Press release

IBN Technologies' Outsourced Tax Preparation Service Strengthens Financial Stability for USA Businesses

Businesses across industries are increasingly relying on IBN Technologies outsourced tax preparation service to ensure compliance, reduce errors, and optimize financial management. From payroll administration to multi-state filings, companies gain accurate, audit-ready solutions that streamline operations, lower risk, and allow teams to focus on growth, making tax services a key component of strategic financial planning.Miami, Florida - 26 Aug, 2025 - Across diverse industries, organizations are relying more heavily on professional tax service to guarantee compliance, reduce exposure to liabilities, and avoid costly penalties associated with multilayered federal, state, and local tax regulations. Whether in retail, healthcare, manufacturing, technology, or real estate, businesses are seeking expert support for accurate filings, payroll administration, deduction optimization, and future-oriented financial planning. Today's tax preparation service [https://www.ibntech.com/us-uk-tax-preparation-services/], supported by digital platforms and virtual systems, streamline processes and make compliance more manageable and efficient. What was once seen as a seasonal task is increasingly recognized as a foundational system for financial strength and long-term competitiveness.

This growing dependence on tax preparation solutions expertise underscores a larger transformation in business financial management [https://www.ibntech.com/blog/small-business-tax-tips-healthy-financial-status/]. Companies increasingly view external tax specialists as both a risk buffer and a performance enhancer, enabling them to maintain compliance while running leaner operations. IBN Technologies is one of the providers leading this evolution, offering customized tax management services that not only secure compliance but also reinforce financial strategy. With outsourced tax and payroll management, businesses free up time and resources to focus on expansion while maintaining full confidence that obligations are handled with precision and reliability.

See how professional tax preparation service reduces errors and risk fast.

Get a Free Consultation: https://www.ibntech.com/free-consultation-for-tax-return/

Inflation Magnifies Tax Compliance Burdens

Rising inflation is pushing operational expenses upward while ever-changing tax regulations compound the strain on business finance teams. Internal tax departments often lack the tools or staffing needed to manage complex compliance demands, resulting in delayed filings, reporting errors, and missed obligations. Many companies still rely heavily on manual spreadsheets, a fragile approach that breaks down during periods of heightened demand, particularly around quarterly deadlines and year-end closings.

- Escalating costs prevent investment in qualified in-house tax talent

- Shifting regulations introduce confusion and inefficiencies

- Manual processes increase vulnerability to data errors

- Weak document handling slows down compliance reviews

- Inadequate oversight practices undermine filing accuracy

Such challenges surface most prominently during busy tax cycles when workloads surge and limitations become unavoidable. To counter this, experts recommend outsourcing tax operations to professional service providers. When recurring mistakes or delays persist, external partners deliver measurable value by offering structured systems, up-to-date regulatory expertise, and audit-ready controls that surpass traditional documentation methods. For many enterprises, tax outsourcing services is no longer a fallback-it has become a strategic measure to strengthen compliance frameworks and build financial resilience.

U.S. Firms Turn to Outsourcing for Reliable Tax Compliance

Across the country, more businesses are shifting toward outsourced tax preparation service to achieve greater accuracy and consistency. Rather than expanding internal staff, organizations partner with professional providers who deliver structured, audit-ready solutions designed to improve regulatory preparedness and filing confidence.

Continuous expert assistance to relieve stress during busy filing cycles

Documentation fully compliant with state and federal regulations

Trained specialists handling tax and bookkeeping across industries

Flexible outsourcing models aligned with unique operational structures

Up-to-date regulatory knowledge applied directly to filing strategies

Support for multi-state compliance as businesses expand footprints

Filing records built to match both IRS and state-specific codes

Secure online dashboards for oversight and performance tracking

End-to-end support on credits, deductions, and classifications

By moving tax functions outside traditional in-house teams, businesses in Texas gain reduced error rates, improved filing timelines, and stronger compliance outcomes. Leading firms like IBN Technologies support this evolution by providing specialized filing frameworks and access to experts experienced in multi-state requirements. Business tax preparation services are a vital component in ensuring these outcomes.

Scalable Tax Services for Compliance Confidence

With deep industry expertise, IBN Technologies provides businesses across the United States with comprehensive tax preparation service and accounting services. Focused on accuracy and regulatory alignment, the firm designs tailored solutions that ensure dependable compliance.

26+ years of leadership in outsourced tax and accounting services

Partner to over 1,500 organizations across three global regions

Manages 50 million+ annual transactions with consistency

Maintains 99.99% accuracy using multi-tier review processes

ISO 9001 & ISO 27001 certifications for quality and security standards

Texas Companies Strengthen Compliance Through Outsourced Tax Support Businesses across Texas are reporting clear advantages from relying on professional outsourced tax preparation service providers. By leveraging expert guidance and structured processes, organizations are filing with greater accuracy, faster turnaround, and consistent compliance throughout the year.

- Reduced errors and improved monitoring for state and federal returns

- Higher precision across quarterly and year-end submissions

- Seamless coordination of multi-state and multi-entity requirements

These outcomes demonstrate how outsourcing tax preparation services for small businesses helps Texas businesses achieve both compliance and operational efficiency. IBN Technologies plays a key role in this transformation, delivering dependable, accurate-focused tax solutions designed to improve financial management.

Outsourced Tax Services Gain Strategic Importance

Across the United States, outsourced tax preparation service is moving from a supportive role to a central element of financial planning. As businesses confront evolving tax codes and growing operational demands, leaders are increasingly seeking external partners capable of delivering both compliance assurance and structured guidance for long-term stability. The combination of precision, transparency, and consistent oversight enables companies to manage regulatory obligations with confidence while positioning themselves for growth.

Analysts point out that this shift represents a significant evolution in corporate approaches to tax and accounting. Tax resolution services reduce exposure to compliance errors, streamline efficiency, and allow organizations to focus scarce internal resources on higher-value initiatives rather than routine paperwork. By adopting standardized frameworks, audit-ready practices, and flexible compliance models across multiple jurisdictions, companies are building resilience into their financial strategies. With momentum continuing to build, outsourced tax preparation service is expected to become a defining feature of modern business operations nationwide.

Related Services:

*

Outsource Payroll Processing Services:https://www.ibntech.com/payroll-processing/

*

Outsource Bookkeeping Services:https://www.ibntech.com/bookkeeping-services-usa/ [https://www.ibntech.com/bookkeeping-services-usa/?PR=EIN]

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 26 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive AR efficiency and growth.

Media Contact

Company Name: IBN Technologies LLC

Contact Person: Pradip

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=ibn-technologies-outsourced-tax-preparation-service-strengthens-financial-stability-for-usa-businesses]

Phone: +1 844-644-8440

Address:66, West Flagler Street Suite 900

City: Miami

State: Florida 33130

Country: United States

Website: https://www.ibntech.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release IBN Technologies' Outsourced Tax Preparation Service Strengthens Financial Stability for USA Businesses here

News-ID: 4160377 • Views: …

More Releases from ABNewswire

The Neighbourhood The Wourld Tour 2026: Cheapest Tickets Available Now - Apply C …

The Neighbourhood's The Wourld Tour 2026 brings the alt-rock band's signature sound to arenas worldwide, supporting their new album (((((ultraSOUND))))). Kicking off March 28 in Austin, TX (Moody Center), the tour hits North America, Europe, Australia, Asia, and more through October 2026-including stops at Madison Square Garden (NYC), TD Garden (Boston), Kia Forum (LA), and recent additions like Little Caesars Arena (Detroit, Nov 19).

The Neighbourhood's The Wourld Tour 2026 [https://www.capitalcitytickets.com/The-Neighbourhood-Tickets]…

Andatel Grande Patong Phuket: 40-50M THB Mold Remediation After 6-Year Coastal C …

Andatel Grande Patong Phuket addresses extensive mold damage from unprecedented six-year COVID closure (March 2023-March 2026) through comprehensive remediation program. The 122-room property invested 40-50 million Thai Baht (35% of total 120-140M budget) demolishing and rebuilding affected ceilings and walls. Coastal humidity exceeding 80% without air conditioning created severe mold penetration throughout property.

PATONG, Phuket, Thailand - February 22, 2026 - One of the best Andatel Grande Patong Phuket option in…

Best Deals on MercyMe 2026 Tour Tickets: Get Affordable Seats at CapitalCityTick …

MercyMe's Wonder + Awe Tour 2026 kicks off March 12 in Greensboro, NC, featuring hits like "I Can Only Imagine" and new tracks from their upcoming album. With special guests Big Daddy Weave, Tim Timmons, and Sam Wesley, the 24+ city spring run spans the U.S., from East Coast arenas to West Coast venues, wrapping April 25 in Spokane, WA.

MercyMe's Wonder + Awe Tour 2026 [https://www.capitalcitytickets.com/MercyMe-Tickets] is bringing an uplifting…

Upcoming Book Offers Readers a Rare Perspective, Taking Them on a Mother's Journ …

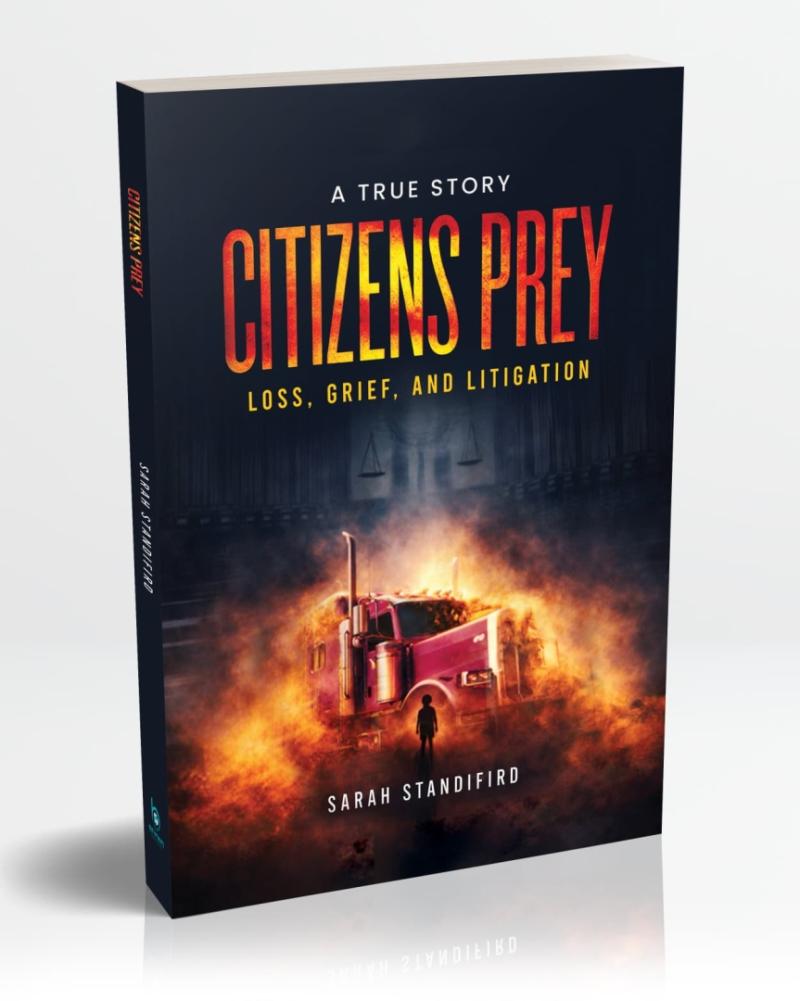

Sarah Standifird's upcoming book, Citizen's Prey, will be released on March 28 and offers a rare, unflinching look at what happens when families are forced to navigate the justice system after preventable tragedy.

With years of experience in the legal industry, Sarah Standifird once worked alongside attorneys nationwide. Now, she writes from the other side of the courtroom-as a grieving mother navigating the system as a client-offering a rare and unflinching…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…

![Outsourced Tax Preparation Service [USA]](https://cdn.open-pr.com/8/2/826148576_g.jpg)