Press release

Commercial Loan Software Market to Hit $15.88 Billion by 2035, Driven by AI and Cloud Adoption

The global commercial loan software (CLS) market is on a strong growth trajectory. Valued at USD 6.13 billion in 2024, it is expected to reach USD 6.71 billion in 2025 and further expand to USD 15.88 billion by 2035, registering a CAGR of 9.1%. The rise of digital banking, automation, and cloud-based platforms has significantly reshaped how institutions handle loan origination, servicing, and compliance. Financial institutions are adopting smarter systems to streamline underwriting, improve risk assessments, and ensure regulatory alignment.Download Sample Report Here : https://www.meticulousresearch.com/download-sample-report/cp_id=6262

In North America alone, more than 68% of mid-sized banks had shifted to digital loan processing systems by 2024. Their main motivations were reducing manual inefficiencies and staying compliant with evolving regulations. Meanwhile, the rapid growth of embedded finance and API-driven solutions is transforming how lenders engage with borrowers and third-party partners. These trends are fueling demand for software equipped with AI-driven decision-making, predictive analytics, and faster turnaround times.

Competitive Landscape

The competitive environment is marked by both established players and innovative newcomers. Leading firms such as FIS, Finastra, nCino, and Temenos continue to dominate the market with robust platforms tailored to diverse lending workflows. For instance, nCino has become popular among regional banks due to its AI-powered credit decisioning tools, while Finastra's Fusion Loan IQ platform maintains a strong global presence.

Smaller players like Lendisoft and CloudBnq are carving out space in niche markets such as SME and community banking. Increasingly, differentiation depends less on the core functionality of these platforms and more on user experience, ease of integration, and advanced compliance features.

Recent Innovations in Loan Software

Innovation is central to the market's momentum. In August 2025, HyperVerge introduced an AI-driven loan origination system focused on fraud detection. This solution offers lenders customizable decision engines, real-time dashboards, and machine learning-powered fraud prevention to reduce risks during underwriting.

The same month, M2P Fintech launched Finflux, an AI-driven loan origination platform designed specifically for microfinance, retail, and SME lending. It integrates with third-party systems, automates notifications, and uses predictive analytics to expand access to underbanked populations. These product launches reflect the industry's broader shift toward greater automation, transparency, and customer-centric innovation.

Browse in Depth : https://www.meticulousresearch.com/product/commercial-loan-software-market-6262

Key Market Drivers

A primary driver of growth is the rising demand for automation. Banks and credit unions are adopting automated solutions to cut costs, reduce errors, and accelerate decision-making. According to surveys in 2024, more than 70% of large banks with assets above USD 10 billion automated key workflows. Regulators like the OCC and FDIC are also encouraging digital adoption to improve transparency and risk management.

Another driver is the growth in SME lending. In Asia-Pacific, SME loan applications through digital channels increased by nearly 28% in 2024. Software providers are responding with solutions that offer flexible repayment terms, multi-channel onboarding, and more accurate credit scoring tailored to SMEs.

AI and predictive analytics are also transforming the market. Banks using AI reported 20% lower default rates and 25% improved loan origination efficiency in 2024. By leveraging borrower behavior and macroeconomic indicators, AI-driven models provide real-time credit risk insights and fraud alerts, which are now being integrated into loan origination platforms worldwide.

Why is AI considered a game changer in commercial loan software?

AI is revolutionizing commercial lending by improving both speed and accuracy in decision-making. It enables lenders to analyze vast amounts of borrower data, predict risks more effectively, and detect potential fraud in real time. For example, banks that implemented AI in loan origination systems saw faster approvals and significantly fewer defaults. This makes AI not just a tool for efficiency but also a safeguard for financial stability.

Regional Market Highlights

North America remains the largest market for commercial loan software (Markt für kommerzielle Kreditsoftware), thanks to high rates of cloud migration and regulatory support. In 2024, over 60% of U.S. banks used cloud-based platforms, and AI adoption in lending rose by 35% year-on-year. Regulatory clarity from agencies like the OCC and CFPB has accelerated digital compliance adoption.

Asia-Pacific is projected to grow at the fastest pace, with a CAGR of 10.9% through 2035. Countries such as India and Indonesia are leading this expansion, supported by fintech innovation, government incentives, and the rapid rise of SME borrowing through digital platforms. In China, the government-backed Digital Finance Development Plan has spurred a 38% rise in digital loan origination in 2024. Vendors like Ping An Technology and Tencent Cloud are playing a central role in modernizing lending operations.

Germany, meanwhile, is modernizing commercial lending to comply with EU-wide regulations like Basel III and GDPR. Over half of German banks upgraded their platforms in 2024, with a growing emphasis on sustainable financing and ESG-based credit scoring.

Segmental Insights

Among applications, loan origination software represents the largest share, accounting for around 30% of the market in 2025. Banks and credit unions are prioritizing digital onboarding, automated verification, and AI-powered decisioning to reduce processing times and improve customer satisfaction.

By component, solutions dominate the market, holding over 70% of the revenue share in 2025. Institutions prefer comprehensive platforms that cover the entire loan lifecycle-origination, risk management, underwriting, and servicing. These solutions integrate AI and machine learning, providing scalability and compliance support while seamlessly connecting with existing core banking systems.

Buy the Complete Report with an Impressive Discount: https://www.meticulousresearch.com/view-pricing/1579

Future Outlook

The global commercial loan software market (Marché des logiciels de prêts commerciaux) is well-positioned for sustained growth. As financial institutions continue to pursue digital-first strategies, demand for cloud-based, AI-enabled, and compliance-focused platforms will intensify. Challenges such as data security, legacy integration, and regulatory diversity remain, but advancements in predictive analytics, low-code development, and ESG scoring are set to reshape the industry over the next decade.

By 2035, commercial loan software will no longer be just an operational tool-it will be an essential driver of competitive advantage, helping lenders deliver faster, smarter, and more transparent services to borrowers worldwide.

About Us:

We are a trusted research partner for leading businesses worldwide, empowering Fortune 500 organizations and emerging enterprises with actionable market intelligence tailored to drive revenue transformation and strategic growth. Our insights reveal forward-looking revenue opportunities, providing our clients with a competitive edge through a diverse suite of research solutions-syndicated reports, custom research, and direct analyst engagement.

Each year, we conduct over 300 syndicated studies and manage 60+ consulting engagements across eight key industry sectors and 20+ geographic markets. With a focus on solving the complex challenges facing global business leaders, our research enables informed decision-making that propels sustainable growth and operational excellence. We are dedicated to delivering high-impact solutions that transform business performance and fuel innovation in the competitive global marketplace.

Contact Us:

Meticulous Market Research Pvt. Ltd.

1267 Willis St, Ste 200 Redding,

California, 96001, U.S.

Email- sales@meticulousresearch.com

USA: +1-646-781-8004

Europe: +44-203-868-8738

APAC: +91 744-7780008

Visit Our Website: https://www.meticulousresearch.com/

For Latest Update Follow Us:

LinkedIn- https://www.linkedin.com/company/meticulous-research

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Commercial Loan Software Market to Hit $15.88 Billion by 2035, Driven by AI and Cloud Adoption here

News-ID: 4169658 • Views: …

More Releases from Meticulous Research®

Global Industrial Ventilation Systems Market Report 2026-2036: Trends, Growth Dr …

The global industrial ventilation systems market was valued at USD 7.5 billion in 2025 and is projected to grow steadily over the forecast period. The market is expected to increase from USD 8.2 billion in 2026 to approximately USD 16.8 billion by 2036, registering a compound annual growth rate (CAGR) of 8.4% from 2026 to 2036. This consistent growth trajectory reflects the rising importance of maintaining safe, compliant, and energy-efficient…

Global Food Packaging Equipment Market Analysis and Forecast 2026-2036: Trends, …

The global food packaging equipment market was valued at USD 20.32 billion in 2025 and is projected to grow steadily over the coming decade. From an estimated USD 21.50 billion in 2026, the market is expected to reach approximately USD 37.08 billion by 2036, registering a compound annual growth rate (CAGR) of 5.6% during the forecast period from 2026 to 2036. In volume terms, the market is anticipated to expand…

Global Autonomous Construction Robots Market Analysis, Trends, and Forecasts 202 …

The autonomous construction robots market is still relatively young, but it is expanding quickly. In 2025, it was valued at around USD 1.8 billion. By 2026, the figure is expected to move up to approximately USD 2.2 billion, and if current projections hold, the market could approach USD 10.5 billion by 2036. That translates to a compound annual growth rate of 18.9% over the 2026-2036 period. This level of growth…

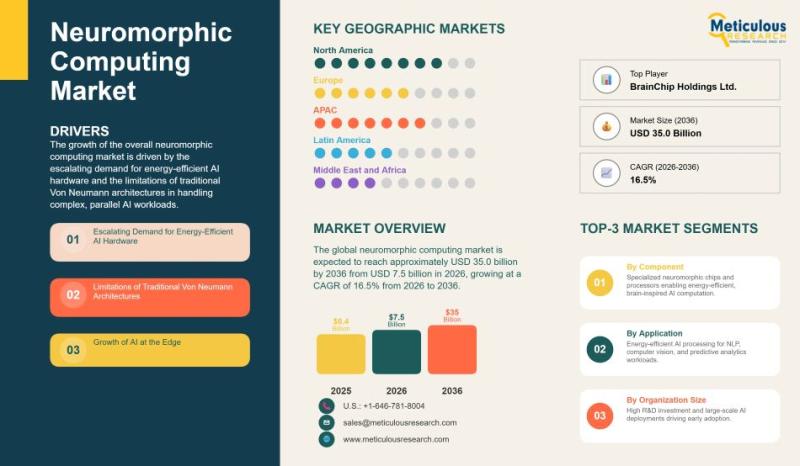

Global Neuromorphic Computing Market Outlook 2026-2036: Trends, Opportunities, a …

The global neuromorphic computing market was valued at USD 6.4 billion in 2025 and is projected to grow to USD 7.5 billion in 2026, reaching approximately USD 35.0 billion by 2036. This expansion reflects a compound annual growth rate (CAGR) of 16.5% from 2026 to 2036. The growth trajectory is driven by the rising demand for energy-efficient artificial intelligence infrastructure and the structural limitations of traditional Von Neumann architectures in…

More Releases for SME

SME Insurance - Market Size | Valuates Reports

SME Insurance - Market Size | Valuates Reports

The global market for SME Insurance was estimated to be worth US$ 18010 million in 2023 and is forecast to a readjusted size of US$ 24100 million by 2030 with a CAGR of 4.2% during the forecast period 2024-2030

View Sample Report

https://reports.valuates.com/request/sample/QYRE-Auto-3D7510/China_SME_Insurance_Market_Report_Forecast_2021_2027

Report Scope

This report aims to provide a comprehensive presentation of the global market for SME Insurance, focusing on the total sales revenue, key…

SME Force Automation Market Investment Analysis

The SME force automation market is expected to witness market growth at a rate of 15.20% in the forecast period of 2021 to 2028. Data Bridge Market Research report on SME force automation market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market's growth. The rising adoption of cloud sales force automation (SFA) software is escalating…

UK SME Insurance Market Report- Competitor Dynamics | Insurers can challenge the …

The research study contains an in detail descriptive overview and analysis of the UK SME Insurance Market, a summary of the UK SME Insurance Market shares constituted by each component, the annual growth of each sector, and the revenue potential of the section. In addition, UK SME Insurance Market production and consumption data are used to determine the geographical features.

Get FREE PDF Sample of the Report @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=4430784

AXA and…

INDIA: Big March for SME

In keeping with recent and ongoing changes in the business landscape, business is focusing on mobility rather than stability, and the service business has evolved accordingly. Globalization is the buzzword as geographic boundaries cease to exist. Business is competing for opportunities in an international arena. Because the world is connected in a single unit, any crisis in one part of the world has repercussions in other parts, too.

Small and medium-sized…

IndiaMART.com Pushes for Cohesive SME Ecosystem through SME Learning Series

Partners with Smallenterpriseindia.com for the Series

Series aims to bring clear understanding of Finance, HR, IT, Communication, Marketing & other business verticals to SMEs

Roadshows in Delhi, Ghaziabad, Gurgaon, Bangalore & Vadodara receive huge response

New Delhi, 28th May, 2011: Small and Medium Enterprises (SMEs) have been playing a vital role in growth and development of Indian economy. They are credited with generating million of job opportunities every year along with contributing a…

IndiaMART.com Plans Massive SME Awareness Campaign

To be launched in 2-3 weeks, campaign's theme centers on boosting awareness amongst SMEs on the need to go online

- Educate buyers & suppliers on how they can leverage Internet for 24X7 global presence, cost-effective marketing & B2B matchmaking

- Highlight catalyzing role of B2B e-marketplaces like IndiaMART.com in growth of SMEs

- Nation-wide drive to be launched across newspapers, magazines, online, radio, electronic & outdoor media

New Delhi,…