Press release

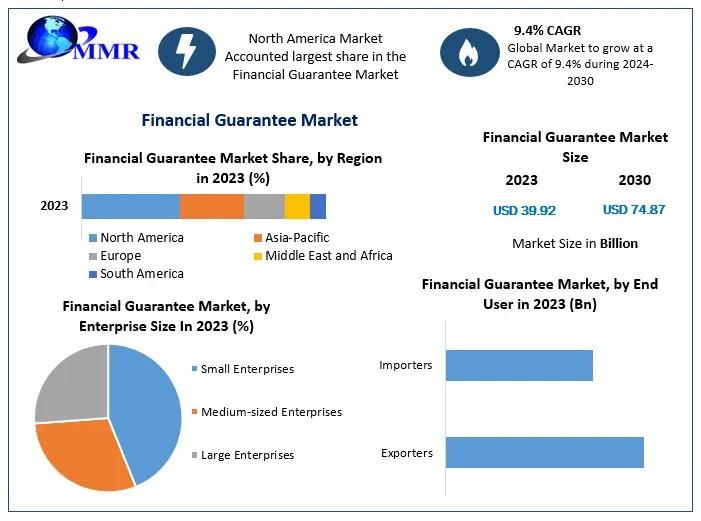

Financial Guarantee Market Expands from USD 39.92 Bn in 2023 to USD 74.87 Bn by 2030

Financial Guarantee Market size was valued at USD 39.92 billion in 2023 and the total Financial Guarantee Market revenue is expected to grow at a CAGR of 9.4 % from 2024 to 2030, reaching nearly USD 74.87 billion.Financial Guarantee Market Overview:

The financial guarantee market plays a crucial role in global trade and investment by providing assurance to lenders, investors, and stakeholders about the repayment or fulfillment of financial obligations. These guarantees, often issued by banks or financial institutions, act as risk mitigation tools that promote trust and enable large-scale projects, international transactions, and credit agreements. Increasing globalization, cross-border trade, and infrastructure development have fueled the demand for financial guarantees. Governments and corporations are increasingly leveraging these instruments to secure funding, reduce counterparty risk, and enhance financial credibility, making them a vital component of today's financial ecosystem.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/221883/

Financial Guarantee Market Outlook and Future Trends:

The outlook for the financial guarantee market remains highly optimistic as businesses expand globally and look for safer financing solutions. The rising complexity of international trade agreements and project financing is expected to boost adoption. Digitalization of banking services, blockchain-enabled smart contracts, and automation in risk assessment are reshaping how financial guarantees are issued and managed. Emerging economies are witnessing higher demand due to infrastructure growth and foreign investments. Future trends also indicate a stronger focus on regulatory compliance, transparency, and ESG-based financing guarantees. These developments will collectively enhance market growth and redefine financial risk management practices.

Financial Guarantee Market Dynamics:

The dynamics of the financial guarantee market are shaped by factors such as increasing global investments, expansion of cross-border trade, and rising demand for credit risk management tools. Financial institutions are offering guarantees to strengthen trust between parties in high-value transactions. However, challenges including regulatory complexities, high costs, and potential misuse pose hurdles to growth. The evolving role of technology, particularly digital verification and automated risk analysis, is improving efficiency and reducing fraud risks. Growing reliance on financial guarantees by corporations, governments, and SMEs highlights the market's importance in ensuring secure, transparent, and reliable financial operations worldwide.

Financial Guarantee Market Key Recent Developments:

Recent developments in the financial guarantee market reflect growing innovation and strategic collaboration among financial institutions. Banks and insurers are launching digital guarantee platforms that streamline issuance and reduce processing time. Several players are adopting blockchain technology to improve transparency and reduce fraud in high-value transactions. Cross-border partnerships between financial institutions are expanding access to guarantees in emerging markets, supporting international trade and investment. Regulatory authorities in various regions are also updating compliance frameworks to strengthen market stability. These advancements underscore the market's shift toward more efficient, technology-driven, and globally integrated financial guarantee solutions.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/221883/

Financial Guarantee Market Segmentation:

by Product

Bank Guarantees

Financial Bank Guarantee

Performance-Based Guarantee

Foreign Bank Guarantees

Documentary Letter of Credit

Standby Letter of Credit (SBLC)

Receivables Financing

Others

by Enterprise Size

Small Enterprises

Medium-sized Enterprises

Large Enterprises

by End User

Exporters

Importers

Some of the current players in the Financial Guarantee Market are:

1. Asian Development Bank

2. Bank of Montreal

3. Barclays

4. BNP Paribas

5. Citibank

6. HSBC

7. ICBC

8. National Bank of Canada

9. Scotia Bank

10. SINOSURE

For additional reports on related topics, visit our website:

♦ Converting Equipment Market https://www.maximizemarketresearch.com/market-report/converting-equipment-market/148542/

♦ Global Specialty Fuel Additives Market https://www.maximizemarketresearch.com/market-report/global-specialty-fuel-additives-market/107326/

♦ Low Voltage Fuse Market https://www.maximizemarketresearch.com/market-report/low-voltage-fuse-market/70499/

♦ India Lighting Market https://www.maximizemarketresearch.com/market-report/india-lighting-market/127659/

♦Base Oil Market https://www.maximizemarketresearch.com/market-report/global-base-oil-market/105579/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

Maximize Market Research is a leading market research and consulting company, recognized for delivering reliable insights and strategies across diverse industries such as healthcare, pharmaceuticals, technology, automotive, and many more. Our expertise lies in providing in-depth market analysis, trend forecasting, competitive benchmarking, and strategic consulting tailored to client needs. We are committed to empowering organizations with actionable intelligence that enhances decision-making, strengthens market positioning, and fuels sustainable business growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Guarantee Market Expands from USD 39.92 Bn in 2023 to USD 74.87 Bn by 2030 here

News-ID: 4166902 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Guarantee

What's Driving the Financial Guarantee Market 2025-2034: The Surge In Digital Pa …

What Are the Projections for the Size and Growth Rate of the Financial Guarantee Market?

The size of the financial guarantee market has been quickly expanding in the past few years. Its projections show a growth from $45.76 billion in 2024 to reach $51 billion in 2025, with a compound annual growth rate (CAGR) of 11.5%. The historical growth in this sector can be credited to factors such as a surge…

What's Driving the Financial Guarantee Market 2025-2034: The Surge In Digital Pa …

What Are the Projections for the Size and Growth Rate of the Financial Guarantee Market?

The size of the financial guarantee market has been quickly expanding in the past few years. Its projections show a growth from $45.76 billion in 2024 to reach $51 billion in 2025, with a compound annual growth rate (CAGR) of 11.5%. The historical growth in this sector can be credited to factors such as a surge…

What's Driving the Financial Guarantee Market 2025-2034: The Surge In Digital Pa …

What Are the Projections for the Size and Growth Rate of the Financial Guarantee Market?

The size of the financial guarantee market has been quickly expanding in the past few years. Its projections show a growth from $45.76 billion in 2024 to reach $51 billion in 2025, with a compound annual growth rate (CAGR) of 11.5%. The historical growth in this sector can be credited to factors such as a surge…

Khaleej Times Introduces Money-Back Guarantee for Advertisers

Khaleej Times, UAE's leading newspaper has announced an initiative designed to enhance advertisers' confidence and deliver measurable results. Under the new Brand Increase Guarantee Program, marketers who invest a minimum of $50,000 in display advertising on khaleejtimes.com over 60 days are assured of achieving an increase in brand lift-or they will receive a complete refund.

To ensure credibility, Khaleej Times has partnered with Readwhere Digital, a third-party research firm, to conduct…

Does Flexibility Guarantee Worklife Balance in 2022?

"We are living at work and working at home, it's all blurred, and it's a huge challenge for everybody. No one's having an easy time with it", says Barbara Corcoran, the founder of The Corcoran Group, a real estate brokerage group in New York City.

Most remote working professionals are in the same pool, just like her. Bacancy's insights on would your organization let you work from home in 2022…

Eye-catching advertising featuring misleading guarantee promises

Advertising featuring a guarantee can be misleading if the guarantee promise is linked to conditions that are not clearly visible to consumers. That was the verdict of the Landgericht (LG) Frankfurt [Regional Court of Frankfurt].

GRP Rainer Lawyers and Tax Advisors in Cologne, Berlin, Bonn, Düsseldorf, Frankfurt, Hamburg, Munich, Stuttgart and London conclude: Clear guidelines relating to what is termed “Blickfangwerbung” (attention-grabbing/eye-catching advertising) had already been set out by the Bundesgerichtshof…