Press release

2025 Faster Payments Service Industry Trends Report: Long-Term Outlook Through 2034

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.How Large Will the Faster Payments Service Market Size By 2025?

In the past few years, the market size for faster payments service has seen rapid growth. The projections indicate an increase from $65.18 billion in 2024 to $73.92 billion in 2025, with a compound annual growth rate (CAGR) of 13.4%. The significant growth over the historic period can be credited to factors such as the increased adoption of digital payments, the heightened demand for immediate fund transfers, increased smartphone and internet usage, a rise in e-commerce transactions, and escalating consumer expectations.

How Big Is the Faster Payments Service Market Size Expected to Grow by 2029?

The market size for faster payments services is poised for significant expansion in the foroming years, reaching a lucrative $120.69 billion by 2029 with a solid Compound Annual Growth Rate (CAGR) of 13.0%. This expansion during the predicted period is due to the growing acceptance of digital payments, burgeoning needs for immediate fund transfers, increasing penetration of smartphones and internet, a surge in e-commerce transactions, and escalating consumer expectations. Key trends that will define the projection period are progress in blockchain technology, advanced authentication techniques using biometrics, breakthroughs in payment apps development, collaboration with open banking platforms, and advancements in fraud detection using AI.

View the full report here:

https://www.thebusinessresearchcompany.com/report/faster-payments-service-global-market-report

Which Key Market Drivers Powering Faster Payments Service Market Expansion and Growth?

The growth of the faster payments service market is expected to be driven by the surging adoption of digital payments. These payments constitute the electronic exchange of funds between entities using digital avenues, eliminating the need for physical cash. The proliferation of digital payments is attributed to the increasing usage of smartphones and internet connectivity, which facilitates a more accessible and convenient medium for electronic transactions. Faster payments service bolsters the digital payment landscape by facilitating real-time fund transfers, making it a preferable choice for individuals and businesses desiring prompt and secure transactions. It mitigates processing delays by enabling 24/7 instant settlements, thereby enhancing financial efficiency. In January 2024, as reported by the European Central Bank, a central banking institution based in Germany, there was a 24.3% increase in the number of contactless card payments, reaching 20.9 billion in 2023 compared to the previous year. As such, the growth of the faster payments service market is spurred by the rising adoption of digital payments.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=27004&type=smp

Which Fast-Growing Trends Are Poised to Disrupt the Faster Payments Service Market?

Leading enterprises in the faster payments services industry are directing their efforts towards creating cutting-edge solutions such as instantaneous payment integrations. These are designed to heighten the pace of transactions, optimize user experience, and cut down processing times. Real-time payment integrations can be defined as smooth interconnectivity between payment interfaces and banking structures that allow immediate fund transfers. For example, in February 2025, Orum Inc., a software firm based in the US, collaborated with Visa Inc., a US-based corporation offering credit card services, to unveil a swift payments network that bolsters the Deliver API solution's capabilities. By using Visa Direct, this platform permits immediate fund transfers to and from bank accounts through debit cards. This introduction provides businesses and financial organisations access to immediate payments for almost 99% of US bank accounts via a single API that amalgamates different payment systems, including Visa Direct, FedNow, RTP, and ACH. This incorporation not only simplifies transactions but also minimises settlement lags, offering a seamless payment experience for final consumers.

What Are the Emerging Segments in the Faster Payments Service Market?

The faster payments service market covered in this report is segmented -

1) By Component: Software, Hardware, Services

2) By Type: Cloud Based, On-Premises

3) By Payment Method: Debit Card Transactions, Credit Card Transactions, E-Wallets, Direct Debits, Bank Transfers

4) By Application: E-Commerce, Remittances, Insurance Payments, Utility Payments, Payroll Services

5) By End User: Banks And Financial Institutions, Retailers, Corporates And Small and Medium Enterprises, Consumers, Government And Public Sector

Subsegments:

1) By Software: Payment Processing Software, Payment Gateway Software, Mobile Payment Applications

2) By Hardware: Payment Kiosks, Card Readers, Biometric Authentication Devices

3) By Services: Consulting and Integration Services, Maintenance and Support Services, Managed Services

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=27004&type=smp

Who Are the Global Leaders in the Faster Payments Service Market?

Major companies operating in the faster payments service market are Visa Inc., PayPal Holdings Inc., Mastercard Incorporated, Fiserv Inc., Fidelity National Information Services Inc., Worldline SA, Finastra Group Holdings Limited, Nets A/S, Stripe Inc., ACI Worldwide Inc., Kraken, Temenos AG., Early Warning Services LLC., Rapyd Financial Network Ltd., Repay Holdings Corporation, Nium Pte. Ltd., Volante Technologies Inc., NovoPayment Inc., Tink AB, Form3 Ltd., The Clearing House Payments Company L.L.C., Currencycloud Group Limited, Montran Corporation

Which are the Top Profitable Regional Markets for the Faster Payments Service Industry?

North America was the largest region in the faster payments service market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the faster payments service market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=27004

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Speak With Our Expert:

Saumya Sahay

Europe - +44 7882 955267,

Asia: +91 88972 63534,

Americas - +1 310-496-7795 or

Email:saumyas@tbrc.info

Follow Us On:

• LinkedIn: https://in.linkedin.com/company/the-business-research-company

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release 2025 Faster Payments Service Industry Trends Report: Long-Term Outlook Through 2034 here

News-ID: 4167329 • Views: …

More Releases from The Business Research Company

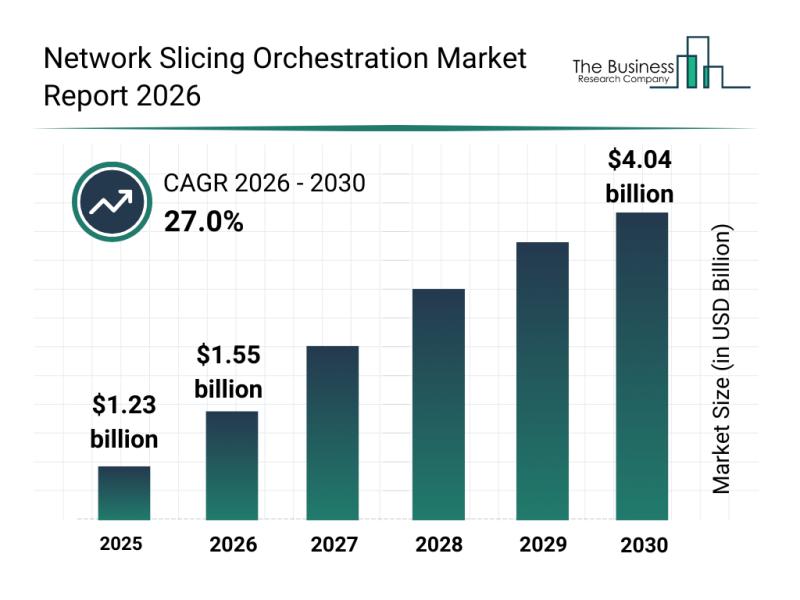

Global Trends Overview: The Rapid Development of the Network Slicing Orchestrati …

The network slicing orchestration market is positioned for remarkable expansion over the coming years, driven by rapid advancements in telecommunications and evolving enterprise demands. As technologies like 5G and edge computing become more widespread, the market is set to transform how networks are managed and optimized, enabling more flexible and efficient connectivity solutions.

Projected Market Size and Growth Trajectory for Network Slicing Orchestration

The network slicing orchestration market is anticipated…

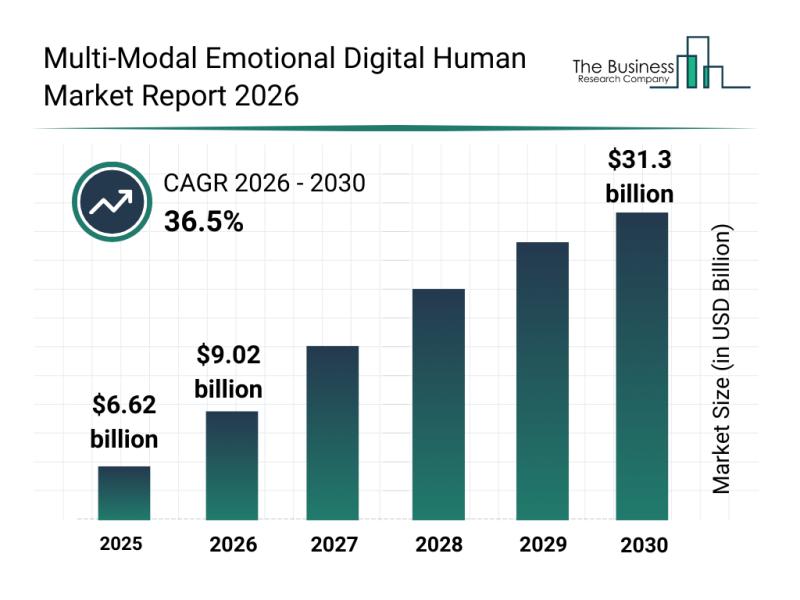

Segmentation, Major Trends, and Competitive Overview of the Multi-Modal Emotiona …

The multi-modal emotional digital human market is poised for remarkable expansion, transforming how digital entities interact with human emotions across various sectors. This emerging field combines advanced AI technologies and emotional intelligence to create digital humans capable of nuanced, empathetic interactions. Let's explore the market's growth outlook, key players, technological trends, and segment classifications shaping this evolving industry.

Projected Growth and Market Value of the Multi-Modal Emotional Digital Human Market …

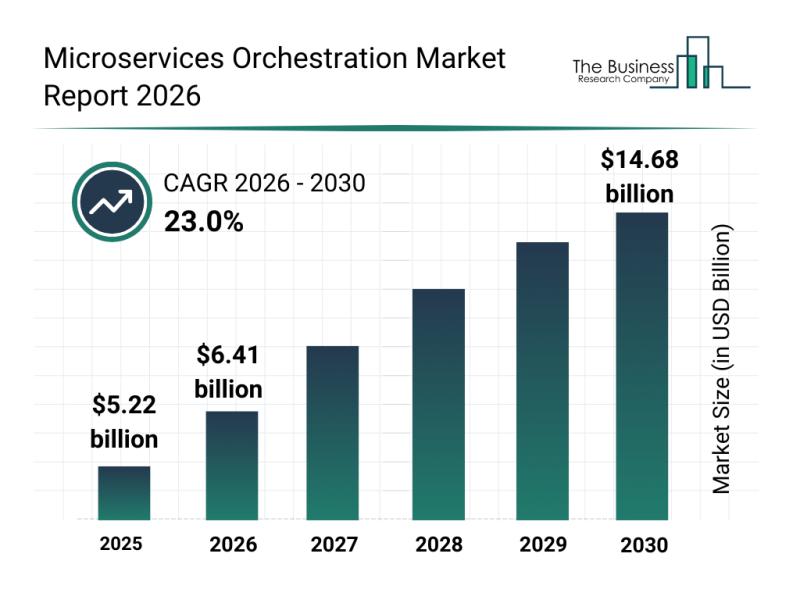

Market Trend Insights: The Impact of Recent Advances on the Microservices Orches …

The microservices orchestration market is rapidly gaining traction as organizations increasingly adopt cloud-native architectures to enhance agility and scalability. With the growing complexity of distributed systems, the need for efficient orchestration solutions that streamline service coordination and management has become critical. Let's explore the market's size, key players, emerging trends, and significant segments shaping its future.

Expected Growth and Market Size for Microservices Orchestration

The microservices orchestration market is projected…

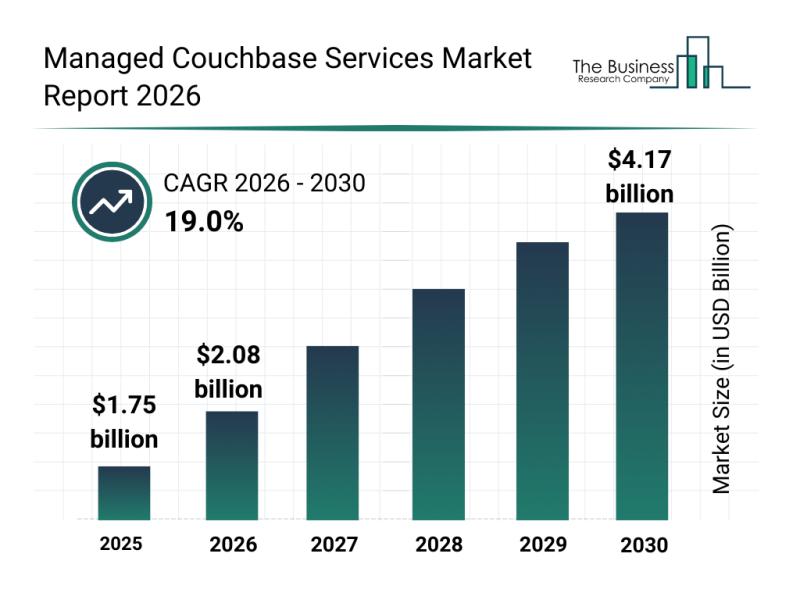

Analysis of Key Market Segments Influencing the Managed Couchbase Services Marke …

The managed couchbase services market is set for substantial expansion in the coming years as businesses increasingly turn to cloud-native solutions for their database needs. With a growing focus on scalability, performance, and security, this sector is becoming a critical component for enterprises managing complex data workloads. Let's explore the market's value projections, key players, emerging trends, and the main segments driving growth.

Anticipated Market Growth and Value of Managed Couchbase…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…