Press release

Equity Management Software Market to Reach USD 2485.73 Million by 2034 | CAGR 12% Driven by Rising ESOP Adoption & Cloud Solutions

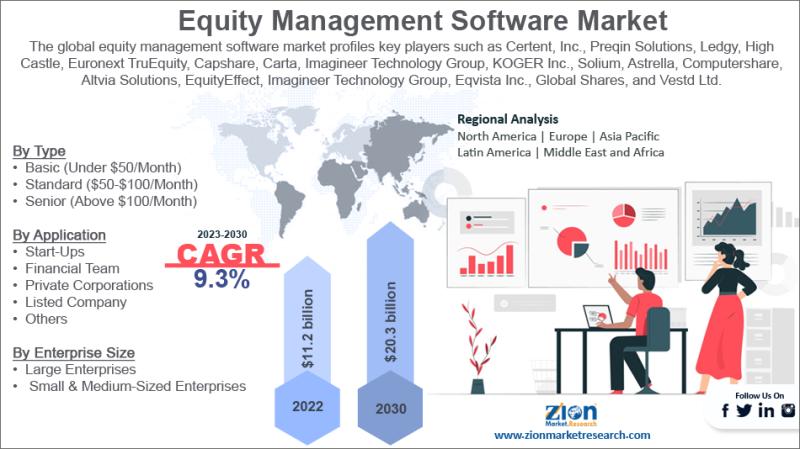

The global equity management software market, valued at USD 800.34 million in 2024, is projected to grow to USD 2485.73 million by 2034, registering a robust CAGR of 12% during the forecast period. This growth is fueled by the increasing complexity of corporate equity structures, the surge in employee stock ownership plans (ESOPs), the demand for regulatory compliance, and rising adoption of cloud-based equity management platforms.🌍 Market Overview

Equity management software, also known as cap table software, enables organizations to track, manage, and optimize their ownership structures. The software assists in automating equity compensation, ensuring compliance, enhancing stakeholder communication, and supporting fundraising activities.

Access a Sample Report with Full TOC and Figures @ https://www.zionmarketresearch.com/sample/equity-management-software-market

Key functionalities include:

Real-time cap table management

Stakeholder reporting & investor relations

Regulatory compliance with SEC, IFRS, and local laws

Valuations and auditing support

Decision-making assistance for fundraising and capital expansion

With growing private market investments and a sharp rise in start-up ecosystems globally, equity management software is emerging as a mission-critical solution.

🚀 Growth Drivers

Complex Equity Structures - Increasing VC funding and diverse shareholder arrangements are driving adoption of advanced equity tools.

ESOP Adoption - Start-ups and enterprises alike are offering stock options, fueling demand for automated tracking solutions.

Regulatory Compliance & Transparency - Rising emphasis on audit readiness and investor confidence boosts software penetration.

Cloud & AI Integration - Modern platforms offering cloud-based, AI-enabled equity solutions enhance efficiency and scalability.

⚠️ Restraints

High Initial Costs - Advanced software integration can be expensive for SMEs and start-ups.

Low Awareness in Emerging Markets - Many firms still rely on manual processes or basic spreadsheets.

Counterfeit & Low-Quality Alternatives - The availability of cheaper, less reliable products may hamper quality adoption.

💡 Opportunities

Urbanization & Globalization - Increasing start-up activity in emerging markets like India, Southeast Asia, and Africa creates strong growth potential.

AI & Workflow Automation - Integration of smart analytics and automation tools will further streamline equity administration.

Cross-Border Investments - With globalization, demand for multi-jurisdictional compliance solutions is expected to surge.

🔎 Market Segmentation

By Type

Basic (Under $50/Month) - Dominating segment due to adoption by small businesses.

Standard ($50-$100/Month)

Senior (Above $100/Month)

By Enterprise Size

Large Enterprises - Strongest adoption, projected to dominate market share.

SMEs - Increasing adoption as cloud-based cost-effective solutions emerge.

By Application

Start-ups - Rapidly growing with global VC funding boom.

Private Corporations - Major revenue contributor.

Listed Companies

Financial Teams & Others

🌎 Regional Insights

North America - Expected to dominate due to widespread adoption across SMEs and large firms, presence of key players (Carta, Preqin, Altvia), and advanced funding ecosystems.

Asia-Pacific - Anticipated to grow at the fastest CAGR, fueled by start-up growth in India, China, Singapore, and Southeast Asia.

Europe - Growth supported by fintech adoption and evolving regulatory frameworks.

Latin America & MEA - Emerging adoption as regional firms embrace digitization in equity management.

🏢 Competitive Landscape

The market is moderately fragmented with players investing in product innovation, acquisitions, and partnerships to expand their footprint.

Key Players:

Capdesk

Euronext

Gust

Preqin Solutions

Carta

Eqvista

Certent

Ledgy

Deep Pool Financial Solutions

Altvia Solutions LLC

Want to know more? Read the full report here: https://www.zionmarketresearch.com/report/equity-management-software-market

Recent Developments:

2021: Ledgy AG raised $10 million in Series A funding to enhance automation features.

2022: Carta acquired Capdesk to expand its presence in the UK and Europe.

2021: Altvia Solutions partnered with Preqin for integrated private equity data solutions.

✅ Conclusion

The Equity Management Software Market is set for exponential growth, climbing from USD 800.34 million in 2024 to USD 2485.73 million by 2034. Factors such as ESOP adoption, regulatory compliance, cloud technology integration, and globalization of investments will drive market expansion.

While high costs and limited awareness in emerging economies remain challenges, the opportunities in AI-driven automation, digital-first start-ups, and cross-border investments will reshape the industry.

By 2034, equity management software will not just be a compliance tool but a strategic enabler of corporate growth, transparency, and investor confidence. 📊💼

Click On This Below Link to See Similar Reports :

Vinyl Siding Market: https://www.zionmarketresearch.com/report/vinyl-siding-market

Quick Commerce Market: https://www.zionmarketresearch.com/report/quick-commerce-market

Intelligent Building Management Systems Market: https://www.zionmarketresearch.com/report/intelligent-building-management-systems-market

H2 Green Steel Market: https://www.zionmarketresearch.com/report/h2-green-steel-market

Cocoa Chocolate Market: https://www.zionmarketresearch.com/report/cocoa-chocolate-market

Asia Pacific Office

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

📞 US OFFICE NO +1 (302) 444-0166

📞 US/CAN TOLL FREE +1-855-465-4651

📧 Email: sales@zionmarketresearch.com

🌐 Website: www.zionmarketresearch.com

In addition to providing our clients with market statistics released by reputable private publishers and public organizations, we also provide them with the most current and trending industry reports as well as prominent and specialized company profiles. Our database of market research reports contains a vast selection of reports from the most prominent industries. To provide our customers with prompt and direct online access to our database, our database is continuously updated.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Equity Management Software Market to Reach USD 2485.73 Million by 2034 | CAGR 12% Driven by Rising ESOP Adoption & Cloud Solutions here

News-ID: 4162855 • Views: …

More Releases from zion market research

Halal Food Market to Reach USD 16.84 Billion by 2034, Expanding at 18.04% CAGR

The global halal food market, valued at USD 3.21 billion in 2024, is projected to reach USD 16.84 billion by 2034 at a robust CAGR of 18.04%. This extraordinary growth is fueled by a rapidly rising global Muslim population, increasing demand for certified halal-compliant food, expanding global halal trade networks, and the emergence of halal as a trusted, premium, ethical, and hygienic food label even for non-Muslim consumers.

Key Market Highlights

Metrics Insight

2024…

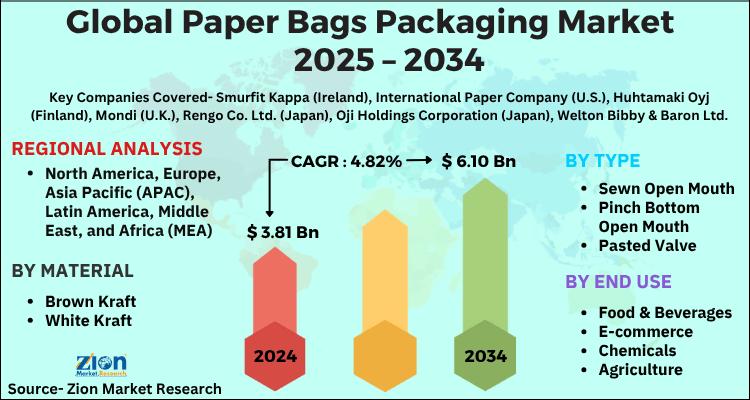

Paper Bags Packaging Market to Reach USD 6.10 Billion by 2034, Expanding at 4.82 …

The global paper bags packaging market, valued at USD 3.81 billion in 2024, is projected to reach USD 6.10 billion by 2034, growing at a 4.82% CAGR between 2025 and 2034. The market is gaining momentum on the back of sustainability mandates, stringent global regulations against single-use plastic, rising consumer environmental consciousness, and the rapid expansion of e-commerce and foodservice industries adopting recyclable packaging.

Key Market Highlights

Indicator Insight

2024 Market Value USD 3.81 Billion

2034…

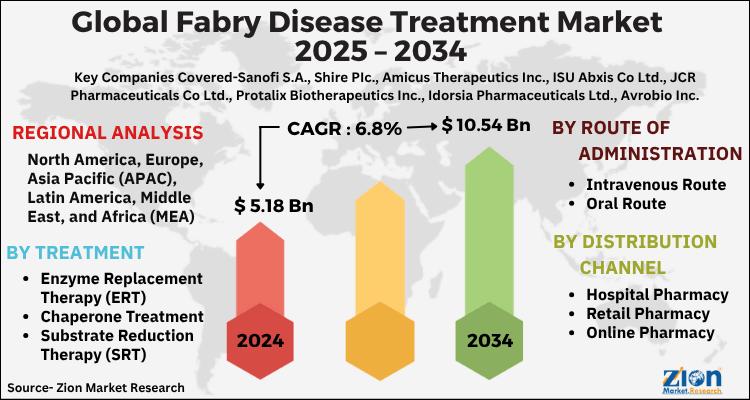

Fabry Disease Treatment Market to Reach USD 10.54 Billion by 2034, Expanding at …

The global Fabry disease treatment market, valued at USD 5.18 billion in 2024, is projected to reach USD 10.54 billion by 2034, growing at a 6.8% CAGR (2025-2034). Market momentum is driven by rising disease awareness and diagnosis, expanding enzyme replacement therapy (ERT) utilization, progress in chaperone and substrate reduction therapies (SRT), and an advancing pipeline in gene and next-generation ERTs. Persistent unmet need-stemming from organ involvement (renal, cardiac, cerebrovascular),…

Snow Sports Apparel Market to Reach USD 5.37 Billion by 2034, Expanding at 7.3% …

The global snow sports apparel market, valued at USD 2.65 billion in 2024, is projected to reach USD 5.37 billion by 2034, growing at a 7.3% CAGR (2025-2034). Growth is driven by the rising popularity of winter sports and outdoor recreation, fabric and garment-tech innovations (breathability, waterproofing, thermal regulation), and the accelerating role of e-commerce, social media, and athlete-led branding in discovery and conversion.

Strategic Market Insights & Key Performance Indicators

2024…

More Releases for Equity

Shah Equity Launches the World's First Integrated Global Private Equity & Hedge …

Shah Equity, a leading innovator in financial services, proudly announces the launch of the world's first integrated Global Private Equity & Hedge Fund. With a strategic focus on Commercial Real Estate, Healthcare, Home Services, and a robust Hedge Fund, Shah Equity is dedicated to maximizing value and fueling sustainable growth, all while expertly hedging investment risks.

In an era where traditional investment models face unprecedented challenges, Shah Equity steps forward with…

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Establishment Consultation,Chinese private equity company,

Pandacu China is a leading private equity firm that specializes in making long-term investments in small and medium-sized enterprises (SMEs) in China. The company was founded in China by a team of experienced finance professionals with a deep understanding of the Chinese market and a strong network of contacts in the private equity and venture capital industry.

https://boomingfaucet.com/

China Private Equity Establishment Consultation

E-mail:nolan@pandacuads.com

SMEs are the backbone of the Chinese economy, and they…