Press release

Australia Digital Payment Market Size, Share, Growth Analysis & Industry Forecast 2025-2033

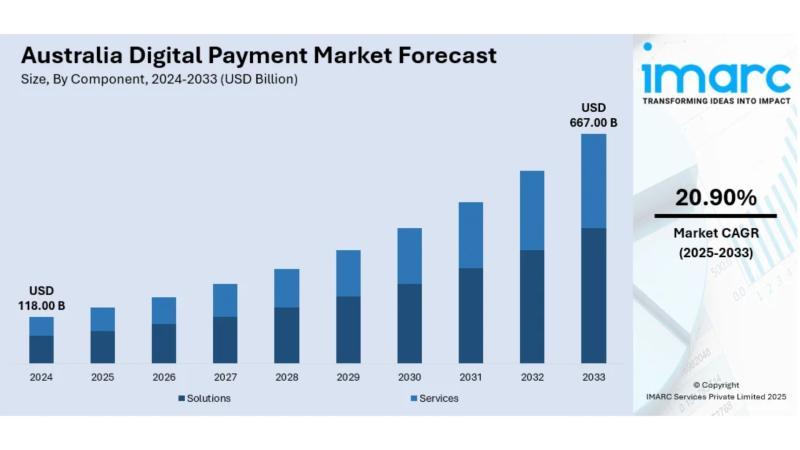

The latest report by IMARC Group, titled "Australia Digital Payment Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia digital payment market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia digital payment market size was valued at USD 118.00 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 667.00 Billion by 2033, exhibiting a growth rate (CAGR) of 20.90% during 2025-2033. Victoria & Tasmania currently dominates the market, holding a significant market share of 38.3% in 2024.Report Attributes:

• Base Year: 2024

• Forecast Years: 2025-2033

• Historical Years: 2019-2024

• Market Size in 2024: USD 118.00 Billion

• Market Forecast in 2033: USD 667.00 Billion

• Market Growth Rate 2025-2033: 20.90%

For an in-depth analysis, you can refer to a sample copy of the report:

https://www.imarcgroup.com/australia-digital-payment-market/requestsample

How Is AI Transforming the Digital Payment Market in Australia?

• Fraud detection algorithms are revolutionizing security protocols with machine learning reducing false positives by 85% while identifying suspicious transactions in real-time

• Personalized payment experiences are enhancing customer engagement through AI-powered recommendation engines and predictive spending analytics

• Voice-activated payment systems are emerging through smart assistants enabling hands-free transactions and simplified authentication processes

• Automated compliance monitoring is streamlining regulatory reporting with AI systems ensuring adherence to AML and KYC requirements across all transactions

Australia Digital Payment Market Overview

• Digital payment adoption is accelerating rapidly with over 85% of Australians now using contactless payments as their primary transaction method

• Buy-now-pay-later services are transforming consumer spending habits with platforms processing over AUD 16 billion in annual transactions

• Open banking implementation is driving innovation across financial services as data sharing enables new payment solutions and competitive pricing

• Government digitization initiatives are supporting cashless economy transition through digital identity frameworks and regulatory modernization

• Cross-border payment solutions are expanding as businesses seek efficient international transaction capabilities for e-commerce and remittances

Key Features and Trends of Australia Digital Payment Market

• Contactless payment technology is becoming the dominant transaction method with tap-and-go payments representing 95% of in-store card transactions

• Mobile wallet integration is deepening through partnerships between banks, retailers, and technology companies offering seamless omnichannel experiences

• Cryptocurrency payment adoption is growing gradually as regulatory clarity improves and major retailers begin accepting digital currency payments

• Biometric authentication systems are enhancing security with fingerprint and facial recognition becoming standard features across payment platforms

• Real-time payment capabilities are expanding through the New Payments Platform enabling instant 24/7 transfers between financial institutions

Growth Drivers of Australia Digital Payment Market

• Cashless Society Transition: Government and private sector initiatives driving reduced cash dependency across retail and service industries

• E-commerce Growth Acceleration: Online shopping expansion requiring sophisticated digital payment solutions and fraud protection capabilities

• Mobile-First Consumer Behavior: Smartphone penetration exceeding 90% enabling widespread adoption of mobile payment applications and services

• Regulatory Framework Modernization: Open banking and Consumer Data Right implementation creating competitive payment innovation opportunities

• Financial Inclusion Initiatives: Digital payment solutions extending banking services to underserved communities and small businesses

Browse Full Report with TOC & List of Figures:

https://www.imarcgroup.com/australia-digital-payment-market

Innovation & Market Demand of Australia Digital Payment Market

• Embedded finance solutions are proliferating as non-financial companies integrate payment capabilities directly into their customer journey workflows

• Central Bank Digital Currency exploration is advancing through Reserve Bank of Australia research pilots examining digital dollar implementation

• Quantum-resistant security protocols are developing to protect future payment systems against emerging cybersecurity threats and advanced computing

• Internet of Things payment integration is enabling automated transactions through connected devices and smart city infrastructure

• Sustainable payment technologies are emerging through carbon-neutral transaction processing and environmentally conscious fintech solutions

Australia Digital Payment Market Opportunities

• Regional market expansion presents significant growth potential as rural and remote areas gain improved internet connectivity and digital literacy

• B2B payment automation offers substantial opportunities for streamlining supply chain transactions and reducing administrative costs

• Cross-border remittance services are creating new revenue streams as multicultural communities seek affordable international money transfer solutions

• Government payment digitization provides large-scale opportunities for tax collection, social services, and public sector transaction processing

• Small business payment solutions represent an underserved market segment requiring tailored tools for inventory, accounting, and customer management

Australia Digital Payment Market Challenges

• Cybersecurity threats are intensifying as sophisticated criminal networks target payment infrastructure with ransomware and data breach attacks

• Regulatory compliance complexity is increasing as multiple authorities oversee different aspects of payment services and data protection requirements

• Technology integration difficulties are constraining legacy system modernization efforts requiring substantial infrastructure investment and expertise

• Consumer privacy concerns are growing regarding data collection and sharing practices across payment platforms and service providers

• Digital divide issues are limiting market penetration among elderly populations and low-income communities lacking technological access

Australia Digital Payment Market Analysis

• Market concentration is shifting as traditional banks compete with fintech startups and technology giants entering the financial services sector

• Partnership strategies are evolving through strategic alliances between established financial institutions and innovative payment technology providers

• Investment patterns are changing with venture capital flowing toward embedded finance, cryptocurrency infrastructure, and regulatory technology solutions

• User behavior analytics are revealing generational differences in payment preferences driving targeted product development and marketing strategies

• Interoperability standards are advancing through industry collaboration ensuring seamless transactions across different payment networks and platforms

Australia Digital Payment Market Segmentation:

1. By Payment Type:

• Mobile Payments

• Online Payments

• Point of Sale Payments

• Peer-to-Peer Payments

2. By Technology:

• Near Field Communication (NFC)

• Quick Response (QR) Codes

• Contactless Cards

• Mobile Applications

3. By End-User:

• Retail & E-commerce

• Healthcare

• Transportation

• Entertainment & Media

• Others

4. By Region:

• Victoria & Tasmania (38.3% market share)

• New South Wales

• Queensland

• South Australia

• Western Australia

• Others (ACT, Northern Territory)

Australia Digital Payment Market News & Recent Developments:

August 2025: Commonwealth Bank launched its new AI-powered fraud detection system, reducing transaction processing time by 40% while improving security accuracy across digital payment channels.

July 2025: Afterpay announced expansion of its merchant network to over 100,000 Australian retailers, integrating with major point-of-sale systems and enabling in-store buy-now-pay-later transactions.

Australia Digital Payment Market Key Players:

• Commonwealth Bank of Australia

• Westpac Banking Corporation

• ANZ Banking Group

• National Australia Bank (NAB)

• PayPal Australia

• Afterpay (Block Inc.)

• Square Australia

• Zip Co Limited

• Apple Pay

• Google Pay

• Samsung Pay

• BPAY Group

• eftpos

• Sezzle

• Klarna

Key Highlights of the Report:

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter's Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=21969&flag=E

FAQs: Australia Digital Payment Market

Q1: What is driving the explosive growth of Australia's digital payment market?

A: The market is primarily driven by cashless society transition, e-commerce growth acceleration, mobile-first consumer behavior, regulatory framework modernization, and financial inclusion initiatives supported by government policy.

Q2: Which region dominates the Australian digital payment market?

A: Victoria & Tasmania leads the market with a significant 38.3% market share in 2024, followed by New South Wales and Queensland in terms of transaction volume and adoption rates.

Q3: How is the Australian government supporting digital payment innovation?

A: The government supports innovation through open banking implementation, Consumer Data Right legislation, RBA regulatory sandboxes, and digital identity framework development enabling secure payment solutions.

Q4: What are the main challenges facing Australia's digital payment market?

A: Key challenges include intensifying cybersecurity threats, increasing regulatory compliance complexity, technology integration difficulties, growing consumer privacy concerns, and digital divide issues affecting market penetration.

Q5: Which payment methods are most popular among Australian consumers?

A: Contactless payments dominate with 95% of in-store card transactions, while mobile payments, buy-now-pay-later services, and peer-to-peer transfers are experiencing rapid growth across all demographic segments.

Conclusion of Report:

• Australia's digital payment landscape is experiencing unprecedented transformation driven by technological innovation, regulatory support, and changing consumer preferences toward contactless solutions

• Strategic partnerships between traditional banks and fintech companies are reshaping competitive dynamics while accelerating product development and market penetration

• Government policy initiatives including open banking and digital identity frameworks are creating favorable conditions for continued innovation and market expansion

• Victoria & Tasmania's market leadership demonstrates the importance of urban density, technological infrastructure, and early adoption in driving regional payment digitization

• Continued investment in cybersecurity, regulatory compliance, and financial inclusion will be essential for sustainable market growth and consumer trust maintenance

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Digital Payment Market Size, Share, Growth Analysis & Industry Forecast 2025-2033 here

News-ID: 4172712 • Views: …

More Releases from IMARC Services Private Limited

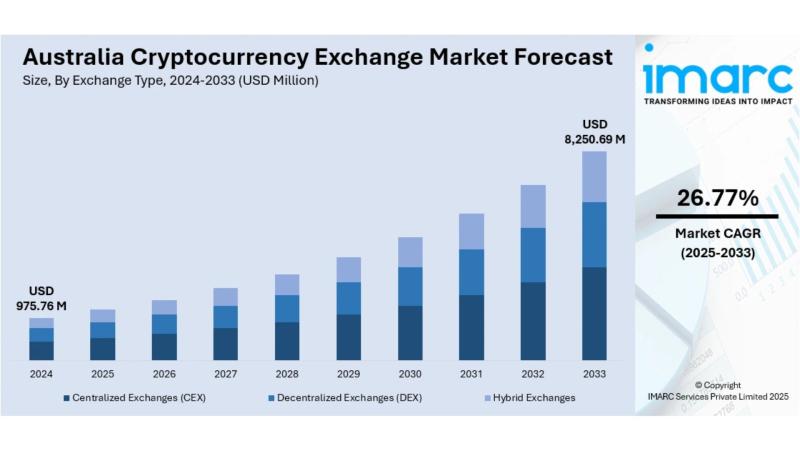

Australia Cryptocurrency Exchange Market Size, Share, Trends 2025-2033

Australia Cryptocurrency Exchange Market Overview

Market Size in 2024: USD 975.76 Million

Market Size in 2033: USD 8,250.69 Million

Market Growth Rate 2025-2033: 26.77%

According to IMARC Group's latest research publication, "Australia Cryptocurrency Exchange Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia cryptocurrency exchange market size was valued at USD 975.76 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,250.69 Million by 2033, exhibiting a…

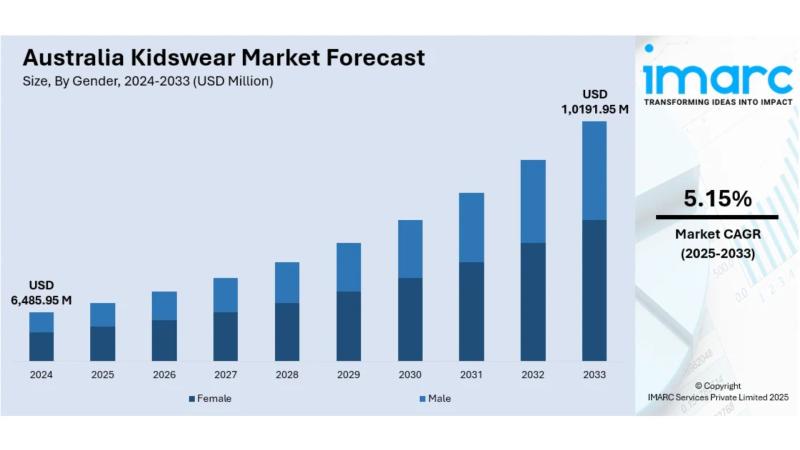

Australia Kidswear Market Size, Share, Trends and Forecast by 2025-2033

Australia Kidswear Market Overview

Market Size in 2024: USD 6,485.95 Million

Market Size in 2033: USD 10,191.95 Million

Market Growth Rate 2025-2033: 5.15%

According to IMARC Group's latest research publication, "Australia Kidswear Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia kidswear market size was valued at USD 6,485.95 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,191.95 Million by 2033, exhibiting a CAGR of 5.15%…

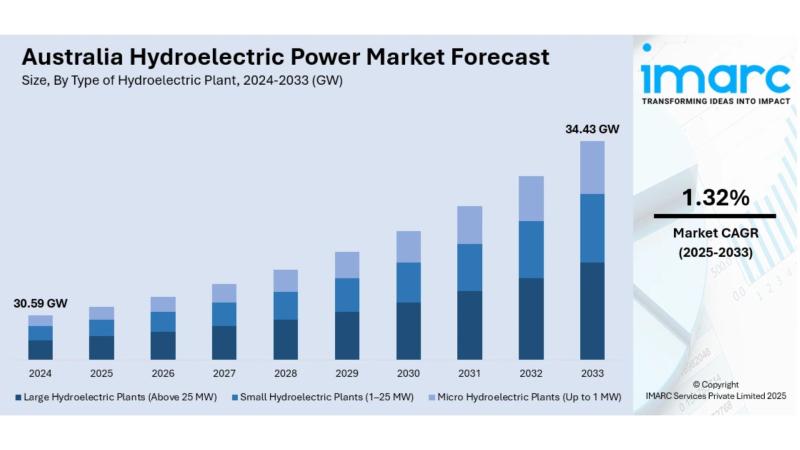

Australia Hydroelectric Power Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Hydroelectric Power Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia hydroelectric power market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia hydroelectric power market size reached 30.59 GW in 2024. Looking forward, IMARC Group expects the market to reach 34.43 GW…

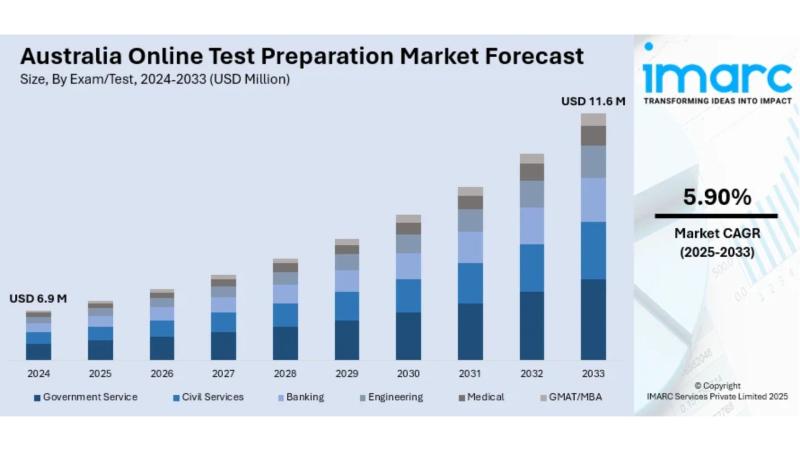

Australia Online Test Preparation Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Online Test Preparation Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia online test preparation market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia online test preparation market size reached USD 6.9 Million in 2024. Looking forward, IMARC Group expects the market…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…