Press release

Australia Chocolate Market Size, Share, Trends and Forecast by 2025-2033

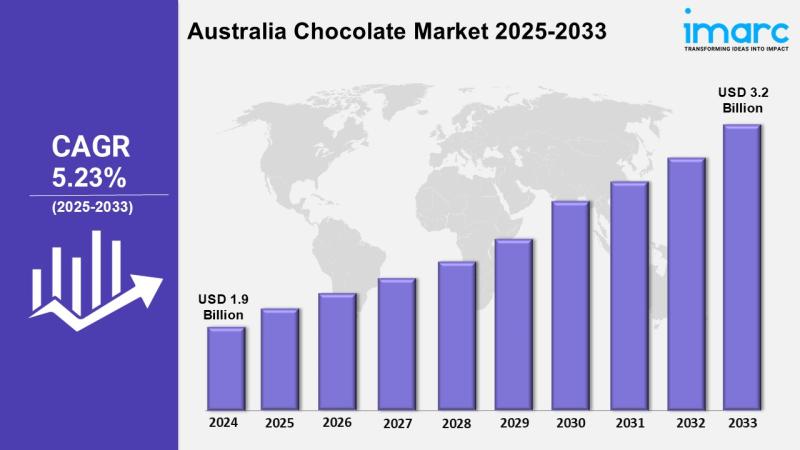

The latest report by IMARC Group, titled "Australia Chocolate Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia Chocolate market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia Chocolate market size reached USD 1.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.2 Billion by 2033, exhibiting a growth rate (CAGR) of 5.23% during 2025-2033.Report Attributes:

• Base Year: 2024

• Forecast Years: 2025-2033

• Historical Years: 2019-2024

• Market Size in 2024: USD 1.9 Billion

• Market Forecast in 2033: USD 3.2 Billion

• Market Growth Rate 2025-2033: 5.23%

For an in-depth analysis, you can refer to a sample copy of the report:

https://www.imarcgroup.com/australia-chocolate-market/requestsample

Australia Chocolate Market Overview

• Premium and artisanal segment growth is driving consumer shift toward high-quality, single-origin, and craft chocolate products across Australian markets

• Health-conscious consumption trends are expanding demand for dark chocolate, sugar-free alternatives, and functional chocolate products with added nutrients

• Seasonal and gifting markets are maintaining strong performance during holidays, celebrations, and special occasions throughout the year

• Retail channel diversification is accelerating through online platforms, specialty chocolate shops, and direct-to-consumer sales complementing traditional outlets

• Sustainable sourcing initiatives are becoming increasingly important as environmentally conscious consumers prioritize ethical and fair-trade chocolate options

Key Features and Trends of Australia Chocolate Market

• Plant-based and vegan chocolate alternatives are emerging as significant growth segments catering to dairy-free and environmentally conscious consumers

• Functional chocolate products are gaining market traction with additions of protein, probiotics, superfoods, and wellness-focused ingredients

• Personalization and customization options are expanding through bespoke chocolate services offering tailored products for individual preferences and occasions

• Local and regional chocolate brands are strengthening their presence by emphasizing Australian cocoa processing and unique flavor profiles

• Packaging innovation and sustainability are advancing with eco-friendly materials and attractive designs enhancing product appeal and environmental responsibility

Growth Drivers of Australia Chocolate Market

• Rising Disposable Income: Increasing household purchasing power enables consumers to spend more on premium, artisanal, and specialty chocolate products

• Growing Health Awareness: Consumer focus on antioxidant-rich dark chocolate and functional ingredients is driving demand for healthier chocolate alternatives

• Gifting and Celebration Culture: Strong tradition of chocolate gifting during holidays, birthdays, and special occasions maintains consistent market demand

• Tourism and Hospitality Growth: Recovery in tourism and expansion of cafes, restaurants, and hotels boosts commercial chocolate consumption

• Innovation in Product Development: Continuous introduction of new flavors, formats, and packaging attracts consumers seeking novel chocolate experiences

Browse Full Report with TOC & List of Figures:

https://www.imarcgroup.com/australia-chocolate-market

Innovation & Market Demand of Australia Chocolate Market

• Smart packaging technologies are incorporating QR codes and interactive elements that provide product information, brand stories, and authenticity verification

• Temperature-controlled distribution systems are improving product quality maintenance throughout the supply chain from manufacturing to retail

• 3D chocolate printing technologies are enabling custom designs and complex shapes for personalized gifts and specialty confectionery applications

• Blockchain traceability solutions are enhancing supply chain transparency by tracking cocoa beans from farm to finished chocolate products

• Automated retail solutions are expanding through vending machines and self-service chocolate dispensing systems in high-traffic locations

Australia Chocolate Market Opportunities

• Export market development is creating opportunities for premium Australian chocolate brands to enter Asian markets with growing middle-class populations

• Corporate gifting segments are expanding with businesses investing in branded chocolate products for client relationships and employee recognition programs

• Health and wellness chocolate categories are growing with products targeting specific dietary needs including diabetic-friendly and protein-enriched options

• E-commerce platform growth is enabling direct-to-consumer sales and subscription services for regular chocolate delivery to households

• Experiential chocolate tourism is emerging with factory tours, tasting experiences, and chocolate-making workshops attracting visitors and generating revenue

Australia Chocolate Market Challenges

• Fluctuating cocoa prices are affecting production costs and profit margins, particularly impacting smaller manufacturers with limited hedging capabilities

• Intense competition from international brands is pressuring local manufacturers with established global presence and marketing resources

• Health concerns about sugar content are influencing consumer behavior and regulatory attention toward chocolate consumption guidelines

• Supply chain disruptions are affecting raw material availability and transportation costs, particularly for imported cocoa and specialty ingredients

• Rising operational costs including labor and energy are constraining profitability across chocolate manufacturing and retail operations

Australia Chocolate Market Analysis

• Market consolidation is occurring as larger manufacturers acquire smaller brands to expand product portfolios and distribution networks

• Premium segment growth is outpacing mass market categories as consumers prioritize quality and unique experiences over price considerations

• Seasonal demand patterns remain significant with peak sales during Easter, Christmas, and Valentine's Day driving annual revenue cycles

• Regional preferences are emerging with different chocolate types and flavors gaining popularity in various Australian states and territories

• Technology adoption is accelerating among progressive manufacturers investing in automation, digital marketing, and e-commerce platforms

Australia Chocolate Market Segmentation:

1. By Product Type:

o Milk Chocolate

o Dark Chocolate

o White Chocolate

o Filled Chocolate

2. By Distribution Channel:

o Supermarkets and Hypermarkets

o Convenience Stores

o Online Retail

o Specialty Chocolate Shops

3. By End User:

o Individual Consumers

o Corporate Gifting

o Food Service Industry

o Institutional Buyers

4. By Region:

o New South Wales

o Victoria

o Queensland

o Western Australia

o Others

Australia Chocolate Market News & Recent Developments:

January 2024: Australian confectionery industry implemented revolutionary AI and digital technologies to boost innovation in chocolate production, with major manufacturers adopting smart quality control systems and automated manufacturing processes to enhance efficiency and consistency.

October 2024: Leading Australian chocolate brands launched expanded ranges of premium dark chocolate and health-focused products, responding to growing consumer demand for antioxidant-rich and functional chocolate alternatives across retail channels.

Australia Chocolate Market Key Players:

• Nestle Australia Limited

• Mondelez International (Cadbury)

• Mars Australia

• Ferrero Australia

• Lindt & Sprungli Australia

• Haigh's Chocolates

• San Churro

• Koko Black

• Darrell Lea

• Fyna Foods Australia

Key Highlights of the Report:

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter's Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=32010&flag=E

FAQs: Australia Chocolate Market

Q1: What factors are driving growth in the Australia chocolate market?

A: The market is primarily driven by rising disposable income enabling premium purchases, growing health awareness toward dark chocolate benefits, strong gifting culture, tourism recovery boosting commercial demand, and continuous product innovation attracting consumers.

Q2: Which chocolate type dominates the Australia chocolate market?

A: Milk chocolate represents the largest segment due to widespread consumer preference, though dark chocolate is experiencing faster growth rates driven by health consciousness and premium positioning trends among Australian consumers.

Q3: How is AI technology impacting Australia's chocolate industry?

A: AI is transforming operations through smart quality control optimizing production processes, flavor innovation platforms, predictive analytics for supply chain management, automated manufacturing systems, and machine learning for personalized customer experiences.

Q4: What challenges face Australia's chocolate market?

A: Key challenges include fluctuating cocoa prices affecting costs, intense international brand competition, health concerns about sugar content, supply chain disruptions, and rising operational costs constraining profitability across the industry.

Q5: Which distribution channels show strongest growth in Australia's chocolate market?

A: Online retail demonstrates the fastest growth as consumer shopping preferences shift digital, while supermarkets maintain the largest market share. Specialty chocolate shops also show strong performance in premium segments.

Conclusion of Report:

• Market momentum is strengthening as Australia's chocolate sector benefits from premiumization trends, health-conscious product development, and technological innovation improving manufacturing efficiency

• Consumer preferences are evolving toward higher quality, functional ingredients, and sustainable sourcing while maintaining strong demand for traditional favorites during seasonal peaks

• Digital transformation is accelerating across production and retail operations, enhancing quality control, customer engagement, and distribution efficiency throughout the industry

• Premium positioning strategies are succeeding as Australian consumers increasingly prioritize quality, unique flavors, and artisanal craftsmanship over basic commodity chocolate products

• Growth prospects remain positive supported by demographic trends, lifestyle changes, and continued innovation in products, packaging, and retail experiences

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Chocolate Market Size, Share, Trends and Forecast by 2025-2033 here

News-ID: 4171119 • Views: …

More Releases from IMARC Services Private Limited

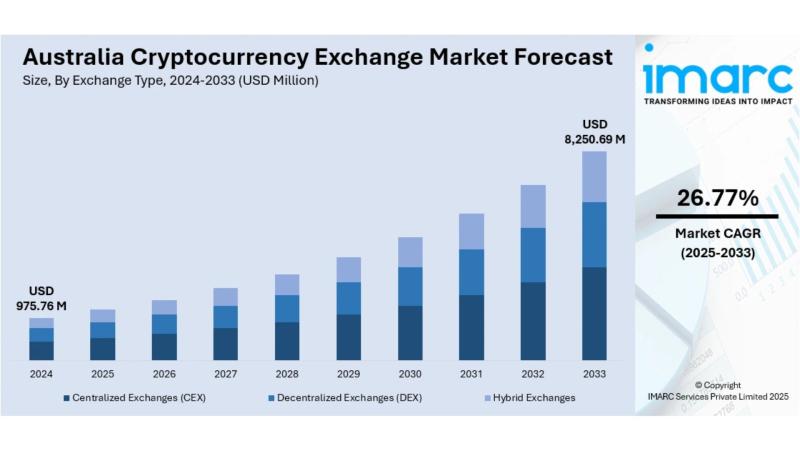

Australia Cryptocurrency Exchange Market Size, Share, Trends 2025-2033

Australia Cryptocurrency Exchange Market Overview

Market Size in 2024: USD 975.76 Million

Market Size in 2033: USD 8,250.69 Million

Market Growth Rate 2025-2033: 26.77%

According to IMARC Group's latest research publication, "Australia Cryptocurrency Exchange Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia cryptocurrency exchange market size was valued at USD 975.76 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,250.69 Million by 2033, exhibiting a…

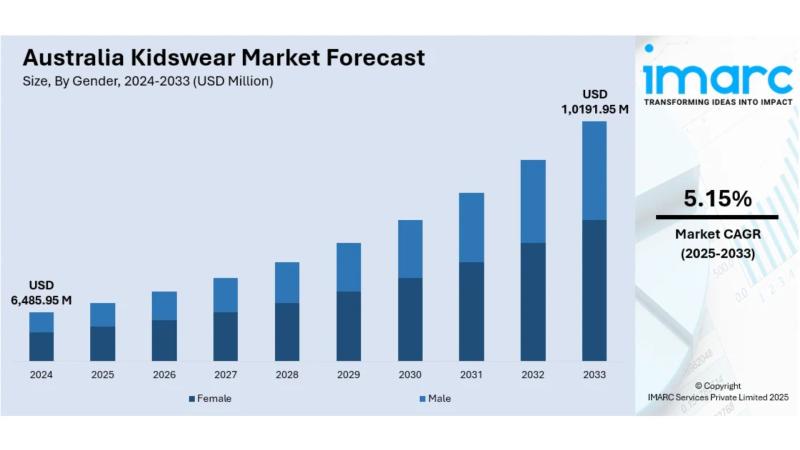

Australia Kidswear Market Size, Share, Trends and Forecast by 2025-2033

Australia Kidswear Market Overview

Market Size in 2024: USD 6,485.95 Million

Market Size in 2033: USD 10,191.95 Million

Market Growth Rate 2025-2033: 5.15%

According to IMARC Group's latest research publication, "Australia Kidswear Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia kidswear market size was valued at USD 6,485.95 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,191.95 Million by 2033, exhibiting a CAGR of 5.15%…

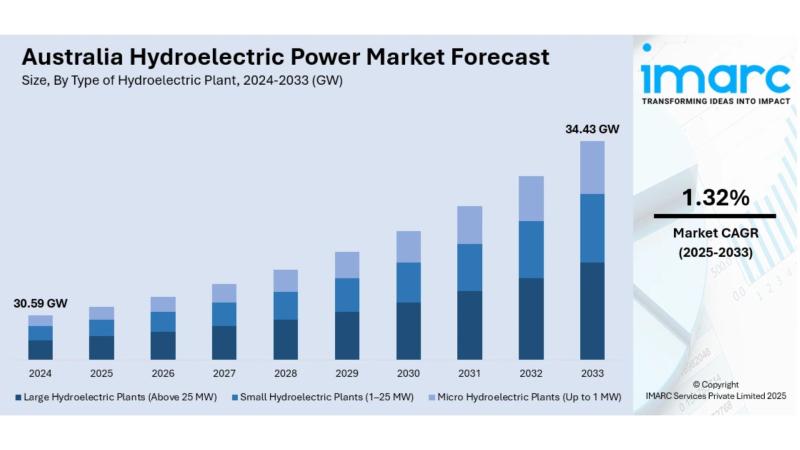

Australia Hydroelectric Power Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Hydroelectric Power Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia hydroelectric power market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia hydroelectric power market size reached 30.59 GW in 2024. Looking forward, IMARC Group expects the market to reach 34.43 GW…

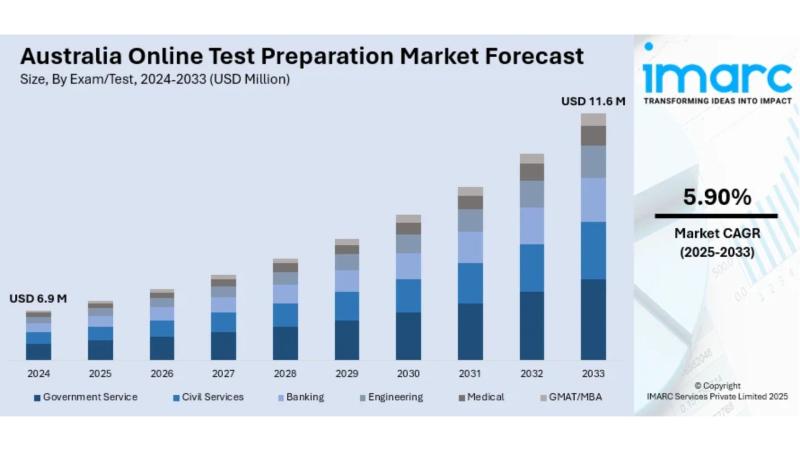

Australia Online Test Preparation Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Online Test Preparation Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia online test preparation market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia online test preparation market size reached USD 6.9 Million in 2024. Looking forward, IMARC Group expects the market…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…