Press release

Australia Auto Parts Aftermarket Market Size, Share and Growth Analysis Report 2024-2033

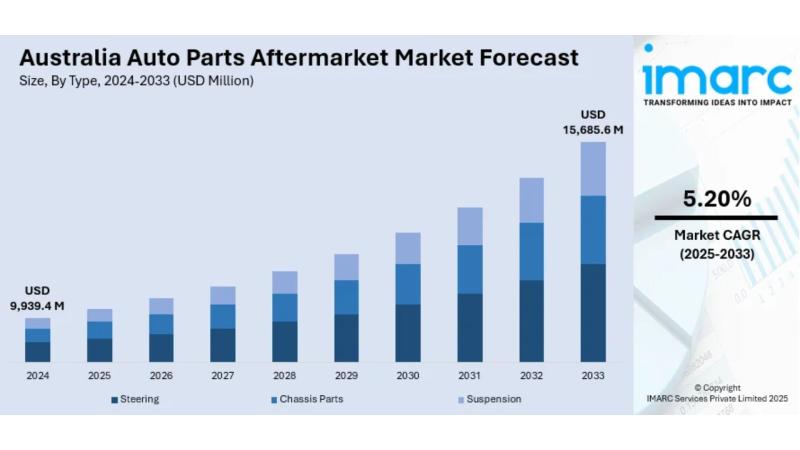

The latest report by IMARC Group, titled "Australia Auto Parts Aftermarket Market Report by Type (Steering, Chassis Parts, Suspension), Application (Passenger Car, Commercial Vehicle), and Region 2025-2033," offers a comprehensive analysis of the Australia auto parts aftermarket market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia auto parts aftermarket market size reached USD 9,939.4 million in 2024. Looking forward, IMARC Group expects the market to reach USD 15,685.6 million by 2033, exhibiting a growth rate of 5.20% during 2025-2033.Report Attributes:

• Base Year: 2024

• Forecast Years: 2025-2033

• Historical Years: 2019-2024

• Market Size in 2024: USD 9,939.4 Million

• Market Forecast in 2033: USD 15,685.6 Million

• Market Growth Rate 2025-2033: 5.20%

For an in-depth analysis, you can refer to a sample copy of the report: https://www.imarcgroup.com/australia-auto-parts-aftermarket-market/requestsample

How Is AI Transforming the Auto Parts Aftermarket in Australia?

• Smart inventory management systems are revolutionizing parts distribution through predictive analytics, enabling suppliers and retailers to optimize stock levels, reduce carrying costs, and improve availability of high-demand components

• Digital cataloging platforms powered by AI are enhancing parts identification accuracy, with image recognition technology helping mechanics and DIY enthusiasts quickly identify compatible components for specific vehicle models and years

• Predictive maintenance analytics are transforming service scheduling and parts demand forecasting, with AI algorithms analyzing vehicle data to predict component failure patterns and optimize replacement timing

• E-commerce personalization engines are improving online shopping experiences by recommending relevant parts based on vehicle specifications, purchase history, and compatibility requirements, increasing conversion rates significantly

• Automated quality inspection systems are enhancing parts manufacturing and distribution quality control, with machine learning algorithms detecting defects and ensuring component reliability before reaching customers

Australia Auto Parts Aftermarket Market Overview

• Aging vehicle fleet acceleration is driving sustained demand, with the average vehicle age reaching 11.2 years in 2024 according to the Australian Automotive Aftermarket Association (AAAA), representing the highest on record

• Vehicle parc expansion continues supporting market growth, with Australia registering 21.2 million motor vehicles as of January 2023, showing a 2.3% increase and ensuring steady aftermarket demand

• E-commerce transformation is reshaping distribution channels, with online platforms providing convenient access to wider product varieties, particularly benefiting regional and remote areas with limited physical stores

• DIY maintenance culture is strengthening across Australia, with car enthusiasts and cost-conscious consumers increasingly undertaking self-servicing and repairs, boosted by online tutorials and accessible parts availability

• Independent workshop expansion is continuing, with suburban and regional areas relying on cost-effective local garages that depend on consistent aftermarket component supplies to serve customer demands

Key Features and Trends of Australia Auto Parts Aftermarket

• Electrical components dominance is expanding with 20% market share in 2024, driven by essential vehicle functionality requirements, regular replacement needs, and emerging electrification trends affecting starter motors and spark plugs

• Online retail growth is accelerating through digital platforms enabling comparison shopping, reviews research, and direct delivery, especially serving regional areas where specialty auto parts stores aren't accessible

• Performance customization demand is increasing among automotive enthusiasts seeking modifications and upgrades, with aftermarket suppliers offering specialized components for vehicle personalization and enhancement

• Climate-specific solutions are gaining importance, with harsh Australian driving conditions from Outback heat to coastal humidity requiring specialized air filters, brake parts, and cooling system components

• Fleet services expansion is growing through ride-sharing and commercial transport sectors requiring reliable, cost-effective maintenance solutions to minimize vehicle downtime and maximize operational efficiency

Growth Drivers of Australia Auto Parts Aftermarket

Market Growth Drivers:

1. Extended Vehicle Lifespan Trend - Australian consumers are maintaining vehicles longer due to cost-of-living pressures and high new vehicle prices, with the average vehicle age reaching 11.2 years, creating sustained demand for replacement parts and maintenance services

2. Harsh Driving Conditions Impact - Australia's diverse and challenging climates from Outback heat to coastal humidity accelerate wear and tear on vehicle components, particularly air filters, brake systems, suspension units, and cooling systems

3. Digital Commerce Revolution - E-commerce growth is transforming parts distribution, with global automotive aftermarket e-commerce expected to reach $15.7 billion by 2029, providing convenient access and competitive pricing for Australian consumers

4. Growing Vehicle Population - Australia's registered motor vehicles reached 21.2 million in January 2023, representing a 2.3% annual increase that directly expands the addressable market for aftermarket parts and services

5. Independent Workshop Preference - Cost-conscious consumers are increasingly choosing independent garages over dealership servicing, with these workshops relying heavily on aftermarket components to provide competitive pricing and personalized service

Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/australia-auto-parts-aftermarket-market

Innovation & Market Demand of Australia Auto Parts Aftermarket

• Advanced materials integration is improving component durability and performance, with manufacturers developing parts specifically designed to withstand Australia's extreme climate conditions and extensive driving distances

• Smart diagnostic tools are enabling more accurate fault detection and parts identification, with digital platforms helping mechanics and consumers identify exact replacement components through vehicle identification systems

• Sustainable manufacturing practices are gaining traction among aftermarket suppliers, with eco-friendly production methods and recycling initiatives becoming important differentiators in competitive markets

• Mobile service integration is expanding through on-demand repair services requiring portable inventory management and real-time parts availability tracking to serve customers at their locations

• Cross-platform compatibility solutions are addressing complex vehicle technology integration, with aftermarket suppliers developing universal components that work across multiple vehicle brands and model years

Australia Auto Parts Aftermarket Market Opportunities

• Electric vehicle transition is creating new market segments for EV-specific components, charging equipment, and specialized maintenance tools as hybrid and electric vehicle adoption accelerates across Australia

• Regional market expansion offers significant growth potential, with rural and remote areas requiring reliable parts distribution networks and local service capabilities to support essential vehicle transportation

• Fleet management services are expanding through ride-sharing, delivery, and commercial transport sectors requiring cost-effective maintenance solutions and bulk purchasing arrangements for operational efficiency

• Performance modification market continues growing among automotive enthusiasts seeking customization, with specialized components for racing, off-road applications, and aesthetic enhancements representing premium price segments

• Digital platform development presents opportunities for innovative e-commerce solutions, mobile applications, and integrated inventory management systems that improve customer experience and operational efficiency

Australia Auto Parts Aftermarket Market Challenges

• Supply chain complexity is increasing due to global logistics challenges, semiconductor shortages, and international shipping disruptions affecting parts availability and pricing stability across the market

• Counterfeit parts proliferation is threatening consumer safety and brand reputation, with fake components entering the market through various channels requiring enhanced authentication and quality control measures

• Skilled labor shortage is affecting installation and service capabilities, with aging workforce demographics and limited technical training programs constraining aftermarket service provider capacity

• Regulatory compliance requirements are becoming more stringent, particularly for safety-critical components and environmental standards, increasing costs and complexity for manufacturers and distributors

• Technology integration challenges are emerging as vehicles become more sophisticated, requiring specialized diagnostic equipment and technical expertise that many independent workshops struggle to acquire

Australia Auto Parts Aftermarket Market Analysis

• Market concentration dynamics are evolving with major players like Bapcor Limited, Repco Australia, and ARB Corporation expanding through acquisitions and strategic partnerships to strengthen market positions

• Price competition intensification is pressuring margins as online platforms and international suppliers offer competitive pricing, forcing traditional retailers to optimize operations and value propositions

• Customer behavior transformation is shifting toward research-driven purchasing decisions, with consumers comparing products online, reading reviews, and seeking technical information before making component purchases

• Regional distribution optimization is becoming critical for success, with companies investing in logistics networks and local inventory management to serve Australia's vast geographic markets effectively

• Technology adoption acceleration is differentiating successful companies, with digital tools for inventory management, customer service, and parts identification becoming essential competitive advantages

Australia Auto Parts Aftermarket Market Segmentation:

1. By Type:

o Steering

o Chassis Parts

o Suspension

2. By Application:

o Passenger Car

o Commercial Vehicle

3. By Region:

o Australia Capital Territory & New South Wales

o Victoria & Tasmania

o Queensland

o Northern Territory & Southern Australia

o Western Australia

Australia Auto Parts Aftermarket Market News & Recent Developments:

April 2024: The Australian Auto Aftermarket Expo attracted over 13,000 auto trade visitors from across Australia, New Zealand, and beyond to the Melbourne Exhibition Centre, showcasing the latest industry innovations, networking opportunities, and business development trends across three days.

2024: The Australian Automotive Aftermarket Association reported the average vehicle age reached 11.2 years, the highest on record, underscoring the growing reliance on maintenance and parts replacement as consumers delay new vehicle purchases due to cost pressures and high prices.

Australia Auto Parts Aftermarket Market Key Players:

• ARB Corporation Ltd

• Auto Parts Group Pty Ltd

• Bapcor Limited

• Carparts2u

• DENSO Auto Parts Australia

• Pedders Suspension & Brakes

• Repco Australia

• Run Auto Parts

• RYCO Group Pty Ltd

• Burson Auto Parts

• Super Retail Group

• GPC Asia Pacific

Key Highlights of the Report:

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter's Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=34805&flag=E

FAQs: Australia Auto Parts Aftermarket Market

Q1: What factors are driving growth in Australia's auto parts aftermarket market?

A: Key growth drivers include extended vehicle lifespan trends with average vehicle age reaching 11.2 years (the highest on record), harsh driving conditions accelerating component wear across diverse Australian climates, digital commerce revolution with global automotive e-commerce expected to reach $15.7 billion by 2029, growing vehicle population reaching 21.2 million registered vehicles (2.3% annual increase), and independent workshop preference driven by cost-conscious consumers seeking competitive alternatives to dealership servicing.

Q2: How is artificial intelligence impacting Australia's auto parts aftermarket sector?

A: AI is transforming the sector through smart inventory management systems using predictive analytics to optimize stock levels, digital cataloging platforms with image recognition technology improving parts identification accuracy, predictive maintenance analytics forecasting component failure patterns, e-commerce personalization engines enhancing online shopping experiences, and automated quality inspection systems ensuring component reliability through machine learning algorithms.

Q3: What challenges does Australia's auto parts aftermarket market face?

A: Major challenges include supply chain complexity from global logistics challenges and semiconductor shortages affecting availability, counterfeit parts proliferation threatening consumer safety and requiring enhanced authentication, skilled labor shortage with aging workforce demographics constraining service capacity, regulatory compliance requirements becoming more stringent for safety-critical components, and technology integration challenges as vehicles become more sophisticated requiring specialized diagnostic equipment.

Q4: Which market segments show the strongest growth potential?

A: Electrical components demonstrate strongest growth with 20% market share driven by electrification trends and essential functionality requirements, e-commerce channels are expanding rapidly particularly serving regional areas, performance customization segments are growing among automotive enthusiasts, climate-specific solutions are gaining importance for harsh Australian conditions, and fleet services are expanding through ride-sharing and commercial transport sectors.

Q5: What opportunities exist for new entrants in Australia's auto parts aftermarket?

A: Emerging opportunities include electric vehicle transition creating new market segments for EV-specific components and charging equipment, regional market expansion in rural and remote areas requiring reliable distribution networks, fleet management services for ride-sharing and delivery sectors, performance modification market for automotive enthusiasts seeking customization, and digital platform development for innovative e-commerce solutions and mobile applications improving customer experience.

Conclusion of Report:

Australia's auto parts aftermarket market stands at a dynamic growth trajectory, expanding from USD 9,939.4 million to USD 15,685.6 million over the next decade, driven by unprecedented vehicle aging trends with average fleet age reaching 11.2 years and sustained vehicle parc growth totaling 21.2 million registered vehicles. The market is experiencing fundamental transformation through digital commerce revolution with global automotive e-commerce expected to reach $15.7 billion by 2029, while harsh Australian driving conditions from Outback heat to coastal humidity continue generating consistent demand for specialized components including air filters, brake systems, and cooling solutions. The strengthening DIY maintenance culture, supported by over 13,000 industry professionals attending major trade expos, combined with independent workshop preference driven by cost-conscious consumers, is creating robust demand for aftermarket solutions. While challenges including supply chain complexity, counterfeit parts concerns, and skilled labor shortages persist, the convergence of AI-powered inventory management, electrical components dominating with 20% market share, and regional expansion opportunities positions the sector for sustained growth. The successful adaptation to electric vehicle transition, performance customization demands, and digital platform innovation, supported by major players like Bapcor Limited, Repco Australia, and ARB Corporation, demonstrates the market's resilience and evolution. With Australia's vast geography and vehicle-dependent lifestyle ensuring continuous aftermarket demand, the industry is well-positioned to capitalize on technological advancement, consumer preference shifts, and the fundamental need for vehicle maintenance across diverse climate conditions and extensive driving distances.

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Auto Parts Aftermarket Market Size, Share and Growth Analysis Report 2024-2033 here

News-ID: 4169014 • Views: …

More Releases from IMARC Services Private Limited

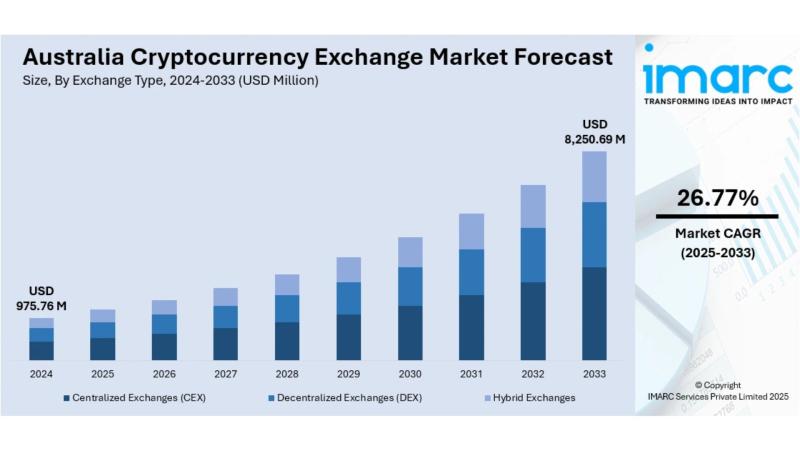

Australia Cryptocurrency Exchange Market Size, Share, Trends 2025-2033

Australia Cryptocurrency Exchange Market Overview

Market Size in 2024: USD 975.76 Million

Market Size in 2033: USD 8,250.69 Million

Market Growth Rate 2025-2033: 26.77%

According to IMARC Group's latest research publication, "Australia Cryptocurrency Exchange Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia cryptocurrency exchange market size was valued at USD 975.76 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,250.69 Million by 2033, exhibiting a…

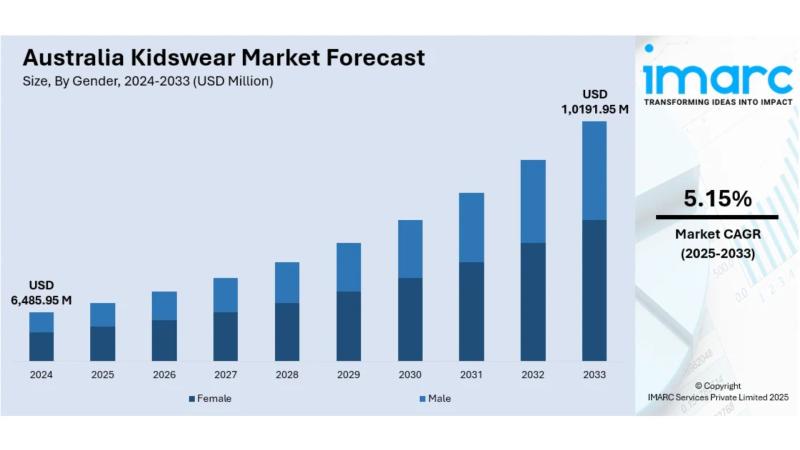

Australia Kidswear Market Size, Share, Trends and Forecast by 2025-2033

Australia Kidswear Market Overview

Market Size in 2024: USD 6,485.95 Million

Market Size in 2033: USD 10,191.95 Million

Market Growth Rate 2025-2033: 5.15%

According to IMARC Group's latest research publication, "Australia Kidswear Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia kidswear market size was valued at USD 6,485.95 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,191.95 Million by 2033, exhibiting a CAGR of 5.15%…

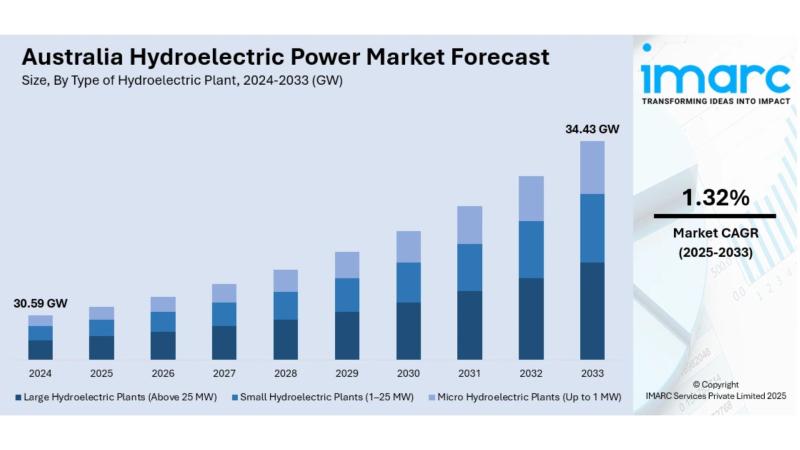

Australia Hydroelectric Power Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Hydroelectric Power Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia hydroelectric power market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia hydroelectric power market size reached 30.59 GW in 2024. Looking forward, IMARC Group expects the market to reach 34.43 GW…

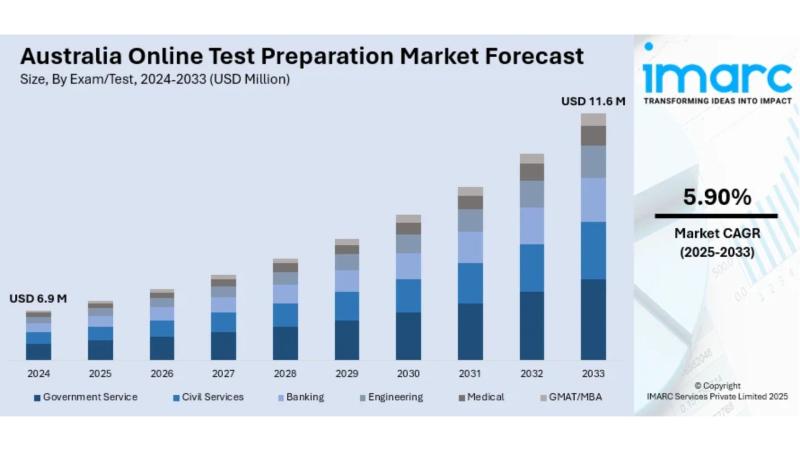

Australia Online Test Preparation Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Online Test Preparation Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia online test preparation market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia online test preparation market size reached USD 6.9 Million in 2024. Looking forward, IMARC Group expects the market…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…