Press release

Australia HVAC Market Size, Share and Growth Analysis Report 2024-2033

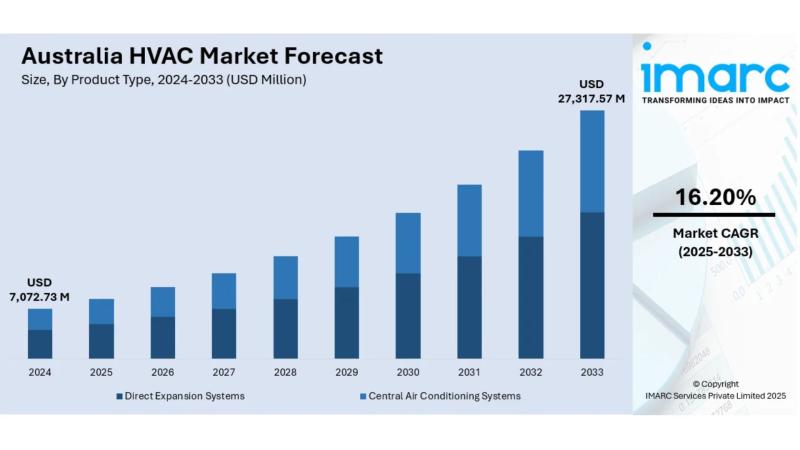

Australia HVAC Market Size, Share and Growth Analysis Report 2024-2033The latest report by IMARC Group, titled "Australia HVAC Market Report by Product Type (Direct Expansion Systems, Central Air Conditioning Systems), End User (Residential, Commercial), and Region 2025-2033," offers a comprehensive analysis of the Australia HVAC market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia HVAC market size reached USD 7,072.73 million in 2024. Looking forward, IMARC Group expects the market to reach USD 27,317.57 million by 2033, exhibiting a growth rate of 16.20% during 2025-2033.

Report Attributes:

• Base Year: 2024

• Forecast Years: 2025-2033

• Historical Years: 2019-2024

• Market Size in 2024: USD 7,072.73 Million

• Market Forecast in 2033: USD 27,317.57 Million

• Market Growth Rate 2025-2033: 16.20%

For an in-depth analysis, you can refer to a sample copy of the report: https://www.imarcgroup.com/australia-hvac-market/requestsample

How Is AI Transforming the HVAC in Australia?

• Smart system optimization is revolutionizing energy efficiency, with AI-controlled heat pumps achieving 13% average energy savings compared to standard heating curves by improving reference room and setpoint temperature matching

• Predictive maintenance analytics are transforming service delivery through machine learning algorithms that analyze system performance data, predict equipment failures, and optimize maintenance scheduling to reduce downtime costs

• Building management integration is advancing through AI-enabled platforms that automatically adjust HVAC operations based on occupancy patterns, weather forecasts, and energy pricing to maximize efficiency and comfort

• Energy consumption analysis powered by artificial intelligence is enabling real-time monitoring and automated optimization of heating, cooling, and ventilation systems, with buildings accounting for 40% of total energy consumption

• Smart diagnostics and troubleshooting systems are enhancing service capabilities through AI-powered fault detection, remote system monitoring, and automated performance adjustments that reduce service calls and operational costs

Australia HVAC Market Overview

• Climate variability demands are driving regional solution customization, with northern states requiring tropical cooling systems while southern areas need efficient heating solutions, creating diverse market opportunities across geographic zones

• Urban infrastructure expansion is accelerating through population growth and interstate migration, with major construction projects including hospitals, educational facilities, and mixed-use developments requiring sophisticated climate control systems

• Energy efficiency mandates are reshaping product development, with rising electricity costs and carbon reduction pressures driving demand for high star-rated systems with inverter technology and smart controls

• Post-pandemic air quality focus is continuing to influence market dynamics, with employers and building owners prioritizing improved ventilation, air purification, and humidity control to create healthier indoor environments

• Heat pump adoption acceleration is gaining momentum, with Australia's air source heat pump market valued at USD 870 million in 2024 and expected to reach USD 1.40 billion by 2030 at 8.43% growth rate

Key Features and Trends of Australia HVAC

• Smart home integration is expanding rapidly through IoT-enabled systems that connect with mobile apps, voice control, and centralized energy management platforms, offering remote temperature control and usage analytics

• Sustainability certification requirements are influencing product selection, with developers seeking NABERS and Green Star ratings requiring HVAC systems that meet strict efficiency criteria and environmental standards

• Retrofit market growth is accelerating in metropolitan areas, with heritage properties and legacy infrastructure being modernized with discrete, high-performance systems to improve energy ratings without compromising architectural integrity

• Commercial automation advancement is progressing through building management systems (BMS) that integrate HVAC automation to optimize efficiency, reduce energy costs, and provide real-time system monitoring capabilities

• Government incentive support is strengthening through programs like Solar Victoria and NSW government funding for heat pump development, including 17 recommendations for industry improvements and minimum energy performance standards

Growth Drivers of Australia HVAC

Market Growth Drivers:

1. Climate Control Regional Demands - Australia's diverse climate zones from tropical north to temperate south create consistent demand for tailored heating and cooling solutions, with urban coastal cities requiring centralized systems for high-rise developments

2. Population Growth and Urbanization - Expanding urban centers in Sydney, Melbourne, and Brisbane are driving infrastructure development including shopping centers, public buildings, and transport hubs requiring efficient HVAC installations

3. Energy Efficiency Regulations - Government-mandated energy standards and green building codes are reinforcing demand for high-efficiency systems with improved performance ratings and lower operating costs

4. Heat Pump Market Expansion - Government incentives and rising energy costs are accelerating heat pump adoption, with potential annual savings of up to $250 for residential users replacing gas systems

5. Smart Technology Integration - Growing consumer preference for connected HVAC systems with mobile app control, voice activation, and predictive maintenance is driving premium product demand and system upgrades

Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/australia-hvac-market

Innovation & Market Demand of Australia HVAC

• Advanced filtration technology is expanding through HEPA filter integration and air purification systems responding to workplace air quality concerns, with businesses investing in upgraded ventilation for employee safety

• Variable refrigerant flow systems are gaining popularity through products like Johnson Controls' SideSmart VRF system offering maximum cooling capacity of 152 kW in slim, modular formats suited for retrofits

• Digital monitoring capabilities are enhancing system performance through AI-driven optimization that improves efficiency, reduces operating costs, and provides real-time performance analytics for building managers

• Sustainable refrigerant adoption is accelerating to meet Australia's plan to cut HFC emissions to 15% of baseline levels by 2036, driving demand for low-carbon HVAC technologies across all sectors

• Modular system design is advancing through scalable solutions capable of adjusting to different occupancy levels and load demands, enabling contractors and developers to integrate HVAC consultants early in planning processes

Australia HVAC Market Opportunities

• Government heat pump initiatives are creating substantial growth potential, with Victoria and NSW governments funding roadmap development including 17 recommendations for industry improvements and minimum energy performance standards

• Commercial retrofit market offers significant expansion opportunities, with aging buildings requiring modern climate systems to meet current energy efficiency standards and workplace health requirements

• Industrial heat pump sector presents emerging growth areas, with global industrial heat pump market estimated to grow by USD 754.8 million from 2025-2029 driven by energy efficiency focus

• Smart building integration provides technology advancement opportunities through IoT connectivity, building management systems, and automated climate control platforms serving commercial and residential sectors

• Regional expansion potential exists in developing markets across Northern Territory, Southern Australia, and Western Australia where infrastructure development and population growth require modern HVAC solutions

Australia HVAC Market Challenges

• Skilled labor shortage is constraining installation and service capabilities, with complex smart systems requiring specialized technical expertise that many contractors struggle to acquire and maintain

• Supply chain disruptions continue affecting component availability and pricing, with global logistics challenges and semiconductor shortages impacting manufacturing and delivery schedules

• Regulatory compliance complexity is increasing costs and development timelines, with stricter energy efficiency standards and environmental regulations requiring continuous product innovation and certification

• High initial investment costs for advanced systems are limiting adoption among price-sensitive consumers, particularly in residential markets where premium smart features command significant price premiums

• Technology integration difficulties are emerging as legacy buildings and older infrastructure struggle to accommodate modern HVAC systems requiring extensive electrical and structural modifications

Australia HVAC Market Analysis

• Market consolidation trends are accelerating through strategic acquisitions like Beijer Ref's September 2022 purchase of 51% of Australian HVAC firms AAD and HVAC Consolidated for USD 43.6 million

• Product innovation acceleration is driving competitive differentiation, with Johnson Controls-Hitachi launching air365 Max Pro systems capable of reducing energy use by up to 39% at part load

• Regional demand variations are shaping distribution strategies, with northern states focusing on cooling solutions while southern markets require integrated heating and cooling systems for year-round comfort

• Commercial sector dominance is continuing through large-scale projects including airport redevelopments, transport interchanges, and mixed-use developments requiring sophisticated centralized HVAC solutions

• Technology adoption patterns show increasing preference for smart, connected systems with mobile app integration, predictive maintenance, and energy management capabilities across all market segments

Australia HVAC Market Segmentation:

1. By Product Type:

o Direct Expansion Systems

o Central Air Conditioning Systems

2. By End User:

o Residential

o Commercial

3. By Region:

o Australia Capital Territory & New South Wales

o Victoria & Tasmania

o Queensland

o Northern Territory & Southern Australia

o Western Australia

Australia HVAC Market News & Recent Developments:

July 2025: Australia's energy and climate ministers agreed to work together to speed up implementation of minimum performance standards for heat pump hot water systems, following the Energy Efficiency Council's roadmap development funded by Victoria and NSW governments with 17 industry improvement recommendations.

June 2024: Johnson Controls-Hitachi Air Conditioning launched a new range of high-efficiency HVAC products in Australia and New Zealand at ARBS 2024, including the air365 Max Pro capable of reducing energy use by up to 39% at part load and SideSmart VRF system offering 152 kW cooling capacity.

Australia HVAC Market Key Players:

• Daikin Australia Pty., Ltd.

• Haier Australia Pty Ltd

• Hitachi, Ltd.

• Johnson Controls

• Kirby HVAC&R Pty Ltd.

• LG Electronics

• Mitsubishi Electric Corporation

• Samsung Australia

• Trane Technologies International Limited

• Fujitsu General

• Panasonic Australia

• Carrier Corporation

Key Highlights of the Report:

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter's Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=34781&flag=E

Conclusion of Report:

Australia's HVAC market stands at an extraordinary growth trajectory, expanding from USD 7,072.73 million to USD 27,317.57 million over the next decade with remarkable 16.20% growth rate, driven by diverse climate demands across tropical north to temperate south regions and unprecedented urbanization in Sydney, Melbourne, and Brisbane. The market is experiencing fundamental transformation through AI integration achieving 13% energy savings, government heat pump initiatives with Victoria and NSW funding comprehensive roadmaps including 17 industry improvement recommendations, and post-pandemic air quality focus continuing to influence workplace and residential system requirements. With heat pump market expansion from USD 870 million to USD 1.40 billion by 2030 offering up to $250 annual residential savings, smart technology adoption through IoT connectivity and mobile app integration, and major product launches like Johnson Controls' air365 Max Pro reducing energy use by 39%, the sector demonstrates robust innovation momentum. While challenges including skilled labor shortages, supply chain disruptions, and regulatory compliance complexity persist, the convergence of energy efficiency regulations mandating high-performance systems, strategic acquisitions like Beijer Ref's USD 43.6 million investment, and Australia's commitment to cut HFC emissions to 15% baseline levels by 2036 positions the market for sustained growth. The successful integration of buildings accounting for 40% of total energy consumption with AI-powered optimization, commercial retrofit opportunities in aging infrastructure, and regional expansion across diverse Australian markets establishes the HVAC industry as a critical component of the nation's sustainable development strategy, supporting climate control innovation, energy efficiency advancement, and indoor air quality improvement across residential and commercial sectors.

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia HVAC Market Size, Share and Growth Analysis Report 2024-2033 here

News-ID: 4169016 • Views: …

More Releases from IMARC Services Private Limited

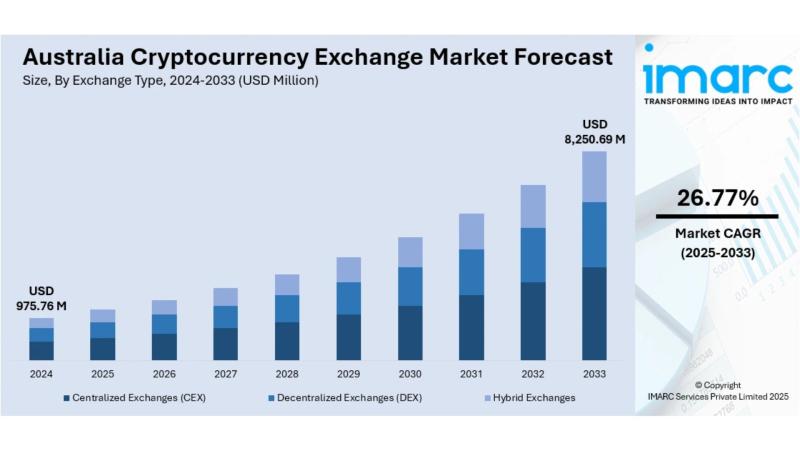

Australia Cryptocurrency Exchange Market Size, Share, Trends 2025-2033

Australia Cryptocurrency Exchange Market Overview

Market Size in 2024: USD 975.76 Million

Market Size in 2033: USD 8,250.69 Million

Market Growth Rate 2025-2033: 26.77%

According to IMARC Group's latest research publication, "Australia Cryptocurrency Exchange Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia cryptocurrency exchange market size was valued at USD 975.76 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,250.69 Million by 2033, exhibiting a…

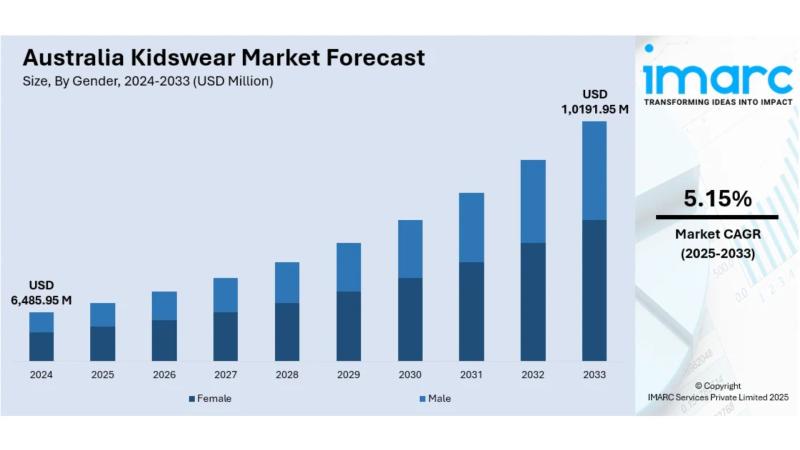

Australia Kidswear Market Size, Share, Trends and Forecast by 2025-2033

Australia Kidswear Market Overview

Market Size in 2024: USD 6,485.95 Million

Market Size in 2033: USD 10,191.95 Million

Market Growth Rate 2025-2033: 5.15%

According to IMARC Group's latest research publication, "Australia Kidswear Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia kidswear market size was valued at USD 6,485.95 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,191.95 Million by 2033, exhibiting a CAGR of 5.15%…

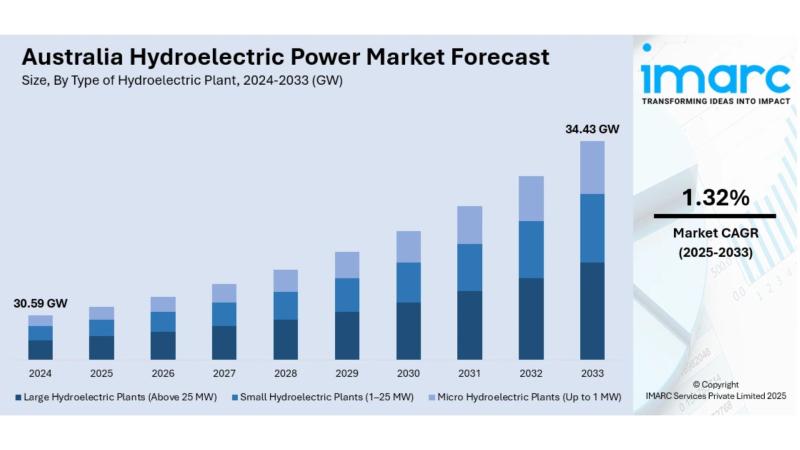

Australia Hydroelectric Power Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Hydroelectric Power Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia hydroelectric power market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia hydroelectric power market size reached 30.59 GW in 2024. Looking forward, IMARC Group expects the market to reach 34.43 GW…

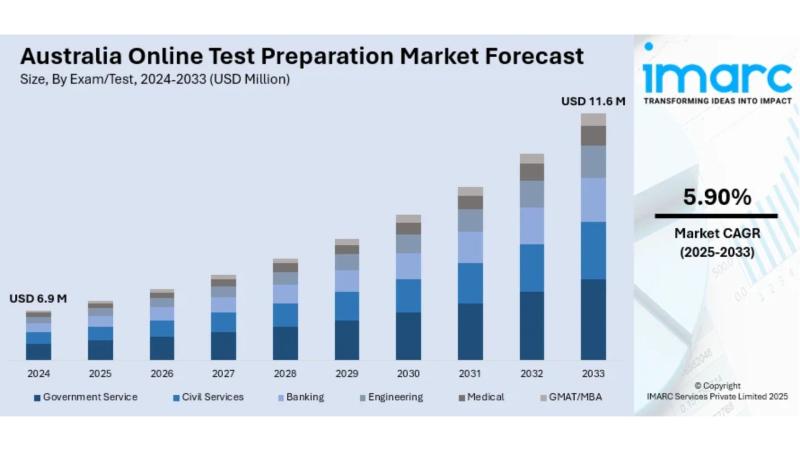

Australia Online Test Preparation Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Online Test Preparation Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia online test preparation market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia online test preparation market size reached USD 6.9 Million in 2024. Looking forward, IMARC Group expects the market…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…