Press release

Global Buy Now Pay Later Market Anticipated to Hit USD 196 Billion by 2032

The global Buy Now Pay Later (BNPL) market is witnessing exponential growth, with its size projected to rise from US$ 44.7 billion in 2025 to US$ 196.0 billion by 2032, representing a CAGR of 23.8% during the forecast period. BNPL services allow consumers to purchase goods without immediate payment, offering enhanced financial flexibility and reducing upfront costs. The surge in e-commerce adoption, coupled with the preference for convenient, interest-free installment options, has fueled the increasing popularity of BNPL solutions across the globe.Modern consumers are gravitating toward hassle-free payment methods that simplify their purchasing journey. Among various segments, e-commerce remains the leading application, as BNPL providers integrate their platforms directly into online checkout processes, offering seamless and instant payment experiences. Geographically, North America and Europe dominate the market due to the presence of well-established financial infrastructure, early fintech adoption, and high digital literacy among consumers.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/35349

Key Highlights from the Report

• The BNPL market is expected to grow at a CAGR of 23.8% from 2025 to 2032.

• Increasing preference for flexible payment options is driving market expansion.

• E-commerce platforms are the primary adopters of BNPL services.

• North America and Europe hold the largest market shares.

• Integration of BNPL with mobile wallets and digital platforms is enhancing adoption.

• Rising consumer awareness and fintech innovations are fueling market growth.

Market Segmentation

The BNPL market can be segmented by payment type and end-user industry. By payment type, it includes installment-based payments and deferred payments. Installment-based payments allow users to spread the total purchase amount over multiple scheduled payments, while deferred payments let consumers delay the full payment for a predetermined period. Installment payments dominate due to their popularity in both e-commerce and in-store purchases, providing manageable repayment schedules.

By end-user, the market spans retail, travel, healthcare, and electronics sectors. Retail is the leading sector, as BNPL options enhance customer conversion rates and boost average transaction value. Travel and hospitality industries are increasingly adopting BNPL to encourage bookings, while electronics and healthcare sectors leverage the services to make high-value purchases more accessible. This wide adoption demonstrates the versatility and growing relevance of BNPL solutions.

Regional Insights

North America leads the BNPL market due to widespread digital adoption, mature fintech infrastructure, and consumer readiness to embrace flexible payment solutions. The United States, in particular, represents a significant share, supported by a strong e-commerce ecosystem and leading BNPL service providers.

Europe is witnessing strong growth as countries like the UK, Germany, and France implement digital payment initiatives and increase consumer awareness of installment-based payment methods. Asia-Pacific is emerging as a high-potential region due to rapid e-commerce penetration, rising smartphone usage, and government support for digital financial services.

Read More: https://www.persistencemarketresearch.com/market-research/buy-now-pay-later-market.asp

Market Drivers

The primary driver of the BNPL market is the increasing consumer preference for flexible and convenient payment options that reduce upfront financial burden. The surge in online shopping and the integration of BNPL services into e-commerce platforms have further strengthened market demand.

Market Restraints

Despite rapid adoption, the BNPL market faces challenges such as regulatory scrutiny, potential overspending by consumers, and credit risk management. These factors may slow adoption in certain regions or require providers to implement stricter consumer credit checks.

Market Opportunities

Emerging opportunities include expansion into underpenetrated regions, partnerships with financial institutions, and integration with digital wallets and fintech apps. Additionally, BNPL adoption in sectors like travel, healthcare, and education offers significant growth potential.

Reasons to Buy the Report

✔ Detailed market analysis covering growth drivers, restraints, and opportunities.

✔ Comprehensive segmentation by payment type and end-user industry.

✔ Regional insights for North America, Europe, and Asia-Pacific markets.

✔ Forecast analysis from 2025 to 2032 with CAGR trends.

✔ Competitive landscape and company insights for strategic planning.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/35349

Frequently Asked Questions (FAQs)

How Big is the Buy Now Pay Later Market?

Who are the Key Players in the Global Buy Now Pay Later Market?

What is the Projected Growth Rate of the Market?

What is the Market Forecast for 2032?

Which Region is Estimated to Dominate the Industry through the Forecast Period?

Company Insights

Key Players operating in the market:

1. Afterpay

2. Klarna

3. Affirm

4. PayPal BNPL

5. Zip Co

Recent Developments:

• Klarna launched new installment options integrated with major e-commerce platforms in 2024.

• Afterpay expanded its partnership with retail chains in North America and Europe, increasing its consumer base.

The Buy Now Pay Later market is set for exponential growth, driven by rising e-commerce adoption, fintech innovations, and evolving consumer preferences for flexible payment solutions. As digital commerce continues to grow worldwide, BNPL services are poised to become an integral part of the global financial ecosystem, presenting significant opportunities for service providers, investors, and technology developers.

Related Reports:

Cloud Business Email Market https://www.persistencemarketresearch.com/market-research/cloud-business-email-market.asp

Healthcare Revenue Cycle Management Software Market https://www.persistencemarketresearch.com/market-research/healthcare-revenue-cycle-management-software-market.asp

Cognitive Systems Spending Market https://www.persistencemarketresearch.com/market-research/cognitive-systems-spending-market.asp

802.15.4 Chipset Market https://www.persistencemarketresearch.com/market-research/802-15-4-chipset-market.asp

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Buy Now Pay Later Market Anticipated to Hit USD 196 Billion by 2032 here

News-ID: 4177400 • Views: …

More Releases from Persistence Market Research

Bicycle Spokes Market Set for Strong Growth at 5.4% CAGR Through 2032 - Persiste …

The global bicycle spokes market is rapidly gaining traction as bicycles continue to be adopted as preferred choices for commuting, fitness, recreation, and eco‐friendly mobility. The global bicycle spokes market size is likely to be valued at US$2.9 billion in 2025 and is expected to reach US$4.2 billion by 2032, registering a steady CAGR of 5.4 % between 2025 and 2032.

➤ Download Your Free Sample & Explore Key Insights: https://www.persistencemarketresearch.com/samples/30615

Bicycle…

Herbal Toothpaste Market Growth Poised at 6.5% CAGR Through 2033 Amid Rising Hea …

The global oral care industry is undergoing a transformational shift as consumers increasingly prioritize natural, chemical free alternatives. Central to this transformation is the herbal toothpaste market, which is rapidly emerging as a mainstream segment driven by rising health consciousness, sustainability trends, and demand for botanical formulations. The global herbal toothpaste market size is likely to be valued at US$ 2.6 billion in 2026 and is projected to reach US$…

Dead Sea Mud Cosmetics Market Set for Steady Expansion Amid Rising Demand for Na …

The global beauty and personal care industry continues to evolve as consumers shift toward natural, mineral-based, and wellness-oriented skincare solutions. Among these, Dead Sea mud cosmetics have gained strong traction for their mineral content and perceived therapeutic benefits. According to industry estimates, the global dead sea mud cosmetics market is likely to be valued at US$1.5 billion in 2026 and is projected to reach US$2.3 billion by 2033, expanding at…

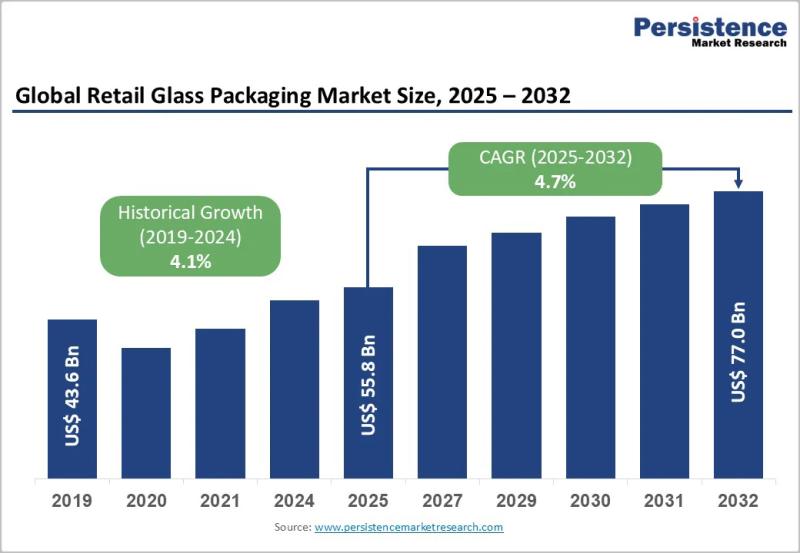

Retail Glass Packaging Market Projected to Reach US$77.0 Billion by 2032 at 5.3% …

The retail glass packaging market continues to play a crucial role in the global packaging ecosystem, particularly across food, beverage, cosmetics, and pharmaceutical retail channels. Glass packaging remains a preferred solution due to its premium appearance, chemical inertness, recyclability, and ability to preserve product integrity. As consumers increasingly prioritize sustainability, safety, and high quality packaging, retail glass packaging has regained strategic importance across both developed and emerging economies. Brands are…

More Releases for BNPL

Abzer Expands UAE Digital Payment Capabilities Through BNPL Collaboration with T …

Abzer, an enterprise technology company delivering digital payment, invoicing, and revenue automation platforms, has announced a strategic collaboration with Tamara to introduce Buy Now, Pay Later (BNPL) capabilities across its payment ecosystem in the United Arab Emirates.

The collaboration is designed to support enterprises and small-to-medium businesses seeking greater flexibility within their customer payment journeys. By integrating Tamara's BNPL functionality into Abzer's Payment Orchestration and Invoicing Suite, businesses can offer installment-based…

How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure

The UK government's announcement of comprehensive Buy Now Pay Later regulations represents more than just consumer protection measures-it signals a fundamental shift in how payment technology will operate across ecommerce platforms. As these rules prepare to take effect next year, technology teams, payment processors, and platform developers face the challenge of rebuilding infrastructure that has largely operated in an unregulated environment since BNPL's explosive growth began.

The regulatory framework demands sophisticated…

The Malaysia BNPL Market is growing owing to Digitalization, Rising Tech-Savvy P …

Focus On Shifting Preference Towards BNPL And Adoption of Online Payments Technology Are Major Factor Contributing Towards Development of BNPL Market in Malaysia

Adoption within Retail: With e-commerce growing faster than before the pandemic, it presents a big opportunity due to increased online payments. This coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry in…

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…