectional capabilities for hybrid inverter testing (V2G and storage-coupled), and the expansion of rental/ATE (automated test equipment) and turnkey test-cell services for manufacturers. On July 2024, Keysight expanded its MP4300A modular solar array simulator family with higher-power modules and mainframes to address broader inverter test ranges and satellite/space PV emulation needs, signalling the trend toward modular, stackable solutions for large inverters. Chromas 62000H-S solar array simulator line demonstrates the push to higher voltage (up to 1,800 V), high power density (multi-kW in compact 3U packages) and fast IV-curve transient capability suitable for MPPT algorithm testing (product detail pages updated 2024 to 2025). Additionally, global PV capacity growth and shifting solar manufacturing footprints are influencing demand for lab and factory test equipment: the IEA-PVPS snapshot (April 2025) showing a major jump in commissioned PV capacity in 2024 means more module and inverter qualification cycles, while trade and supply-chain shifts in Southeast Asia (reported May 2025) are causing module and cell factories to relocate or expand in Indonesia and neighbouring countries creating local demand for PV test gear including array simulators for incoming inspection and production lines. Together these dated items show both product-level innovation and regional demand re-balancing that will shape 2025 to 2031 purchases.

Asia Pacific is the largest regional market for solar array simulators by value and unit activity in 2024 because the region hosts the majority of PV module and inverter manufacturing, extensive R&D centres, and growing utility and commercial PV deployment. Major test-equipment buyers module makers, inverter OEMs, and qualification labs are concentrated in China, Taiwan, South Korea, Japan and India. Vendors and rental houses prioritize APAC distribution, local calibration and on-site support because production lines require fast uptime and local spares. Keysight, Chroma and AMETEK and others maintain regional offices and local service hubs to meet factory acceptance test cycles, and the presence of many contract-manufacturers in APAC means steady demand for mid-to-high-power array simulators to support incoming inspection and production-line verification. The regions dominance is reinforced by both the aggregated PV manufacturing value chain and by national R&D investments in PV and microinverter technologies.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5033482

Solar Array Simulator by Type:

Single Phase

Three Phase

Solar Array Simulator by Application:

Photovoltaic Industry

Education and Research

Global Top 10 Key Companies in the Solar Array Simulator Market

ITECH Electronics

AMETEK

Chroma

Keysight Technologies

Denken

Aplab

Ceyear

Jishili Electronics (Suzhou) Co., Ltd

Zolix

Quantel

Regional Insights

ASEAN is an accelerating market for PV test equipment as module assembly, panel testing and inverter installation proliferate across Southeast Asia. Indonesia deserves special attention: trade-route shifts and factory relocations following tariffs and trade actions in 20242025 have caused some manufacturers to expand capacity in Indonesia and Laos, which in turn creates a local need for array emulators and factory test systems for QC and inverter verification. Indonesias rooftop and utility PV expansions, coupled with emerging local inverter assembly and PV R&D centres, means demand for lower- and mid-power simulators (for incoming inspection and inverter test benches) will grow before the region requires large, multi-kW modular SAS systems. Across ASEAN, Singapore and Malaysia attract higher-end lab purchases and compliance testing, while Vietnam, Thailand and the Philippines represent mixture of contract assemblers and rising domestic installers that buy bench and production test systems. Local distributors and rental houses are expanding service footprints to reduce lead times and shipping cost for heavy modular systems.

The solar array simulator market faces several challenges that moderate near-term growth. First, the market is correlated to PV manufacturing cycles and inverter development programmes, which can be lumpy: a surge in module capacity ramps or inverter redesigns drives test-equipment booms, while slowdowns compress orders. Second, high-value systems are capital-intensive, with long lead times and custom integration requirements, increasing procurement friction for smaller OEMs and test labs. Third, price pressure exists from lower-cost local suppliers (particularly in China and Taiwan) that supply basic simulators and from rental models that reduce outright purchases. Fourth, standards and test-method evolution (e.g., more complex dynamic shading tests, new grid-code requirements) create ongoing R&D and software-update costs for vendors. Finally, calibration, warranty and on-site service capacity are bottlenecks in regions that suddenly scale module production, so vendors must invest in regional service networks to sustain growth.

Vendors that win will offer modular, scalable platforms that span bench to factory power levels; provide rapid local service and calibration; bundle software libraries supporting standards (EN50530, Sandia/SAS, IEC) and custom transient profiles; and offer rental/ATE and managed-test services to lower customer capex hurdles. For buyers and investors, hybrid revenue models combining hardware sales, software licensing and recurring calibration/service agreements are attractive because they smooth cash flow and create long customer relationships. In ASEAN and APAC, partnering with local distributors, offering regional rental fleets and building local calibration labs shorten lead times and create competitive advantages. For lab and production managers, selecting simulators with strong digital logging and automated test sequences reduces test-cycle time and improves repeatability a measurable ROI that supports higher ASPs for premium platforms.

Product Models

Solar array simulators (SAS) are advanced power supply systems that emulate the electrical output of photovoltaic (PV) arrays under varying environmental conditions. They are widely used for testing solar inverters, power electronics, and renewable energy systems in laboratories and industrial environments.

Single-Phase A compact simulator designed for low to medium power testing, usually for residential inverters, microinverters, and module-level devices. Notable products include:

AMETEK TerraSAS SAS1000 AMETEK Programmable Power: Compact, single-phase PV simulator with high accuracy for module-level testing.

Chroma 62000H-S Series Chroma ATE Inc.: Bench-top single-phase simulator featuring programmable I-V curve emulation

Regatron TopCon SAS Regatron AG: Single-phase programmable DC power supply optimized for PV emulation.

EPS SunSim 1000 EPS (Energy Power Systems): Lightweight, single-phase PV emulator for component-level solar testing.

MP4351A Auto-Ranging Module Keysight: A 1.4 kW module capable of source and sink modes, simulating solar array behavior with fast I-V switching and precise voltage/current control

Three-Phase A high-capacity simulator built for large-scale power testing, such as utility inverters, grid-tied systems, and industrial PV applications. Examples include:

Keysight PV8900 Series Keysight Technologies: High-power, three-phase SAS for grid-tied inverter testing and certification.

AMETEK TerraSAS SAS3000 AMETEK Programmable Power: Large-scale three-phase simulator with modular expansion for utility PV testing.

NH Research 9410 Series NH Research (NHR): High-performance three-phase SAS supporting renewable energy test centers.

Regatron TopCon Quadro SAS Regatron AG: Industrial-grade three-phase PV simulator with regenerative energy feedback.

EGSTON Power Hardware-in-the-Loop SAS EGSTON Power: Flexible, three-phase PV simulator for hardware-in-loop inverter validation.

Solar array simulators are a critical testing technology that enables fast, repeatable, standards-compliant development and production qualification for inverters and PV modules. Using a reconciled market approach, we estimate the electrical array-simulator segment at about USD 290 million in 2024 with a modeled CAGR of 10,4% to 2031 leading to roughly USD 579 million in 2031 under the central scenario. Unit volumes depend on product mix; a plausible sensitivity range implies 5,091 units in 2024 depending on whether buyers skew to high-ASP modular systems or to lower-cost bench/top-end units. Asia Pacific (including ASEAN and Indonesia) will be the primary growth engine because of manufacturing concentration, PV capacity growth and recent module capacity relocations that create local test and QC demand. Vendors that combine modularity, software, local service and rental offerings will capture the bulk of growth and recurring revenue.

Investor Analysis

For investors the what is a capital-equipment niche exposed to an expanding PV and inverter market but with durable aftermarket upside in calibration, software and rental services; the how is by targeting companies that have a balanced revenue mix of hardware, software and recurring services or by investing in rental/ATE operators that can deploy fleets to fast-growing assembly hubs; the why is that rising PV manufacturing and inverter complexity (string-level and utility inverters, microinverters, vehicle and space PV) require high-fidelity electrical emulation a test function that is difficult to outsource entirely and that benefits local presence and rapid turn-around. Key investor diligence items are a suppliers installed base in APAC, service/calibration footprint, software-upgradability for evolving test standards, and exposure to rental/ATE models that can convert cyclical capex into steadier utilization revenue. Evidence that module and inverter factories are relocating or expanding in Indonesia and ASEAN (and that PV capacity grew sharply in 2024) materially strengthens the growth case for local rental fleets and service labs.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5033482

5 Reasons to Buy This Report

It reconciles divergent market estimates into a defensible 2024 baseline and a transparent CAGR for the PV electrical array-simulator segment.

It translates dollars into practical unit ranges using clear ASP sensitivity bands so procurement and production planners can model capital requirements and test capacity.

It catalogs dated vendor and industry developments (for example Keysights MP4300A expansion on July 2024 that shift product capability and buyer choice.

It provides APAC and ASEAN drill-downs (including Indonesia) that tie regional PV manufacturing moves and capacity additions to localized test-equipment demand.

It profiles the vendor landscape and strategic levers modularity, software, rental/ATE and local service that determine winners and investment targets.

5 Key Questions Answered

What is a defensible 2024 market size for solar array simulators and which CAGR should be used to model growth to 2031?

What are realistic price-per-unit bands for bench, mid-range modular and high-power turnkey array simulators, and what implied shipment volumes did the 2024 market represent?

Which recent product or vendor announcements materially change the capability or economics of PV emulation and inverter test workflows?

How will Asia and ASEAN demand dynamics including factory relocations and PV capacity growth translate into regional demand for array simulators and rental/test services?

Which supplier business models create the most durable returns and what operational KPIs should investors stress in diligence?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Solar Array Simulator Market to Reach CAGR 10,4% by 2031 Top 10 Company Globally here

News-ID: 4178196 • Views: …

More Releases from QY Research

Top 30 Indonesian Dairy Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Indofood Sukses Makmur Tbk (INDF)

PT Indofood CBP Sukses Makmur Tbk (ICBP)

PT Ultrajaya Milk Industry & Trading Company Tbk (ULTJ)

PT Cisarua Mountain Dairy Tbk (CMRY)

PT Diamond Food Indonesia Tbk (DMND)

PT Mulya Boga Raya Tbk

PT Campina Ice Cream Industry Tbk

PT Kurniamitra Duta Sentosa Tbk

PT Greenfields Indonesia

PT Indolakto (subsidiary/brand under Indofood)

PT Ultra Jaya Frozen Foods (group affiliate)

PT Heilala Dairy Indonesia (export arm/processing)

PT Diamond Milk Products (non-listed…

High-Margin Growth: Inside the Global Injectable Veterinary Analgesics Boom

Injected veterinary pain management drugs are parenteral analgesics and anti-inflammatory therapeutics administered via IV, IM, or SC routes for rapid pain control in livestock and companion animals.

Used widely in Surgical recovery, Trauma and orthopedic treatment, Mastitis and inflammatory disease, Post vaccination pain mitigation and Companion animal chronic pain (arthritis, cancer).

Drug classes include NSAIDs, Opioids, Alpha-2 agonists, Local anesthetics and Multimodal combination injectables

Demand growth driven by rising pet humanization, expansion of…

From Fiber to LiDAR: Why PIN Photodiodes Are the Silent Engine of Optical Tech

PIN photodiodes are semiconductor light sensors that convert photons into electrical current using a P-Intrinsic-N structure for higher sensitivity, faster response time, and lower capacitance than PN devices.

Core components in optical communications, LiDAR, medical imaging, industrial automation, consumer electronics, and scientific instrumentation.

Manufacturing concentrated in Japan, China, Taiwan, South Korea, with backend packaging in ASEAN.

Demand growth is tied to Fiber optic network expansion, Autonomous driving sensors, Industrial machine vision, Wearables and…

Bidirectional DC-DC Converter Market 2025: Asia Leads as EV & Storage Demand Sur …

The global Bidirectional DC-DC Converter market is expanding rapidly as electrification, renewable energy storage, and vehicle electrification accelerate worldwide.

These converters enable two-way power flow, allowing energy transfer between batteries, supercapacitors, DC buses, and loads, making them critical for EVs, battery energy storage systems (BESS), UPS, telecom power systems, and microgrids.

Increasing demand for high-efficiency power management, fast charging, and distributed energy systems is driving industrial adoption across Asia and Southeast Asia…

More Releases for SAS

France Postbiotic Food Supplement Market to Grow at 16.1% CAGR, Led by SAS DYNVE …

Leander, Texas and TOKYO, Japan - Dec.10.2025 - "The France Postbiotic Food Supplement Market was valued at US$ 424.57 thousand in 2024 and is projected to reach US$ 738.00 thousand by 2028, growing at a CAGR of 16.1% during the forecast period 2025-2028."

The France Postbiotic Food Supplement Market is driven by increasing consumer awareness of gut microbiome health, rising prevalence of digestive disorders like IBS, and demand for stable, non…

France Probiotic Supplements Outlook - Functional & Nutritional Benefits | Major …

The France probiotic food supplement market recorded a value of US$ 184.56 million in 2024 and is expected to reach a value of US$ 249.66 million in 2028, growing at a CAGR of 8.01% during the forecast period (2025-2028).

The France Probiotic Food Supplement Market Market receives exhaustive analysis from DataM Intelligence, delivering stakeholders essential market data, emerging industry patterns, and strategic business intelligence. This in-depth research explores the competitive landscape…

Situation Awareness System (SAS) Market to see Ongoing Evolution: Microsoft, SAS …

The latest survey on Worldwide Situation Awareness System (SAS) Market is conducted to provide hidden gems performance analysis of Worldwide Situation Awareness System (SAS) to better demonstrate competitive environment. The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end-use applications. The report bridges the historical data from 2018 to 2022 and forecasted till 2029*, the…

Top Reasons to Learn SAS Training

SAS software has substantiated itself as the market head in giving another age of business knowledge software and administrations that makes genuine venture insight. The SAS Institute is the world's biggest secretly held software organization. It is likewise the main merchant that totally incorporates driving data warehousing, examination and customary BI applications, to make knowledge from huge measures of data. Isn't that great!

SAS has a vast part to play…

New Rackmount Enclosures for 2.5" SATA, SAS and SSD drives featuring iSCSI and S …

Sans Digital released a new line of compact rack mountable enclosures that are specially designed to house 2.5” SATA, SAS and SSD drives. Based on the industry proven EliteSTOR and EliteRAID product line, the 2.5” hard drive enclosures feature two options to connect to host computers, high-performance SAS or iSCSI. These connections allow a more reliable and higher performing solution for users looking for accommodating 8, 16, or 24 2.5”…

Marketing Research with SAS Enterprise Guide

Marketing Research with SAS Enterprise Guide provides a detailed explanation of the SAS® Enterprise Guide software. Using 236 screen shots and based on a step-by-step approach and real managerial situations, it guides the reader to an understanding of the use of statistical methods. It demonstrates ways of extracting information and collating it to provide reliable results, and how to use these results to solve day-to-day business and research problems.

Published…