Press release

U.S. Factoring Services Market to Reach US$ 598.1 Bn by 2031

The US factoring services market has witnessed remarkable growth over recent years, driven by the increasing demand for flexible financial solutions among businesses of all sizes. Factoring, a financial service that allows companies to sell their accounts receivables at a discount to access immediate cash, has become an essential tool for maintaining liquidity. In 2024, the market was valued at US$325.1 billion, and it is expected to reach US$598.1 billion by 2031, registering a robust CAGR of 9.1%. The adoption of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Natural Language Processing (NLP) is enhancing operational efficiency and risk assessment capabilities, further boosting market growth.The market is predominantly driven by the growing presence of small and medium-sized enterprises (SMEs) seeking agile financing options, combined with technological innovations in the fintech ecosystem. Among factoring types, domestic factoring services dominate the market with a share of 68% in 2024, owing to the increasing volume of domestic trade. Geographically, North America, particularly the United States, leads the market due to the advanced financial infrastructure, widespread adoption of digital finance, and a high concentration of SMEs. The combination of technological advancements and robust economic activity continues to make the US the most lucrative region for factoring services.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/34770

Key Highlights from the Report

• Increased adoption of fintech solutions drives the US factoring services market growth.

• The market is projected to maintain a steady growth rate of 9.1% CAGR through 2031.

• Domestic factoring services hold the largest market share at 68% in 2024.

• Growing utilization of blockchain technology enhances market efficiency and revenue generation.

• Small and medium enterprises account for 58% of the market share in 2024.

• Rising demand for flexible financing solutions among SMEs remains a key growth driver.

Market Segmentation

The US factoring services market can be segmented based on factoring type, enterprise size, and end-use industries. By factoring type, domestic factoring continues to dominate due to the high volume of inter-company trade and operational simplicity. International factoring, although smaller in share, is witnessing rapid adoption with the expansion of cross-border trade and globalization of SMEs. This segment is gaining traction, particularly among businesses seeking to mitigate credit risks in foreign markets.

In terms of enterprise size, small and medium enterprises (SMEs) are the primary users of factoring services due to their need for immediate working capital. Large enterprises leverage factoring primarily for strategic cash flow management and supply chain optimization. By end-user industry, manufacturing, wholesale, and service sectors represent the largest adopters. The diversification across sectors reflects the growing acceptance of factoring as a mainstream financial solution beyond traditional trade industries.

Regional Insights

North America, led by the United States, is the largest regional market for factoring services due to its advanced financial systems and technology adoption. The availability of sophisticated fintech solutions, combined with a high number of SMEs, underpins sustained market growth.

The Asia-Pacific region is emerging as a promising market for factoring services, with countries like China and India demonstrating increasing demand. Factors such as expanding SMEs, rapid digitization of financial processes, and rising international trade activities are driving growth in these markets.

Market Drivers

The primary drivers of the US factoring services market include the rising adoption of fintech solutions, technological innovations, and the growing number of SMEs seeking working capital. Businesses are increasingly opting for factoring as it provides immediate liquidity without the need for traditional bank loans, which can be cumbersome and time-consuming.

Market Restraints

Despite the market's robust growth, high fees associated with factoring services, regulatory hurdles, and concerns around credit risk management can restrain adoption. Additionally, SMEs with unstable financial histories may face difficulties in securing favorable factoring terms, limiting their ability to fully benefit from these services.

Read More: https://www.persistencemarketresearch.com/market-research/us-factoring-services-market.asp

Market Opportunities

The market presents significant opportunities, particularly in digital factoring platforms, blockchain integration, and expansion into underserved industries. Fintech innovations, including AI-driven credit assessments and automated payment processing, are expected to create new avenues for growth. International factoring and cross-border trade financing also provide untapped potential for market expansion.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/34770

Reasons to Buy the Report

✔ Comprehensive analysis of market size, forecast, and growth trends from 2024 to 2031

✔ In-depth insights into market segmentation by factoring type, enterprise size, and end-use industries

✔ Regional market intelligence with North America and Asia-Pacific trends

✔ Key drivers, restraints, and opportunities influencing market growth

✔ Profiles of leading players with recent developments and competitive landscape

Frequently Asked Questions (FAQs)

How Big is the US Factoring Services Market?

Who are the Key Players in the Global Market for Factoring Services?

What is the Projected Growth Rate of the Market?

What is the Market Forecast for 2032?

Which Region is Estimated to Dominate the Industry through the Forecast Period?

Company Insights

Key players operating in the US factoring services market include:

• BlueVine Capital Inc.

• Triumph Business Capital

• altLINE by The Southern Bank Company

• Paragon Financial Group

• TCI Business Capital

Recent Developments:

• BlueVine launched AI-driven credit assessment tools in 2024 to enhance loan approval speed and accuracy.

• Triumph Business Capital expanded into international factoring services in 2025, targeting SMEs engaged in cross-border trade.

Related Reports:

Warehouse Software Market https://www.persistencemarketresearch.com/market-research/warehouse-software-market.asp

Ai Agents Market https://www.persistencemarketresearch.com/market-research/ai-agents-market.asp

Ambient Intelligence Market https://www.persistencemarketresearch.com/market-research/ambient-intelligence-market.asp

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release U.S. Factoring Services Market to Reach US$ 598.1 Bn by 2031 here

News-ID: 4166779 • Views: …

More Releases from Persistence Market Research

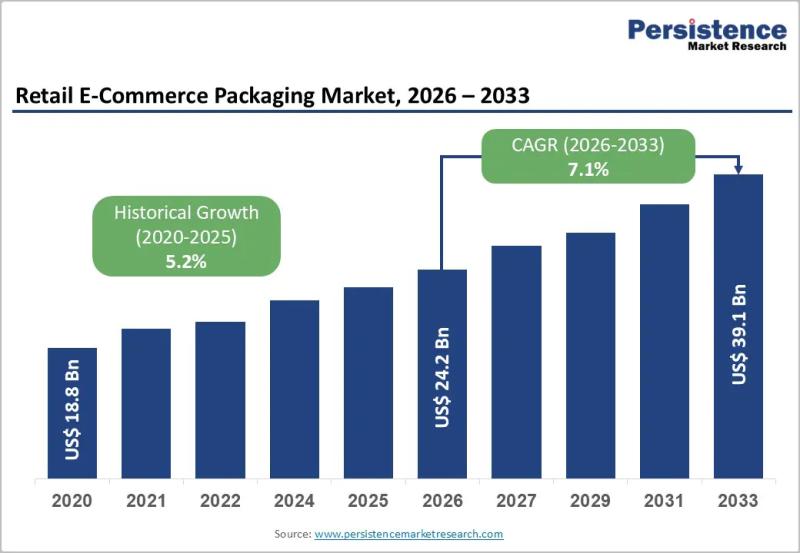

Retail E-Commerce Packaging Market to Reach US$39.1 Billion by 2033 - Persistenc …

The retail e-commerce packaging market has become a critical pillar of the modern supply chain as online shopping reshapes consumer purchasing behavior worldwide. With the rapid expansion of digital marketplaces direct to consumer brands and omnichannel retail strategies packaging is no longer just a protective medium but a brand touchpoint and sustainability statement. Retail e-commerce packaging includes corrugated boxes mailers protective fillers tapes labels and sustainable packaging formats designed specifically…

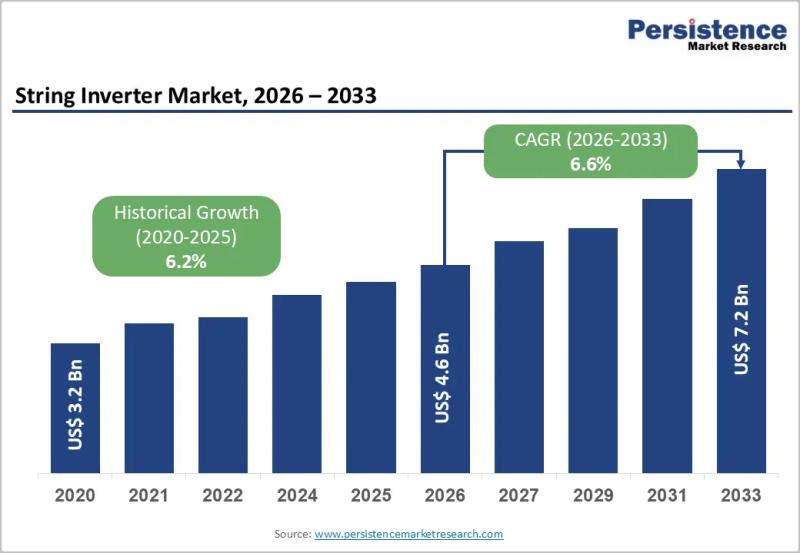

String Inverter Market to Reach US$7.2 Billion by 2033 - Persistence Market Rese …

The string inverter market is emerging as a critical pillar of the global solar photovoltaic ecosystem, supporting the transition toward decentralized renewable energy systems. String inverters play a central role in converting direct current generated by solar panels into usable alternating current for grid connection or onsite consumption. Compared to central inverters, string inverters provide greater design flexibility, easier installation, and improved system monitoring at the string level. Their widespread…

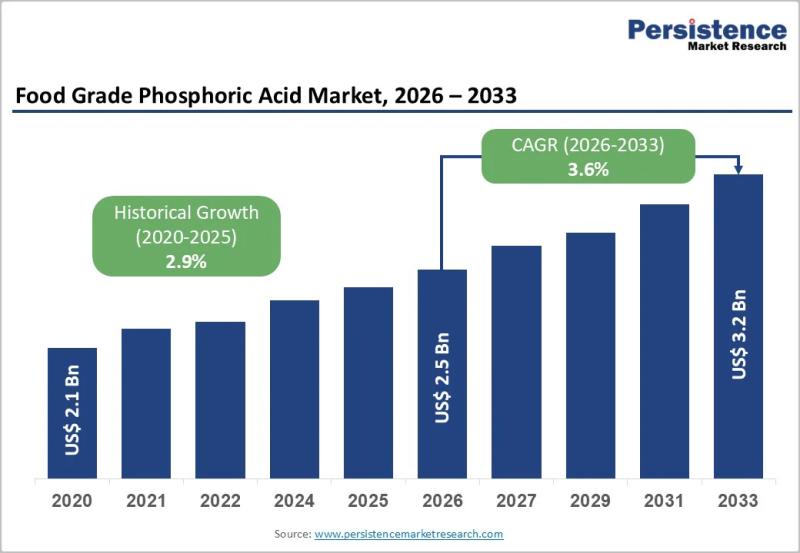

Food Grade Phosphoric Acid Market to Reach US$3.2 Billion by 2033 - Persistence …

The food grade phosphoric acid market plays a critical role in the global food and beverage industry, serving as a key ingredient in acidity regulation, flavor enhancement, preservation, and pH stabilization. Food grade phosphoric acid is widely used in carbonated soft drinks, processed foods, dairy products, bakery formulations, and meat processing applications. Its ability to provide a sharp tangy taste and extend shelf life makes it indispensable for beverage manufacturers…

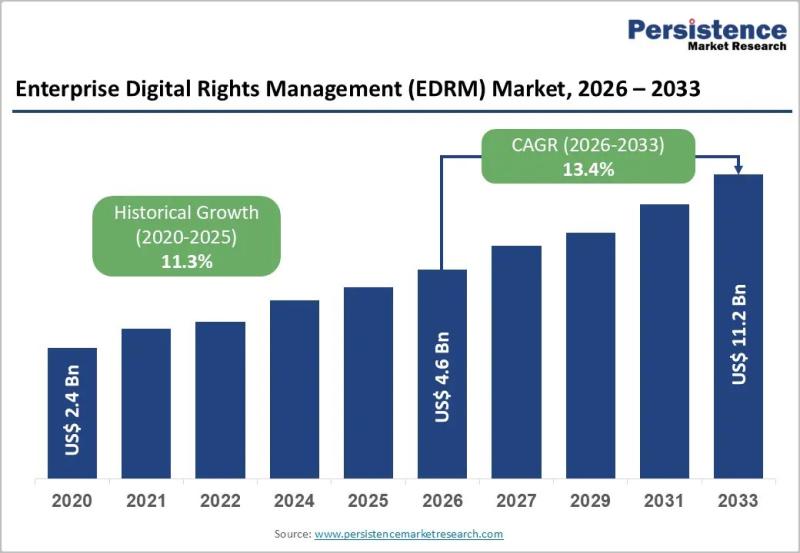

Electronic Document Management System (EDMS) Market to Surpass US$ 27.7 Billion …

The global Electronic Document Management System (EDMS) Market is projected to be valued at US$ 9.7 billion in 2026 and is expected to reach US$ 27.7 billion by 2033, expanding at a robust CAGR of 16.2% during 2026-2033. Organizations worldwide are accelerating digital transformation initiatives by shifting from paper-based processes to intelligent document management platforms. This structural transition is enabling enterprises to enhance workflow automation, improve data governance, and reduce…

More Releases for SMEs

Digitization in SMEs: Opportunities and challenges

Digitalization in German companies has made significant progress in recent years, as evidenced above all by the increasingly widespread use of ERP (Enterprise Resource Planning) software. ERP systems are key tools for the integration and automation of business processes ranging from financial accounting and human resources to production and sales. Current studies show that a growing number of companies in Germany are using ERP solutions to increase their competitiveness and…

Swoop launches voice offering for SMEs

ASX-listed telco Swoop has launched a new voice offering aimed at small to medium-sized businesses (SMBs).

Launched this year, the offering includes unlimited SIP trunks [https://www.swoop.com.au/business/voice/sip-trunks/] and unified communications [https://www.swoop.com.au/business/voice/unified-communications/] voice services.

The launch follows Swoop's acquisition of Sydney-based telecommunications wholesale voice service Seventeen Services.

"This acquisition is set to propel Swoop to new heights by enabling the launch of cutting-edge voice products, amplifying the company's offerings, and cementing its position as a…

Swoop launches voice offering for SMEs

ASX-listed telco Swoop has launched a new voice offering aimed at small to medium-sized businesses (SMBs).

Launched this year, the offering includes unlimited SIP trunks and unified communications voice services.

The launch follows Swoop's acquisition of Sydney-based telecommunications wholesale voice service Seventeen Services.

"This acquisition is set to propel Swoop to new heights by enabling the launch of cutting-edge voice products, amplifying the company's offerings, and cementing its position as a frontrunner in…

How free software can benefit SMEs

Intuitive, easy and quick. MEDUSA4 Personal for small companies is impressive whichever way you look at it

Cambridge, UK and Pittsford, NY – 2 November 2016: A modern design, new functions and more possibilities for commercial use make the free CAD software ideal for day-to-day use in construction and planning.

Big benefits for small companies

Companies producing construction drawings and plans can use MEDUSA4 Personal's complete range of functions free of charge. If…

60% of Polish SMEs use IT services

Approx. 60% of small and medium sized enterprises use IT services in Poland. Some 30% of SMEs declare to employ people responsible for IT. The number of portable computers used by SMEs has been growing. On average, there are five such computers per one SME. The proportion of companies which use EU funds to finance ICT development has gone down over the last two years.

Use of IT services

According to the…

IndiaMART.com Enriches SMEs with Power of Internet

First-of-its kind report on Internet & SMEs to be unveiled at 'Free for SMEs' Conference

- FISME to ardently support the conference

- Erudite speakers to share valuable information

- Importance & scope of mobile marketing for SMEs also to be highlighted

New Delhi, 2nd July 2010: With global economy becoming increasingly reliant on Information and Communication Technology (ICT) for undertaking various businesses, Indian Small and Medium Enterprises (SMEs) too are expected to…