Press release

Top Trends Transforming the Tax Tech Market Landscape in 2025: AI-Powered Audit Tool Streamlines Data Analysis And Minimizes Risk

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Will the Tax Tech Industry Market Size Be by 2025?

The size of the tax tech market has experienced fast expansion in the last few years. The market is projected to increase from $19.44 billion in 2024 to $22.52 billion in 2025, with a compound annual growth rate (CAGR) of 15.8%. The historical growth is associated with a surge in the need for automation in tax activities, an uptick in the usage of cloud-based financial solutions, growing emphasis on regulatory compliance, an escalated demand for real-time tax reporting, the increasing globalization of commercial activities, and the surge in digital transformation within finance departments.

What's the Long-Term Growth Forecast for the Tax Tech Market Size Through 2029?

Anticipations hint towards a significant surge in the tax tech market size in the forthcoming years. The market is predicted to expand to a whopping $39.99 billion in 2029, exhibiting a compound annual growth rate (CAGR) of 15.4%. This growth during the forecast period is attributed to factors such as higher demand for real-time compliance tools, escalating necessity for cross-border tax solutions, increase in e-invoicing norms globally, widened utilization of big data analytics in tax planning, and heightened focus on detecting and preventing fraud along with increased investment in fintech infrastructure. The forecast period will likely witness key trends like progress in AI-led tax analytics, sophisticated integration of tax software with Enterprise Resource Planning (ERP) systems, innovation in tax reporting backed by blockchain, application of machine learning for predictive tax insights, and progress in cloud-centric tax platforms.

View the full report here:

https://www.thebusinessresearchcompany.com/report/tax-tech-global-market-report

What Are the Key Growth Drivers Fueling the Tax Tech Market Expansion?

As tax regulations become progressively more complex, it is anticipated that the tax tech market will experience significant growth. The complexity of these regulations lies in the frequently-changing and intricate tax laws and reporting requirements that differ from jurisdiction to jurisdiction, making it increasingly challenging for businesses. This escalating complexity is a result of the global expansion of businesses, which demands compliance with multiple, and sometimes contradictory tax laws in varying countries. Tax tech simplifies the management of these complicated tax regulations by automating compliance proceedings, thus aiding businesses in keeping up with shifting laws. It minimizes manual labor by optimizing data entry and reporting, which enhances accuracy and operational efficiency. For instance, the UK Government reported in April 2025 that a total of 240 tax policy changes were enforced between 2022 and 2024. These alterations are predicted to impose a net cost of roughly $1,129 million (£875 million) on His Majesty's Revenue and Customs (HMRC), and about $1,228 million (£913 million) in compliance costs for businesses in the subsequent years. As a result, the rising complexity of tax regulations is fueling the expansion of the tax tech market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=27094&type=smp

What Are the Key Trends Driving Tax Tech Market Growth?

Key players in the tax tech market, such as Thomson Reuters, are focusing their efforts to enhance product offerings with advanced technologies like AI-driven anomaly detection systems. With an aim to boost operations efficiency, improve accuracy, and minimize manual intervention during tax audits, these systems leverage intelligent algorithms to spot irregularities or inconsistencies in the tax data. This facilitates a smoother compliance process and mitigates the chances of errors. As a case in point, in November 2023, the information services firm from Canada, Thomson Reuters, introduced new automation and AI functionalities to its tax products. The update included a feature for automated detection of discrepancies during audits, using AI to identify inconsistencies in the financial records, thereby improving audit accuracy and minimizing manual data checks. This new feature aims to simplify data analysis, reduce possible threats, and ensure better adherence to compliance.

How Is the Tax Tech Market Segmented?

The tax tech market covered in this report is segmented -

1) By Component: Software, Services

2) By Tax Type: Direct Tax, Indirect Tax, Property Tax, Payroll Tax, Other Tax Types

3) By Deployment Mode: Cloud-Based, On-Premises

4) By Technology: Robotic Process Automation, Big Data And Analytics, Natural Language Processing, Blockchain, Artificial Intelligence (AI) And Machine Learning (ML), Other Technologies

5) By Industry Vertical: Pharmaceutical And Healthcare, Banking, Financial Services, And Insurance, IT And Telecom, Retail And E-commerce, Oil And Gas, Manufacturing, Government, Other Industries

Subsegments:

1) By Software: Tax Compliance Software, Tax Filing Software, Tax Planning And Advisory Software, Transfer Pricing Software, Value Added Tax (VAT) Or Goods And Services Tax (GST) Automation Software, Cryptocurrency Tax Software

2) By Services: Consulting Services, Integration And Implementation Services, Support And Maintenance Services, Managed Services

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=27094&type=smp

Which Companies Are Leading the Charge in Tax Tech Market Innovation?

Major companies operating in the tax tech market are Automatic Data Processing Inc., Thomson Reuters Corporation, Wolters Kluwer N.V., Paychex Inc., H&R Block Inc., DATEV eG, Ryan LLC, Sovos Compliance LLC, Rippling Inc., Avalara Inc., Xero Limited, Vertex Inc., Canopy Tax Inc., Drake Enterprises Ltd., Tax Technologies Inc., TaxJar Inc., TaxAct Inc., ZenLedger Inc., Bloomberg Industry Group Inc., TaxDome LLC

Which Regions Are Leading the Global Tax Tech Market in Revenue?

North America was the largest region in the tax tech market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the tax tech market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=27094

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Speak With Our Expert:

Saumya Sahay,

Americas: +1 310-496-7795,

Asia: +44 7882 955267 & +91 8897263534,

Europe: +44 7882 955267,

Email: saumyas@tbrc.info

The Business Research Company - www.thebusinessresearchcompany.com

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top Trends Transforming the Tax Tech Market Landscape in 2025: AI-Powered Audit Tool Streamlines Data Analysis And Minimizes Risk here

News-ID: 4164751 • Views: …

More Releases from The Business Research Company

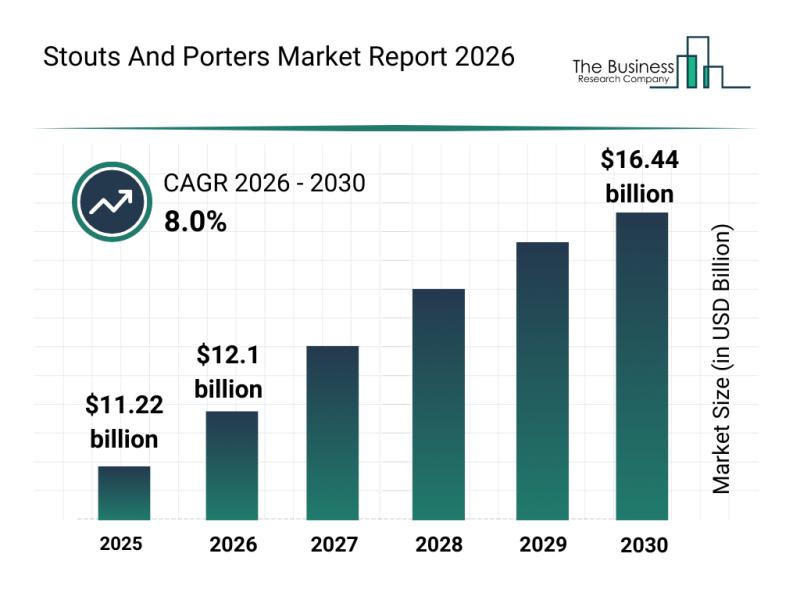

Competitive Landscape: Key Market Leaders and Emerging Competitors in the Stouts …

The stouts and porters market is on track for notable expansion as consumer preferences continue to shift toward unique and premium beer experiences. With a growing appreciation for specialty brews and innovative brewing methods, this market is set to achieve significant milestones in the coming years. Below is an overview of the market size, key players, current trends, and segmentation that define this dynamic sector.

Projected Market Size and Growth Momentum…

Trends in Growth, Segment Analysis, and Competitive Strategies Influencing the S …

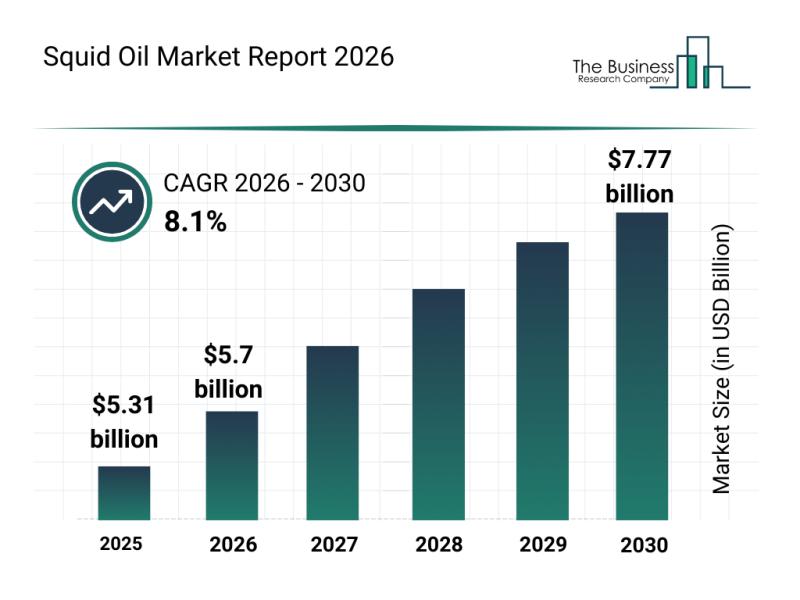

The squid oil market is gaining significant traction as demand surges for natural omega-3 sources and sustainable marine products. This industry is evolving rapidly due to innovations in health supplements, pharmaceuticals, and eco-friendly harvesting methods. Let's dive into the current market outlook, key players, emerging trends, and segment analysis shaping the future of squid oil.

Growth and Market Expansion Prospects in the Squid Oil Market

The squid oil market is…

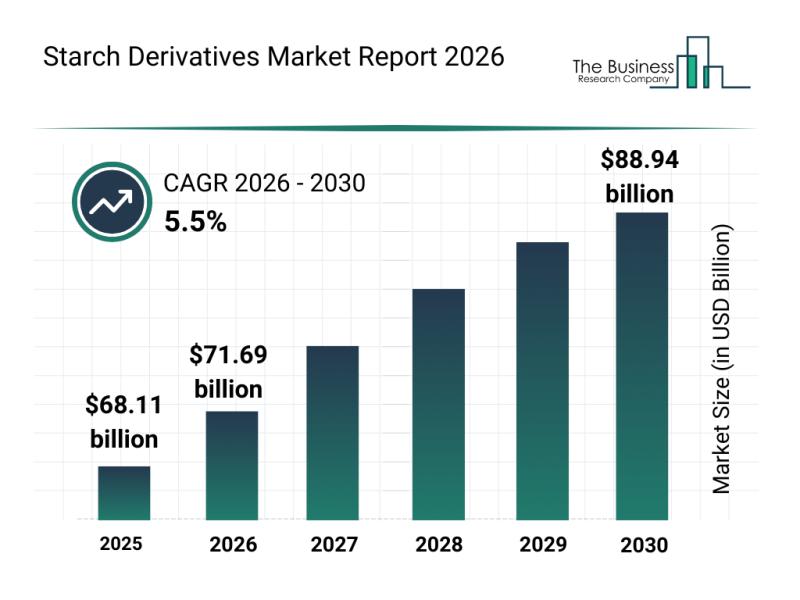

Future Perspectives: Key Trends Shaping the Starch Derivatives Market Up to 2030

The starch derivatives market is positioned for remarkable growth in the coming years, driven by evolving industrial demands and technological innovations. As industries increasingly seek specialized starch products for diverse applications, this sector is expected to expand significantly by 2030. Let's explore the market's size, leading players, prevailing trends, and key segmentations to understand the landscape better.

Future Market Size and Growth Potential of the Starch Derivatives Market

The starch…

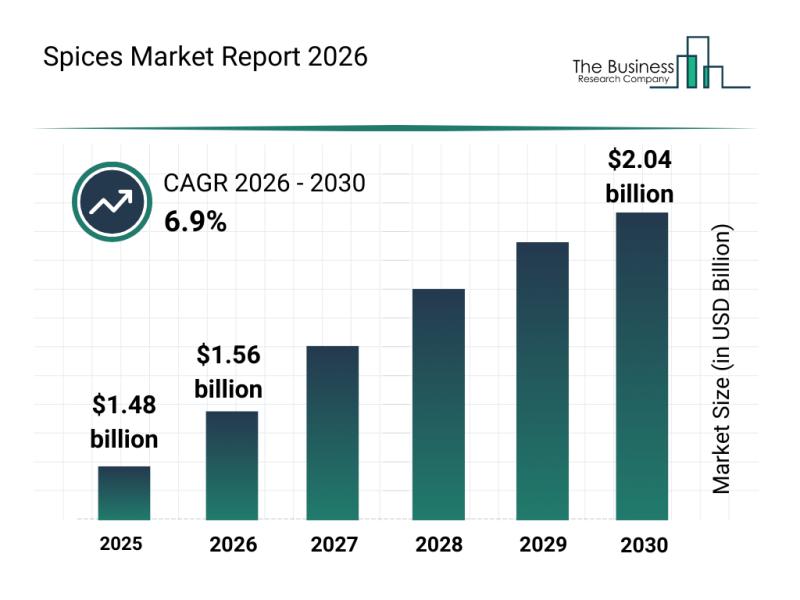

Analysis of Key Market Segments Driving the Spices Market

The spices market is on track for substantial expansion in the coming years, driven by evolving consumer preferences and industry advancements. This report explores the anticipated market size, the key players dominating the sector, prevailing trends influencing growth, and the various market segments shaping its future.

Forecasted Growth Trajectory of the Spices Market by 2030

The spices market is projected to reach a value of $2.04 billion by 2030, growing…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…