Press release

What's Driving the Financial Guarantee Market 2025-2034: The Surge In Digital Payments And Transactions To Propel Financial Guarantee Market Growth

What Are the Projections for the Size and Growth Rate of the Financial Guarantee Market?The size of the financial guarantee market has been quickly expanding in the past few years. Its projections show a growth from $45.76 billion in 2024 to reach $51 billion in 2025, with a compound annual growth rate (CAGR) of 11.5%. The historical growth in this sector can be credited to factors such as a surge in import and export businesses happening in developing nations, growth in the realm of digital transactions and payments, a rise in awareness, an increased requirement for security and risk management solutions, and an elevated demand for financial guarantee products.

In the coming years, it is predicted that the financial guarantee market will undergo a swift expansion, reaching a value of $78.13 billion in 2029 with a compound annual growth rate (CAGR) of 11.2%. This anticipated growth is linked with several factors including the rising adoption of financial guarantees by small and medium scale enterprises (SMEs), an escalation in the financial risk associated with business transactions, a surge in the use of digital payment platforms, and the increasing complexity of worldwide supply chains. The forecast period is set to see significant trends like technological advancements, the creation of customized guarantee solutions designed to meet the changing requirements of the digital economy, an increased demand for risk management measures, up-to-date developments, and inventive solutions.

What Are the Forces Behind the Rapid Growth of the Financial Guarantee Market?

The anticipated growth of the financial guarantee market aligns with the escalating trend of digital payments and transactions. These digital transactions, which eschew traditional cash or check methods and facilitate electronic transfer between parties, are increasingly popular. This popularity can be attributed to their convenience, enhanced security, and the expanding prevalence of online and mobile commerce. The role of financial guarantees is crucial as it assures that payments in digital transactions will be executed, reinforcing trust, and inviting more users to utilize digital means for payments. For example, the rise in digital transactions is evident in the October 2024 report by the UK finance, the trade body representing the UK banking and financial services industry. It reported that the total number of UK debit card transactions in July 2024 was 2.3 billion, marking a 5.1% increase from the same month of the previous year. The overall expenditure reached a staggering £68.8 billion, signifying a 0.9% hike. Credit card transactions also flourished, with a 403 million total count in July, an 8.2% rise. The spending reached £22.5 billion, denoting an 8.5% increase. Simultaneously, contactless payments represented 65% of all credit card transactions and 77% of debit card transactions, seeing a 2.7% rise in 1.63 billion contactless transactions recorded. Therefore, the upsurge in digital payments and transactions significantly contributes to the burgeoning growth of the financial guarantee market.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18608&type=smp

Which Businesses Are at the Forefront of Financial Guarantee Market Development?

Major companies operating in the financial guarantee market are The Industrial and Commercial Bank of China, HSBC Holdings plc, Citigroup Inc., AIG (American International Group), Liberty Mutual Insurance Group Inc., BNP Paribas SA, Zurich Insurance Group, Chubb Limited, Bank of Montreal, Barclays plc, Scotiabank, The Hartford, Markel Corporation, S&P Global, Arch Capital Group, Genworth Financial, National Bank of Canada, Moody's Investors Service, Asian Development Bank, Radian Group, Fitch Ratings Inc, SINOSURE, Assured Guaranty, AMBAC Assurance Corporation, United Guaranty Corporation

What Are the Latest Innovations in the Financial Guarantee Market?

Prominent businesses in the financial guarantee market are pushing the envelope by pioneering novel solutions, such as a digitized form of traditional paper-based bank guarantee procedures, to reinforce the effectiveness and safeguards involved in guarantee issuance and management. A digitized form of traditional paper-based bank guarantee processes involves electronic issuance, supervision, and validation of bank guarantees, utilizing digital platforms to coordinate and secure the process, eliminating the requirement for physical papers. For example, in June 2023, the Bank of Baroda, an established banking and financial services company in India, introduced the Electronic Bank Guarantee (e-BG) on the BarodaINSTA platform, in partnership with the National E-Governance Services Limited (NeSL), a financial information-regulated entity based in India. The electronic bank guarantee is a groundbreaking overhaul aimed at simplifying, securing, and improving accessibility in banking. This unveiling marks a critical milestone in the financial guarantee market, distinguished by its inventive attributes, technological progress, and considerable implications for banking efficiency and safety.

How Is the Financial Guarantee Market Segmented?

The financial guarantee market covered in this report is segmented -

1) By Product Type: Bank Guarantees, Documentary Letter Of Credit, Standby Letter Of Credit (SBLC), Receivables Financing, Other Product Types

2) By Enterprise Size: Small Enterprises, Medium-Sized Enterprises, Large Enterprises

3) By End User: Exporters, Importers

Subsegments:

1) By Bank Guarantees: Performance Guarantees, Payment Guarantees, Bid Bond Guarantees, Advance Payment Guarantees, Customs And Tax Guarantees

2) By Documentary Letter Of Credit: Export Letters Of Credit, Import Letters Of Credit, Revolving Letters Of Credit, Transferable Letters Of Credit, Red Clause Letters Of Credit

3) By Standby Letter Of Credit (Sblc): Performance Sblc, Payment Sblc, Commercial Sblc, Financial Sblc, Trade Finance Sblc

4) By Receivables Financing: Factoring (Accounts Receivable Financing), Invoice Discounting, Supply Chain Finance, Asset-Based Lending, Trade Receivables Securitization

5) By Other Product Types: Surety Bonds, Credit Insurance, Guarantee-Backed Loans, Structured Finance Guarantees, Trade Credit Guarantees

Pre-Book Your Report Now For A Swift Delivery:

https://www.thebusinessresearchcompany.com/report/financial-guarantee-global-market-report

Where Is the Financial Guarantee Market Growth Most Prominent?

North America was the largest region in the financial guarantee market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the financial guarantee market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Is Covered In The Financial Guarantee Global Market Report?

- Market Size Analysis: Analyze the Financial Guarantee Market size by key regions, countries, product types, and applications.

- Market Segmentation Analysis: Identify various subsegments within the Financial Guarantee Market for effective categorization.

- Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

- Growth Trends Analysis: Examine individual growth trends and prospects in the Market.

- Market Contribution: Evaluate contributions of different segments to the overall Financial Guarantee Market growth.

- Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

- Industry Challenges: Analyze challenges and risks affecting the Financial Guarantee Market.

- Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18608

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release What's Driving the Financial Guarantee Market 2025-2034: The Surge In Digital Payments And Transactions To Propel Financial Guarantee Market Growth here

News-ID: 3861352 • Views: …

More Releases from The Business Research Company

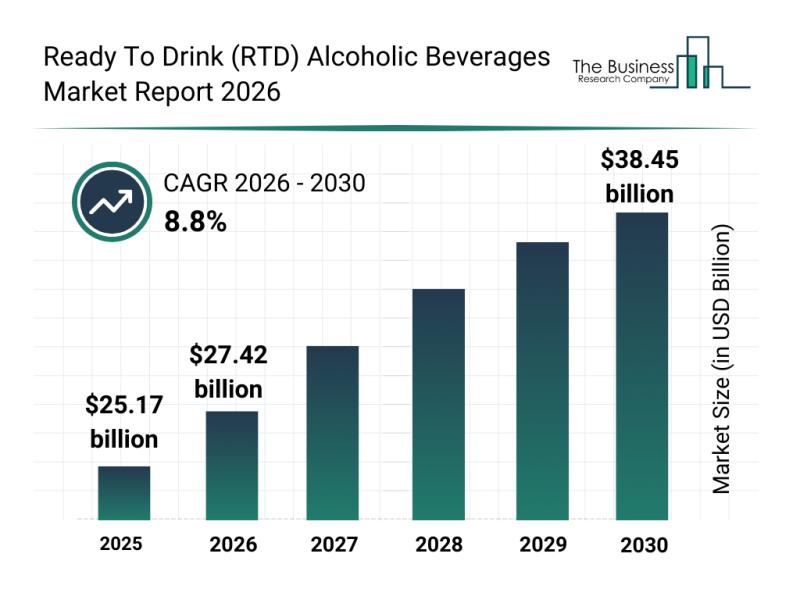

Outlook for the Ready To Drink (RTD) Alcoholic Beverages Market: Major Segments, …

The ready-to-drink (RTD) alcoholic beverages market is on track to experience significant growth over the coming years, driven by evolving consumer preferences and industry innovations. This sector is rapidly expanding as more consumers seek premium, convenient, and sustainable options in their alcoholic beverage choices. Let's explore the market's projected size, key drivers, major players, emerging trends, and segmentation details shaping its future.

Projected Expansion and Market Size of the Ready To…

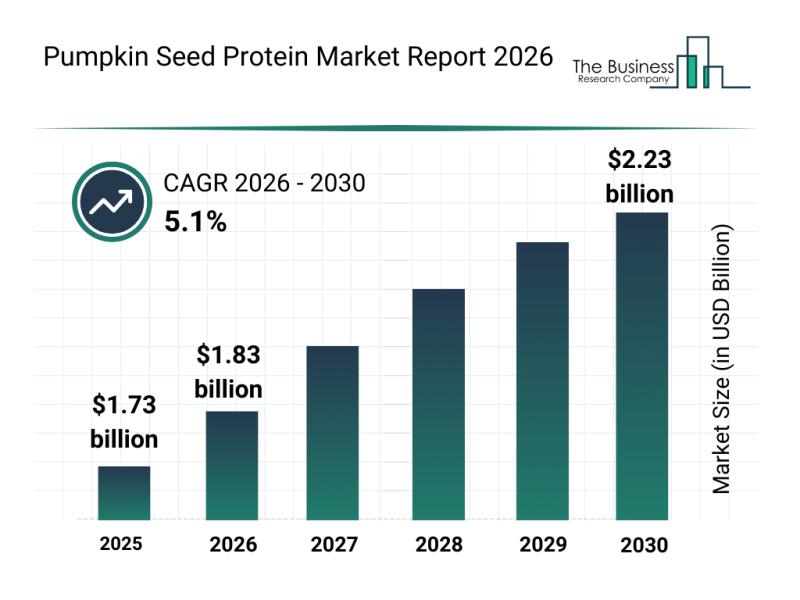

Emerging Sub-Segments Transforming the Pumpkin Seed Protein Market Landscape

The pumpkin seed protein market is emerging as a promising sector within the broader landscape of plant-based proteins. With increasing consumer interest in alternative, allergen-free protein sources and sustainable nutrition, this market is set to witness substantial growth and innovation. Let's explore the market size projections, key players, current trends, and major product segments shaping the future of pumpkin seed protein.

Projected Market Valuation and Growth Expectations for Pumpkin Seed Protein…

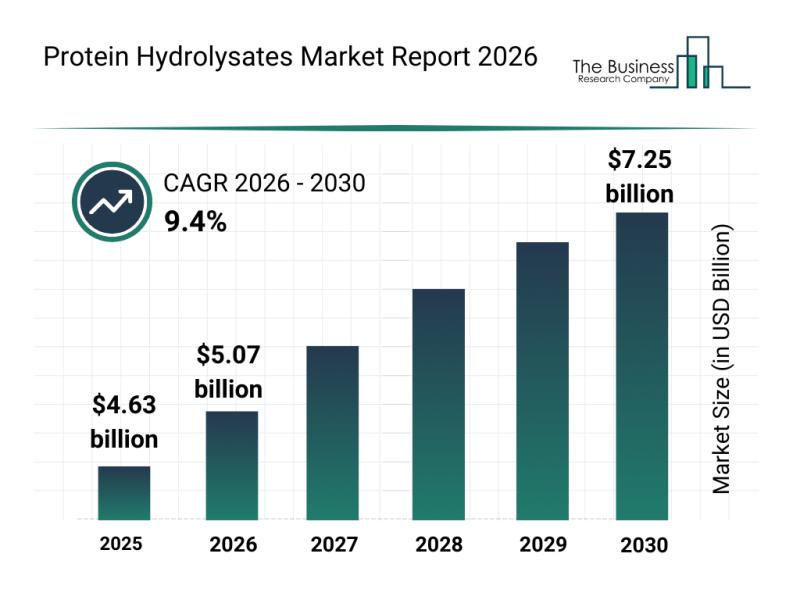

Top Players and Market Competition in the Protein Hydrolysates Industry

The protein hydrolysates market is positioned for significant expansion in the coming years as consumer preferences and nutritional science continue to evolve. With increasing attention on tailored nutrition solutions and the rise of plant-based options, this market is gearing up for robust growth and innovation.

Protein Hydrolysates Market Size Projections Through 2030

The protein hydrolysates market is forecasted to grow substantially, reaching a value of $7.25 billion by 2030. This…

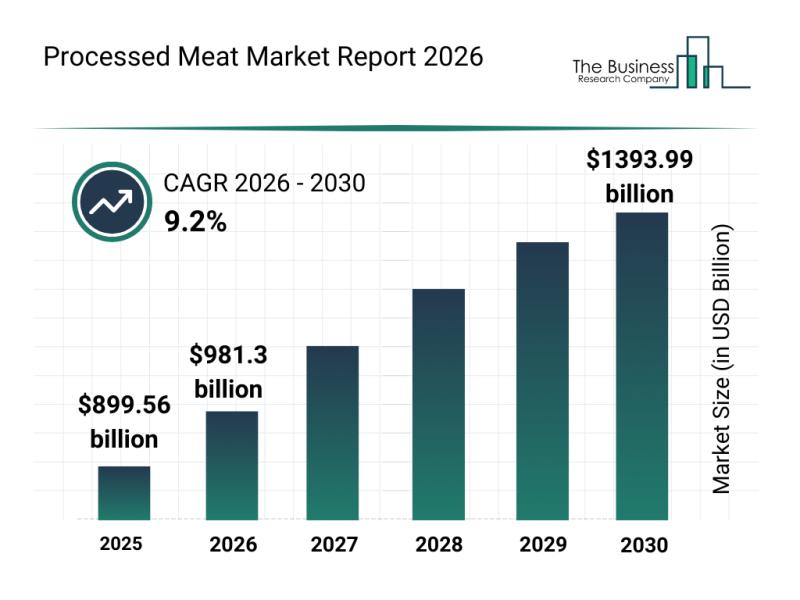

Processed Meat Market Overview: Major Segments, Strategic Developments, and Lead …

The processed meat industry is positioned for substantial expansion over the coming years, driven by evolving consumer preferences and technological advancements. As the market adapts to changing demands and regulatory landscapes, it is expected to reach impressive valuation milestones. Let's explore the current market size, key players, emerging trends, and detailed segment analyses shaping this sector's future.

Forecasted Market Size and Growth Trajectory of the Processed Meat Market

The processed…

More Releases for Guarantee

What's Driving the Financial Guarantee Market 2025-2034: The Surge In Digital Pa …

What Are the Projections for the Size and Growth Rate of the Financial Guarantee Market?

The size of the financial guarantee market has been quickly expanding in the past few years. Its projections show a growth from $45.76 billion in 2024 to reach $51 billion in 2025, with a compound annual growth rate (CAGR) of 11.5%. The historical growth in this sector can be credited to factors such as a surge…

What's Driving the Financial Guarantee Market 2025-2034: The Surge In Digital Pa …

What Are the Projections for the Size and Growth Rate of the Financial Guarantee Market?

The size of the financial guarantee market has been quickly expanding in the past few years. Its projections show a growth from $45.76 billion in 2024 to reach $51 billion in 2025, with a compound annual growth rate (CAGR) of 11.5%. The historical growth in this sector can be credited to factors such as a surge…

Khaleej Times Introduces Money-Back Guarantee for Advertisers

Khaleej Times, UAE's leading newspaper has announced an initiative designed to enhance advertisers' confidence and deliver measurable results. Under the new Brand Increase Guarantee Program, marketers who invest a minimum of $50,000 in display advertising on khaleejtimes.com over 60 days are assured of achieving an increase in brand lift-or they will receive a complete refund.

To ensure credibility, Khaleej Times has partnered with Readwhere Digital, a third-party research firm, to conduct…

Does Flexibility Guarantee Worklife Balance in 2022?

"We are living at work and working at home, it's all blurred, and it's a huge challenge for everybody. No one's having an easy time with it", says Barbara Corcoran, the founder of The Corcoran Group, a real estate brokerage group in New York City.

Most remote working professionals are in the same pool, just like her. Bacancy's insights on would your organization let you work from home in 2022…

Eye-catching advertising featuring misleading guarantee promises

Advertising featuring a guarantee can be misleading if the guarantee promise is linked to conditions that are not clearly visible to consumers. That was the verdict of the Landgericht (LG) Frankfurt [Regional Court of Frankfurt].

GRP Rainer Lawyers and Tax Advisors in Cologne, Berlin, Bonn, Düsseldorf, Frankfurt, Hamburg, Munich, Stuttgart and London conclude: Clear guidelines relating to what is termed “Blickfangwerbung” (attention-grabbing/eye-catching advertising) had already been set out by the Bundesgerichtshof…

EUROPETS INTRODUCES HEALTH & BEHAVIOUR GUARANTEE CERTIFICATE

Premier supplier of pedigree dogs in the UAE Europets, introduces important certification as part of their guarantee.

Dubai, U.A.E.: 27th April, 2016

Dogs have been man’s best friend for thousands of years, with their domestication having taken place in two instance, the second being most recently approximately 5,000 years ago. Since then, they have played a major role in our lives as guards and companions along the way. Over the years, numerous…