Press release

Australia Fintech Market Projected to Reach USD 9.5 Billion by 2033

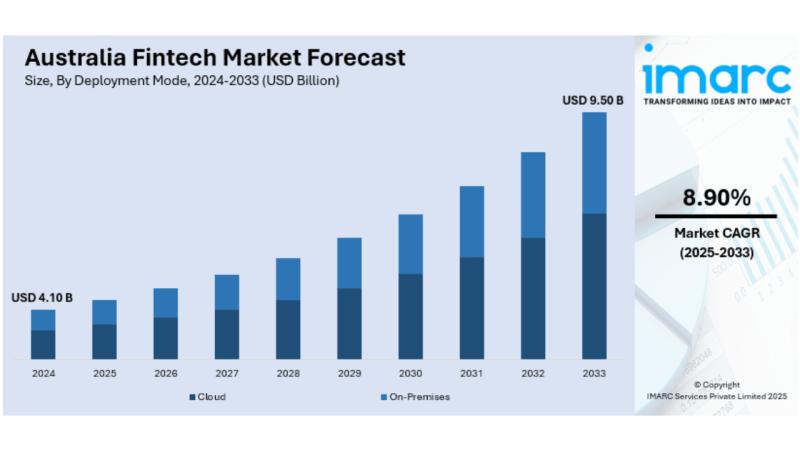

The latest report by IMARC Group, titled "Australia Fintech Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia fintech market growth. The report includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia fintech market size reached USD 4.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.50 Billion by 2033, exhibiting a growth rate (CAGR) of 8.90% during 2025-2033.• Base Year: 2024

• Forecast Years: 2025-2033

• Historical Years: 2019-2024

• Market Size in 2024: USD 4.10 Billion

• Market Forecast in 2033: USD 9.50 Billion

• Market Growth Rate 2025-2033: 8.90%

Australia Fintech Market Overview

Australia's fintech market is expanding rapidly, driven by the widespread adoption of digital banking, open banking under the Consumer Data Right (CDR), mobile wallets, and real-time digital payment platforms. Regulatory support and strong collaboration within the fintech ecosystem are fostering innovation. Significant institutional investment in technologies like blockchain, artificial intelligence, and cybersecurity is accelerating the growth of robo-advisory services, alternative lending platforms, neo-banks, and decentralized finance (DeFi). High smartphone and internet penetration continues to support user adoption, while increasing trust is being reinforced through stronger security measures and regulatory compliance.

Request For Sample Report:

https://www.imarcgroup.com/australia-fintech-market/requestsample

Australia Fintech Market Trends

Market Trends

• Digital Payments Dominance: Digital payments led the Australian fintech landscape in 2024, accounting for 44.1% of the market share. The adoption of real-time account-to-account payments and mobile wallets continues to rise, driven by consumer demand for seamless and cashless transactions.

• RegTech Emergence: Regulatory technology (RegTech) has become the third-largest fintech segment in Australia, with nearly 80 active participants. This growth is fueled by increasing compliance demands and the need for efficient regulatory reporting and monitoring.

• Consolidation and M&A Activity: The fintech sector has seen a reduction in the number of independent firms, from over 800 in 2022 to 767 in 2024. This decline is attributed to mergers and acquisitions, as well as fintechs ceasing operations, indicating a trend towards market consolidation.

Market Growth

• Market Size and Forecast: The Australian fintech market was valued at USD 4.10 billion in 2024 and is projected to reach USD 9.50 billion by 2033, exhibiting a CAGR of 8.90% during 2025-2033.

• Investment Trends: In the second half of 2024, Australia registered $1.1 billion in fintech investments across 43 deals, marking a significant improvement from the previous year. Notable transactions included Experian's acquisition of Illion for $540 million.

Opportunities

• Embedded Finance Growth: The integration of financial services into non-financial platforms presents opportunities for fintechs to offer seamless financial products within various ecosystems, enhancing customer experience and engagement.

• Cross-Border Expansion: Australian fintechs have the potential to expand internationally, leveraging the country's strong regulatory framework and technological advancements to tap into global markets.

• AI and Blockchain Integration: The adoption of artificial intelligence and blockchain technologies can drive innovation in areas such as fraud detection, credit scoring, and secure transactions, offering competitive advantages to fintech firms.

Market Drivers

• Government Initiatives: Supportive policies, including the implementation of open banking regulations, have fostered competition and innovation within the fintech sector, encouraging the development of new financial products and services.

• Consumer Demand for Digital Solutions: The increasing preference for digital and mobile-first financial services among consumers is driving the growth of fintech solutions, particularly in payments, lending, and wealth management.

• Investment in Innovation: Continued investment in fintech startups and partnerships between financial institutions and technology firms are strengthening the industry's expansion, facilitating the development of innovative financial solutions.

Australia Fintech Market Segmentation

By Deployment Mode:

• Cloud

• On Premises

By Technology:

• API

• AI

• Blockchain

• Data Analytics

• RPA

• Others

By Application:

• Payments & Fund Transfer

• Loans

• Insurance & Personal Finance

• Wealth Management

• Others

By End User:

• Banking

• Insurance

• Securities

• Others

By State:

• New South Wales

• Victoria

• Queensland

• Western Australia

• South Australia & Tasmania

• Others

Browse Full Report with TOC & List of Figures:

https://www.imarcgroup.com/australia-fintech-market

Latest Australia Fintech Market News

• March 2025: The report emphasizes growing demand for convenient digital financial services and regulatory collaboration.

• May 2024: Crypto ownership among 31% of adults reflects growing consumer acceptance and fintech innovation.

Key Highlights of the Australia Fintech Market Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID 19 Impact on the Market

4. Porter's Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current, and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information not currently within the scope of the report, customization is available.

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=6065&flag=E

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create lasting impact. The company provides a comprehensive suite of market entry and expansion services, including market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals, licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Fintech Market Projected to Reach USD 9.5 Billion by 2033 here

News-ID: 4169165 • Views: …

More Releases from IMARC Group

Trinitrotoluene Production Plant DPR & Unit Setup 2026: Demand Analysis and Proj …

Setting up a trinitrotoluene production plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This critical explosive compound serves military and defense, mining and quarrying, construction and demolition, and industrial explosives manufacturing applications. Success requires careful site selection, efficient nitration processes, stringent safety protocols for handling hazardous materials, reliable raw material sourcing, and compliance with industrial safety regulations to ensure profitable and sustainable operations.

Market Overview…

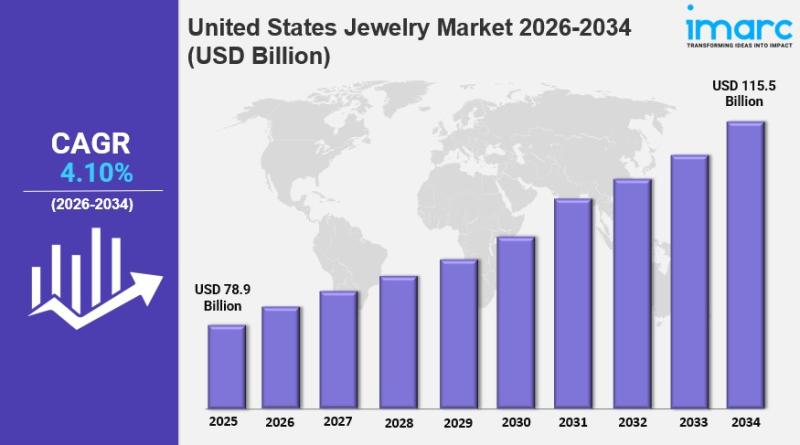

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…