Press release

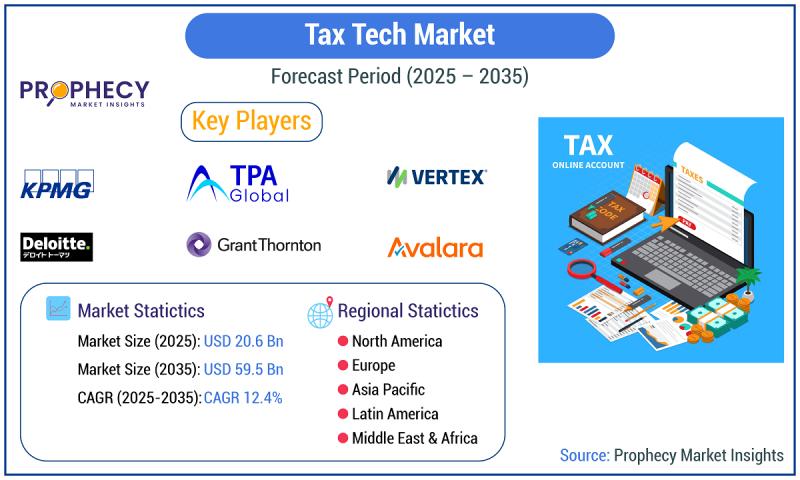

Tax Tech Market to Reach USD 59.5 Billion by 2035 | Growth, SWOT Insights, and Key Players

The Tax Technology (Tax Tech) Market is witnessing rapid adoption as businesses modernize their tax compliance and reporting systems. Estimated at USD 18.6 billion in 2024, the market is forecasted to expand to USD 59.5 billion by 2035, growing at a CAGR of 12.4%. With complex global tax structures, stricter regulations, and demand for real-time digital solutions, tax tech has become a vital enabler of efficiency and transparency.Get Sample Copy :- https://www.prophecymarketinsights.com/market_insight/Insight/request-sample/5838

Key Market Drivers

Complex Global Tax Regulations - Frequent changes in tax laws push enterprises to adopt automation.

Digital Transformation in Finance - Cloud-based tax platforms accelerate efficiency.

AI & Automation - Predictive analytics, NLP, and RPA reduce manual errors.

SME Adoption Rising - Scalable SaaS solutions are creating new opportunities.

Global Trade Expansion - Cross-border e-commerce boosts demand for automated compliance.

Market Segmentation

By Component

Software: Tax Compliance Software, Tax Planning & Management Software, Others

Services: Implementation Services, Support & Maintenance, Others

By Tax Type

Direct Tax, Indirect Tax, Property Tax, Payroll Tax, Others

By Technology

Robotic Process Automation (RPA)

Big Data & Analytics

Natural Language Processing (NLP)

Blockchain

Artificial Intelligence (AI) & Machine Learning (ML)

Others

By Enterprise Size

Large Enterprises

Small & Medium Enterprises (SMEs)

By Industry Vertical

BFSI, Healthcare, IT & Telecom, Retail & E-commerce, Manufacturing, Government, Oil & Gas, Others

By Region

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

SWOT Insights

Strengths

Strong demand due to rising global tax complexity.

Widespread adoption of AI, cloud, and automation.

Recurring revenue models for solution providers.

Weaknesses

High initial investment for advanced solutions.

Integration challenges with legacy financial systems.

Limited awareness among small businesses in developing economies.

Opportunities

Growing adoption of SaaS-based tax solutions among SMEs.

Expansion into emerging markets with evolving tax frameworks.

Rising demand for blockchain-based transparency in tax reporting.

Threats

Rising cybersecurity risks in financial data handling.

Regulatory uncertainties and sudden policy shifts.

Intense competition from global consulting and tech firms.

Competitive Landscape & Top Key Players Analysis

The Tax Tech Market is dominated by global consulting firms, software providers, and compliance solution specialists. Competition is intensifying as companies enhance AI-driven offerings, expand cloud platforms, and strengthen cross-border compliance capabilities.

Top Key Players:

Deloitte, PwC, KPMG, and EY - Global professional service giants leading in tax consulting and digital compliance platforms.

SAP SE & Wolters Kluwer N.V. - Technology innovators offering integrated ERP and tax automation modules.

Avalara, Vertex, and Sovos Compliance - Specialists focusing on real-time compliance solutions for SMEs and enterprises.

Thomson Reuters - A major player in digital tax and accounting technology with global reach.

Xero Limited & TaxJar - SaaS providers gaining traction among small businesses and e-commerce firms.

Download Sample PDF :- https://www.prophecymarketinsights.com/market_insight/Insight/request-pdf/5838

Strategically, these companies are:

Forming alliances with ERP and accounting software vendors.

Investing in AI & blockchain-enabled tax compliance systems.

Expanding into emerging markets with regulatory digitization initiatives.

Strategic Insights

Cloud migration is reshaping the competitive landscape.

AI-driven predictive tax planning is becoming mainstream.

SME-focused solutions represent the fastest-growing segment.

Global M&A activity indicates consolidation in the tax tech ecosystem.

Recent Developments

2024: Avalara expanded ERP integrations for automated tax compliance.

2024: Thomson Reuters launched AI-powered tax analytics features.

2023: Sovos Compliance expanded global e-invoicing solutions.

2023: SAP enhanced its tax management suite for multi-jurisdictional compliance.

FAQs

Q1. What is the market size forecast for 2035?

The Tax Tech Market will reach USD 59.5 billion by 2035 at a CAGR of 12.4%.

Q2. Which technologies are most influential?

AI, RPA, blockchain, NLP, and big data analytics are driving innovation.

Q3. Which industries are adopting tax tech most?

BFSI, IT & Telecom, Retail, Healthcare, and Government sectors dominate adoption.

Q4. Who are the leading players?

Deloitte, PwC, KPMG, EY, SAP, Wolters Kluwer, Avalara, Vertex, and Thomson Reuters are key leaders.

Q5. What is the biggest opportunity in this market?

The SME segment and emerging markets offer vast growth potential through affordable SaaS solutions.

Author

Authored by Shweta R., Business Development Specialist at Prophecy Market Insights. This analysis is based on primary and secondary research, offering strategic insights into the global Tax Tech Market.

India: Sai Ambience, Kunal Icon Rd, Pimple Saudagar, Pune

US: 964 E. BadilloStreet #2042 Covina, CA 91724

US toll free: +1 689 305 3270

Rest of world: + 91 7775049802

About Us

Prophecys expertize area covers products, services, latest trends, developments, market growth factors, and challenges along with market forecast in various business areas such as Healthcare, Pharmaceutical, Biotechnology, Information Technology (IT), Automotive, Industrial, Chemical, Agriculture, Food and Beverage, Energy, and Oil and Gas. We also offer various other services such as, data mining, information management, and revenue enhancement suggestions.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Tech Market to Reach USD 59.5 Billion by 2035 | Growth, SWOT Insights, and Key Players here

News-ID: 4165094 • Views: …

More Releases from PROPHECY MARKET INSIGHTS

Stationary Fuel Cell Market Size, Trends, Analysis, and Forecast till 2035

(Oct-2025/Pune) The latest study titled Stationary Fuel Cell Market, published by Prophecy Market Insights, offers comprehensive insights into the global and regional markets projected to expand significantly between 2025 and 2035. The report provides a detailed analysis of market dynamics, value chain, investment opportunities, competitive landscape, and key market segments. It further explores strategic initiatives, technological advancements, and emerging opportunities across the fuel cell industry.

In 2024, the Stationary Fuel Cell…

Bio-identical hormone replacement Trends and Strategic Analysis 2025-2035

The Latest study titled Bio-identical hormone replacement market, published by Prophecy Market Insights, provides valuable insights into both regional and global markets projected to grow in value from 2025 to 2035. The comprehensive research delves into the evolving market dynamics, value chain analysis, prominent investment areas, competitive landscape, regional outlook, and key market segments. It also offers a thorough assessment of the global market's drivers and constraints. Additionally, the report…

Pharmaceutical Drugs Market to Reach USD 3357 Billion by 2035, Growing at a CAGR …

Prophecy Market Insights has released its latest study on the Pharmaceutical Drugs Market, revealing significant growth opportunities driven by innovation in drug discovery, rising healthcare spending, and the global demand for effective therapies. The market, valued at USD 1750 billion in 2024, is expected to grow to USD 3357.0 billion by 2035, at a steady CAGR of 6.8% during the forecast period (2025-2035).

Get Preview (PDF) Here: https://www.prophecymarketinsights.com/market_insight/Insight/request-pdf/6055

Market Overview

The Pharmaceutical Drugs…

Satellite Data Services Market 2035 Outlook: Key Drivers, SWOT Insights & Top Co …

Prophecy Market Insights has recently released a comprehensive research report on the Satellite Data Services Market, highlighting key trends, market dynamics, competitive insights, and growth opportunities expected through 2035. The market, valued at USD 10.6 billion in 2024, is projected to reach USD 52.5 billion by 2035, registering a remarkable CAGR of 17.6% during the forecast period.

Get Sample PDF: https://www.prophecymarketinsights.com/market_insight/Insight/request-pdf/6053

Market Overview

The Satellite Data Services Market is witnessing rapid expansion, driven…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…